- Home

- »

- Next Generation Technologies

- »

-

Smart Glasses Market Size, Share, Industry Report, 2033GVR Report cover

![Smart Glasses Market Size, Share & Trends Report]()

Smart Glasses Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Monocular, Binocular, Audio, Immersive), By Operating System (Android, Linux), By Glass Tinting Technology, By Application (Education), By Connectivity, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-053-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Glasses Market Summary

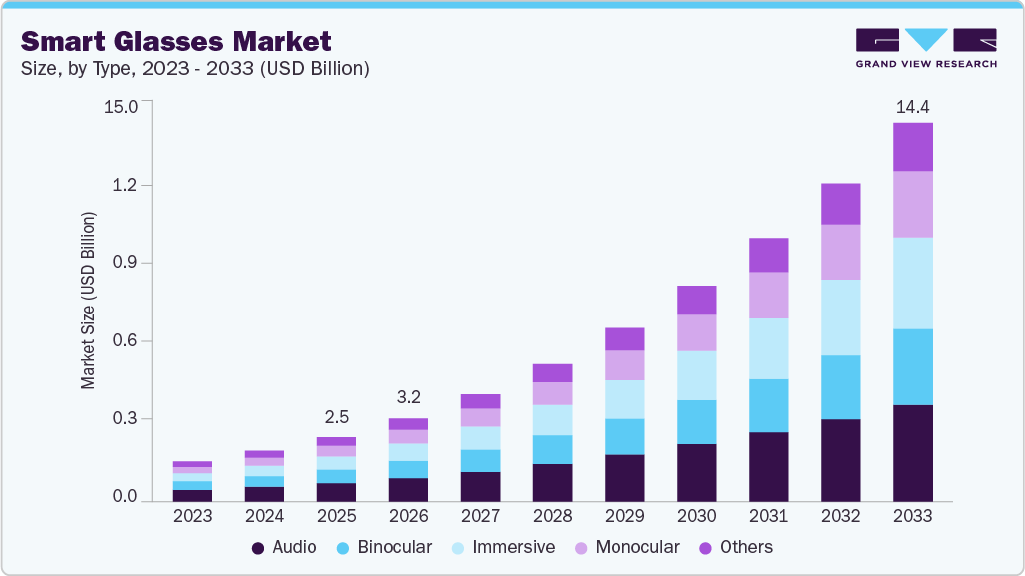

The global smart glasses market size was estimated at USD 2,463.6 million in 2025 and is projected to reach USD 14,380.4 million by 2033, growing at a CAGR of 24.2% from 2026 to 2033. The market growth is driven by a convergence of technological advancements and increasing consumer demand for wearable technology.

