- Home

- »

- Homecare & Decor

- »

-

Surface Disinfectant Wipes Market Size, Industry Report 2030GVR Report cover

![Surface Disinfectant Wipes Market Size, Share & Trends Report]()

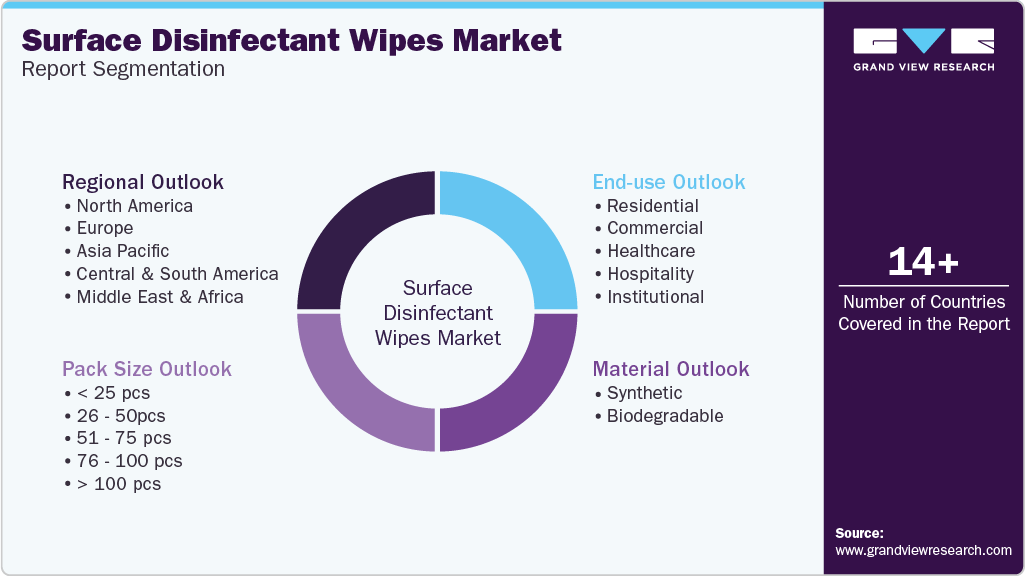

Surface Disinfectant Wipes Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Synthetic, Biodegradable), By Pack Size (< 25 pcs, 26 - 50 pcs, 51 - 75 pcs, 76 - 100 pcs, > 100 pcs), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surface Disinfectant Wipes Market Trends

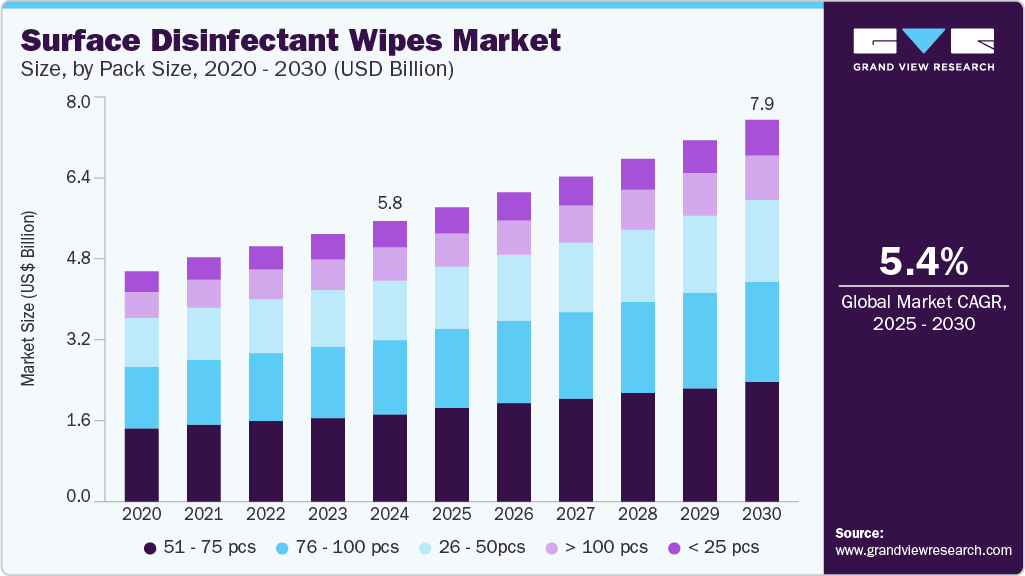

The global surface disinfectant wipes market size was estimated at USD 5,832.5 million in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2030. The increase in hospital-acquired infections has led to a large need for surface disinfectant wipes in healthcare institutions.

