- Home

- »

- Next Generation Technologies

- »

-

Surge Protection Devices Market Size & Share Report, 2030GVR Report cover

![Surge Protection Devices Market Size, Share & Trends Report]()

Surge Protection Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Type, By Power Rating, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-846-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surge Protection Devices Market Summary

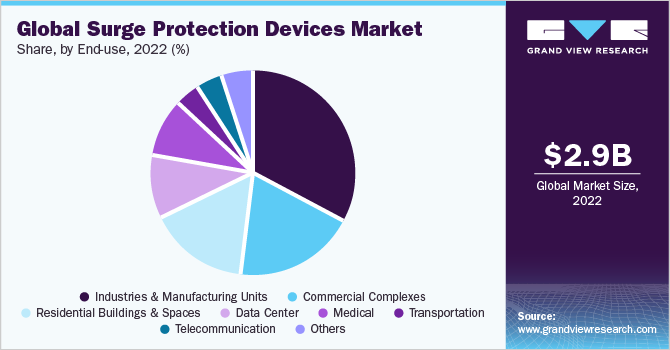

The global surge protection devices market size was estimated at USD 2.89 billion in 2022 and is projected to reach USD 4.88 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030. The growth of the market can be attributed to the growing demand for surge protection devices (SPD) to protect the new, innovative electrical and electronic gadgets being installed in homes and offices.

Key Market Trends & Insights

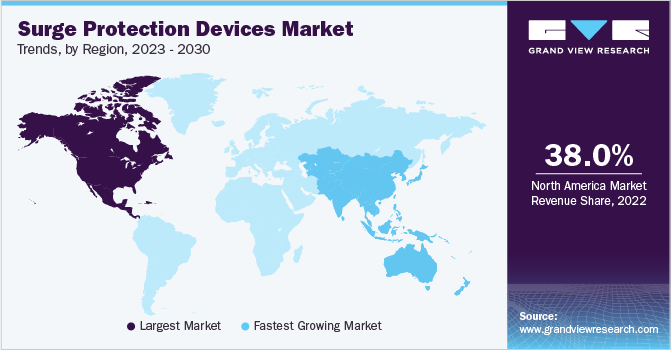

- North America dominated the surge protection devices (SPD) market in 2022 and accounted for a share of over 38.0% of the global revenue.

- By product, the hard-wired segment dominated the market in 2022 and accounted for a share of more than 44.0% of the global revenue.

- By type, the type 2 segment dominated the market in 2022 and accounted for a share of more than 30.0% of the global revenue.

- By power rating, the 100.1-200 kA segment dominated the market in 2022 and accounted for a share of more than 32.0% of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 2.89 Billion

- 2030 Projected Market Size: USD 4.88 Billion

- CAGR (2023-2030): 6.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Other factors that are expected to drive the demand for surge protection devices include the alternative energy programs being pursued aggressively all over the world and the rising operating costs stemming from power quality issues and the resultant frequent equipment failure. The ability of surge protection devices to cut electricity bills by reducing the power consumed by gadgets is also expected to play a vital role in driving the growth of the market over the forecast period.

The continued amendments various governments are making in their respective regulations for public safety are expected to contribute to the growth of the market. For instance, in the U.S., the National Electrical Code, which is published and sponsored by the National Fire Protection Association in Quincy, Massachusetts, is updated every three years in line with the rapid advances in technology. The code was updated to its 2020 edition and the revised edition contains a new requirement to ensure surge protection for the entire house. While the new rule applies to new homes, it becomes applicable to the existing homes when the service panel is updated. The revised National Electrical Code envisages protecting the appliances, electronic equipment, and computers from electrical surges.

The growing demand for smart power strips is also one of the major factors accentuating the market growth. The demand for Wi-Fi enabled power strips is high among the customers due to its capabilities to automatically set schedules and timers as well as monitor energy usage. Various companies thereby, are making efforts to provide Wi-Fi enabled power strips. For instance, in September 2018, TP-Link’s Kasa Smart, a consumer smart home brand announced the introduction of the Kasa Smart Wi-Fi Power Strip. This power strip comes with ETL-certified surge protection that safeguards devices against sudden power surges.

The increasing developments made in smart homes worldwide is expected to boost the demand for smart home-enabled surge protection devices worldwide. According to the statistics provided by Oberlo, 63.43 million households in the U.S. actively use smart home gadgets in 2023. The adoption of smart gadgets in the coming years is expected to grow at a growth rate of 10.2%. Oberlo predicts that there will be 93.59 million households in the U.S. using smart home gadgets by 2027. These smart gadgets, thereby, are expected to make smart homes technologically convenient and easier.

