- Home

- »

- Consumer F&B

- »

-

Sugar-free Confectionery Market Size, Industry Report, 2030GVR Report cover

![Sugar-free Confectionery Market Size, Share & Trends Report]()

Sugar-free Confectionery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sweet & Candy Confectionery, Chocolate Confectionery), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-956-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sugar-free Confectionery Market Summary

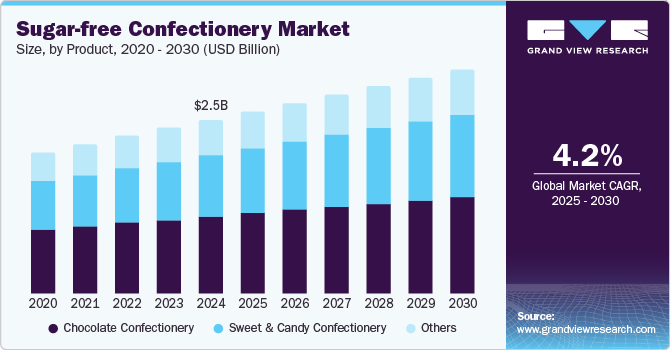

The global sugar-free confectionery market size was valued at USD 2.45 billion in 2024 and is projected to reach USD 3.16 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing prevalence of disorders such as diabetes, hypertension, and obesity, which are linked to high sugar intake, as well as the incorporation of health and wellness trends in diet, are major factors driving sales of sugar-free items such as confectionery.

Key Market Trends & Insights

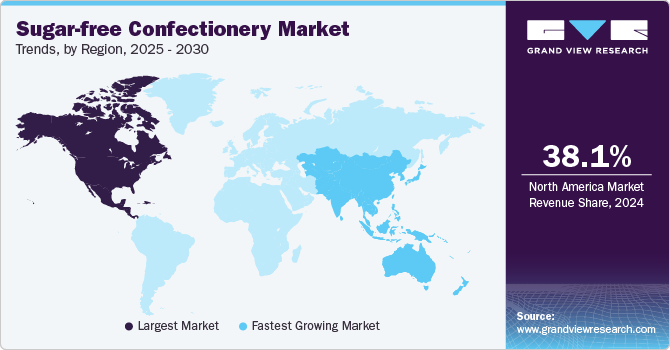

- The North America sugar-free confectionery market accounted for the largest revenue share of 38.1% globally in 2024.

- The U.S. sugar-free confectionery market accounted for a dominant revenue share in the regional market in 2024.

- By product, the chocolate confectionery segment accounted for the largest revenue share of 44.7% in 2024.

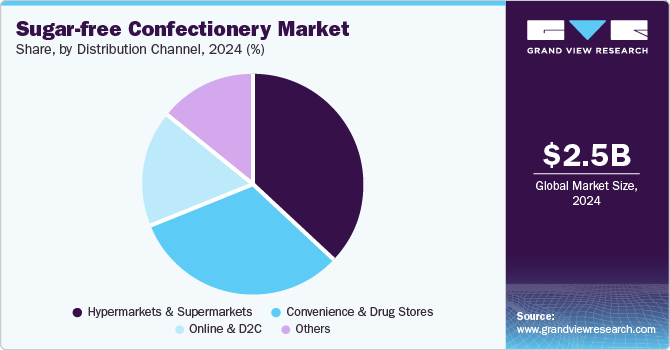

- By distribution channel, the hypermarkets & supermarkets segment accounted for the largest revenue share in the global sugar-free confectionery industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.45 Billion

- 2030 Projected Market Size: USD 3.16 Billion

- CAGR (2025-2030): 4.2%

- North America: Largest market in 2024

The sugar-free confectionery industry includes a wide range of products, such as candies, chocolates, gum, and other sweets, which are manufactured using sugar substitutes or natural sweeteners, including stevia, erythritol, and xylitol. The growing popularity of alternative diet plans such as low-carb, keto, and paleo, which help restrict carbohydrate and sugar intake, further encourage consumers to choose sugar-free options.

With an increasing number of individuals being diagnosed with diabetes globally, there is a growing demand for diabetic-friendly food products. According to the World Health Organization (WHO), between 1990 and 2022, there was a four-fold increase in the prevalence of diabetes globally, with 830 million people living with the disorder as of 2022. This has highlighted the need to reduce sugar intake in food, creating opportunities for manufacturers of zero- or low-sugar food items to promote their offerings. Sugar-free confectionery, sweetened with alternatives that do not cause significant spikes in blood glucose levels, is a preferred choice for people managing diabetes and pre-diabetes. The availability of alternatives such as stevia, monk fruit extract, and sucralose has made it easier for confectionery companies to create sugar-free products and offer a taste that resembles traditional sugar-based sweets.

