- Home

- »

- Medical Devices

- »

-

Surgical Blade Market Size, Share & Growth Report, 2030GVR Report cover

![Surgical Blade Market Size, Share & Trends Report]()

Surgical Blade Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Stainless Steel, High-grade Carbon Steel), By Material, By End Use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-371-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Blade Market Size & Trends

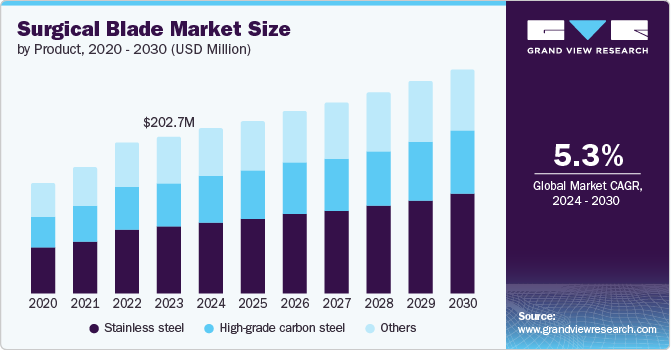

The global surgical blade market size was estimated at USD 202.7 million in 2023 and is projected to grow at a CAGR of 5.30% from 2024 to 2030. The increasing prevalence of chronic diseases, an aging population, rising number of surgical procedures, and advancements in surgical techniquesare major factors driving the market growth. According to the International Society of Aesthetic Plastic Surgery, 26.2 million surgical procedures were performed in U.S. in 2022. This includes both aesthetic and reconstructive surgeries, indicating a substantial volume of surgical activity in the region, propelling the market growth for surgical blades.

The increasing prevalence of chronic diseases is a primary driver of the global market. Diseases such as cardiovascular conditions, cancer, and diabetes are rising at an alarming rate, significantly contributing to the surge in surgical procedures worldwide. For instance, cardiovascular diseases are the leading cause of death globally, accounting for nearly 18 million deaths annually, according to the World Health Organization (WHO). This high incidence necessitates numerous surgical interventions, including coronary artery bypass grafting and angioplasty, which require precise and reliable surgical blades. Similarly, cancer cases are increasing, According to the International Agency for Research on Cancer (IARC) reporting over 19 million new cases in 2020 alone. Surgical procedures such as tumor resections and biopsies are critical components of cancer treatment, driving the demand for high-quality surgical blades. In addition, the rising prevalence of diabetes, which affects over 422 million people worldwide as per WHO estimates, often leads to complications like diabetic foot ulcers that require surgical management. These chronic conditions highlight the critical need for surgical interventions, thereby escalating the demand for surgical blades.

The development of minimally invasive surgeries has revolutionized the medical field, requiring more precise and specialized surgical instruments, including blades. For instance, laparoscopic surgeries, which involve small incisions and the use of cameras and specialized tools, demand highly sharp and precise blades to ensure minimal tissue damage and quicker patient recovery. These technological advancements not only improve surgical outcomes but also increase the frequency of surgeries performed, thus boosting the demand for advanced surgical blades. With advancements in medical technology and improved healthcare infrastructure, the accessibility & safety of surgical interventions have significantly increased. This has led to a rise in elective surgeries, such as cosmetic and orthopedic procedures, and necessary surgeries, including cardiovascular & cancer-related operations. For instance, according to McLeod Health statistics, in 2022, a total of 18,577,953 orthopedic procedures were performed in the U.S.

The aging global population is also a crucial factor propelling the market growth. As life expectancy increases, the elderly population is growing, leading to a higher incidence of age-related health issues that often require surgical intervention. For instance, conditions such as osteoarthritis, cataracts, and various forms of cancer are more prevalent among older adults, necessitating surgical treatment. According to the CDC, adults aged 65 and above are at a higher risk of heart disease, COPD, diabetes, cancer, neurological problems, and other chronic illnesses. Patients with such illnesses require surgeries, which drives the demand for surgical blades.

