- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sunglasses Market Size, Share And Growth Report, 2030GVR Report cover

![Sunglasses Market Size, Share & Trends Report]()

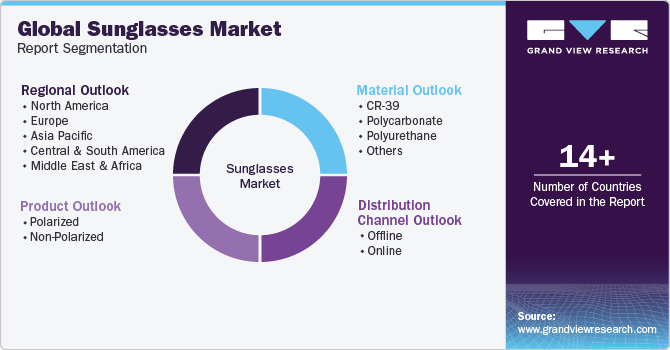

Sunglasses Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polarized, Non-polarized), By Material (CR-39, Polycarbonate, Polyurethane), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-897-8

- Number of Report Pages: 131

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sunglasses Market Summary

The global sunglasses market size was estimated at USD 23.52 billion in 2023 and is anticipated to reach USD 36.44 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. The rising popularity of eyewear, particularly sunglasses, as an essential part of modern lifestyle, is projected to drive the demand for sunglasses over the forecast period.

Key Market Trends & Insights

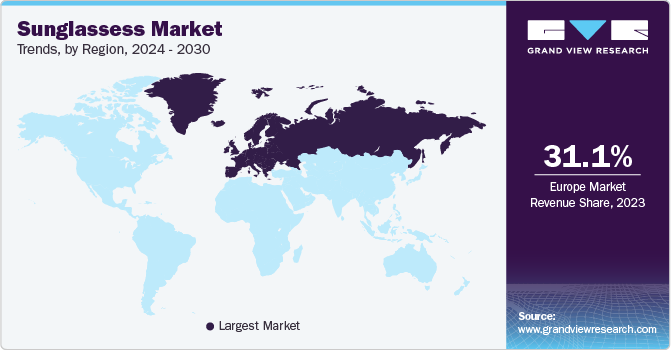

- Europe held a sizable share of over 31.1% of the global sunglasses industry in 2023.

- The Asia Pacific sunglasses industry is anticipated to grow with a CAGR of 6.4% over the forecast period.

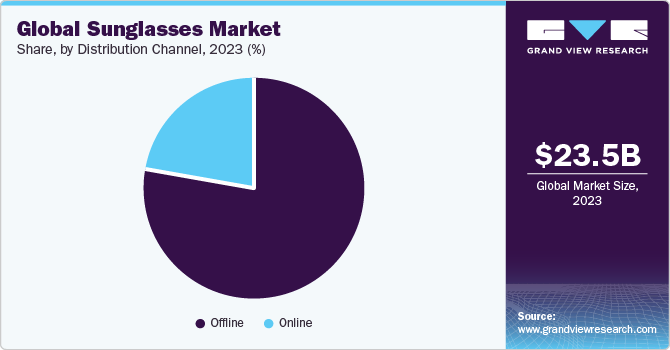

- By distribution channel, the sunglasses sales through offline channels held a 78.6% share in 2023.

- By material, polycarbonate-based sunglasses held 45.3% share of the global market in 2023.

- By product, non-polarized sunglasses held a 78.3% share of the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.52 Billion

- 2030 Projected Market Size: USD 36.44 Billion

- CAGR (2024-2030): 5.6%

- Europe: Largest market in 2023

High-end designers and fashion houses have incorporated sunglasses into their collections, turning them into coveted items. Iconic fashion brands such as Gucci, Prada, and Chanel have produced eyewear lines, making sunglasses a practical accessory as well as a style statement. Celebrities and influencers often sport these designer shades, further reinforcing their status as a fashion essential. Various organizations, including the World Health Organization (WHO), are actively raising awareness about the detrimental impacts of UV radiation. They are crafting guidelines and suggestions to safeguard against excessive sun exposure. The American Academy of Ophthalmology advises for appropriate eye protection, such as sunglasses with UV-blocking capabilities, to shield the eyes from the potential harm caused by prolonged exposure to ultraviolet rays.

Furthermore, Prevent Blindness, an eye health and safety organization has designated May as Ultraviolet Awareness Month with an aim to educate the public about the heightened risk of various conditions, ranging from corneal sunburns to diseases like cataracts and eye cancers. Furthermore, consumers are increasingly willing to invest extra money in branded and expensive sunglasses to make unique fashion statements. Manufacturers are responding to these trends by offering sunglasses in various styles, colors, and shapes to cater to consumer preferences.