Key Market Trends & Insights

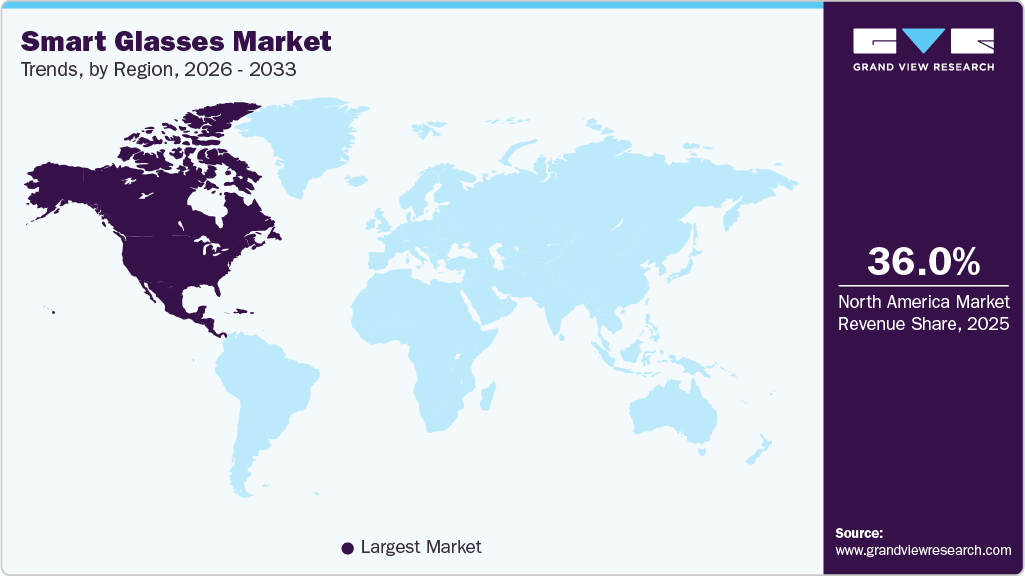

- The smart glasses industry in North America accounted for the largest revenue share of over 36% in 2025.

- The U.S. smart glasses industry dominated the market with a share of over 88% in 2025.

- Based on type, the audio segment accounted for the largest revenue share of over 28% in 2025.

- Based on glass tinting technology, the polymer-dispersed liquid crystals segment holds a substantial share of over 24% in 2025.

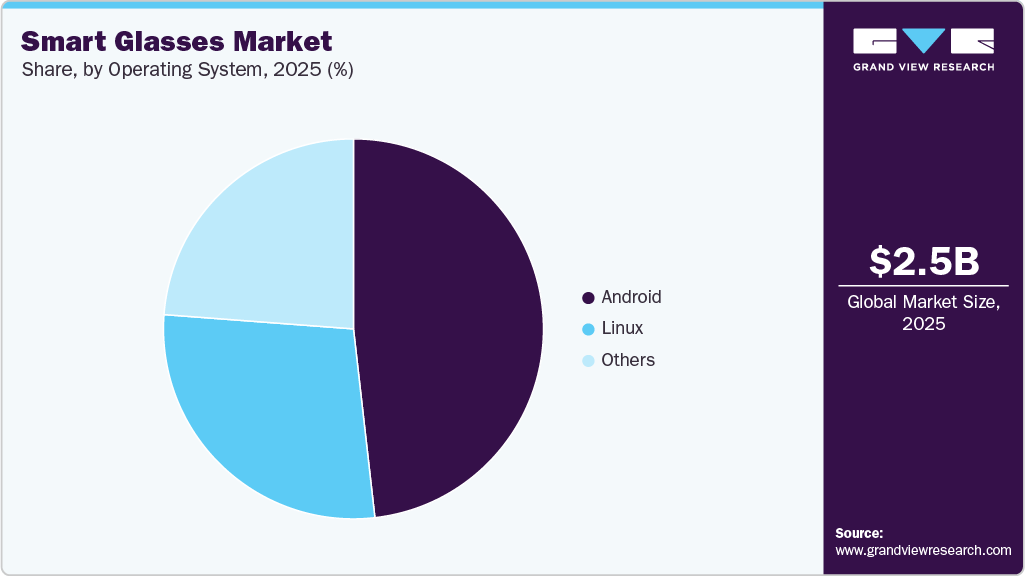

- Based on operating system, the Android segment accounted for the largest revenue share of over 48% in 2025.

- Based on application, the industrial segment accounted for the largest revenue share of over 27% in 2025.

- Based on connectivity, the Bluetooth segment accounted for the largest market share of over 52% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,463.6 Million

- 2033 Projected Market Size: USD 14,380.4 Million

- CAGR (2026-2033): 24.2%

- North America: Largest market in 2025

Technological advancements in miniaturized displays, AI-powered computer vision, sensor integration, and edge computing, significantly enhancing user experience and accelerating the growth of the smart glasses industry. The increase in enhanced connectivity through the internet of things (IoT) and the rise of augmented reality (AR) applications are propelling the market. Consumers are increasingly drawn to smart glasses for their potential to enhance everyday experiences, from navigation and communication to gaming and fitness tracking, accelerating the growth of the smart eyewear market and the broader AR smart glasses market. The rising trend of remote work and virtual collaboration tools has created a greater need for devices that facilitate seamless interaction, further boosting the appeal of the AR glass market in both personal and professional contexts.

