- Home

- »

- Medical Devices

- »

-

Surgical Laser Market Size & Share Report, 2020-2027GVR Report cover

![Surgical Laser Market Size, Share & Trends Report]()

Surgical Laser Market Size, Share & Trends Analysis Report By Product (Solid-state, Gas, Diode), By Application (Aesthetic, Dentistry), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-011-1

- Number of Report Pages: 126

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global surgical laser market size was valued at USD 4.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 11.1% from 2020 to 2027. High growth opportunities in developing countries and increasing focus towards minimally invasive surgeries have revolutionized the market. The growth of the medical tourism industry due to the globalization of the healthcare system is driving the market for surgical lasers. The number of people traveling abroad to seek medical treatment has shown steady growth in recent years. Many countries have placed themselves as medical destinations with high-quality services and advanced technologies in order to attract patients. Due to the high cost of treatments and procedures in the developed countries, the developing regions are now capitalizing by catering to the rising demand for medical treatment with better facilities and at an affordable cost.

Increasing demand for minimally invasive or noninvasive procedures and patient inclination towards reduced hospital stay are the factors pushing manufacturers to develop products and equipment that are technologically advanced and offer faster recovery. This is boosting the competitive rivalry with new product launches. For instance, in July 2018, Candela Corporation received the U.S. Food and Drug Administration approval for its Vbeam Prima, a Pulsed Dye Laser (PDL), which is used for a wide range of skin conditions such as rosacea, acne, facial, leg, and spider veins, scars, port wine stains, warts, stretch marks, and wrinkles.

The increasing adoption of dental lasers owing to the surgical benefits and growing initiatives adopted by the developers to raise awareness is a positive growth factor. In February 2018, Biolase, Inc. announced initiatives to enhance dental laser awareness by offering educational courses in laser dentistry, thus helping dentists in providing optimal care to the patients.

Growing awareness about advanced aesthetic procedures is an important factor leading to increasing acceptance and demand for advanced cosmetic procedures across the world, both in the developed and the developing regions. Over recent years, there has been a significant surge in the number of cosmetic procedures that involve surgical laser equipment. According to the data from the American Society of Plastic Surgeons (ASPS), the U.S. reported around 17.7 million cosmetic procedures in 2018. These include surgeries as well as minimally invasive procedures. The source further states that these procedures increased by 200% since the year 2000.

Product Insights

The solid-state laser systems segment is expected to account for the largest revenue share of 37.7% in 2019 in the market for surgical lasers. Solid-state systems are further bifurcated into Erbium Yttrium Aluminum Garnet (Er: YAG), Neodymium Yttrium Aluminum Garnet (Nd: YAG), Holmium Yttrium Aluminum Garnet (Ho: YAG), Ruby laser systems, and others. The Nd:YAG laser systems for cosmetic purposes have been adopted around the world with market players introducing their products and surgical laser systems in various geographies. For instance, in June 2020, Cynosure introduced the Elite iQ, a system designed for aesthetic procedures such as skin revitalization and laser hair removal in the U.S., Australia, and Europe. The product is equipped with a live Melanin Reader that offers customized laser hair removal treatments on various parts of the body. Advancements in Nd:YAG lasers coupled with high adoption of the laser type due to efficient results on almost all skin types are some of the major factors augmenting the growth of the segment in the surgical lasers market.

Carbon dioxide surgical lasers contribute a significant share among the gas-laser systems owing to the inexpensive nature of these surgical laser systems coupled with the accuracy of procedures. Market players are focused on the launch of CO2 lasers due to various advantages offered by these systems. For instance, in March 2018, OmniGuide Holdings, Inc., introduced C-LAS Line of Sight CO2 laser system. The laser system offers minimally invasive surgical procedures, thereby providing patients with more treatment options using the precision of CO2 laser energy.

End-use Insights

The hospital segment dominated the market for surgical lasers and accounted for a revenue share of 40.4% in 2019. The segment is anticipated to maintain its dominance over the forecast period. The growth of the hospital segment is attributed to the increasing number of aesthetic procedures in hospitals in key markets such as the U.S., Germany, and Japan. For instance, according to the data published by the American Society of Plastic Surgeons (ASPS), in 2018, around 4,488,550 cosmetic procedures were performed in hospitals in the U.S. Furthermore, increasing awareness about the aesthetic and cosmetic procedure in emerging economies such as India and China are anticipated to support segment growth.

Ambulatory surgical centers accounted for the fastest growth due to the rising number of surgical procedures carried out in the ASCs. This helps in reducing the overall turnaround time and out of pocket expenditure for patients. ASCs also help in expanding the reach of advanced surgeries in remote areas.

Application Insights

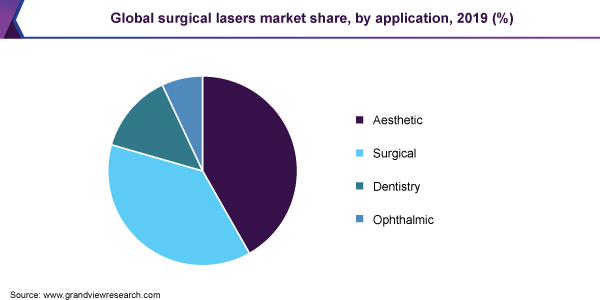

The aesthetic segment captured 32.3% of the revenue share in 2019 and is anticipated to maintain its dominance over the forecast period. Based on the application, the market for surgical lasers is segmented into aesthetic, surgical, dentistry, and ophthalmic. Growth in the aesthetic sector is facilitated by an increasing number of the U.S. Food and Drug Administration (FDA) approvals that expand dermatology applications such as skin rejuvenation, varicose vein treatment, acne, tattoo, and pigmented lesions. Also, in November 2016, Fotona d.o.o. inaugurated the Laser and Health Academy (LA&HA) for offering the research and education on new medical laser applications, conducting advanced workshops and seminars, and improve treatment standards and treatment efficiency.