Key Highlights:

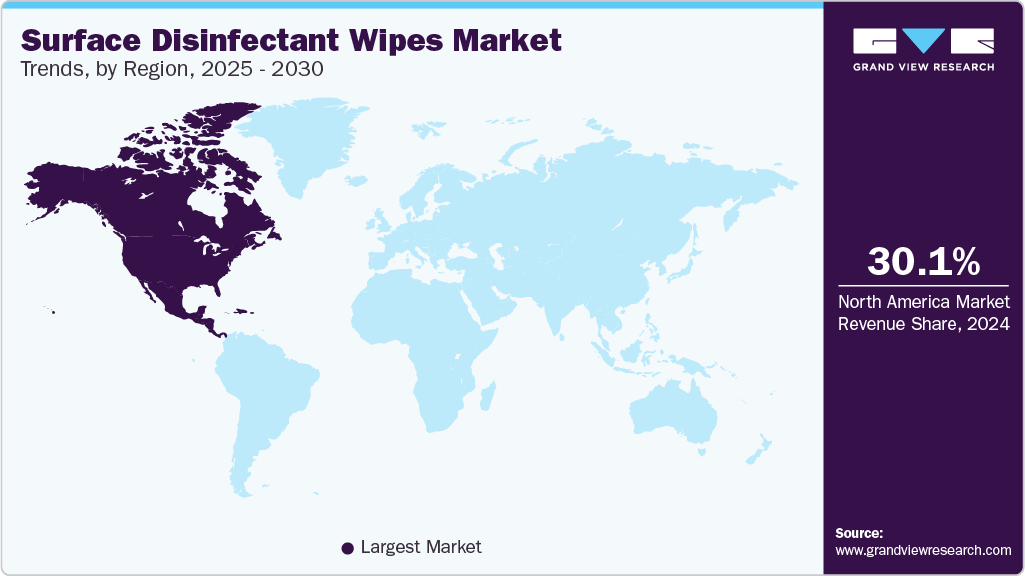

- The surface disinfectant wipes industry in North America accounted for a share of 30.08% in 2024.

- The surface disinfectant wipes market in the U.S. is set to grow at a significant CAGR from 2025 to 2030.

- Based on pack size segment, 51 - 75 pcs pack size of surface disinfectant wipes held a share of 31.29% in 2024 due to cost-efficiency and suitability for moderate-use environments.

- By on material segment, synthetic surface disinfectant wipes accounted for a revenue share of 79.73% in 2024.

