- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sustainable Athleisure Market Size, Industry Report, 2030GVR Report cover

![Sustainable Athleisure Market Size, Share & Trends Report]()

Sustainable Athleisure Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Mass, Premium), By Product (Shirt, Yoga Pant, Leggings, Shorts), By Gender (Men, Women), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-240-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sustainable Athleisure Market Summary

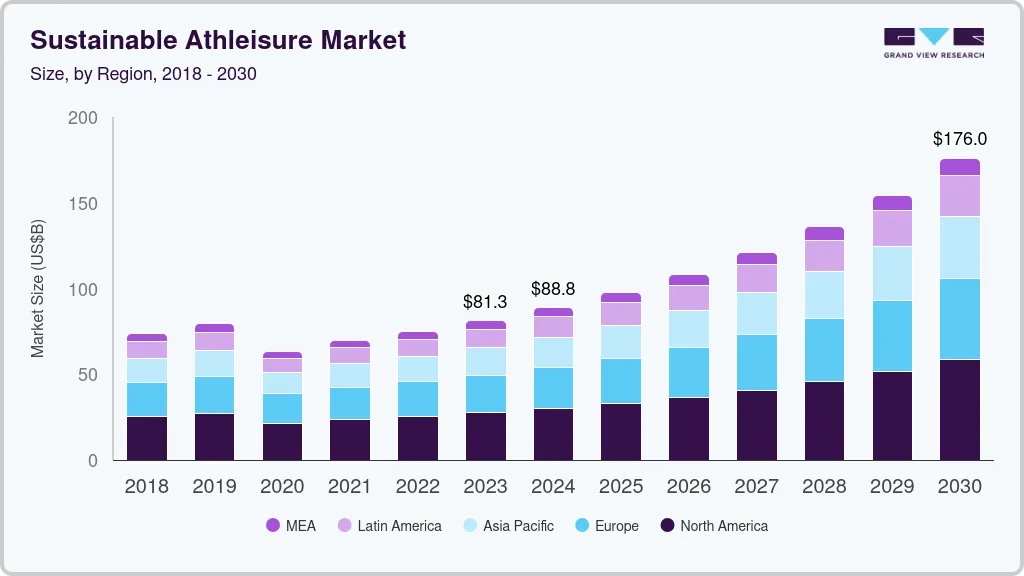

The global sustainable athleisure market size was estimated at USD 88.75 billion in 2024 and is projected to reach USD 176.05 billion by 2030, growing at a CAGR of 12.5% from 2025 to 2030. The increasing popularity of fitness and wellness aspects among individuals and their focus on contributing to sustainability objectives is a primary driver for market growth.

Key Market Trends & Insights

- The North America sustainable athleisure market accounted for the largest global revenue share of 33.8% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- By type, the mass sustainable athleisure segment accounted for the largest revenue share of 62.2% in 2024.

- By product, the shirt segment accounted for the largest revenue share in the global market in 2024.

- By gender, the demand for sustainable athleisure among men accounted for a larger revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 88.75 Billion

- 2030 Projected Market Size: USD 176.05 Billion

- CAGR (2025-2030): 12.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are becoming more aware of the environmental impact of their purchasing decisions. Sustainable athleisure brands use eco-friendly materials such as organic cotton, recycled polyester, hemp, and Tencel, which are biodegradable or made from recycled resources, thus reducing environmental impact. Additionally, the presence of several major brands and the emergence of various innovative manufacturing processes and materials have created notable growth avenues for this market.

Several brands are adopting recycled materials to reduce their environmental footprint. Recycled polyester (from plastic bottles), recycled nylon, and other repurposed fabrics are being increasingly used by companies to create high-performance activewear. They have also boosted their sourcing of materials such as organic cotton, hemp, or bamboo, which require fewer pesticides and water, minimizing the impact on the environment. Furthermore, brands are partnering with organizations focused on sustainability, such as the Better Cotton Initiative and Global Recycled Standard, to improve environmental and social practices in the supply chain. These factors have further accelerated developments in the global sustainable athleisure industry over the past few years.