The growth of the surgical segment is attributed to the increasing prevalence of cardiac, urologic, and gynecology conditions combined with product innovations and approvals. In July 2020, The SuperPulsed Laser System developed by Soltive Laser System was launched in the U.S. to assist urologists in achieving better outcomes for stone lithotripsy and soft tissue applications. In June 2020, Candela Corporation received Health Canada approval for the CO2RE laser to treat Stress Urinary Incontinence (SUI) and the Genitourinary Syndrome of Menopause (GSM) in women. According to the article published in the National Center for Biotechnology Information, in April 2019, Urinary Incontinence (UI) majorly affects women and occurs in 20-30% of young women, 30-40% in middle-aged women, and above 50% of women in old age.

Regional Insights

North America accounted for the largest revenue share of around 44.2% in 2019 and is expected to continue its dominance over the forecast period. Regionally, the market for surgical lasers is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. This dominance is attributed to developed healthcare infrastructure, high adoption of technologically advanced aesthetic laser devices, and increasing demand for aesthetic and cosmetic procedures in North America. Furthermore, the local presence of major players and continuous strategic initiatives by them is anticipated to further create a positive environment for the market. According to the American Society of Plastic Surgeons (ASPS), the total number of ablative laser-assisted skin resurfacing procedures performed in the U.S. in 2016 were reported to be 316,886. Moreover, the number had increased as compared to 2015, which accounted for 326,120 procedures.

In Asia Pacific, the market for surgical lasers is expected to grow at a lucrative rate over the forecast period. Several key players are undertaking various growth strategies in order to expand the awareness about its surgical laser devices and to gain a competitive edge. For instance, in September 2018, Lumenis Ltd., a medical device company for surgical, aesthetic, and ophthalmic applications organized the ‘GuruKool’ exclusive scientific program and workshop in Bangalore, India.

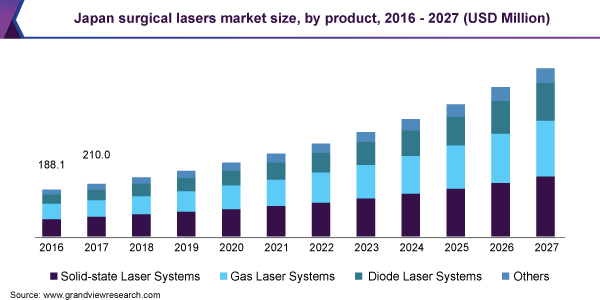

Japan is anticipated to account for the largest revenue share in the market for surgical lasers in the Asia Pacific. For instance, according to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS), in 2018, around 1,320,533 aesthetic/cosmetic procedures were performed in Japan. The same source also stated that 401,713 hair removal procedures were performed in the country in 2018.

Key Companies & Market Share Insights

Product launch, strategic acquisitions, and product innovation are the major strategies adopted by the market players to retain their market share. In 2016, Fotona d.o.o. inaugurated the Laser and Health Academy (LA&HA) to offer research, education, and publishing in the field of laser medicine. The organization focuses on the demonstration of advanced laser techniques by conducting workshops and seminars to improve treatment standards and treatment efficacy/efficiency. Some of the prominent players in the surgical laser market include:

-

Cynosure, Inc.

-

Lumenis Ltd.

-

Candela Corporation

-

Cutera, Inc.

-

Lutronic Corporation

-

El.En Group

-

Fotonad.o.o

-

Alcon

-

Biolase

-

Asclepion Laser Technologies GmbH

Surgical Laser Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 5.5 billion

Revenue forecast in 2027

USD 11.4 billion

Growth Rate

CAGR of 11.1% from 2020 to 2027

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

The U.S.; Canada; the U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Cynosure, Inc.; Lumenis Ltd.; Candela Corporation; Cutera, Inc.; Lutronic Corporation; El.En Group; Fotonad.o.o; Alcon; Biolase; Asclepion Laser Technologies GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global surgical lasers market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Solid-state Laser Systems

-

Erbium Yttrium Aluminum Garnet (Er: YAG)

-

Neodymium Yttrium Aluminum Garnet (Nd: YAG)

-

Holmium Yttrium Aluminum Garnet (Ho: YAG)

-

Ruby Laser Systems

-

Others

-

-

Gas Laser Systems

-

CO2

-

Excimer

-

Helium Neon

-

-

Diode Laser Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Surgical

-

Aesthetic

-

Dentistry

-

Ophthalmic

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global surgical laser market size was estimated at USD 4,932.5 million in 2019 and is expected to reach USD 5,459.4 million in 2020.

b. The global surgical laser market is expected to grow at a compound annual growth rate of 11.1% from 2020 to 2027 to reach USD 11,440.6 million by 2027.

b. North America dominated the surgical laser market with a share of 44.2% in 2019. This is attributable to rising healthcare awareness, adoption of advanced technologies, and product approvals.

b. Some key players operating in the surgical laser market include Cynosure, Inc., Lumenis Ltd., Candela Corporation, Cutera, Inc., Lutronic Corporation, El.En Group, Fotona d.o.o, OmniGuide Holdings, Inc., Alcon, Biolase, Inc., and Asclepion Laser Technologies GmbH.

b. Key factors that are driving the surgical laser market growth include the presence of a large number of cosmetic laser manufacturers, increasing prevalence of ophthalmic conditions, and high demand for the use of surgical techniques among healthcare practitioners.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."