In addition, governments worldwide recognize the potential of smart glasses and AR-enabled wearables across various sectors, prompting initiatives to boost their adoption and sales within the smart eyewear technology market. Many countries are investing in research and development programs to advance AR and VR technologies, which are integral to the AR smart glasses market ecosystem. Public-private partnerships are emerging to create pilot projects that demonstrate the practical applications of smart eyewear in fields such as healthcare, education, and manufacturing. Providing funding and incentives, governments are encouraging innovation and fostering an environment where businesses in the smart eyewear market can thrive, thereby driving market growth.

Furthermore, expanding use cases across healthcare, education, and industrial sectors are driving broader adoption of smart glasses and AR-enabled wearables, strengthening demand within the AR glass market. Healthcare providers are increasingly leveraging smart glasses for remote assistance, surgical support, and real-time data visualization to improve clinical outcomes and training efficiency. Educational institutions are integrating immersive AR-based learning tools to enhance student engagement and modernize traditional teaching methods. Growing consumer awareness and rising technology adoption in emerging economies are further accelerating market expansion by opening new, previously untapped regional opportunities for the smart eyewear market.

Moreover, manufacturers in the market are placing a strong emphasis on growth strategies that prioritize innovation and customer engagement across the smart eyewear technology market. Companies are investing heavily in research and development to enhance their products' functionality, design, and user experience in the competitive AR smart glasses market. Collaborations with technology firms and research institutions are becoming commonplace, aiming to leverage expertise and accelerate the development of next-generation AR-enabled smart glasses. Aligning product offerings with market needs and emerging trends, companies are well-positioned to capitalize on the growing demand within the global smart eyewear market.

Type Insights

The audio segment accounted for the largest market share of over 28% in 2025. The demand for hands-free audio experiences drives segmental growth. Audio-enabled smart glasses have gained popularity among consumers seeking a seamless blend of entertainment and utility, as these glasses allow users to listen to music, receive calls, and interact with virtual assistants without needing additional accessories. Advancements in bone conduction and open-ear audio technologies strengthen this segment’s leadership by delivering improved sound quality, thereby securing its position as a key driver of sustained market growth.

The immersive segment is expected to register the fastest CAGR of over 26% from 2026 to 2033. This segment growth is driven by an increasing appetite for augmented reality (AR) and virtual reality (VR) applications. As more industries recognize the benefits of immersive technology, sectors such as retail, education, and healthcare are increasingly adopting smart glasses for enhanced user engagement and interactive training experiences. The expansion of 5G and improvements in graphics rendering have contributed to the growth of the segment by allowing smoother visual experiences in the smart glasses industry.

Application Insights

The industrial segment accounted for the largest market share in 2025, owing to its deployment on production lines to deliver real-time, step-by-step assembly instructions directly within workers’ field of vision, enhancing task accuracy, operational efficiency, and overall productivity. These factors collectively strengthen the segment’s growth, supported by increasing adoption of Industry 4.0 practices, rising investment in smart manufacturing infrastructure, growing demand for workforce optimization, and continued advancements in industrial AR and wearable computing technologies.

The healthcare segment is expected to register the fastest CAGR from 2026 to 2033. The growth is driven by the integration of heads-up, see-through, and eye-on glass tinting capabilities, which allow clinicians to maintain direct eye contact with patients while preserving full situational awareness and accessing clear, real-time visual information on areas of clinical interest. These features enhance patient interaction, diagnostic accuracy, and procedural efficiency, making smart glasses increasingly valuable in medical workflows and supporting continued expansion of this segment.

Connectivity Insights

The Bluetooth segment accounted for the largest market share in 2025, driven by the technology’s reliability and ease of integration with a wide array of devices. Bluetooth provides users with seamless wireless connectivity for calls, audio, and data transfer, making it a staple in consumer-grade smart glasses and an essential feature in enterprise-grade devices. The widespread adoption of Bluetooth technology in smart glasses is further propelled by its low power consumption, which extends battery life, a critical factor for wearable devices. These factors drive the growth of the Bluetooth segment in the market.

