- Home

- »

- Consumer F&B

- »

-

Sugar Substitutes Market Size, Share, Industry Report, 2033GVR Report cover

![Sugar Substitutes Market Size, Share & Trends Report]()

Sugar Substitutes Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (High Intensity Sweeteners, Low Intensity Sweeteners, High Fructose Syrup), By Application (Food, Beverages, Health & Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-092-7

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sugar Substitutes Market Summary

The global sugar substitutes market size was estimated at USD 7.97 billion in 2024, and is projected to reach USD 15.48 billion by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The market is driven by rising health consciousness and increasing prevalence of diabetes and obesity.

Key Market Trends & Insights

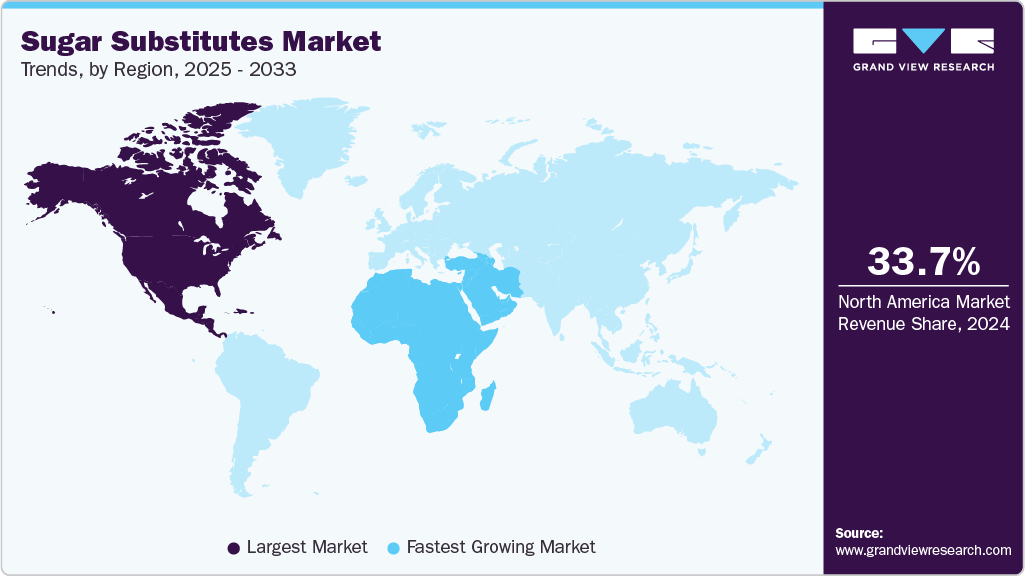

- North America dominated the global sugar substitutes market with the largest revenue share of 33.7% in 2024.

- The sugar substitutes market in the U.S. held the largest revenue share of 83.1% in 2024.

- By type, high-intensity sweeteners led the market and accounted for a share of 71.2% in 2024.

- By application, the beverages segment led the market and accounted for a share of 44.2% in 2024.

Key Market Trends & Insights

- 2024 Market Application: USD 7.97 Billion

- 2033 Projected Market Application: USD 15.48 Billion

- CAGR (2025-2033): 7.6%

- North America.: Largest market share in 2024

- Middle East & Africa: Fastest growing market

Growing demand for low-calorie, natural sweeteners in food and beverage products further fuels the market growth. The sugar substitute market is propelled by the growing shift toward clean-label and plant-based ingredients, as consumers seek healthier alternatives to refined sugar. Technological advancements in formulation have enhanced the taste and stability of sugar substitutes, broadening their applications across various sectors. Increasing government initiatives to reduce sugar intake are also encouraging product innovation. In addition, the expanding availability of sugar-free and functional food products in retail channels supports steady market growth.Rising awareness of dental health and the harmful effects of excessive sugar consumption is boosting the demand for sugar substitutes. According to the World Health Organization (WHO) data published in August 2025, dental cavities are the most common non-communicable disease globally, affecting approximately 2.5 billion people. The growing popularity of fitness and weight management programs is encouraging consumers to opt for low-calorie sweetening options. Expanding foodservice and beverage industries are increasingly incorporating sugar alternatives to meet diverse dietary preferences. Moreover, the rapid urbanization and changing lifestyles in developing economies are creating new opportunities for market expansion.