Government initiatives and healthcare infrastructure development further drive the market growth. Many countries are investing heavily in their healthcare systems to improve accessibility and quality of care. For instance, India's Ayushmaan Bharat scheme aims to provide affordable healthcare to over 500 million people, significantly increasing the number of surgeries performed in public healthcare facilities. Similarly, China's Healthy China 2030 plan focuses on enhancing healthcare services, leading to a rise in surgical procedures and the need for surgical instruments, including blades. These government efforts to enhance healthcare infrastructure and provide better medical services directly contribute to the market growth.

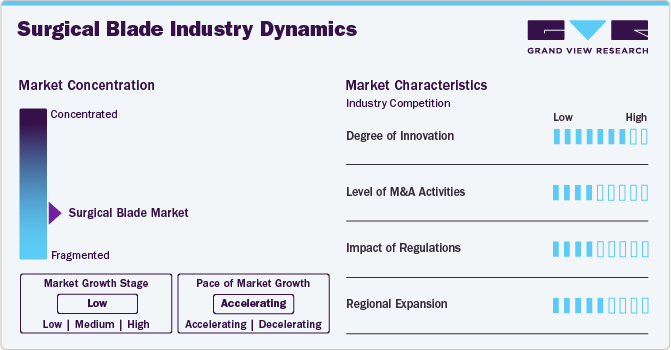

Market Concentration & Characteristics

The market growth is low, and the pace is accelerating. The market is defined by several distinct characteristics that shape its dynamics and growth trajectory. Companies in the market are constantly investing in the research and development to enhance blade materials and designs, leading to products such as diamond-coated and ceramic blades, which offer superior precision and durability.

The market is characterized by a moderate degree of innovation, driven by continuous advancements in medical technology and the growing demand for precise surgical instruments. For instance, the development of ceramic and diamond-coated blades represents significant innovation in the industry. These materials offer superior sharpness and durability compared to traditional stainless steel blades, enhancing surgical precision and reducing the risk of tissue damage. The incorporation of laser technology for blade manufacturing is another innovative step, allowing for ultra-thin and highly accurate blades suitable for delicate procedures like ophthalmic surgeries.

The market has seen a notable level of mergers and acquisitions (M&A) activities as companies strive to expand their market share, diversify their product portfolios, and enhance their technological capabilities. For instance, in September 2023, Acrotec Group, a Swiss manufacturer of high-precision components, has acquired Friedrich Daniels, a German manufacturer of surgical instruments and complete solutions. These M&A activities facilitate the sharing of technological expertise, streamline supply chains, and enable companies to offer comprehensive solutions to healthcare providers. As a result, M&A activities are a crucial strategic tool for growth and competitiveness in the global market.

Regulations significantly impact the market growth, ensuring the safety and efficacy of products used in medical procedures. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent guidelines on the manufacturing, sterilization, and labelling of surgical blades. For instance, the FDA’s regulations under 21 CFR Part 820 mandate that manufacturers adhere to Quality System Regulations (QSR) to ensure that surgical blades meet high standards of quality and safety. In May 2021, the European Union's Medical Device Regulation (MDR) came into effect, imposing more rigorous requirements for clinical evaluation and post-market surveillance of medical devices, including surgical blades. Compliance with these regulations ensures product reliability and patient safety but also increases the cost and complexity of bringing new products to market.

Regional expansion is a critical strategy for market growth, with companies seeking to tap into emerging markets and increase their global footprint. Asia-Pacific, in particular, represents a significant growth opportunity due to its large population, increasing healthcare expenditure, and rising incidence of chronic diseases. For instance, B. Braun Melsungen AG has expanded its operations in India and China to cater to the growing demand for surgical instruments in these regions. In 2021, the company opened a new manufacturing facility in Penang, Malaysia, to enhance its production capacity and supply chain efficiency in the Asia-Pacific region.

Product Insights

The stainless steel segment led the market with the largest revenue share of 43.10% in 2023 and is also expected to grow at the fastest CAGR of 5.7% during the forecast period, due to their widespread adoption and proven efficacy in various surgical procedures. Stainless steel blades are favored for their exceptional sharpness, durability, and resistance to corrosion, which are crucial attributes in maintaining surgical precision and patient safety. In addition, the healthcare sector's ongoing focus on infection control and surgical safety bolsters demand for high-quality, sterile surgical instruments.