Surge protection devices are of paramount importance for protecting electrical installations. As such, the growing sales of household electronic devices across the globe are expected to accentuate the growth of the surge protection devices (SPD) market. According to the study conducted by the United States Public Interest Research Group (U.S. PIRG), a nonprofit organization focusing on consumer issues, as of 2021, American households spent about USD 1,767 on buying new electronic products per year. However, lower awareness of surge protection devices in emerging countries and regions is anticipated to hinder the growth of the market.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has had an adverse impact on the market. The production of surge protection devices has been particularly affected due to supply chain disruptions. Manufacturers of various electronic components, including surge protection devices, confronted short-term operational issues stemming from the lack of site access and supply chain constraints. They also remained concerned about the safety of their workers in the wake of the outbreak of the pandemic and were busy evaluating various risk factors. On the other hand, the outbreak of the pandemic took a significant toll on the buying power of consumers, which culminated in a gradual decline in the sales of electronic gadgets, which also restrained the demand for surge protection devices to some extent.

Product Insights

The hard-wired segment dominated the market in 2022 and accounted for a share of more than 44.0% of the global revenue. Hard-wired SPDs are typically installed on power lines for the protection of devices and outlets downstream from the device. They can also protect AC-powered, connected systems and equipment from the damages stemming from transients, surges, and AC power-induced events. Hard-wired surge protection devices are also used in commercial, industrial, and residential applications, such as lighting circuits, motor controllers, and power distribution. Hence, hard-wired SPDs can be the most convenient surge protection solution to ensure reliable operations and extended performance.

The plug-in segment is anticipated to grow at the highest CAGR over the forecast period. Plug-in SPDs are mainly installed in intermediate panels and at the origin of the network to protect the equipment from indirect lightning strikes. As such, plug-in surge protection devices are used for protecting sensitive electrical equipment, such as refrigerators and television sets, among others. The demand for plug-in SPDs is anticipated to increase over the forecast period owing to the application of plug-in SPDs and the advantages they can offer at various endpoints. A plug-in SPD may require external overcurrent protection or may be included within the SPD.

Type Insights

The type 2 segment dominated the market in 2022 and accounted for a share of more than 30.0% of the global revenue. Type 2 SPDs are designed for industrial and commercial applications. The protection of electrical equipment and distribution panels at a factory or a commercial facility is of foremost importance, as power failure or equipment damage can severely hamper productivity. The main function of type 2 surge protection devices is to limit transient voltage and protect sensitive electronics and Mp/Mc-based boards. Hence, type 2 SPDs are mainly installed on the load side of the main service equipment.

The type 1 segment is expected to register the fastest growth over the forecast period. Type 1 SPDs are incorporated primarily to protect electronic equipment from lightning surges. Climatic changes in recent years have led to an increase in lightning strikes. Hence, the growing need to protect electrical equipment used in applications, such as solar plants and smart grids, from lightning surges is expected to drive the growth of the segment over the forecast period. The rise in the installation of type 1 surge protection devices in sump and irrigation pumps, farm controls, and garages, among others, is also expected to drive the growth of the segment.

Power Rating Insights

The 100.1-200 kA segment dominated the market in 2022 and accounted for a share of more than 32.0% of the global revenue. SPDs with a higher kA factor do not provide enhanced protection but rather deliver a longer product life. Hence, SPDs with a higher kA factor are ideal for industrial and data center applications. As a result, the demand for SPDs with a 100.1-200 kA power rating is growing worldwide.

The 50.1-100 kA segment is projected to grow at the highest CAGR over the forecast period. SPDs with power ratings ranging from 50.1 kA to 100 kA are primarily used by manufacturing units and for residential and commercial applications. As SPDs with 50.1-100 kA power ratings are capable of providing the necessary protection and longevity; the use of higher-rating SPDs, such as SPDs with ratings of 100.1 kA and above, is only feasible for applications that are less price-sensitive and subject to regular high power surges. Hence, the 50.1-100 kA segment is expected to emerge as the fastest-growing segment over the forecast period.

End-use Insights

The industries & manufacturing units segment dominated the market in 2022 and accounted for a share of over 33.0% of the global revenue. Advances in technology and the strong emphasis on augmenting profitability are prompting companies to deploy various automation systems and high-end electronics. However, companies using electrical equipment are often subject to power line abnormalities and heavy lightning that may lead to the breakdown of the equipment. Such breakdowns typically add to the company’s operational costs. Hence, the adoption of SPDs is particularly anticipated to increase over the forecast period due to their ability to counter any overvoltage on the electrical distribution network.

