- Home

- »

- Pharmaceuticals

- »

-

Substance Abuse Treatment Market Size Analysis Report 2030GVR Report cover

![Substance Abuse Treatment Market Size, Share & Trends Report]()

Substance Abuse Treatment Market (2023 - 2030) Size, Share & Trends Analysis Report By Treatment Type (Tobacco/Nicotine & Vaping, Alcohol), By End-use (Rehabilitation Centers, Clinics, Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Substance Abuse Treatment Market Summary

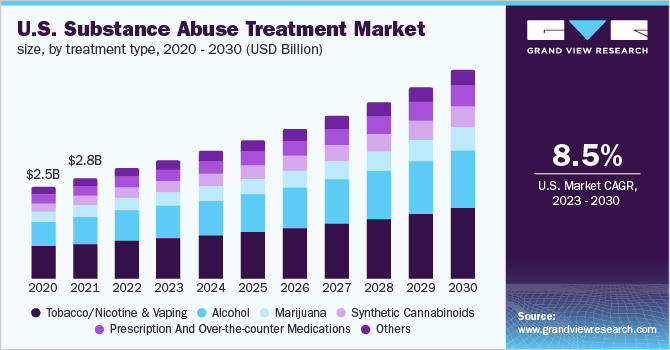

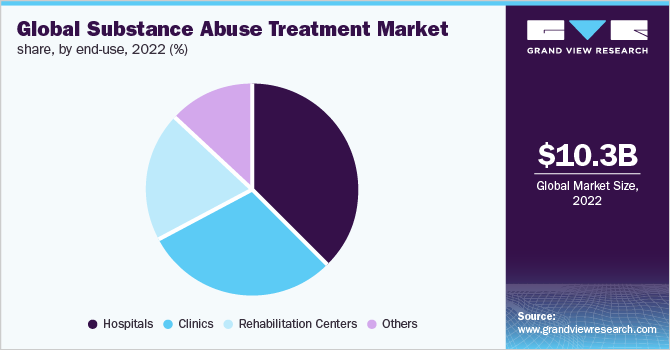

The global substance abuse treatment market size was estimated at USD 10.25 billion in 2022 and is projected to reach USD 20.51 billion by 2030, growing at a CAGR of 9.05% from 2023 to 2030. The industry is witnessing rapid growth due to factors, such as the rising awareness about the treatments and increasing prevalence of substance abuse disorders.

Key Market Trends & Insights

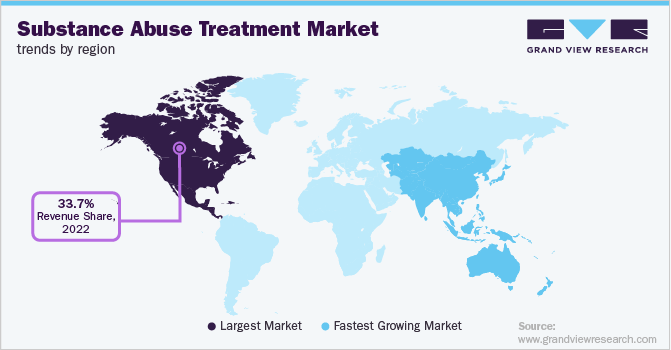

- North America dominated the industry in 2022 and accounted for the largest share of more than 33.65% of the overall revenue.

- By treatment type, the tobacco/nicotine and vaping segment held the largest share of more than 33.30% of the overall revenue in 2022.

- By end use, the hospital end-use segment dominated the industry in 2022 and accounted for the largest share of 37.83% of the total revenue.

Market Size & Forecast

- 2022 Market Size: USD 10.25 Billion

- 2030 Projected Market Size: USD 20.51 Billion

- CAGR (2023-2030): 9.05%

- North America: Largest market in 2022

Moreover, supportive government initiatives, such as drug awareness campaigns and prevention programs, are expected to drive industry growth over the forecast period. Substance abuse refers to the use of illegal drugs, prescription or over-the-counter drugs, or alcohol for purposes other than those intended, or in excessive amounts.

