- Home

- »

- Smart Textiles

- »

-

Surgical Gloves Market Size, Share & Trends Report, 2030GVR Report cover

![Surgical Gloves Market Size, Share, & Trends Report]()

Surgical Gloves Market (2023 - 2030) Size, Share, & Trends Analysis Report By Material (Natural Rubber, Nitrile), By End-use, By Sterility, By Form, By Distribution, By Usage, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-069-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Gloves Market Summary

The global surgical gloves market size was estimated at USD 2,005.6 million in 2022 and is projected to reach USD 3,160.3 million by 2030, growing at a CAGR of 5.8% from 2023 to 2030. The rising awareness among industry participants about the importance of employee safety is anticipated to drive market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, South Africa is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, natural rubber accounted for a revenue of USD 752.1 million in 2022.

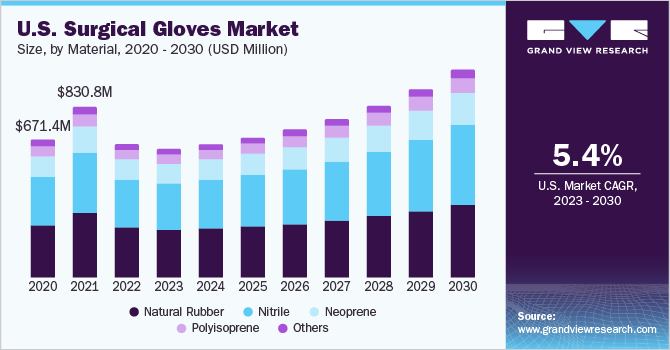

- Nitrile is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 2,005.6 Million

- 2030 Projected Market Size: USD 3,160.3 Million

- CAGR (2023-2030): 5.8%

- North America: Largest market in 2022

Surgical gloves are widely used by healthcare professionals while performing surgical procedures, which helps reduce the transmission of infection from patients to healthcare professionals. The demand-supply gap for surgical gloves is expected to expand internationally due to supply restrictions, including limited manufacturing capacity, lengthy construction times, and a shortage of labor during the pandemic period.

Additionally, it is projected that trade restrictions would cause companies to experience logistical difficulties when procuring raw materials, which will exacerbate the gap between supply and demand for surgical gloves However, manufacturers are increasingly focused on digitalization, automation, innovation, and artificial intelligence, which has improved process efficiency, fueling market expansion in the coming years.

According to the Population Reference Bureau, the number of people aged 65 and above in the U.S. is expected to double from 52 million in 2018 to 95 million by 2060. The U.S. also spends the highest expenditure on healthcare globally. As industry players are becoming more conscious of the value of employee safety, the aforementioned variables are therefore likely to have a beneficial effect on the market. For instance, according to U.S. Centers for Medicare & Medicaid Services report 2023, in 2021, the healthcare spending per person was USD 12,914 in the U.S., which was USD 5,000 higher than that of any other high-income country.

Furthermore, the World Health Organization (WHO) and the U.S. Food and Drug Administration (FDA) have suggested that medical gloves be used strictly for all types of treatments being performed in the medical field. Healthcare workers wear medical gloves, such as surgical gloves, to stop the transmission of microorganisms that could lead to an infection or disease. These aforementioned factors are anticipated to augment the demand for surgical gloves in the coming years.

The rising number of surgical procedures being performed in the U.S., such as appendectomy, cesarean section, carotid endarterectomy, Coronary Artery Bypass Graft (CABG), and circumcision, is anticipated to drive the demand for surgical gloves. For instance, according to the Centers for Medicare & Medicaid Services, U.S. hospitals immediately adopted new safety standards after the pandemic's impact which resulted in a significant decline in non-essential surgery rates. The surgical gloves act as a shield guarding the healthcare personnel against infectious diseases. At the time of surgeries, surgeons and other expert professionals have a potential risk of getting infected by the patients. Thus, surgical gloves aid in shielding healthcare personnel from cross-contamination.

Furthermore, the government is promoting programs to increase awareness related to hygiene and safety in hospitals and other healthcare facilities owing to a rise in adversarial events caused by poor cleanliness standards, which are expected to boost market demand. For instance, stringent regulations require employers to assess the workplace for hazards that necessitate the use of PPE including surgical gloves. Moreover, the expanding aging population is anticipated to drive the number of hospital visits, thereby having a positive impact on market growth over the projection period. For instance, 80% of older people would live in low- and middle-income nations in 2050, driving market expansion, as predicted by WHO.