The USB segment is expected to register the fastest CAGR from 2026 to 2033. The growth is driven by its high data transfer reliability, low latency, and consistent power delivery capabilities. USB connectivity enables secure wired communication for real-time video streaming, firmware updates, device configuration, and large data file transfers, making it highly suitable for environments with strict data security and limited wireless infrastructure. Growing deployment of ruggedized wearable devices and increased integration of smart glasses with industrial PCs are further strengthening the growth of the USB segment in the global smart glasses industry.

Glass Tinting Technology Insights

The polymer-dispersed liquid crystals (PDLC) segment accounted for the largest market share in 2025, driven by their effectiveness in controlling light transmission and providing privacy. PDLC technology is widely used in commercial and residential settings where adjustable transparency is essential, such as in conference rooms and vehicle windows. The popularity of PDLC smart glass is supported by its cost-effectiveness and reliability, making it a preferred choice for architectural applications and energy-efficient building designs in the smart glasses industry.

The electrochromic (EC) segment is expected to register the fastest CAGR from 2026 to 2033. The segmental growth is driven by its dynamic tinting capability, which allows for real-time light transmission adjustment. This technology is highly favored in the automotive and architectural sectors, where it enhances user comfort by reducing glare and heat. EC smart glass is particularly valuable for energy management in buildings, as it can automatically adjust to varying light conditions, reducing reliance on artificial lighting and climate control, making it a promising solution for sustainable building practices.

Operating System Insights

The Android segment accounted for the largest market share in 2025, driven by the platform’s open-source nature and broad developer support. Android’s adaptability allows manufacturers to customize software for various applications, making it an ideal choice for enterprise solutions and consumer applications. Its extensive app ecosystem and compatibility with existing Android devices drive its popularity, facilitating seamless user integration and encouraging innovation in the smart glasses industry. These factors drive the growth of the Android segment in the market.

The Linux segment is expected to register the fastest CAGR from 2026 to 2033. The growth is driven by the platform’s stability, security, and customization options, which make it appealing for applications requiring high data privacy and operational flexibility. Industries such as manufacturing and healthcare are increasingly adopting Linux-based smart glasses for workflow management, diagnostics, and real-time data sharing, thereby positioning Linux as a steadily emerging competitor in the smart glasses industry.

Regional Insights

North America smart glasses industry dominated the global smart glasses industry with a share of over 36% in 2025, driven by the region's technological advancements and high consumer demand for innovative wearable devices. The increasing integration of smart glasses in sectors such as healthcare, education, and enterprise solutions has further fueled this growth. In addition, the cultural acceptance of wearable technology, coupled with the rise of remote work and digital collaboration tools, has made smart glasses an appealing choice for consumers and businesses alike, solidifying North America's leading position in the market.

U.S. Smart Glasses Market Trends

The U.S. smart glasses industry dominated the market with a share of over 88% in 2025, driven by a combination of innovation, investment, and consumer adoption. Major tech companies, including Google, Microsoft, and Apple, actively invest in smart glasses technology, resulting in advanced features and improved user experiences. The country's tech-savvy population is eager to embrace new gadgets that enhance productivity and entertainment, contributing to a growing consumer base for the smart glasses industry in the country.

Europe Smart Glasses Market Trends

The Europe smart glasses industry is expected to grow at a CAGR of over 23% from 2026 to 2033, owing to the rising demand across various industries, including healthcare, automotive, and retail. European companies are increasingly recognizing the potential of smart glasses for enhancing operational efficiency and customer engagement. The region's commitment to research and development, supported by governmental policies to foster innovation, has created a conducive environment for manufacturers of smart glasses.