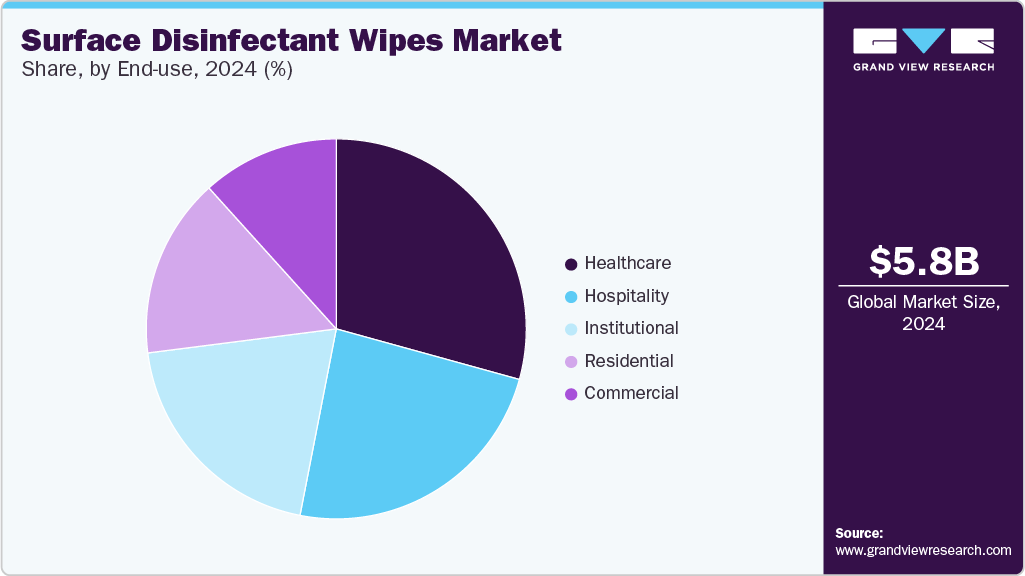

- By end use segment, surface disinfectant wipes used at various healthcare facilities accounted for a revenue share of 29.29% in 2024.

The Office of Disease Prevention and Health Promotion reports that 1 in every 31 hospitalized patients in the United States suffers from a healthcare-associated infection (HAI). These infections cause approximately 6,80,000 cases yearly, resulting in billions of dollars in unnecessary healthcare expenses in the U.S. The surface disinfectant wipes industry is growing due to strict infection control rules in hospitals and clinics. Moreover, the growing use of endoscope reprocessors and surgical units has increased demand for surface disinfectant wipes globally. Surgical units contributed to the increase in demand due to the crucial importance of sterilization in surgical settings. The growing number of surgical operations, both regular and complex, has led to an increased need for surface disinfectant wipes to ensure sterility. As healthcare systems developed internationally due to aging populations and technological breakthroughs, surface disinfectant wipes became increasingly important for infection control in hospital settings.

The increase in demand for eco-friendly and biodegradable surface disinfectant wipes has created significant opportunities in the global industry. Consumers and industries increasingly seek natural, biodegradable surface disinfectant wipes to promote environmental sustainability. Furthermore, governmental support for green surface disinfectant wipes in industries such as healthcare and food processing has fueled the increasing production of eco-friendly and biodegradable surface disinfectant wipes.

For instance, in July 2024, Byotrol introduced its first plastic-free, biodegradable surface disinfectant wipe under the CHEMGENE MEDLAB brand. This new product aligns with the company's commitment to sustainability by offering an eco-friendly alternative for surface disinfection. The wipe is designed to effectively eliminate pathogens while reducing environmental impact, catering to the growing demand for sustainable hygiene solutions.

Many companies worldwide have implemented sustainable sanitation practices to achieve certifications such as Leadership in Energy and Environmental Design (LEED), which is expected to generate a favorable market opportunity for eco-friendly surface disinfectant wipes. As companies and consumers value sustainability, the demand for bio-based surface disinfectant wipes is expected to increase, boosting overall surface disinfectant wipes industry growth.