Material Insights

The natural rubber segment led the surgical gloves market and accounted for 37.5% of the global revenue share in 2022. The surgical gloves made from natural rubber or latex are tactile, owing to which, they are highly preferred in sensitive applications, such as surgeries and medical procedures. In addition, they are flexible and comfortable to wear and ideal for handling water-based or biological materials. The demand for such gloves in the medical sector is expected to grow significantly on account of the FDA-approved usage of latex gloves in the medical sector.

Nitrile surgical gloves segment is expected to witness a CAGR of 6.7% over the forecast period. These gloves are generally preferred while dealing in high-risk settings such as patients with infectious diseases or surgeries involving blood and other bodily fluids. Due to the high risk associated with surgical procedures and operating room environments, surgical gloves are tested rigorously to meet the guidelines specified by the Food and Drug Administration. These aforementioned factors are expected to drive the demand for market expansion.

As nitrile gloves are latex-free, this encourages their acceptance level among individuals who are sensitive to latex/natural rubber and further leads to a decrease in the odds of allergic reactions. Other surgical gloves such as vinyl gloves are latex-free and made from plasticizers and polyvinyl chloride. Vinyl gloves offer an ideal solution wherein a regular change of gloves is essential. Growing demand for FDA-approved and antimicrobial gloves is expected to boost the segment growth over the estimated period.

Neoprene is a type of synthetic rubber made from chloroprene that has been polymerized. The material is utilized in medical laboratories where personnel frequently work with chemicals that might harm the skin since it is waterproof and gives resistance to stretching and chemicals. In addition, these gloves are far more stretch-resistant than latex and nitrile gloves, enabling a snug fit. Gloves made of neoprene provide a better grip and keep hands dry. Neoprene gloves are therefore particularly helpful for dentists, doctors, and surgeons, as well as those using wet tools, propelling market expansion.

Form Insights

The powder-free segment led the market and accounted for 87.3% of the global revenue share in 2022. As powder-free gloves are becoming more popular in the healthcare industry, powder-free gloves are expected to dominate the market over the next years. Additionally, it is projected that over the coming years, the market for powder-free gloves would benefit from strict limitations on powdered gloves by numerous governments around the world.

The FDA issued a rule to ban powdered surgical medical gloves, noting that surgical gloves posed severe risks to patients, including allergic reactions, post-surgical adhesions, and airway & wound inflammation. Furthermore, the rule does not apply to the powder that is used throughout the manufacturing process of powder-free gloves, only a traced amount is used to make it into the finished product. The aforementioned factors are anticipated to drive the demand for the powder-free surgical gloves segment over the forecast period.

Surgical gloves without powder are chlorinated to make them less form-fitting and facilitate simple procedures for putting on and taking off. Over the forecast period, increasing demand for powder-free gloves across several industries, including chemical, medical, and food processing, is anticipated to drive the market.

Powdered gloves are expected to witness a CAGR of 4.4% over the forecast period. The presence of corn flour in these gloves prevents them from clinging together. Powdered gloves contain corn flour, which can, however, irritate the skin of both users and those who come into touch with them. Also, it has been seen that the powder from powdered gloves adheres to hands, furnishings, and clothing, posing a contamination risk. For instance, when dentists are required to reach out inside a patient's mouth with their bare hands, it results in direct contact with starch. This is a significant cause of concern in the dentistry field. These aforementioned factors are expected to hamper the growth of powdered gloves demand in the coming years.

Sterility Insights

The sterile segment led the market and accounted for 67.4% of the global revenue share in 2022. Surgical sterile gloves offer quality standards and are often used by surgeons and the operation theater (OT) staff. Such gloves are only fit for a single use and then the gloves are discarded. These aforementioned factors are anticipated to drive the demand for sterile gloves in the coming years. For instance, Ansell Ltd. acquired Nitritex Limited, a UK-based manufacturer of premium cleanroom, healthcare, and life sciences consumables, to broaden its product portfolio offering sterile and non-sterile gloves and other accessories.

