- Home

- »

- Medical Devices

- »

-

Surgical Laser Market Size & Share, Industry Report, 2030GVR Report cover

![Surgical Laser Market Size, Share & Trends Report]()

Surgical Laser Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Solid-state Laser Systems, Gas Laser Systems, Diode Laser Systems), By Application (Aesthetic, Surgical, Dentistry), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-011-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Laser Market Size & Trends

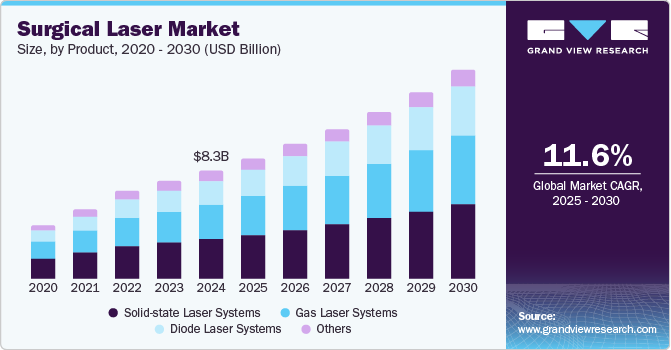

The global surgical laser market size was estimated at USD 8.28 billion in 2024 and is projected to grow at a CAGR of 11.6% from 2025 to 2030. The growth is driven by the increasing prevalence of chronic diseases. The growing preference for minimally invasive surgical techniques among patients and healthcare providers contributes to the market's expansion, as these procedures typically result in reduced recovery times and less postoperative pain.

The technological advancements in laser systems continue to improve their capabilities and applications across various medical specialties. Moreover, the aging population worldwide is increasing the demand for surgical procedures, thus promoting the use of surgical lasers in clinical settings. Therefore, these factors collectively support the expansion of the surgical laser market.

Surgical lasers have greatly improved medical procedures by offering greater precision, safety, and control than traditional methods. Innovation such as femtosecond, diode, and CO2 lasers have expanded their use across several medical specialties. Femtosecond lasers enable precise eye surgeries, while diode lasers are commonly used in dental and urology treatments. CO2 lasers are ideal for skin surgeries and tissue removal. These technological advancements allow for more effective treatments with less risk and faster recovery. As a result, surgical lasers are now essential tools in fields such as ophthalmology, dermatology, urology, and ENT.

Moreover, these new technologies enable surgeons to target tissues more accurately, minimizing collateral damage and reducing the risk of complications. For instance, CO2 lasers are particularly effective in soft tissue surgeries due to their ability to vaporize tissue while preserving surrounding structures. This leads to improved healing times and reduced postoperative discomfort.

Product Insights

The solid-state laser systems segment dominated the market with a revenue share of 37.0% in 2024, driven by their precision and versatility in various applications. These lasers are increasingly favored in medical procedures, particularly in fields such as dermatology and ophthalmology, due to their ability to deliver targeted energy with minimal damage to surrounding tissues. Moreover, advancements in solid-state laser technology have enhanced their efficiency and effectiveness, leading to broader adoption across healthcare settings. Therefore, the solid-state laser systems segment is well-positioned for continued growth within the surgical laser market.

Due to their versatility, compact size, and affordability, the diode laser systems segment is projected to experience the fastest CAGR of 12.9% over the forecast period. Diode lasers can be used across various medical specialties, including ophthalmology, dentistry, and dermatology, making them highly adaptable for multiple procedures. In addition, continuous improvements in diode laser technology, such as enhanced power output and portability, have made these systems more accessible to a broader range of healthcare providers. As demand for cost-effective, efficient, and easy-to-use surgical tools increases, the adoption of diode lasers is expected to grow rapidly.

Application Insights

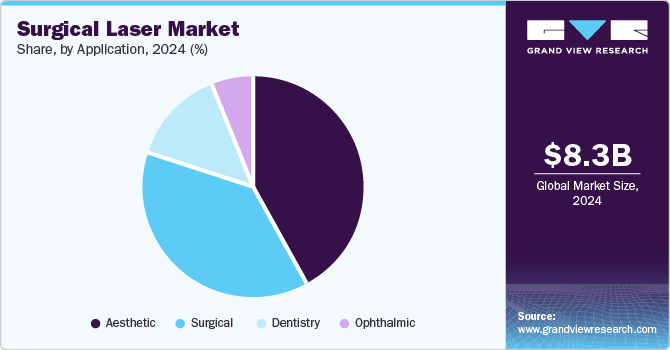

The aesthetic segment dominated the market with the largest revenue share of 41.6% in 2024, fueled by the growing demand for non-invasive cosmetic procedures. These lasers are widely used in aesthetic treatments such as skin resurfacing, hair removal, tattoo removal, and wrinkle reduction due to their precision and minimal downtime. In addition, advances in laser technology have improved the safety and effectiveness of these treatments, making them more appealing to a wider range of patients. Therefore, the rising popularity of aesthetic procedures is driven by increasing disposable incomes, changing beauty standards, and growing awareness of laser-based treatments.