Consumers are increasingly aware of the negative environmental effects of the fashion industry, particularly in terms of waste, water consumption, and chemical pollution. As a result, they are more inclined to choose brands that prioritize sustainability, especially in segments such as athleisure, where performance, durability, and fabric composition are critical. Improving accessibility to information regarding climate change, textile waste, and resource depletion have made consumers more knowledgeable, driving demand for products that align with their environmental concerns. Platforms such as Instagram, TikTok, and YouTube allow consumers to share their opinions and values regarding eco-friendly products, creating strong demand for sustainable brands. Consumers are using social media to demand transparency, compelling companies to adopt environment-friendly practices and communicate them effectively. The presence of certifications such as Fair Trade, Global Recycled Standard (GRS), and OEKO-TEX are further influencing purchase decisions in the industry. These labels provide consumers with assurance that the products they are buying adhere to sustainability standards, ensuring responsible production methods and materials.

Type Insights

The mass sustainable athleisure segment accounted for the largest revenue share of 62.2% in 2024 in the global market. The rising number of consumers buying athleisure items from notable brands has led to an increase in mass production activities to cater to this strong demand. A substantial portion of the health-conscious demographic further demands products that can be long-lasting, recyclable, and aligned with sustainability objectives. Advances in sustainable material technologies have made it more affordable to produce eco-friendly athleisure clothing at scale. Fabrics such as recycled polyester, organic cotton, and biodegradable spandex are becoming more cost-effective, making sustainable options available to a broader audience.

The premium sustainable athleisure segment is expected to advance at the fastest CAGR during the forecast period. The increasing pace of urbanization and growing disposable income levels of consumers have encouraged manufacturers to launch premium and high-quality products such as shirts, shorts, and yoga pants that adhere to sustainability norms. Consumers are generally willing to invest in eco-friendly, high-performance, and durable products. The use of high-quality materials, such as organic cotton blends, recycled polyester, and merino wool, during production, contributes to products that have a longer lifespan. High-end sustainable athleisure brands have strengthened their focus on aesthetics, creating designs that are environment-friendly while also aligning with luxury preferences.

Product Insights

The shirt segment accounted for the largest revenue share in the global market in 2024. These products often use breathable, moisture-wicking, and stretchable fabrics, making them ideal for workouts and casual wear. The demand for such types of shirts is growing rapidly as consumers seek versatility and high-performance wear that can transition seamlessly between different activities. These clothing items are designed to be versatile and multifunctional, being considered perfect for activities such as running, cycling, and gym workouts while also proving stylish enough to wear casually in everyday settings. The ability to wear athleisure shirts for both exercise and leisure without sacrificing style or comfort makes them appealing to consumers who value both performance and aesthetics.

The yoga pant segment is expected to advance at a significant CAGR during the forecast period in this market. The rapid growth in popularity globally of yoga, fitness, and wellness culture has resulted in a substantial demand for comfortable, high-performance, and functional clothing, with yoga pants being a notable product in this regard. Yoga pants are designed to provide flexibility, comfort, and support, making them ideal for exercise and relaxation. Brands are introducing sustainable options that can offer the same level of performance to wearers but with functional and environmentally friendly materials. The presence of several notable companies developing eco-friendly yoga pants and strategies to build an omnichannel presence is expected to boost the visibility of these products, aiding segment expansion.

Gender Insights

The demand for sustainable athleisure among men accounted for a larger revenue share in the global market in 2024. The growing interest in health, fitness, and active lifestyles is a significant driver for athleisure market demand among this gender. Men are increasingly adopting wellness-focused practices, which has translated into a substantial demand for comfortable, functional, and stylish activewear. Sustainable athleisure appeals to this demographic by offering high-performance clothing that aligns with their environmental responsibility values. Over the past decade, there has been a noticeable shift in purchasing trends among the male population, as they have become more willing to experiment with their wardrobe choices, including athleisure. The growing popularity of athleisure has driven the acceptance of sustainable options among men as part of a broader shift in attitudes toward fashion.

The demand for sustainable athleisure among women is expected to grow at the highest CAGR from 2025 to 2030. Women, particularly those belonging to younger generations, are more aware of the environmental and social impacts of fast fashion. This awareness has led them to demand sustainable alternatives, including athleisure, which is known for its functionality and versatility. Sustainability-focused athleisure brands often provide detailed information about the materials they use, the environmental impact of their products, and the ethical standards upheld in their manufacturing processes. This transparency builds trust and loyalty among consumers and has become a notable strategy for companies aiming to boost product sales through the women’s category.