Manufacturers are expanding their product offerings to include a variety of sugar-free sweets such as chocolates, gummies, candies, lollipops, and cookies, as well as zero-sugar versions of conventional treats such as caramel, fudge, and hard candies. This range of options caters to different consumer tastes and preferences, attracting more customers to the category. There has also been a notable rise in the availability of premium and gourmet sugar-free confectionery products, which appeal to affluent consumers willing to pay a premium for healthier and indulgent alternatives. An increasing proportion of consumers opt for sugar-free confectionery as part of their weight management efforts. These products are often perceived as low-calorie alternatives to traditional sweets, making them more appealing to people looking to maintain or lose weight. Companies are accordingly developing and marketing their products based on consumer preferences, aiding the expansion of the sugar-free confectionery industry.

Product Insights

The chocolate confectionery segment accounted for the largest revenue share of 44.7% in 2024 in the sugar-free confectionery industry. The widespread popularity of chocolate confectioneries and increasing awareness regarding the high sugar content in conventional varieties have compelled consumers to shift to sugar-free alternatives. These chocolates are particularly appealing to diabetic individuals, as they allow them to satisfy their chocolate cravings without causing a noticeable increase in blood glucose levels. Additionally, continued advancements in sweetener technology have led to significant improvements in these products' taste and texture, fueling the segment growth.

Meanwhile, the sweet & candy confectionery segment is anticipated to advance at the fastest CAGR during the forecast period. The continued growth in sales of candies and sweets and the high rate of product innovations have led to the increased proliferation of sugar-free offerings in this category. Brands are also aiming to cross-promote sugar-free candies with other health-focused items such as nutritional bars, fruit drink mixes, and frozen dairy desserts to boost sales. Additionally, the development of new and improved sugar substitutes and better manufacturing techniques has allowed brands to offer alternatives with a taste and texture similar to conventional products.

Distribution Channel Insights

The hypermarkets & supermarkets segment accounted for the largest revenue share in the global sugar-free confectionery industry in 2024. In recent years, consumers are increasingly seeking products that align with their health goals, including reducing sugar intake due to concerns about obesity, diabetes, and other lifestyle disorders. As a result, sugar-free confectionery is becoming a staple offering in supermarkets and hypermarkets. These outlets are well-positioned to meet the growing demand for such offerings, providing a wide selection of candies, chocolates, gums, and other sweets that cater to various dietary needs. Retailers extensively run promotional campaigns and discounts on sugar-free items to encourage consumers to try these products. These events effectively raise awareness about the availability of such healthier options, boosting sales.

The online & D2C segment is expected to witness the fastest CAGR from 2025 to 2030 in the global market. The convenience offered by online platforms, coupled with increasing awareness regarding the harms of excessive sugar consumption, has compelled consumers to look for healthier alternatives to candies and chocolates. E-commerce platforms such as Amazon, Walmart, Target, and various specialized online health stores offer an extensive range of sugar-free confectionery products that may not be readily available in physical retail stores. This includes chocolates, gums, hard candies, gummies, and mints, catering to a variety of tastes and preferences. The online mode further makes it easier for consumers to access confectionery brands from different regions and countries that may not have physical retail distribution in their area. This allows for greater market access and the opportunity for consumers to experiment with international brands.

Regional Insights

The North America sugar-free confectionery market accounted for the largest revenue share of 38.1% globally in 2024. The regional demand for these products is primarily driven by factors such as growing health consciousness and the increasing prevalence of lifestyle disorders such as diabetes and heart disease. For instance, in Mexico, reports state that the prevalence of diabetes stood close to 13 million in 2022, being the second-leading cause of mortality in the country. As a result, through various advertisements and campaigns, governments and private health institutions in the region are creating awareness regarding the benefits of low sugar intake. This has allowed companies operating in the region to expand their footprint. In May 2023, Barry Callebaut launched the Callebaut NXT and SICAO Zero dairy-free, low-sugar chocolates for the younger health-conscious demographic in Mexico.

U.S. Sugar-free Confectionery Market Trends

The U.S. sugar-free confectionery market accounted for a dominant revenue share in the regional market in 2024, owing to the increasing incidences of diabetes, particularly type 2 diabetes, in the country. Sugar-free options have become essential as individuals with this condition seek to manage their blood sugar levels. Additionally, a growing awareness of the connection between high sugar consumption and conditions such as heart disease, cavities, and tooth decay has prompted many consumers to lower the use of sugar in their food. In November 2023, the U.S. Food and Drug Administration convened a meeting to outline strategies to reduce added sugar consumption in the country. Measures discussed included taxes on sugary beverages, voluntary targets for sugar reduction, and counter-marketing and educational campaigns for citizens. Implementing such measures could discourage consumers from consuming confectionery items with high sugar content, enabling sugar-free options to witness increased sales.