The Germany smart glasses industry is expected to grow significantly in the coming years, driven by strong industrial digitization initiatives and the country’s leadership in Industry 4.0 adoption. Manufacturing, automotive, and engineering companies are increasingly deploying smart glasses to support hands-free assembly guidance, remote expert assistance, quality inspection, and workforce training. Government-backed programs promoting industrial automation in R&D and enterprise AR solutions are further strengthening market expansion across both industrial and healthcare sectors.

The UK smart glasses industry is witnessing rapid expansion, supported by growing adoption across healthcare, logistics, construction, and field services industries. Healthcare providers are leveraging smart glasses for telemedicine, clinical training, and real-time patient data visualization. The integration of AI, computer vision, and 5G connectivity is further enhancing device capabilities, positioning smart glasses as a key component of the UK’s evolving digital workplace ecosystem.

Asia Pacific Smart Glasses Market Trends

The Asia Pacific smart glasses industry is expected to grow at the fastest CAGR of 27% from 2026 to 2033, driven by rapid urbanization, expanding 5G infrastructure, and increasing smartphone and wearable device penetration across major economies. Rising investments in Industry 4.0 initiatives, smart manufacturing, and digital healthcare are accelerating enterprise adoption of AR-enabled wearable solutions for remote assistance, training, and workflow optimization. Favorable government policies promoting digital transformation and smart city development are further strengthening regional demand of the smart glasses industry.

The China smart glasses industry is driven by large-scale deployment of 5G networks, strong government support for artificial intelligence and augmented reality technologies, and the country’s expanding electronics manufacturing ecosystem. Increasing adoption of smart glasses in logistics, industrial maintenance, healthcare diagnostics, and public safety applications is also fueling market growth. Rising investments in metaverse platforms and immersive e-commerce are creating additional commercial use cases, accelerating nationwide adoption.

The Japan smart glasses industry is expanding steadily, owing to the country’s focus on robotics integration, precision manufacturing, and workforce automation to address labor shortages in industrial and healthcare sectors. Strong demand for hands-free visualization tools in surgical assistance, eldercare monitoring, and factory quality inspection is driving enterprise deployment. Continuous innovation by electronics manufacturers in lightweight optics, battery efficiency, and ergonomic design is improving user comfort, further supporting long-term market growth.

Key Smart Glasses Company Insights

Some of the key players operating in the market include Microsoft Corporation and Google LLC, among others.

-

Microsoft Corporation designs and develops mixed-reality and enterprise smart glasses solutions under its HoloLens product line. Its portfolio includes AR head-mounted displays, spatial mapping software, cloud integration via Azure, AI-based computer vision, and industrial remote-assistance platforms. The company serves industries such as manufacturing, healthcare, defense, aerospace, construction, education, energy, and logistics, supporting use cases including training, equipment maintenance, surgical visualization, and digital twin implementation.

-

Google LLC develops smart glasses and augmented reality platforms focused on enterprise productivity and industrial applications. Its product offerings include Google Glass Enterprise Edition, AR software development kits, computer vision tools, voice control systems, and cloud-based data services. The company serves sectors such as logistics, healthcare, manufacturing, field services, warehousing, and utilities, enabling hands-free workflows, real-time information access, remote collaboration, and operational efficiency.

Lumus Ltd. and Vuzix Corporation are some of the emerging market participants in the smart glasses industry.

-

Lumus Ltd. designs and develops optical waveguide display engines and augmented-reality visualization components for smart glasses manufacturers. Its product portfolio includes transparent waveguide optics, high-brightness display modules, micro-projectors, and AR system reference designs. The company primarily serves smart glasses OEMs, defense contractors, industrial solution providers, and automotive HUD developers, enabling lightweight, high-resolution, energy-efficient AR displays.

-

Vuzix Corporation designs and manufactures smart glasses and wearable display technologies focused on enterprise and industrial markets. Its offerings include monocular and binocular AR smart glasses, waveguide-based optics, voice-controlled interfaces, enterprise device management software, and ruggedized wearable systems. The company serves logistics, manufacturing, healthcare, warehousing, field services, and defense sectors, supporting applications such as remote assistance, order picking, inspection, and telemedicine.