The commercial complexes segment is anticipated to grow at a promising CAGR over the forecast period. The commercial sector in developing economies, such as India, is growing noticeably owing to the favorable policies, such as Make in India and Startup India, being pursued by the government. Competition within the commercial sector is particularly expected to intensify owing to such encouraging initiatives. Hence, commercial establishments are expected to opt for SPDs to safeguard their equipment, prevent any undesired downtimes, save costs, and augment profitability, thereby driving the growth of the segment over the forecast period. The strong emphasis electrical designers are putting on ensuring that commercial SPDs are installed in compliance with the regulatory requirements also bodes well for the growth of the segment.

Regional Insights

North America dominated the surge protection devices (SPD) market in 2022 and accounted for a share of over 38.0% of the global revenue. The region happens to be an early adopter of advanced technologies. The level of awareness about the benefits of SPDs is also very high in the region. When it comes to the U.S., electricity consumption for residential and commercial applications accounts for approximately 37% of the total electricity consumption. The U.S. is also home to states such as Florida, Louisiana, Mississippi, and Alabama, which are highly prone to lightning strikes. Hence, the adoption of SPDs to protect electronic appliances from sudden energy fluctuations is very high in these states. As such, North America has emerged as the largest regional market owing to all these factors.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth can be attributed to the growing awareness in countries such as China, India, and Japan about the benefits offered by SPDs. Moreover, the rising levels of disposable income in the Asia Pacific are also allowing individuals to spend on premium consumer electronics, such as LED television sets, washing machines, and refrigerators, among others. The strong consumer emphasis on protecting these consumer electronics is expected to drive the growth of the regional market over the forecast period.

Key Companies & Market Share Insights

The market can be described as highly competitive owing to the presence of several prominent players. Key strategies adopted by the market players include new product development, capacity expansion, merger & acquisition, strategic collaborations, partnerships, and agreements; and investment in research & development activities. Companies, such as General Electric Company, are particularly focusing on providing power strips and wall tap surge protectors. Companies are particularly providing 6-outlet, 2-outlet, 4-outlet, and 8-outlet power strip surge protectors.

Having realized that product quality is the key aspect of the market, key players are focusing on enhancing their product portfolios. Key players are primarily focusing on developing sophisticated and innovative products based on extensive research and development. For instance, in June 2023, Littelfuse, Inc., an industrial technology manufacturing company, launched the National Electrical Manufacturers Association (NEMA) style Surge Protective Device (SPDN) series to protect equipment from transient overvoltage situations that last for micro-seconds and help reduce downtime and costly damage. Some of the prominent players in the global surge protection devices market are:

-

ABB Ltd.

-

General Electric Company

-

Schneider Electric

-

Eaton Corporation plc

-

Legrand

-

Emerson Electric Co.

-

Siemens

-

CG Power and Industrial Solutions Limited

-

Littelfuse, Inc.

-

Bourns, Inc.

Surge Protection Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.07 billion

Revenue forecast in 2030

USD 4.88 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, type, power rating, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB Ltd; General Electric Company; Schneider Electric; Eaton Corporation plc; Legrand; Emerson Electric Co.; Siemens; CG Power and Industrial Solutions Limited; Littelfuse, Inc.; Bourns, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surge Protection Devices Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global surge protection devices market report based on product, type, power rating, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Hard-wired

-

Plug-in

-

Line Cord

-

Power Control Devices

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Type 1

-

Type 2

-

Type 3

-

Type 4

-

-

Power Rating Outlook (Revenue, USD Million, 2017 - 2030)

-

0-50 kA

-

50.1-100 kA

-

100.1-200 kA

-

200.1 kA and Above

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Complexes

-

Data Center

-

Industries & Manufacturing Units

-

Medical

-

Residential Buildings & Spaces

-

Telecommunication

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

- Australia

-

-

Latin America

-

Brazil

- Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surge protection devices market size was estimated at USD 2.89 billion in 2022 and is expected to reach USD 3.07 billion in 2023.

b. The global surge protection devices market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 4.88 billion by 2030.

b. North America dominated the SPDs market with a share of more than 38.0% in 2022. This is attributable to increased sales of SPD integrated electronic devices such as personal laptops, printers, television, microwave devices, and washing machines among others.

b. Some key players operating in the SPDs market include ABB Ltd., CG Power and Industrial Solutions Limited, Eaton Corporation PLC, Emerson Electric Co., and General Electric.

b. Key factors that are driving the surge protection devices market growth include the increasing use of electronics in residential and commercial sectors and the high cost associated with electrical equipment downtime.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.