The sugar substitute market is gaining momentum due to the surge in vegan and keto diet trends that emphasize reduced sugar intake. Increasing R&D investments by manufacturers to develop innovative, cost-effective, and natural sweeteners are enhancing product diversity. Growing consumer inclination toward sustainable and environmentally friendly products also supports market growth. Furthermore, expanding e-commerce platforms are improving the accessibility and visibility of sugar substitute products globally.

Consumer Insights for Sugar Substitutes Market

Type Insights

The high-intensity sweeteners market accounted for the largest revenue share of 71.2% in 2024. The demand for high-intensity sweeteners is driven by their superior sweetness potency, allowing manufacturers to reduce production costs and calorie content simultaneously. Expanding use in pharmaceuticals and personal care products for taste masking and formulation stability is boosting adoption. Regulatory approvals for newer, safer synthetic and natural sweeteners are enhancing market confidence. In addition, rising consumption of diet beverages and low-sugar confectionery products is further accelerating market growth. In July 2023, Tate & Lyle PLC introduced TASTEVA SOL, a stevia-based sweetener, as an addition to its sweetener portfolio. TASTEVA SOL is a premium stevia sweetener with 200x the solubility and can be used in combination with Reb M stevia sweeteners for a high sugar substitute.

The low-intensity sweeteners market is projected to grow significantly at the fastest CAGR of 6.0% from 2025 to 2033. The low-intensity sweeteners market is driven by their ability to provide subtle sweetness without altering the original taste profile of foods and beverages. Increasing incorporation in dairy, baked goods, and sauces to cater to moderate sugar reduction trends is boosting demand. Consumer preference for natural and minimally processed ingredients supports the adoption of these sweeteners. Moreover, innovations in blending low-intensity sweeteners with other sugar alternatives are expanding their application scope.

Application Insights

The beverages segment accounted for the largest revenue share of 44.2% in 2024. The use of sugar substitutes in beverages is driven by the growing demand for low-calorie and sugar-free drinks among health-conscious consumers. Rising popularity of ready-to-drink teas, soft drinks, and energy drinks with reduced sugar content encourages manufacturers to adopt alternatives. Flavor stability and solubility of modern sweeteners allow for consistent taste in various beverage formulations. In addtion, increasing regulatory pressure to limit sugar content in drinks fuels the adoption of substitutes.

The sugar substitutes for health & personal care applications are projected to grow at the fastest CAGR of 7.9% from 2025 to 2033. In health and personal care products, sugar substitutes are increasingly used in oral care items such as toothpaste and mouthwash to prevent cavities. They are also incorporated in dietary supplements and protein products to enhance palatability without adding calories. Rising consumer preference for functional and wellness-focused personal care products supports their use. Moreover, innovations in natural sweeteners make formulations safer and more appealing to health-conscious consumers.

Regional Insights

The North America sugar substitutes market accounted for a share of 33.7% in 2024, driven by high health awareness and widespread adoption of low-calorie and diet-friendly products. Government initiatives to curb sugar consumption and combat obesity are encouraging manufacturers to innovate. Strong presence of leading food and beverage companies accelerates product development. The rising popularity of functional beverages and nutraceuticals further supports demand. In addition, advanced distribution networks make sugar substitutes easily accessible to consumers.

U.S. Sugar Substitutes Market Trends

The sugar substitutes market in the U.S. held the largest revenue share of 83.1% in 2024, driven by the increasing prevalence of diabetes and lifestyle-related health issues is a primary driver for sugar substitutes. Consumers are actively seeking natural and plant-based sweetening options. Moreover, the growing influence of fitness and wellness trends pushes demand for low-sugar products. Innovations in clean-label formulations enhance product appeal. Moreover, aggressive marketing by beverage and snack manufacturers is boosting adoption.

Europe Sugar Substitutes Market Trends

The sugar substitutes market in Europe is projected to grow at the fastest CAGR of 6.4% from 2025 to 2033. Europe’s sugar substitutes market is propelled by stringent government regulations on sugar content in foods and beverages. Rising consumer preference for organic and natural sweeteners is driving growth. Increasing demand for sugar-free confectionery and dairy products supports market expansion. Health-conscious lifestyles and aging population trends further contribute. The region’s focus on sustainability and eco-friendly production also encourages the adoption of sugar alternatives.