Innovations in stainless steel alloy formulations enhance the blades' performance, making them even more attractive to healthcare providers. Moreover, the cost-effectiveness and availability of stainless-steel blades make them a preferred choice in both developed and emerging markets. With companies continuously improving their product offerings and expanding their global reach, the stainless-steel segment is set to experience robust growth, reflecting its critical role in modern surgical practices.

Material Insights

Based on material, the sterile segment led the market with the largest revenue share of 75.6% in 2023 and is expected to grow at the fastest CAGR of 5.5% during the forecast period. This dominance is attributed to the increasing emphasis on infection control, advancements in sterilization technologies, and the rising number of surgical procedures worldwide.Sterile surgical blades are essential in preventing surgical site infections (SSIs), which are a significant concern in medical procedures. According to the Centers for Disease Control and Prevention (CDC), SSIs are among the most common healthcare-associated infections, accounting for about 20% of all infections. The use of sterile surgical blade helps mitigate this risk by ensuring that instruments are free from microbial contamination, thereby protecting patients from potential postoperative infections. This emphasis on infection control is driving hospitals and surgical centers to adopt sterile blades more widely, contributing to their substantial market share.

Advancements in sterilization technologies have also played a crucial role in the growth of the sterile surgical blade segment. Modern sterilization methods, such as gamma irradiation and ethylene oxide (EO) sterilization, provide highly effective means of ensuring that surgical blades are free from any viable microorganisms. For instance, gamma irradiation is widely used due to its ability to penetrate deep into materials and its effectiveness in sterilizing complex instruments. These innovations not only enhance the safety and efficacy of surgical blades but also increase their adoption across various medical facilities.

End Use Insights

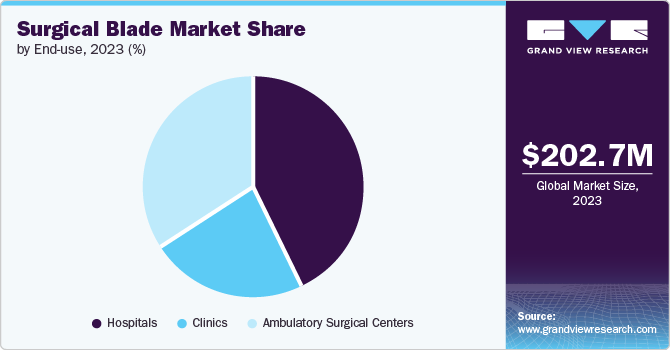

Based on end use, the hospitals segment led the market with the largest revenue share of 42.52% in 2023, due to its pivotal role in the healthcare system and its significant demand for high-quality surgical instruments. Hospitals are the primary settings for a wide array of surgical procedures, ranging from routine operations to complex surgeries, which drives the substantial demand for surgical blades. They are often at the forefront of medical innovation, incorporating the latest surgical techniques and equipment to enhance patient care. For instance, the rise of minimally invasive surgeries, such as laparoscopic and robotic-assisted surgeries, requires highly precise and technologically advanced surgical blades. These procedures involve small incisions and demand instruments that can perform with exceptional accuracy to reduce tissue damage and promote quicker recovery times. Hospitals’ investment in cutting-edge surgical tools aligns with their goal of providing the best possible care, further driving the demand for advanced surgical blades.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 5.5% during the forecast period. They offer a convenient, cost-effective, and efficient alternative to traditional hospital-based surgeries, contributing to their rapid expansion and growing demand for surgical instruments, including surgical blades. Minimally invasive surgeries, which are often performed on an outpatient basis, have become increasingly common due to their benefits of reduced recovery times, lower risk of complications, and decreased overall healthcare costs. ASCs typically offer lower overhead costs compared to hospitals, resulting in reduced charges for surgical procedures. This affordability makes ASCs an attractive option for patients and insurance providers alike. According to the report published by Commonwealth of Massachusetts in February 2024, procedures conducted in Ambulatory Surgical Centers (ASCs) are significantly more cost-effective compared to Hospital Outpatient Departments (HOPDs), with prices generally 30-55% lower. This cost advantage is particularly appealing in an era where healthcare cost containment is a priority for both public and private payers. As more surgeries shift to these cost-effective settings, the demand for surgical blades used in ASCs is expected to increase.