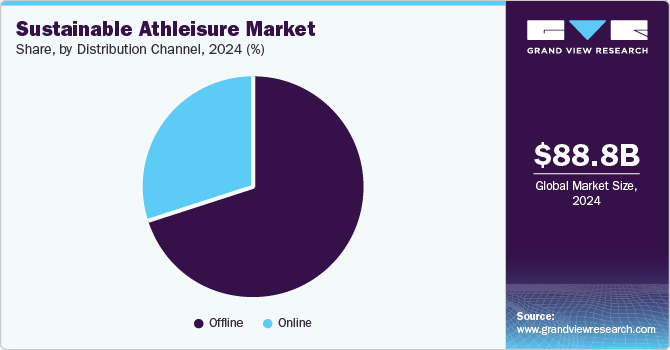

Distribution Channel Insights

The offline segment accounted for the largest revenue share in the global sustainable athleisure industry in 2024. The purchase of these products through physical outlets is becoming more prevalent as consumers increasingly seek eco-conscious alternatives in their shopping experiences. Offline stores allow customers to comprehensively assess the materials' quality, softness, stretch, and comfort. This is particularly important for sustainable athleisure products often made from innovative, eco-friendly materials such as recycled polyester, bamboo, and organic cotton. Brands, on their part, are increasingly investing in creating in-store experiences that align with their values. This may include eco-friendly store design, sustainable packaging, and product displays that highlight the environmental impact of their offerings. Such stores become popular among consumers who are aligned with sustainability values.

The online segment is expected to advance at the fastest CAGR in the market from 2025 to 2030. Modern consumers have become comfortable making sustainable fashion choices online, and several sustainable athleisure brands are building their strategies around e-commerce platforms. Online platforms allow customers to access a broader selection of sustainable athleisure brands and products than they would typically find in local stores. This is particularly valuable for niche or emerging brands that may not have a physical retail presence but offer unique eco-conscious products that appeal to environmentally aware shoppers. Moreover, brands can provide in-depth descriptions of their materials, production processes, and certifications on e-commerce sites. This level of transparency helps consumers make informed decisions about the sustainability of the products they are purchasing, ensuring customer loyalty and repeated visits.

Regional Insights

The North America sustainable athleisure market accounted for the largest global revenue share of 33.8% in 2024. Regional consumers are becoming increasingly aware of the environmental impact of their purchasing decisions. Sustainable athleisure brands that use eco-friendly materials such as organic cotton, recycled polyester, hemp, and biodegradable fabrics have thus become popular among eco-conscious consumers. Moreover, the rising preference for products that reduce carbon footprint, utilize less water, and minimize waste is a significant driver of market demand in economies such as the U.S. and Canada. Athletes and celebrities who promote sustainable lifestyles or create their own sustainable fashion lines further play a significant role in driving the demand for sustainable athleisure in the region. High-profile endorsements have helped normalize the concept of sustainability in the clothing market, boosting its appeal among consumers.

U.S. Sustainable Athleisure Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024. Increasing awareness regarding sustainability practices in the fashion and clothing sector and the extensive presence of several major brands selling sustainable clothing items and accessories have aided market expansion in the economy. American consumers are constantly seeking alternatives to conventional and environmentally harmful fabrics. Sustainable athleisure brands that incorporate recycled or organic fabrics, biodegradable materials, and eco-conscious dyes have thus developed a substantial following among consumers in the country. Furthermore, the U.S. is witnessing a growing focus on fitness, wellness, and active lifestyle practices, resulting in a surge in demand for athleisure products. Consumers are interested in clothing materials that support their fitness and wellness goals. Sustainable athleisure has thus emerged as an attractive option for those who want to align their eco-conscious values with their active lifestyles.

Europe Sustainable Athleisure Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. The European Union (EU) has established stringent regulations aimed at reducing environmental impact, including laws on carbon emissions, waste management, and product recyclability. Many regional economies have set ambitious sustainability targets, such as achieving net-zero carbon emissions by 2050. This has made developing sustainable athleisure products a promising area for manufacturers, as they align with consumer and governmental priorities. Additionally, several European consumers are looking for ways to extend the lifecycle of their clothing, including athleisure. Brands that offer products designed for longevity, or those that provide recycling and repurposing programs, are thus seeing increased demand. For example, offering repair services or providing incentives for customers to return old garments for recycling are features that attract eco-conscious consumers.