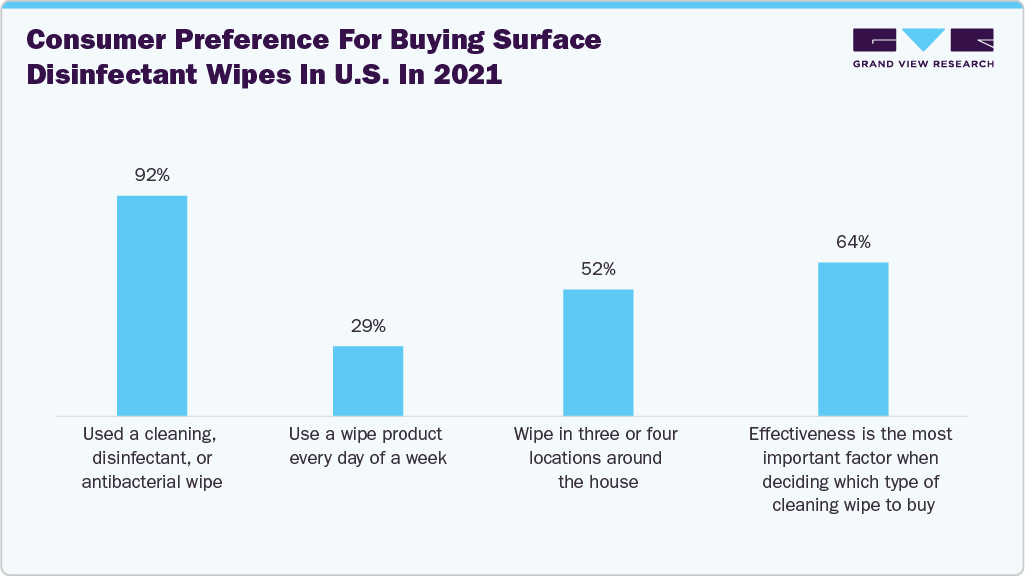

Consumer Surveys & Insights

A 2021 survey conducted by the American Cleaning Institute (ACI) revealed that disinfecting wipes have become an integral part of American households. The study provides insights into American consumers' usage patterns and preferences regarding cleaning wipes. When selecting cleaning wipes, consumers prioritize effectiveness, with 26% citing it as the most important factor. Other considerations include value (19%), durability (19%), brand name (18%), and package size (13%). These preferences highlight consumers' emphasis on cleaning products' performance and practicality.

The survey also highlighted a shift in cleaning behaviors influenced by the COVID-19 pandemic. A substantial 85% of Americans expressed their intention to maintain the heightened cleaning practices adopted during the pandemic, even as it subsides. Approximately 62% of participants expressed intentions to maintain enhanced cleaning routines to safeguard the health of others. Specifically, 50% planned to frequently disinfect high-touch surfaces, indicating a lasting impact of pandemic-induced hygiene practices on consumer habits. This commitment underscores a lasting shift in hygiene habits, with many individuals recognizing the importance of regular cleaning and disinfecting to safeguard health.

According to Brian Sansoni, ACI’s (American Cleaning Institute) Senior Vice President of Communications, Outreach & Membership, the results from ACI’s National Cleaning Survey show that 62 percent of respondents plan to continue pandemic-related cleaning behaviors for the health and wellness of others. Proper use of cleaning and disinfecting wipes is a part of that process. Millions of Americans will continue to rely on these products as a part of their daily and weekly routines to help keep their households clean and safe.

Pack Size Insights

51 - 75 pcs pack size of surface disinfectant wipes held a share of 31.29% in 2024 due to cost-efficiency and suitability for moderate-use environments. These packs offer enough wipes to support frequent use without the bulkiness of larger containers, making them ideal for households and small businesses that require regular disinfection but have limited storage space. This size is particularly appealing for users who want to maintain hygiene routines without constantly repurchasing or carrying overly large packages.

< 25 pcs pack size of surface disinfectant wipes is expected to grow at a CAGR of 6.4% from 2025 to 2030. Portability is the primary driver for pack sizes containing fewer than 25 wipes. These smaller packs are convenient for travel, on-the-go use, or keeping in places like purses, cars, or backpacks. They cater to individuals who want quick access to disinfectant wipes for personal or situational use, such as wiping down shopping cart handles or sanitizing hands and surfaces in public areas. The compact format meets the growing demand for hygiene solutions that are both accessible and easy to carry.

Material Insights

Synthetic surface disinfectant wipes accounted for a revenue share of 79.73% in 2024. The growth is driven by the growing demand for convenient and effective hygiene solutions in both residential and commercial settings. As consumers and businesses prioritize quick and reliable methods to control the spread of harmful pathogens, synthetic surface disinfectant wipes offer a practical advantage due to their ready-to-use format, consistent disinfectant application, and compatibility with a wide range of surfaces. Their ease of use, combined with time-saving benefits and proven efficacy against viruses and bacteria, has contributed to their widespread adoption, especially in high-traffic areas such as hospitals, offices, schools, and public transport systems.

The biodegradable surface disinfectant wipes segment is expected to grow at a CAGR of 6.9% from 2025 to 2030. With environmentally preferred purchasing policies in place in more than three-quarters of U.S. states and certified eco-conscious products required for new custodial contracts in federal buildings, demand for more environmentally friendly cleaners in public facilities continues to rise. For instance, in August 2024, the Clorox EcoClean product platform launched Clorox EcoClean Disinfecting Wipes. These wipes use naturally derived ingredients, including a citric acid active ingredient, and are made with a 100% plant-based substrate.