Europe Sugar-free Confectionery Market Trends

Europe sugar-free confectionery market accounted for a substantial revenue share in the global market for sugar-free confectionery in 2024. The increasing rates of obesity in Europe, especially in countries such as the UK and Southern Europe, have triggered concerns about the prominent role of sugar in contributing to weight gain and other health problems. According to data by Eurostat, over 50% of people over the age of 16 living in the European Union were overweight (pre-obese) in 2022. As a result, food items with minimal to no sugar are considered a better alternative for those seeking to curb sugar intake and avoid such health problems. Manufacturers are making significant efforts to ensure clear labeling on their offerings that highlight the absence of sugar. This transparency helps drive regional product demand, as health-conscious buyers can make informed purchasing decisions.

Asia Pacific Sugar-free Confectionery Market Trends

The Asia Pacific region is expected to witness the highest CAGR during the forecast period in the sugar-free confectionery market. A steady rise in disposable income levels and improved access to health-related information has enabled consumers in Asia-Pacific to become more health-conscious. This has led to an increased focus on minimizing sugar intake, particularly among urban populations. Moreover, the growing middle-class demographic in countries such as China, India, and Southeast Asia is driving demand for healthier alternatives to food products. Consumers are increasingly willing to spend on sugar-free chocolates and candies. In India, a survey conducted by LocalCircles in 2024 to understand sweet consumption patterns among citizens found that 55% of the surveyed consumers stated that they would consider sweets with 25-75% lower sugar content. Similar consumer preferences are being observed in other regional economies, highlighting a readiness to move towards low-sugar and sugar-free food items.

China accounted for the largest revenue share in the Asia Pacific market for sugar-free confectionery in 2024. A growing prioritization for wellness-based lifestyles among younger demographics in the economy is enabling market demand. Furthermore, the extensive prevalence of diabetes and obesity has compelled the Chinese government to take steps that promote healthier eating habits and reduce the population's overall sugar consumption. These initiatives include public health campaigns that warn about the negative effects of excessive sugar, making consumers more inclined to opt for alternatives such as sugar-free products. Manufacturers can also leverage omnichannel strategies, resulting in their products reaching a wider consumer base. Platforms such as Tmall and JD.com offer an expansive selection of sugar-free candies, chocolates, and other sweets, which has helped strengthen the market.

Key Sugar-free Confectionery Company Insights:

Some major companies involved in the global sugar-free confectionery industry include Asher’s Chocolate, HERSHEY, and Russell Stover Chocolates, among others.

-

Asher’s Chocolate is an American manufacturer based in Pennsylvania that develops a wide variety of chocolate products, including dark and milk chocolates, white chocolate, sugar-free confections, and gluten-free confections. The company’s products are available through various retail channels, including its online store and partnerships with candy retailers. It also offers wholesale options for businesses looking to stock products.

-

HERSHEY is an American multinational confectionery manufacturer headquartered in Pennsylvania specializing in producing chocolates. The company is well-known for several brands, including KitKat, ICE BREAKERS, Hershey’s Kisses, Cadbury, Lily’s, and others. Hershey offers a range of zero-sugar products in their chocolate candy, sweet, and gum categories. The company has strengthened its offerings in this space by acquiring the confectionery brand Lily’s in 2021.

Key Sugar-Free Confectionery Companies:

The following are the leading companies in the sugar-free confectionery market. These companies collectively hold the largest market share and dictate industry trends.

- Abdallah Candies Inc.

- ASHER’S CHOCOLATE CO.

- Diabetic Candy.com, LLC

- Dr. John's Healthy Sweets LLC

- THE HERSHEY COMPANY

- ROY chocolatier

- Russell Stover Chocolates, LLC

- Nuts To You

- Sugarless Confectionery

- Ghirardelli Chocolate Company

Recent Developments

-

In May 2024, Asher’s Chocolate announced the launch of a new sugar-free chocolate range featuring options such as Vanilla Caramels, Raspberry Jellies, and Mini Peanut Butter Cups. These products have been made using premium ingredients and natural sweeteners, making them an ideal option for diabetic individuals, those managing their sugar intake, and those following keto diet. The chocolates are available at the company’s online store and select retail outlets in Delaware Valley.

Sugar-free Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.57 billion

Revenue forecast in 2030

USD 3.16 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Saudi Arabia

Key companies profiled

Abdallah Candies Inc.; ASHER’S CHOCOLATE CO.; Diabetic Candy.com, LLC; Dr. John's Healthy Sweets LLC; THE HERSHEY COMPANY; ROY chocolatier; Russell Stover Chocolates, LLC; Nuts To You; Sugarless Confectionery; Ghirardelli Chocolate Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sugar-free Confectionery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sugar-free confectionery market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sweet & Candy Confectionery

-

Chocolate Confectionery

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Online & D2C

-

Convenience & Drug Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.