For invasive surgeries that require close contact with a human body, sterile surgical gloves are regarded as a medical necessity. Several key medical procedures require the use of sterile gloves. Such surgeries include performing tracheotomies in newborns, premature infants, and immunocompromised patients, and inserting central intravenous. Furthermore, changing sterile bandages for surgical wounds, protecting immunocompromised individuals who become severely compromised, and dressing skin wounds when there is a high risk of contamination or infection are some applications of sterile gloves.

The FDA screen non-sterile glove manufacturers to make sure that they follow the standard assurance level (SAL) and have a greater acceptable quality level (AQL) than sterile gloves. Such gloves are economically viable and are commonly favored for basic surgical operations that do not mandate sterile conditions, which in turn, will boost the market demand for the non-sterile surgical gloves industry.

Non-sterile gloves are expected to witness a CAGR of 4.8% over the forecast period. Non-sterile gloves are safe for the majority of minor medical procedures even though they haven't been specially treated to remove all biological contamination. As they are employed in clean techniques, healthcare workers maintain clean gloves while using them and adhere to accepted infection control practices. Non-sterile gloves are quite useful in clinical settings and entirely safe for basic medical operations. These aforementioned factors are expected to propel the demand for non-sterile surgical gloves in the coming years.

Distribution Insights

The offline distribution segment accounted for 63.5% of the global revenue share in 2022. Offline channels play an essential role in the surgical gloves industry as product manufacturers are dependent on distributors, and wholesalers to supply their products to consumers. The gloves are also distributed through offline modes, such as drug stores, hospital pharmacies, over-the-counter pharmacies, and retail stores along with social media advertising and e-commerce. Manufacturers supply their products through multi-brand retailers, exclusive distributors, and independent distributors.

The offline distribution channel segment market is expected to expand owing to various established traditional distribution channels including drug stores, hospital pharmacies, over-the-counter pharmacies, and retail stores. In addition, owing to the global outbreak of the pandemic in 2020, these offline modes have started delivering essential protective equipment such as surgical gloves and medicines.

The online distribution segment is expected to witness a CAGR of 6.8% over the forecast period. The adoption rate of online channels has been growing owing to the widespread pandemic, as governments imposed strict lockdowns and people refrained from going outdoors. Further, advantages offered by the online mode, such as the convenience of doorstep delivery, and the availability of a broad range of products at discounted rates, are propelling clients to opt for online shopping. Such factors are increasing product sales from the online channel and subsequently impacting segment growth.

Companies with an e-commerce site did better than those without a digital branch during the crisis. The online distribution channel helps manufacturers lower costs associated with products like surgical gloves. These costs include distribution costs, setup, and operational costs. These gloves are sold on several e-commerce sites such as IndiaMART, MedicalExpo, Amazon, and Alibaba in various geographical regions. The discounts and incentives that online merchants provide on surgical gloves purchases are also projected to raise end-user demand and the volume of online transactions. These aforementioned factors drive the demand for the online distribution of surgical gloves.

Usage Insights

The disposable segment accounted for 93.8% of the global revenue share in 2022. The segment demand is anticipated to grow significantly over the coming years on account of several factors including favorable occupational safety regulations, increasing importance of safety and security at workplaces, and rising healthcare expenditure. Furthermore, surgical gloves prevent bodily harm from potentially dangerous substances, such as abrasive objects, alcohols, and detergents, and even from biohazards such as viruses & germs, bodily fluids, and others.

Reusable surgical gloves are expected to witness a CAGR of 2.6% over the forecast period. These gloves are lightweight and used in a variety of activities and sectors, including construction, hazardous chemical handling, mining, agricultural, and domestic cleaning. Reusable gloves used in the food industry, for instance, must adhere to local health authority guidelines. As these gloves come into direct touch with food, they are designed to help minimize the spread of infection.