End Use Insights

Surface disinfectant wipes used at various healthcare facilities accounted for a revenue share of 29.29% in 2024. The critical need for infection prevention and control drives the growth. Hospitals, clinics, and other medical facilities rely heavily on these wipes to quickly and effectively disinfect high-touch surfaces, reducing the risk of healthcare-associated infections (HAIs). Their convenience and proven efficacy against a broad spectrum of pathogens make them indispensable tools for maintaining sterile environments and protecting both patients and healthcare workers.

The residential demand for surface disinfectant wipes is expected to grow at a CAGR of 6.2% from 2025 to 2030. The primary driver for residential or household use is the growing consumer focus on hygiene and convenience, particularly following the heightened awareness brought about by the COVID-19 pandemic. Families use surface disinfectant wipes for their ease of use and portability, allowing for quick clean-ups and reassurance of a germ-free environment. The desire to maintain a clean and safe living space, especially in homes with children, elderly family members, or pets, continues to fuel demand for these accessible and effective cleaning products.

Regional Insights

The surface disinfectant wipes industry in North America accounted for a share of 30.08% in 2024, due to a rise in public awareness related to health and hygiene, driven by health crises and a growing focus on cleanliness in homes, workplaces, and public spaces. Major cities with high disinfectant demand include New York City, Los Angeles, Chicago, and Toronto, where dense populations have developed an increased need for effective surface disinfectant wipes.

Some of the key brands operating in the region include Clorox and Lysol, all of which have expanded their product lines to meet consumer preferences for effective surface disinfectant wipes. In addition, trends such as increased online shopping for cleaning supplies and the adoption of sustainable products have influenced purchasing behavior. The focus on maintaining health standards across various sectors, including healthcare and hospitality, has further fueled the demand for surface disinfectant wipes in North America.

U.S. Surface Disinfectant Wipes Market Trends

The surface disinfectant wipes market in the U.S. is set to grow at a significant CAGR from 2025 to 2030. Initiatives such as stricter public health regulations, stringent cleaning standards in healthcare facilities, and workplace safety programs have been implemented in the U.S. The rise of antimicrobial guidelines in schools and food industries is expected to drive surface disinfectant wipes usage in the U.S. In addition, the booming tourism and hospitality sectors require enhanced sanitation practices in hotels, restaurants, and recreational areas.

Europe Surface Disinfectant Wipes Market Trends

The surface disinfectant wipes market in Europe accounted for a revenue share of 29.42% in 2024. Europe has implemented strict hygiene regulations, particularly under the EU Biocidal Products Regulation (BPR), which requires high standards for surface disinfectant wipes use in public spaces, healthcare, and food industries. In addition, green cleaning initiatives promote eco-friendly surface disinfectant wipes across the region. Cultural attitudes toward cleanliness and hygiene, particularly in countries such as Germany and Sweden, have contributed to consistently high demand for surface disinfectant wipes. The rise of community initiatives promoting public health and sanitation also influenced consumer behavior, highlighting the importance of maintaining clean environments.

Central & South America Surface Disinfectant Wipes Market Trends

The surface disinfectant wipes market in Central & South America is expected to grow at a CAGR of 14.6% from 2025 to 2030. Governments in the Central & South America region have introduced initiatives to promote disinfectant use, including stricter hygiene regulations in public spaces, hospitals, and food industries. These measures aim to improve sanitation standards and enhance regional public health. Increased urbanization and industrialization in countries such as Brazil, Argentina, and Colombia have increased the need for strict hygiene protocols in workplaces and public spaces, thus driving market growth across the region. The expansion of healthcare facilities, particularly in regions with improving healthcare infrastructure, has driven the demand for surface disinfectant wipes in hospitals and clinics.

Key Surface Disinfectant Wipes Company Insights

The surface disinfectant wipes industry is fragmented primarily due to the presence of several globally recognized and regional players. Some prominent companies in this market are Clorox Company, Kimberly-Clark Corporation, Ecolab Inc., Reckitt Benckiser Group PLC, and others.