Regional Insights

North America dominated the surgical blade market with a revenue share of 35.7% in 2023, due to its advanced healthcare infrastructure, high surgical procedure volumes, and technological innovations. The National Library of Medicine reported that in July 2021, nearly nine major surgeries were performed for every 100 older people in the U.S., and over one in seven Medicare beneficiaries underwent a major surgery over five years, representing nearly 5 million unique older people. This substantial increase in surgical cases underscores the growing demand for reliable and high-quality surgical blades. The market's growth is also supported by the region's aging population and the increasing prevalence of chronic diseases requiring surgical interventions. For instance, According to the CDC report published in February 2024, an estimated 129 million people in the U.S. have at least 1 major chronic disease such as cancer, heart disease, obesity, diabetes and hypertension, leading to a substantial number of cardiovascular surgeries that rely on precise surgical blades for optimal outcomes.

U.S. Surgical Blade Market Trends

The surgical blade market in U.S. is experiencing robust expansion, driven by stringent FDA regulations ensuring high standards of quality and safety for medical devices. This growth is further supported by the advanced healthcare infrastructure in the country. For instance, according to data published by the Urgent Care Association in May 2024, there are approximately 14,714 urgent care centers in the U.S. that offer diagnostic services and care to more than 100 million patients annually.

Europe Surgical Blade Market Trends

The surgical blade market in Europe is characterized by a diverse healthcare landscape across countries with varying healthcare expenditures and surgical practices. Countries like Germany, France, and the United Kingdom are major contributors to the market, driven by their advanced healthcare systems and increasing surgical volumes. The European market benefits from strong regulatory oversight provided by the European Medicines Agency (EMA), which ensures rigorous standards for the safety, efficacy, and quality of surgical blades. The implementation of the Medical Device Regulation (MDR) in 2021 has further strengthened these standards, necessitating comprehensive clinical evaluations and post-market surveillance to enhance patient safety.

The UK surgical blade market is currently experiencing notable growth, propelled by several key factors. One significant driver is the increasing demand for surgical procedures due to the rising prevalence of chronic diseases and the aging population. Conditions such as cardiovascular diseases, orthopedic disorders, and cancer require surgical interventions that rely heavily on precise and efficient surgical blades. This demand is further augmented by advancements in surgical techniques and materials, which enhance surgical outcomes and necessitate the use of specialized instruments, including high-quality blades.

Asia Pacific Surgical Blade Market Trends

The surgical blade market in Asia Pacific is poised to witness at a significant CAGR of 5.7% over the forecast period. This growth is driven by several factors unique to the region. The increasing healthcare expenditure and the advanced healthcare infrastructure in countries like China, India, and Japan are expanding access to surgical procedures. As these economies develop, there is a corresponding rise in the demand for high-quality surgical instruments, including blades. In addition, the aging population and the prevalence of chronic diseases in the region are contributing to higher surgical volumes, further boosting market growth. For example, China's healthcare reforms and investments in healthcare infrastructure are driving the expansion of surgical capabilities across the country.

The China surgical blade market is experiencing significant growth, driven by several key factors that highlight the country's expanding healthcare sector and technological advancements. One of the primary drivers of this growth is the rapid development of China's healthcare infrastructure. With a population exceeding 1.4 billion people, China faces increasing healthcare demands, including a rising number of surgical procedures. The prevalence of chronic diseases such as cardiovascular diseases, cancer, and diabetes is contributing to higher surgical volumes, necessitating a corresponding demand for high-quality surgical instruments, including surgical blades. This demographic shift underscores the critical role that surgical blades play in enabling precise and efficient surgical interventions.