This leads to triggering social, physical, emotional, and occupational issues in an individual. Cannabis was the most used substance in 2021, with an estimated 192 million people using it worldwide. Opioids are the most threatening substance with the total number of deaths due to opioid use disorders increasing to 71% over the last decade, a 92% increase among women compared to a 63% increase among men. The increasing addiction among the population is giving rise to the need to spread awareness regarding the threats that illicit drugs pose to health. Public and private organizations are constantly focusing on organizing campaigns and programs to make people aware of the negative impacts of substance abuse and support the adoption of addiction treatment amongst the addict population.

For instance, in March 2022, Texas Health and Human Services launched a public awareness campaign of USD 23.2 million to prevent substance abuse disorder and help gain access to addiction treatment and services. Moreover, the increasing adoption of Nicotine Replacement Therapy (NRT) owing to the growing public awareness about the adverse effects associated with smoking is expected to provide an opportunity for market growth. Moreover, the acceptance of NRT is projected to increase as a result of technological developments in therapies with the introduction of innovative products, such as flavored chewing gums, heat-not-burn products, and lozenges.

For instance, in February 2023, Sesh+, a smoking cessation company with the motive of preventing addiction and providing treatment, developed NRT products in flavors, such as cinnamon, pomegranate, and wintergreen, to enhance the adoption of treatment. However, the industry growth is being restrained by the relapse of addiction due to the discontinuation of therapies. According to the National Institute on Drug Abuse estimates, 40-60% of individuals relapse within 30 days of leaving an inpatient addiction treatment center, and nearly 85% relapse within the first year of treatment. Patients are treated with medications to help curb cravings and re-establish healthy brain function. These medications also help patients to overcome withdrawal symptoms during detoxification, which is the initial step in the addiction treatment process.

Treatment Type Insights

The tobacco/nicotine and vaping segment held the largest share of more than 33.30% of the overall revenue in 2022. The dominance of the segment is attributed to the increasing prevalence of tobacco addiction among the population. It is estimated that globally, around 22.3% of the population uses tobacco, which leads to the death of 8 million people each year. Tobacco is frequently referred to as a gateway drug as it can lead to the use and abuse of other substances. Teenagers who smoke are 22 times more probable to use cocaine, 8 times more probable to use marijuana, and 3 times more likely to use alcohol than nonsmokers. Tobacco is associated with causing harm to almost every organ of the body including impairment of the lungs and decreased lung function. This further propels the need for addiction treatment for such health conditions.

The alcohol segment is expected to register the fastest growth rate over the forecast period owing to its high consumption, easy availability, and heightened social acceptance, resulting in its increasing consumption worldwide. According to the WHO estimates, 3 million deaths every year worldwide result from the harmful use of alcohol; this represents 5.3 % of all deaths. After tobacco addiction, alcohol abuse is the second-most common type of substance abuse globally. An alcohol use disorder occurs when a person’s drinking causes distress or harm, affecting around 10% of adult men and 5% of adult women. Alcohol addiction treatment market is projected to witness a surge over the forecast period. This includes major alcohol addiction treatment drugs such as disulfiram, acamprosate, and naltrexone

End-use Insights

The hospital end-use segment dominated the industry in 2022 and accounted for the largest share of 37.83% of the total revenue. The dominance is attributed to the delayed detection of the condition because of social stigmatization among patients leading to apprehension on availing the treatment, which often results in severe cases of addiction that need hospitalization for providing the user with the needed addiction treatments, thereby driving the segment's growth. In addition, individuals with prolonged substance abuse often develop other health conditions, such as cardiovascular disease, stroke, cancer, HIV/AIDS, Hepatitis B and C, lung disease, and mental disorders; hospitals being centers for primary treatment, also offer treatment for health conditions associated with substance abuse.

The rehabilitation centers segment is expected to register the fastest CAGR over the forecast period. Rehabilitation centers provide more treatment options, amenities, and specialized care, such as dual diagnosis, and are the most preferred method for patients who are required to undergo long-term addiction treatment, which may last six months to a year or more. Furthermore, rehabilitation centers are forming alliances with hospitals to provide better care to patients. However, the high cost associated with addiction treatment followed in a rehabilitation center is expected to hinder the growth of the segment. For instance, over 30 days, general outpatient rehab costs between USD 1,400-10,000. This equates to USD 5,700 per month on average. However, addiction treatment pharmaceutical product account for only a fraction of these costs.