-

The Clorox Company is a U.S.-based multinational manufacturer and marketer of consumer and professional products, best known for its namesake bleach and cleaning solutions. Headquartered in Oakland, California, Clorox has built a broad portfolio of trusted brands across cleaning, health, wellness, and household categories. With a strong commitment to sustainability and social responsibility, the company focuses on innovation and product safety while maintaining its position as a leader in the consumer goods industry.

-

Reckitt Benckiser, commonly known as Reckitt, is a British multinational company that produces health, hygiene, and nutrition products for global markets. Headquartered in Slough, England, Reckitt owns a diverse array of well-known brands including Lysol, Dettol, Durex, and Enfamil. The company prioritizes science-led innovation and consumer well-being, aiming to create high-quality products that promote cleaner, healthier lives. Reckitt is also actively engaged in environmental and social impact initiatives as part of its long-term sustainability strategy.

Key Surface Disinfectant Wipes Companies:

The following are the leading companies in the surface disinfectant wipes market. These companies collectively hold the largest market share and dictate industry trends.

- Clorox Company

- Kimberly-Clark Corporation

- Ecolab Inc.

- Reckitt Benckiser Group PLC

- 3M

- S. C. Johnson & Son, Inc.

- GOJO Industries, Inc.

- Procter & Gamble Co.

- Metrex Research, LLC

- PDI Healthcare

Recent Developments

-

In July 2024, Ecolab introduced the Disinfectant 1 Wipe, marking a significant advancement in sustainable healthcare hygiene. This product is the first disinfectant wipe to receive EPA registration while being entirely plastic-free and readily degradable. Composed solely of wood pulp fibers, it offers effective hospital-grade disinfection in just one minute.

-

In October 2022, Lysol Pro Solutions, a division of Reckitt, introduced an 800-count disinfecting wipes bucket and refill packs, aiming to meet businesses' high-volume disinfection needs. This new format is designed to enhance hygiene standards, reduce plastic waste, and offer cost-effective solutions for large-scale cleaning operations. The initiative reflects Lysol's commitment to supporting businesses in maintaining elevated cleanliness expectations.

-

In June 2021, PDI Healthcare introduced a new softpack format for its Super Sani-Cloth Germicidal Disposable Wipes, aiming to enhance portability and sustainability in infection prevention practices. This redesigned packaging contains 80 wipes per pack and utilizes 80% less plastic than the traditional large canister format, significantly reducing plastic waste.

Surface Disinfectant Wipes Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 6,123.0 million

Revenue forecast in 2030

USD 7,952.5 million

Growth rate (revenue)

CAGR of 5.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, pack size, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Clorox Company; Kimberly-Clark Corporation; Ecolab Inc.; Reckitt Benckiser Group PLC; 3M; S. C. Johnson & Son, Inc.; GOJO Industries, Inc.; Procter & Gamble Co.; Metrex Research, LLC; PDI Healthcare

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surface Disinfectant Wipes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surface disinfectant wipes market report based on material, pack size, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biodegradable

-

-

Pack Size Outlook (Revenue, USD Million, 2018 - 2030)

-

< 25 pcs

-

26 - 50pcs

-

51 - 75 pcs

-

76 - 100 pcs

-

>100 pcs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Healthcare

-

Hospitality

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface disinfectant wipes market was estimated at USD 5,832.5 million in 2024 and is expected to reach USD 6,123.0 million in 2025.

b. The global surface disinfectant wipes market is expected to grow at a compound annual growth rate of 5.37% from 2025 to 2030 to reach USD 7,952.5 million by 2030.

b. North America dominated the surface disinfectant wipes market in 2024 with a share of about 30.08%. The industry here is booming due to rise in public awareness related to health and hygiene, driven by health crises and a growing focus on cleanliness in homes, workplaces, and public spaces.

b. Key players in the surface disinfectant wipes market are Clorox Company; Kimberly-Clark Corporation; Ecolab Inc.; Reckitt Benckiser Group PLC; 3M; S. C. Johnson & Son, Inc.; GOJO Industries, Inc.; Procter & Gamble Co.; Metrex Research, LLC; and PDI Healthcare.

b. Key factors that are driving the surface disinfectant wipes market growth include increase in hospital-acquired infections, increase in demand for eco-friendly and biodegradable surface disinfectant wipes, and growing demand for convenient and effective hygiene solutions in both residential and commercial settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.