The surgical blade market in India is experiencing significant growth, driven by a combination of increasing healthcare expenditure, rising surgical procedures, advancements in medical technology, and supportive government initiatives. This robust growth trajectory is a reflection of India's expanding healthcare infrastructure and the growing demand for quality medical devices. According to The Indian Express in January 2024, India conducts approximately 30 million surgeries every year, primarily in small- and mid-size hospitals (85%), compared to corporate hospitals (15%). According to recent research, there is a need for about 3,646 surgeries per 100,000 people annually in India, with one-third of surgeries undertaken among individuals aged 30 to 49. This translates to an annual requirement of nearly 50 million surgeries in the country. In contrast, high-income countries average around 23,000 surgeries per 100,000 people annually.

Latin America Surgical Blade Market Trends

The surgical blade market in Latin America is experiencing significant growth, driven by a combination of factors including increasing healthcare expenditure, rising prevalence of chronic diseases, expanding healthcare infrastructure, and advancements in medical technology. This market growth is a reflection of the region’s commitment to improving healthcare access and quality, despite economic and logistical challenges. Regulatory frameworks in countries such as Brazil (Brazilian Health Regulatory Agency), and Argentina (National Administration of Drugs, Food and Medical Technology) are becoming more stringent, ensuring that surgical blades and other medical devices meet high standards of safety and efficacy.

Key Surgical Blade Company Insights

The key industry players operating across the global market implementing numerous strategic initiatives such as mergers, partnerships, collaborations, acquisitions, etc. The prominent strategies companies undertaking are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth.

Key Surgical Blade Companies:

The following are the leading companies in the surgical blade market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- Johnson & Johnson Service, Inc.

- Conmed Corporation

- Integra LifeSciences

- Smith & Nephew

- Becton, Dickinson and Company (BD)

- B. Braun Melsungen Ag

- Cadence Inc

- Integer Holdings Corporation

- Olympus Corporation

- Stryker

- Boston Scientific Corporation

- Erbe Elektromedizin Gmbh

- 3M Healthcare

Recent Developments

-

In October 2020, Entrepix Medical, LLC, launched Planatome Technology, an advanced nano-polishing technique for surgical instruments. This technology creates a smooth, precise blade without manufacturer defects, reducing tissue trauma and ensuring a safer surgical experience compared to traditional scalpels

-

In June 2020, Olympus introduced two single-use electrosurgical knives for Endoscopic Submucosal Dissection (ESD) in the U.S. Both knives feature integrated submucosal injection for efficient, safe, and reliable ESD performance

Surgical Blade Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 212.06 million

Revenue forecast in 2030

USD 289.08 million

Growth rate

CAGR of 5.30% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic Plc; Johnson & Johnson Service, Inc.; Conmed Corporation; Integra LifeSciences; Smith & Nephew; Becton, Dickinson and Company (BD); B. Braun Melsungen Ag; Cadence Inc; Integer Holdings Corporation; Olympus Corporation; Stryker; Boston Scientific Corporation; Erbe Elektromedizin Gmbh; 3M Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Blade Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global surgical blade market report based on product, material, end use, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless steel

-

High-grade carbon steel

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non-sterile

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical blade market size was estimated at USD 202.7 million in 2023 and is expected to reach USD 212.06 million in 2024.

b. The global surgical blade market is expected to grow at a compound annual growth rate of 5.30% from 2024 to 2030 to reach USD 289.08 million by 2030.

b. North America dominated the surgical blade market with a share of 35.7% in 2023. This is attributable to well-established healthcare sector and increasing prevalence of obesity and cardiac disorders.

b. Some key players operating in the surgical blade market include Swann-Morton Limited; PL Medical Co.; Hill-Rom, LLC; Beaver-Visitec International; VOGT Medical; Hu-Friedy Mfg. Co., LLC; B. Braun Melsungen AG; and Surgical Specialties Corporation.

b. Key factors that are driving the market growth include increase in surgeries due to increase in number of accidents, coupled with a growing geriatric population prone to various disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.