The dentistry segment is projected to grow at a CAGR of 13.3% over the forecast period due to the increasing adoption of laser technology for a wide range of dental procedures. Lasers offer several advantages in dentistry, such as greater precision, reduced pain, faster recovery times, and minimized risk of infection compared to traditional methods. They are used for soft tissue surgeries, cavity preparation, teeth whitening, gum disease treatment, and root canal procedures. In addition, advancements in laser technology, such as more efficient and portable diodes and CO2 lasers, have grown the dentistry segment fast.

End-use Insights

The hospital segment dominated the market with the largest revenue share of 39.4% in 2024, driven by the high volume of hospital surgical procedures and the advanced infrastructure available for laser treatments. Hospitals are equipped with the necessary resources, skilled medical professionals, and specialized departments to handle complex surgeries that require precision, such as in ophthalmology, urology, and oncology. In addition, the growing demand for advanced surgical treatments and the rising preference for laser-based procedures due to their precision and quicker recovery times fuel the segment's dominance. As healthcare systems continue to invest in cutting-edge technologies, hospitals remain the primary setting for the widespread adoption of surgical lasers.

The ambulatory surgical centers (ASCs) segment is projected to grow at a CAGR of 12.2% over the forecast period attributed to the increasing demand for outpatient procedures and the rising preference for cost-effective, minimally invasive treatments. ASCs offer patients the advantage of shorter recovery times and lower treatment costs. In addition, these centers provide the flexibility to perform a wide range of laser-assisted procedures, including those in ophthalmology, dermatology, and urology. Moreover, ASCs are more accessible than hospitals, attracting patients seeking quick and convenient alternatives. Therefore, the growing adoption of portable and compact laser systems is driving the expansion of ASCs in the surgical laser market.

Regional Insights

North America surgical laser market dominated the global market with a revenue share of 44.7% in 2024 owing to advanced healthcare infrastructure and the high adoption rate of cutting-edge medical technologies. In addition, the region benefits from a well-established healthcare system, with hospitals and ambulatory surgical centers increasingly incorporating surgical lasers into various procedures. Moreover, rising awareness among healthcare professionals and patients about the benefits of laser surgeries further fuels market growth.

U.S. Surgical Laser Market Trends

The U.S. surgical laser market dominated North America, with a significant revenue share in 2024 attributed to advanced healthcare infrastructure and many well-equipped hospitals and ambulatory surgical centers. According to the American Society of Plastic Surgeons (ASPS), approximately 15.6 million cosmetic procedures were performed in 2020, many of which utilized laser technology due to its precision and reduced recovery times. This trend reflects patient's preferences for less invasive options that minimize discomfort and expedite healing.

Asia Pacific Surgical Laser Market Trends

Asia Pacific surgical laser market is expected to register the highest CAGR of 12.3% over the forecast period, due to the rapid improvements in healthcare infrastructure and increasing access to advanced medical technologies. In addition, as healthcare standards rise in emerging markets such as China, India, and Southeast Asia, there is a growing shift toward minimally invasive procedures that leverage surgical laser precision and faster recovery times. For instance, according to the World Health Organization (WHO), the number of people living with diabetes in the Asia Pacific region is projected to rise significantly, necessitating more effective treatment options that include laser therapies. This increasing incidence highlights the urgent need for innovative surgical solutions.

The rising incidence of chronic diseases such as diabetes and cancer in India is driving the surgical laser market. The increase in diabetes cases is making laser therapies essential for managing complications associated with the disease, such as diabetic retinopathy and chronic wounds. For instance, the Indian government's initiatives, such as the Ayushman Bharat Scheme, significantly improve access to healthcare services, indirectly encouraging the adoption of advanced medical technologies such as surgical lasers. Furthermore, these initiatives aim to make healthcare more affordable and accessible to the broader population, particularly in underserved areas.