Middle East & Africa Sugar Substitutes Market Trends

The Middle East & Africa sugar substitutes market is projected to grow at the fastest CAGR of 8.8% from 2025 to 2033. As the region is witnessing increased incidence of diabetes and obesity is a key driver for sugar substitutes. Rising demand for diet and sugar-free beverages and snacks supports market growth. Urbanization and westernization of diets are encouraging healthier alternatives. Government campaigns promoting public health awareness influence consumer choices. Moreover, expanding retail infrastructure makes sugar substitutes more widely available across the region.

Key Sugar Substitutes Company Insights

The sugar substitutes market is experiencing steady growth, driven by increasing consumer demand for high-performance and multifunctional kitchen appliances, rising disposable incomes, and the trend toward modern home designs. Leading brands in the region are heavily investing in innovation, offering features such as dual-fuel options, smart temperature controls, multiple oven cavities, and energy-efficient technologies to appeal to tech-savvy and quality-conscious consumers.

Key Sugar Substitutes Companies:

The following are the leading companies in the sugar substitutes market. These companies collectively hold the largest market share and dictate industry trends.

- Tate & Lyle

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Freres

- Ajinomoto Co.

- JK Sucralose Inc.

- The NutraSweet Company

- GLG Life Tech Corp.

- Nutrinova

Recent Developments

-

In November 2024, Samyang Corporation became the first company worldwide to secure approval from Food Standards Australia New Zealand (FSANZ) for its rare sugar sweetener Allulose, allowing it to be officially used as a food ingredient in Australia and New Zealand. Allulose is recognized as a low-calorie sweetener, as it is a rare sugar with 70% of the sweetness of sucrose, yet with nearly zero calories.

-

In April 2024, Ingredion announced the launch of its new plant‑based sweetening solution called PURECIRCLE Clean Taste Solubility Solution (CTSS), a clean‑label stevia extract that boasts over 100× solubility improvement relative to traditional Reb M stevia.

Sugar Substitutes Market Report Scope

Report Attribute

Details

Market value in 2025

USD 8.61 billion

Revenue Forecast in 2033

USD 15.48 billion

Growth rate (Revenue)

CAGR of 7.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion, volume in Thousand Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional Scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Indonesia; Australia; Brazil; Argentina; Turkey; South Africa

Key companies profiled

Tate & Lyle; Cargill Incorporated; Archer Daniels Midland Company (ADM); Ingredion; Roquette Freres; Ajinomoto Co.; JK Sucralose Inc.; The NutraSweet Company; GLG Life Tech Corp.; Nutrinova

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sugar Substitutes Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the sugar substitute market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Thousand Tons; 2021 - 2033)

-

High Intensity Sweeteners

-

Natural

-

Stevia Extracts

-

Licorice Root Extracts

-

Monk Fruit Extracts

-

-

Artificial

-

Aspartame

-

Cyclamate

-

Saccharin

-

Sucralose

-

Others

-

-

-

Low Intensity Sweeteners

-

Xylitol

-

Sorbitol

-

Maltitol

-

Mannitol

-

Trehalose

-

Isomaltulose

-

Others

-

-

High Fructose Syrup

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Tons; 2021 - 2033)

-

Food

-

Bakery

-

Confectionery

-

Dairy

-

Others

-

-

Beverages

-

Juices

-

Functional Drinks

-

Carbonated Drinks

-

Non-Dairy

-

Milk and Dairy

-

Others

-

-

Health & Personal Care

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Tons, 2021 - 2033)

-

North America

-

U.S.

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sugar substitute size was estimated at USD 7.97 billion in 2024 and is expected to reach USD 8.61 billion in 2025.

b. The global sugar substitutes market is expected to grow at a compounded growth rate of 7.6% from 2025 to 2033 to reach USD 15.48 billion by 2033.

b. High-intensity sweeteners led the market in terms of revenue with a market share of 71.2% in 2023. High-intensity sweeteners have a much higher sweetness than table sugar (sucrose), so fewer quantities of these sweeteners are required to achieve the same sweetness as sugar. The growing health and wellness trend globally is predicted to drive the application of high-intensity sweetness in the coming years.

b. Some key players operating in white Sugar Substitutes market are Tate & Lyle, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Freres, Ajinomoto Co., JK Sucralose Inc.,The NutraSweet Company, PureCircle, E. I. DuPont De Nemours

b. The increased incidences of health problems associated with sugar intake such as diabetes and obesity in developing markets are driving the market growth. Furthermore, sugar substitutes are expected to benefit from fluctuating supply as well as pricing of sugar.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.