For instance, in July 2023, Luxottica partnered with Eastman Kodak to include Kodak products in the Luxottica brand by January 2024. The brand will manufacture optical products for Kodak and will also undertake servicing for the same. Since Kodak is an iconic brand with good brand value, it will help Luxottica leverage its brand position. The fashion industry has been pivotal in popularizing sunglasses as a must-have accessory.

In October 2023, Meta Platforms and Ray-Ban, a brand from Luxottica Group, partnered to introduce the second-generation Ray-Ban Meta smart glasses featuring AI technology. These smart sunglasses come equipped with an integrated speaker, a 12MP camera, and a five-microphone system, offering users the capabilities of live streaming, music playback, messaging, and phone calls.

Moreover, the rise of social media and the constant sharing of personal photos have also contributed to the acceptance of sunglasses as a lifestyle accessory. People now view sunglasses as a way to express individuality and enhance their overall look. Whether oversized, retro, or minimalist frames, sunglasses can add a touch of sophistication, mystery, or glamour to one's appearance. They have become an essential part of the modern selfie culture, and people take great care in selecting the perfect pair to complement their outfits.

Distribution Channel Insights

The sunglasses sales through offline channels held a 78.6% share in 2023. Offline channels, encompassing hypermarkets, supermarkets, and specialty stores, are pivotal in offering consumers a diverse range of branded sunglasses. The continued growth and enhancement of the retail sector have become a driving force behind the increased sunglasses sales. These retail establishments feature a selection of global brands, contributing to the broader accessibility of various glasses. In addition, the social aspect of shopping, the ease of returns and exchanges, support for local businesses, fashion trends on display, availability of niche brands, and options for emergency replacements all contribute to the offline segment’s ongoing growth.

The online segment is expected to grow at a CAGR of 6.8% from 2024 to 2030. Online channels are timesavers compared to a visit to the physical stores, providing a convenient way to order sunglasses directly from websites. Moreover, many online platforms offer free shipping and home delivery services, further enhancing their appeal to consumers. Promotional efforts by brands on various social media platforms have also driven the growth of this segment. Brands are launching their products exclusively on e-commerce websites to attract a broader consumer base. Moreover, online shoppers benefit from access to product reviews, customer ratings, and recommendations from other buyers. This information empowers consumers to make informed decisions about the quality and suitability of sunglasses they are considering.

Material Insights

Polycarbonate-based sunglasses held 45.3% share of the global market in 2023. Polycarbonate is a highly favored material for making sunglasses due to its exceptional qualities. This versatile material boasts impressive impact resistance, safeguarding the eyes against accidents and unexpected bumps while preventing shattering. Moreover, the cost-effectiveness of polycarbonate lenses makes quality sunglasses more accessible to consumers.

CR-39-based sunglasses segment is expected to grow at a CAGR of 5.2% from 2024 to 2030. CR-39, also known as allyl diglycol carbonate (ADC), is a widely used material for making eyeglass lenses, including sunglasses. The popularity of CR-39 lenses stems from its several advantages. Firstly, CR-39 offers outstanding optical clarity, ensuring low abbe value, essential for prescription and non-prescription sunglasses. These lenses also possess a level of impact resistance, providing a degree of safety compared to traditional glass lenses. Although not as shatterproof as polycarbonate or Trivex lenses but, CR-39 offers better impact resistance than glass.

Regional Insights

Europe held a sizable share of over 31.1% of the global sunglasses industry in 2023. The popularity of sunglasses in Europe can be attributed to its rich fashion culture, where customers often view sunglasses as a style statement and follow trends set by fashion houses and celebrities. Paris, London, and Milan are some of the fashion capitals in Europe, and designer sunglasses are very popular for their aesthetic appeal. Also, Europeans are increasingly aware of the importance of eye health and willing to spend on high-quality sunglasses to prevent harmful UV exposure to the eyes that may lead to cataracts and macular degeneration.

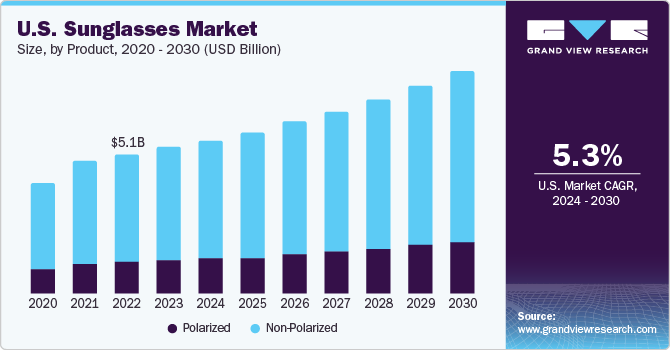

The North America sunglasses industry is anticipated to grow with a CAGR of 5.3% over the forecast period. Sunglasses are both a popular and essential item for travelers, and travel retailers have become their go-to destinations as they collaborate with leading sunglasses makers to meet this demand and generate substantial revenue. In November 2022, Hudson, a prominent travel retailer boasting a network of 1,000 stores across North America, announced its collaboration with Sunglass Hut as part of this expansion.