Asia Pacific Sustainable Athleisure Market Trends

The Asia Pacific region is expected to expand at the highest CAGR in the global market from 2025 to 2030. Regional countries, particularly those with large urban populations such as China, India, Japan, and South Korea, face significant challenges related to pollution and waste management. As environmental concerns increase, there is a growing interest in reducing waste and adopting eco-friendly lifestyles. This awareness is driving the demand for sustainable products, including athleisure made from eco-friendly fabrics, recycled materials, and sustainable production processes. Furthermore, the increasing purchasing power of consumers in this region has aided the expansion of the sustainable athleisure industry. The movement of a significant population to urban areas has led to the adoption of lifestyles that demand greater comfort, convenience, and functionality in their basic necessities, including clothing. Athleisure, known for its versatility and comfort, is considered a staple in daily wardrobes, and sustainable products appeal to consumers who want to make informed purchasing decisions.

China accounted for the largest revenue share in the regional market for sustainable athleisure in 2024. The country is one of the largest clothing and textile markets globally, making the incorporation of sustainability in these sectors an important aspect of its development. In addition to international manufacturers, several local brands, including Icicle, Krop, Klee Klee, and Ziran, have emerged in recent years to take advantage of this promising market, boosting competition in this area. Millennials and Gen Z consumers in China are highly aware of global environmental issues and are more inclined to choose sustainable products. These generations are increasingly prioritizing sustainability when making purchasing decisions in terms of both product and packaging. As they represent a growing consumer base, their preferences for sustainable athleisure are expected to positively shape the industry's expansion in the coming years.

Key Sustainable Athleisure Company Insights

Some major companies involved in the global sustainable athleisure industry include Under Armour, PANGAIA, and ABLE, among others.

-

Under Armour is an American sportswear company headquartered in Baltimore, Maryland, specializing in developing, marketing, and distributing apparel, footwear, and related accessories. The company has developed a range of products highlighting its sustainability initiatives, catering to men, women, and children. These include pants, polos, long sleeves, hoodies, sweatshirts, and sneakers.

-

PANGAIA is a UK-based materials science company specializing in developing sustainable fashion items, using biomaterials and bio-engineered technologies to create environment-friendly apparel, particularly loungewear. The company leverages several notable technologies and materials to manufacture its products, such as the plant-based and ethically sourced FLWRDWN, PANHEMP, and PANETTLE materials, the PLNTFIBER & FRUTFIBER fabric, and the C-FIBER fabric made from seaweed powder, eucalyptus pulp, and organic cotton.

Key Sustainable Athleisure Companies:

The following are the leading companies in the sustainable athleisure market. These companies collectively hold the largest market share and dictate industry trends.

- adidas AG

- Under Armour, Inc.

- Vuori

- PANGAIA

- Outerknown

- ABLE

- HANESBRANDS INC.

- EILEEN FISHER

- Patagonia, Inc.

- Wear Pact, LLC

Recent Developments

-

In January 2025, the Royal Group from Abu Dhabi announced its acquisition of PANGAIA, an innovative material technology and lifestyle brand based in the UK. The acquisition is expected to enable PANGAIA to strengthen its operational and financial aspects and accelerate its sustainable fashion development. The Royal Group is a major conglomerate with a diverse portfolio of companies under its control across various industries.

-

In November 2024, the performance lifestyle brand Vuori announced that it had received USD 825 million in funding, led by Stripes and General Atlantic, alongside other investors. The funding is expected to support Vuori's global omnichannel expansion strategy, which includes plans to establish 100 stores by 2026, focusing on the European and Asian markets. General Atlantic and Stripes will be strategic partners in this development, leveraging their expertise to help Vuori scale sustainably and expand its product offerings.

Sustainable Athleisure Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 97.72 billion

Revenue forecast in 2030

USD 176.05 billion

Growth rate

CAGR of 12.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, gender, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

adidas AG; Under Armour, Inc.; Vuori; PANGAIA; Outerknown; ABLE; HANESBRANDS INC.; EILEEN FISHER; Patagonia, Inc.; Wear Pact, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Athleisure Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable athleisure market report based on type, product, gender, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shirt

-

Yoga Pant

-

Leggings

-

Shorts

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.