Key Smart Glasses Companies:

The following key companies have been profiled for this study on the smart glasses market.

- Amazon. Com, Inc.

- Vuzix Corporation

- Bose Corporation

- Flows Bandwidth

- Google LLC

- Lenovo

- Lumus Ltd.

- Magic Leap, Inc.

- Microsoft Corporation

- Razer Inc.

Recent Developments

-

In October 2025, Vuzix Corporation entered into a strategic partnership with BUNDLAR to enable no-code XR content creation and delivery for Vuzix smart glasses across enterprise and defense markets, positioning wearable AR devices as scalable solutions for immersive training, field support, and operational workflows. This collaboration enhances Vuzix’s ecosystem by enabling organizations to author augmented reality content without coding expertise, accelerating the adoption of the smart glasses industry for real-world applications.

-

In May 2025, Google LLC continued to advance its smart glasses ecosystem with the Android XR platform, designed to run AI-enhanced smart glasses alongside headsets, bringing Gemini-powered contextual assistance, real-time translation, messaging, and navigation directly into wearable form factors. Partnerships with eyewear brands such as Gentle Monster and Warby Parker aim to accelerate stylish, commercially viable smart glasses designs for broader consumer adoption.

-

In January 2025. Lumus Ltd. announced the launch of its Z-30 optical engine for AR smart glasses in early 2025, featuring a compact 30-degree field-of-view waveguide architecture designed to enable smaller, lighter, and higher-brightness displays for both consumer and enterprise eyewear applications. This development positions Lumus as a critical supplier of optical components for the next-generation smart glasses industry.

Smart Glasses Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,161.3 million

Revenue forecast in 2033

USD 14,380.4 million

Growth rate

CAGR of 24.2% from 2026 to 2033

Base Year of Estimation

2025

Actual Data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in Thousand Units, Revenue in USD million/ million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, glass tinting technology, operating system, application, connectivity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc.; Vuzix Corporation; Bose Corporation; Flows Bandwidth; Google LLC; Lenovo; Lumus Ltd.; Magic Leap, Inc.; Microsoft Corporation; Razer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Smart Glasses Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart glasses market report based on type, glass tinting technology, operating system, application, connectivity, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Monocular

-

Binocular

-

Audio

-

Immersive

-

Others

-

-

Glass Tinting Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Polymer-Dispersed Liquid Crystals

-

Electrochromic (EC) Smart Glass

-

Photochromic

-

Suspended Particles Device (SPD)

-

Others

-

-

Operating System Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Android

-

Linux

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Education

-

Gaming

-

Healthcare

-

Industrial

-

Others

-

-

Connectivity Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Bluetooth

-

HDMI

-

USB

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart glasses market size was estimated at USD 2,463.6 million in 2025 and is expected to reach USD 3,161.3 million in 2026.

b. The global smart glasses market is expected to grow at a compound annual growth rate of 24.2% from 2026 to 2033 to reach USD 14,380.4 million by 2033.

b. The audio segment accounted for the largest market share of over 28% in 2025. The demand for hands-free audio experiences drives segmental growth. Audio-enabled smart glasses have gained popularity among consumers seeking a seamless blend of entertainment and utility, as these glasses allow users to listen to music, receive calls, and interact with virtual assistants without needing additional accessories. Advancements in bone conduction and open-ear audio technologies strengthen this segment’s leadership by delivering improved sound quality, thereby securing its position as a key driver of sustained market growth.

b. Some of the key players operating in the smart glasses market include Amazon.com, Inc.; Vuzix Corporation; Bose Corporation; Flows Bandwidth; Google LLC; Lenovo; Lumus Ltd.; Magic Leap, Inc.; Microsoft Corporation; Razer Inc.

b. The smart glasses market is experiencing growth, driven by a convergence of technological advancements and increasing consumer demand for wearable technology. Technological advancements in miniaturized displays, AI-powered computer vision, sensor integration, and edge computing, significantly enhancing user experience and accelerating the growth of the smart glasses industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.