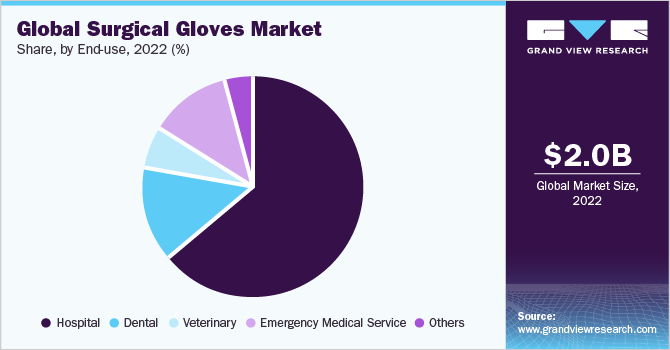

End-use Insights

The hospital end-use segment accounted for 63.8% of the global revenue share in 2022. The need for surgical gloves in hospitals is increasing as a result of the rise in hospital visits and readmissions due to chronic diseases. For instance, the World Health Organization estimated that 4.1 million people globally suffered from chronic respiratory disorders in 2022. Moreover, chronic diseases, commonly referred to as non-communicable diseases, claim the lives of 41 million people annually, or 74% of all fatalities worldwide according to the WHO report.

The demand for surgical gloves in the healthcare sector such as veterinary, emergency medical services, and others has been significantly influenced by growing awareness about the safety and health measures associated with the treatment of patients and emergency response incidents. Furthermore, the risks related to the on-the-job transmission of bloodborne pathogens and germs have led to increased adoption of surgical gloves among the aforementioned end-users.

The end-use category for emergency medical services is anticipated to grow at a CAGR of 6.1% over the forecast period. The end-use segment for emergency medical services is likely to be driven by the rising number of urgent care visits made at clinics due to patients' expanding choices for amenities and affordability, which has resulted in a rise in the use of surgical gloves in such facilities to support the industry landscape. Moreover, among the important aspects fostering market expansion are the soaring demand for emergency treatment, increasing rates of trauma, and rising healthcare spending.

The ‘Others’ end-use segment comprises clinical, treatment centers, and nursing homes, among others.Factors such as the expansion of public healthcare systems, increased economic power, and population growth are anticipated to increase healthcare spending globally.

Furthermore, the aging population, rising number of people with chronic & long-term conditions, increased investments in MedTech & expensive infrastructure, increasing labor costs & staff shortages, and the growing demand for broader ecosystem services are expected to boost the demand for surgical gloves among other end-users in the coming years. For instance, India spends roughly 0.6% of GDP on R&D in the healthcare sector, compared to the U.S.'s 2.8%, China's 2.1%, and Israel's 4.3%. Thus, increasing investment in R&D in the healthcare sector will drive market growth.

Regional Insights

North America accounted for 36.6% of the global market revenue in 2022 owing to ongoing advancements in the field of surgery due to advancements in medical technology, and the aid of supportive systems such as High-Reliability Organizations (HROs) which are likely to surge the hospital sector growth as well as promote the product demand. Strict government regulations leading to the safety of patients, doctors, and other personnel in hospitals and others, as well as severe fines for disobedience, are expected to propel the demand. For instance, surgical gloves must be offered sterile and powder-free, and products that meet their requirements should bear the mark "CE EN 455". Furthermore, sterile and powder-free surgical gloves must be provided. Also, the FDA has recognized ASTM D3577-19 as a standard for surgical gloves, which stimulates the market.

Asia Pacific region is expected to witness a CAGR of 6.5% over the forecast period. The growing aging population, rising disposable incomes, greater health awareness, and easy access to insurance, and high expenditure by private & public players in the sector are projected to boost the demand for healthcare services. Furthermore, the increasing cases of obesity have augmented the instances of chronic illnesses, such as diabetes, and heart diseases in the country, which will further require various treatments and services which in turn, is likely to profit the market growth in the country. For instance, the U.S. Census Bureau predicts that by 2060, there will be more than 1.2 billion Asians aged 65 and older, meaning that one in ten persons worldwide would be an older Asian, which will increase market demand.

The growing need for personal protective equipment in Europe will drive the market for surgical gloves due to the increase in the number of qualified nurses, midwives, associate nurses, and other care workers in Europe. For instance, the global nursing and midwifery workforce, which made up 50% of the global health workforce, is made up of about 27 million men and women. Germany was the top-performing EU member state with a 3.4% share, followed by Finland (3.0%), Belgium (2.9%), and Ireland (2.8%). The National Health Plan 2018-22 of France, which strives to assure the quality, safety, and appropriateness of the healthcare sector, is another example of a stringent regulation that exists and that has boosted the need for surgical gloves.