Regional Insights

North America dominated the industry in 2022 and accounted for the largest share of more than 33.65% of the overall revenue. The segment is expected to grow further at a steady CAGR maintaining its dominant position throughout the forecast period. The growing population exposed to addiction, well-structured reimbursement policies, legalization of marijuana in various states, and developed healthcare sectors are expected to drive the regional market. According to the CDC, nearly 17% of the population are binge alcohol drinkers in the U.S. and around 6% are exposed to heavy drinking. Moreover, nicotine addiction is most common in the U.S. with nearly 40 million adults addicted to tobacco smoking. Thereby creating a major opportunity for addiction treatment market in North America.

Furthermore, public and private organizations in the region are constantly focusing on spreading awareness regarding the serious threats associated with substance abuse, and drug addiction which propels regional market growth. Asia Pacific is estimated to register the fastest CAGR over the forecast period. This can be attributed to the geographical expansion of key players in Asian countries, coupled with developing healthcare infrastructure and supportive government initiatives to improve nicotine, alcohol and drug addiction treatment adoption. In addition, rising incidences of alcohol, tobacco, and opioid addiction in Asian countries will boost the regional market growth. However, a lack of public awareness and healthcare disparities among emerging economies may hinder growth.

Key Companies & Market Share Insights

The key players operating are constantly focusing on changing existing technologies and introducing new ones that enhance patient outcomes and significantly increase the effectiveness & efficiency of healthcare. For instance, in February 2023, Jovive Health launched Medication-Assisted Treatment (MAT) to help diminish the effects of dependence on opioids for patients with Opioid Use Disorders (OUD). Some of the key players in the global substance abuse treatment market include:

-

Teva Pharmaceutical Industries Ltd.

-

Abbott

-

GSK plc.

-

Cipla Inc.

-

Lilly (Eli Lilly and Company)

-

Novartis AG

-

Sun Pharmaceutical Industries Ltd.

-

Dr. Reddy’s Laboratories Ltd.

-

Viatris Inc.

-

AstraZeneca

Substance Abuse Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.13 billion

Revenue forecast in 2030

USD 20.51 billion

Growth rate

CAGR of 9.05% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; Abbott; GSK plc.; Cipla Inc.; Lilly (Eli Lilly and Company); Novartis AG; Sun Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.; Viatris Inc.; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Substance Abuse Treatment Market Segmentation

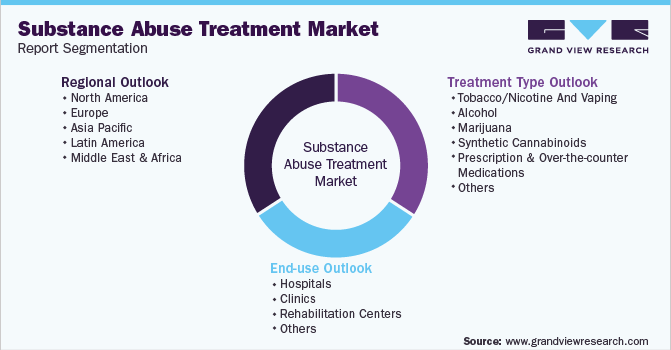

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global substance abuse treatment market report based on treatment type, end-use, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco/Nicotine And Vaping

-

Alcohol

-

Marijuana

-

Synthetic Cannabinoids

-

Prescription And Over-the-counter Medications

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Rehabilitation Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global substance abuse treatment market size was estimated at USD 10.25 billion in 2022 and is expected to reach USD 11.13 billion in 2023.

b. The global substance abuse treatment market is expected to grow at a compound annual growth rate of 9.05% from 2023 to 2030 to reach USD 20.51 billion by 2030.

b. North America dominated the substance abuse treatment market with a share of 33.69% in 2022. The growing population exposed to addiction, well-structured reimbursement policies, legalization of marijuana in various states, and developed healthcare sectors are expected to drive the market.

b. Some key players operating in the substance abuse treatment market include Teva Pharmaceutical Industries Ltd., Abbott, GSK plc., Cipla Inc., Lilly (Eli Lilly and Company), Novartis AG, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Viatris Inc., and AstraZeneca.

b. Key factors that are driving the market growth include the rising awareness and escalating prevalence rate of substance abuse disorders which is propelling the demand for efficient treatments. Moreover, other factors such as the increasing government initiatives to support treatment of addicted population aided with rising drug awareness campaigns and prevention programs is expected to further drive the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.