The Asia Pacific sunglasses industry is anticipated to grow with a CAGR of 6.4% over the forecast period. Various factors, including fashion, culture, economic conditions, and technological advancements, are shaping consumer demand for eyewear across Asia Pacific. Consumers across different Asia Pacific countries have diverse preferences and requirements, leading to numerous local and international brands catering to these various needs. China's booming middle class has created a substantial demand for luxury eyewear. Global brands like Ray-Ban and Prada, alongside domestic brands like Etnies, cater to various consumer segments, from affordable to high-end luxury.

Product Insights

Non-polarized sunglasses held a 78.3% share of the global market in 2023. They have been driven by changing consumer preferences and evolving fashion trends. One of the primary factors contributing to their increased demand is their fashion and style appeal. Non-polarized sunglasses come in different styles, shapes, and colors, making them a popular fashion accessory. Many people now choose sunglasses based on their appearance and how well they complement their outfits rather than solely for their functional benefits.

Polarized sunglasses industry is expected to grow at a CAGR of 6.2% from 2024 to 2030. The substantial surge in popularity of polarized sunglasses can be attributed to their ability to significantly reduce glare, making them invaluable for outdoor enthusiasts and drivers. By blocking horizontal light waves responsible for glare, polarized lenses enhance visual clarity, improve contrast, and provide a more comfortable and safer viewing experience, particularly in bright sunlight.

Key Companies & Market Share Insights

The sunglasses industry is highly competitive, with established brands, product innovation, direct-to-consumer distribution models, online presence, and prices playing key roles. The global sunglasses industry is characterized by the presence of many well-established players such as Luxottica Group, Safilo Group, Kering Eyewear S.p.A., LVMH Group, and De Rigo S.p.A. Some of their initiatives include:

-

In September 2023, Ray-Ban (a brand by Luxottica) partnered with Meta to launch smart sunglasses with built-in audio, microphone, camera, and charging case. These glasses allow users to stream and broadcast content in real-time and are expected to be game-changers in digital content creation

-

In July 2023, Luxottica partnered with Eastman Kodak to include Kodak products in the Luxottica brand by January 2024. The brand will manufacture optical products for Kodak and will also undertake servicing for the same. Since Kodak is an iconic brand with good brand value, this partnership is expected to help Luxottica leverage its brand position in Asia Pacific

-

In February 2020, Safilo Group acquired 61.34% of Miami-based company Prive Goods, LLC. The acquired eyewear company focuses on collaborations with internet celebrities and has a concentrated distribution in the U.S. The acquisition helped Safilo Group stay relevant in the U.S. market

Key Sunglasses Companies:

- Luxottica Group

- Safilo Group S.p.A.

- Kering Eyewear S.p.A.

- De Rigo S.p.A.

- CHARMANT Group

- Revo

- Fielmann Group

- STATE Optical Co.

- LVMH

- Marcolin S.p.A.

Sunglasses Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.82 billion

Revenue forecast in 2030

USD 36.44 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Luxottica Group; Safilo Group S.p.A; Kering Eyewear S.p.A.; De Rigo S.p.A.; CHARMANT Group; STATE Optical Co.; Revo; LVMH; Marcolin S.p.A.; Feilmann Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Sunglasses Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sunglasses market report based on product, material, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polarized

-

Non-Polarized

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

CR-39

-

Polycarbonate

-

Polyurethane

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising global awareness regarding the harmful effects of UV rays on the eyes, and growing acceptance of sunglasses as a part of modern lifestyle accessories.

b. The global sunglasses market size was estimated at USD 23.52 billion in 2023 and is expected to reach USD 24.82 billion by 2024.

b. The global sunglasses market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 36.44 billion by 2030.

b. Europe dominated the sunglasses market with a share of 31.1% in 2023. The strong performance of prominent players, including Luxottica and Safilo is driving the growth of this region.

b. Some of the prominent market players in the sunglasses market are Luxottica Group, Safilo Group, Maui Jim, De Rigo, Charmant, Specsavers Optical, and Revo.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.