Europe Surgical Laser Market Trends

Europe surgical laser market held a substantial market share in 2024, driven by the increasing incidence of eye disorders, particularly in countries such as Germany and the UK. For instance, the European Society of Cataract and Refractive Surgeons (ESCRS) has reported a rise in the use of laser-assisted cataract surgery, highlighting its benefits, such as reduced recovery times and lower complication rates compared to traditional methods. Moreover, various studies show that patients prefer procedures that minimize discomfort and expedite healing, further supporting this trend. Therefore, the growing adoption of laser-assisted surgeries is a key factor fueling the demand for surgical lasers in Europe.

The surgical laser market growth in Germany can be attributed to the increasing geriatric population, which is leading to a rise in the prevalence of chronic diseases such as diabetes and cardiovascular conditions. For instance, as the Federal Statistical Office of Germany reported, the proportion of people aged 65 and older is expected to rise significantly, which can drive demand for surgical interventions that often utilize laser technology. This demographic shift demands more effective and less invasive treatment options, further boosting the surgical laser market.

Key Surgical Laser Company Insights

Some key companies operating in the market include Lutronic Corporation (Cynosure LLC), Lumenis Be Ltd, Candela Corporation, Cutera, Inc., and Alcon Inc. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands through medical device validation and verification.

-

Lutronic Corporation (Cynosure LLC) offers various surgical laser and aesthetic devices for different medical applications. Its product lineup includes systems such as the Elite iQ for hair removal, PicoSure for tattoo removal and skin revitalization, and Potenza for RF microneedling.

-

Lumenis Be Ltd. offers a wide range of advanced surgical laser and light-based technologies for various medical applications. Its product lineup includes the UltraPulse and AcuPulse CO2 laser for skin resurfacing, the LightSheer systems for laser hair removal, and the M22 multi-application platform for treating multiple skin conditions.

Key Surgical Laser Companies:

The following are the leading companies in the surgical laser market. These companies collectively hold the largest market share and dictate industry trends.

- Lutronic Corporation (Cynosure LLC)

- Lumenis Be Ltd

- Candela Corporation

- Cutera, Inc.

- IRIDEX Corporation

- El.En. S.p.A.

- Fotona

- Alcon Inc.

- BIOLASE, Inc.

- ASCLEPION

Recent Developments

-

In June 2024, Lumenis launched Folix, the first FDA-cleared fractional laser designed for hair loss treatment. Using unique fractional technology, Folix stimulates hair follicles to promote regrowth while minimizing damage to surrounding tissues. It addresses male and female pattern hair loss, offering a non-invasive solution with enhanced patient comfort.

-

In June 2022, Cynosure introduced the PicoSure Pro, an FDA-cleared 755nm picosecond laser designed for safe, effective treatments on all skin types. Using an advanced platinum focus lens to boost collagen and elastin, it targets pigmentation, wrinkles, acne scars, and pores. The device is the first picosecond laser approved for treating melasma and other hyperpigmentation issues.

Surgical Laser Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.21 billion

Revenue forecast in 2030

USD 15.96 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product,application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Lutronic Corporation (Cynosure LLC); Lumenis Be Ltd; Candela Corporation; Cutera, Inc.; IRIDEX Corporation; El.En. S.p.A.; Fotona; Alcon Inc.; BIOLASE, Inc.; ASCLEPION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Laser Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global surgical laser market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid-state Laser Systems

-

Erbium Yttrium Aluminum Garnet (Er: YAG)

-

Neodymium Yttrium Aluminum Garnet (Nd: YAG)

-

Holmium Yttrium Aluminum Garnet (Ho: YAG)

-

Ruby Laser Systems

-

Others

-

-

Gas Laser Systems

-

CO2

-

Excimer (Argon, Krypton)

-

Helium Neon

-

Others

-

-

Diode Laser Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aesthetic

-

Surgical

-

Dentistry

-

Ophthalmic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical laser market size was estimated at USD 4,932.5 million in 2019 and is expected to reach USD 5,459.4 million in 2020.

b. The global surgical laser market is expected to grow at a compound annual growth rate of 11.1% from 2020 to 2027 to reach USD 11,440.6 million by 2027.

b. North America dominated the surgical laser market with a share of 44.2% in 2019. This is attributable to rising healthcare awareness, adoption of advanced technologies, and product approvals.

b. Some key players operating in the surgical laser market include Cynosure, Inc., Lumenis Ltd., Candela Corporation, Cutera, Inc., Lutronic Corporation, El.En Group, Fotona d.o.o, OmniGuide Holdings, Inc., Alcon, Biolase, Inc., and Asclepion Laser Technologies GmbH.

b. Key factors that are driving the surgical laser market growth include the presence of a large number of cosmetic laser manufacturers, increasing prevalence of ophthalmic conditions, and high demand for the use of surgical techniques among healthcare practitioners.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.