The demand for healthcare services in Central & South America is on the rise owing to several factors including the aging population on account of longer life expectancy and lower birth rates coupled with rising instances of non-communicable and chronic diseases and expanding healthcare coverage. In addition, public-private partnerships are increasing in the healthcare sector. Thus, improving healthcare infrastructure coupled with the expanding healthcare industry is expected to benefit the growth of the surgical gloves industry in the region over the forecast period. For instance, in May 2020, Rubberex Corp (M) Bhd undertook a private settlement to raise USD 6.9 million. This settlement allowed the company to expand its production lines for nitrile gloves, thereby driving market expansion.

Key Companies & Market Share Insights

Market players have adopted several strategies such as joint ventures, mergers, acquisitions, new product developments, and expansions to enhance market penetration and cater to the varying requirements of various end-users, such as hospitals, veterinary, emergency medical services, and other facilities. For instance, Cranberry introduced bio-nitrile biodegradable powder-free examination gloves in May 2023. These gloves are intended to address the growing demand for sustainable products.

Furthermore, in March 2021, Hartalega Holdings Berhad invested USD 1.7 billion to build new 16 glove factories in Malaysia. In addition, to expand its glove manufacturing activities, Hartalega Holdings Berhad paid USD 55.4 million to Northern Gateway Free Zone Sdn Bhd in March 2021 for 250 acres of property in Kedah. In the upcoming years, the market for surgical gloves is expected to be driven by the aforementioned factors. Some prominent players in the global surgical gloves market include:

-

Top Glove Corporation

-

Hartalega Holdings

-

Sempermed

-

Globus Group

-

Kanam Latex Industries Pvt. Ltd.

-

Narang Medical Limited

-

MRK Healthcare Pvt. Ltd.

-

Cardinal Health Inc.

-

Ansell Ltd.

-

Sun Healthcare (M) Sdn. Bhd.

-

Berner International GmbH

-

Dach

-

ERENLER MEDİKAL SAN. TİC. LTD. ŞTİ.

-

Medline Industries, Inc.

-

Leboo Healthcare Products Limited

Surgical Gloves Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,916.7 million

Revenue forecast in 2030

USD 3,160.3 million

Growth Rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Material, form, distribution, sterility, end-use, usage, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; Russia; Spain; France; Italy; UK; China; Japan; India; Australia; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Top Glove Corporation; Hartalega Holdings; Sempermed; Globus Group; Kanam Latex Industries Pvt. Ltd.; Narang Medical Limited; MRK Healthcare Pvt. Ltd.; Cardinal Health Inc.; Ansell Ltd.; Sun Healthcare (M) Sdn. Bhd; Berner International GmbH; Dach; ERENLER MEDİKAL SAN. TİC. LTD. ŞTİ.; Medline Industries, Inc.; Leboo Healthcare Products Limited

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global surgical gloves market report based on material, form, distribution, sterility, end-use, usage, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Neoprene

-

Polyisoprene

-

Others

-

-

Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile Gloves

-

Non- Sterile Gloves

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Powder-free

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Veterinary

-

Emergency medical service

-

Dental

-

Others

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surgical gloves market size was estimated at USD 2,005.6 Million in 2022 and is expected to reach USD 1,916.7 Million in 2023.

b. The surgical gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 3,160.3 Million by 2030.

b. Hospital end-use accounted for the largest surgical gloves market with a revenue share of 63.8% in 2022. The need for surgical gloves in hospitals is increasing as a result of the rise in hospital visits and re-admissions due to chronic diseases.

b. Some key players operating in the surgical gloves market include Top Glove Corporation, Hartalega Holdings, Sempermed, Globus Group, Kanam Latex Industries Pvt. Ltd., Narang Medical Limited, MRK Healthcare Pvt. Ltd., Cardinal Health Inc., Ansell Ltd., Sun Healthcare (M) Sdn. Bhd, Berner International GmbH, Dach, ERENLER MEDİKAL SAN. TİC. LTD. ŞTİ., Medline Industries, Inc., Leboo Healthcare Products Limited.

b. Key drivers driving the surgical gloves market growth include the rising awareness among industry participants with regard to the importance of employee safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.