- Home

- »

- Clothing, Footwear & Accessories

- »

-

Athleisure Market Size, Share & Trend Analysis Report, 2030GVR Report cover

![Athleisure Market Size, Share & Trend Report]()

Athleisure Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Yoga Apparel, Leggings), By, Category, By End-user (Men, Women, Children), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-350-8

- Number of Report Pages: 131

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Athleisure Market Summary

The global athleisure market size was estimated at USD 358.07 billion in 2023 and is projected to reach USD 662.56 billion by 2030, growing at a CAGR of 9.3% from 2024 to 2030. The growing enthusiasm for sports and outdoor recreational activities among the young population is expected to drive up the demand for athleisure.

Key Market Trends & Insights

- North America dominated the athleisure market with the revenue share of 40.81% in 2023.

- The athleisure market in the U.S. accounted for the largest revenue share of 89.3% in 2023.

- By product, the shirts & t-shirts segment led the market with the largest revenue share of 38.51% in 2023.

- Based on category, the mass athleisure segment led the market with the largest revenue share of 66.12% in 2023.

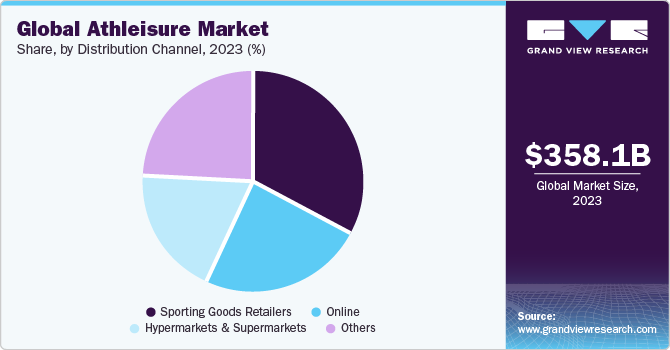

- Based on distribution channel, the sporting goods retailers segment led the market with the largest revenue share of 33.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 358.07 Billion

- 2030 Projected Market Size: USD 662.56 Billion

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

A key factor contributing to this trend is the increasing awareness of fitness and health, which is boosting the need for comfortable and stylish clothing. A global shift towards more casual and adaptable attire has propelled athleisure into the forefront of fashion. This trend mirrors the increasing prioritization of comfort and versatility in everyday wear, allowing individuals to seamlessly transition between gym sessions and daily activities without compromising style. Moreover, the pervasive emphasis on health and wellness has fueled the adoption of active lifestyles, with athleisure serving as both a practical and fashionable solution.

The availability of sports apparel with advanced features such as moisture management, temperature control, and other performance-enhancing characteristics that prevent discomfort and potential injury has piqued consumer interest. Many are willing to pay a premium for these added benefits. For example, Nike Inc. claims that its Dri-FIT fabric, used in its sports apparel, supports the body's natural cooling system by wicking away sweat and dispersing it across the fabric's surface for faster evaporation. Consequently, these enhanced features in athleisure products have influenced consumer habits to favor athletic apparel during various activities.

The rising trend of athleisure among all age groups is significantly boosting the demand for these products for everyday wear. The desire to be fit and healthy has resulted in consumers prioritizing garments that can seamlessly transition between various daily activities. The increasing number of individuals participating in outdoor activities, such as hiking, marathons, and camping, is one of the major factors boosting the demand for athleisure.

In October 2022, more than 40,000 runners took part in the 2022 Bank of America Chicago Marathon while more than 50,000 runners finished the TCS New York City Marathon in November 2022. This scenario is boosting the need for sports apparel and athleisure. Several manufacturers are capitalizing on this trend and offer high-profile sporty and fashionable athleisure to cater to the consumer demand for apparel that is not only suitable for a workout or the gym but is also stylish and suitable for a variety of everyday activities.

Athleisure leads the way in terms of design innovation. The rising prominence of technological advancements in sportswear and activewear is driving their adoption among customers in their daily routines. Companies are infusing fabrics with the latest technologies to produce the most comfortable and convenient products. For instance, Lululemon Athletica offers fabrics such as Nulux Fabric, Everlux Fabric, Nulu Fabric, Warpstreme Fabric, and ABC Tech that are lightweight and quick drying.

Market Concentration & Characteristics

The degree of innovation in the global market is high and continues to grow rapidly. Athleisure brands are constantly introducing new technologies, materials, and designs to enhance performance, comfort, and style. From advanced moisture-wicking fabrics to seamless construction techniques, innovations aim to meet the evolving needs and preferences of consumers.

The regulations significantly impact the market growth by enforcing product safety and quality standards, ensuring the use of non-toxic materials, and sustainable practices. They also mandate ethical labor practices and fair working conditions in manufacturing. Trade regulations, including import/export controls and labeling requirements, influence supply chains and pricing. In addition, marketing regulations ensure that brands make truthful claims and provide transparent information about their products

Product substitutes for the market include traditional athletic wear designed for specific sports, casual wear like jeans and t-shirts for everyday use, formal sportswear such as tennis or golf outfits that blend style and function, and loungewear like sweatpants and hoodies for maximum comfort at home. These alternatives cater to various needs, from performance and style to relaxation and casual dressing.

The level of mergers and acquisitions (M&A) activities in the athleisure industry is currently moderate. As the technology matures and market demand grows, companies are increasingly exploring strategic partnerships, acquisitions, and collaborations to enhance their capabilities, expand their product offerings, and gain a competitive edge.

Product Insights

The shirts & t-shirts segment led the market with the largest revenue share of 38.51% in 2023. Athleisure brands offer shirts and t-shirts with performance-enhancing features such as moisture-wicking fabrics, stretchability, and breathability, making them suitable for both athletic pursuits and casual wear. This versatility appeals to consumers seeking comfortable yet stylish clothing options for everyday activities.

The yoga apparel market is projected to grow at the fastest CAGR of 11.3% from 2024 to 2030. Yoga apparel is designed with specific features to support the movements and postures practiced in yoga. Fabrics with moisture-wicking properties, four-way stretch, and seamless construction are favored for their ability to provide comfort, flexibility, and ease of movement. Consumers appreciate athleisure brands that prioritize functionality without compromising on style.

Category Insights

Based on category, the mass athleisure segment led the market with the largest revenue share of 66.12% in 2023. Mass category athleisure brands offer products at more affordable price points compared to premium or luxury brands. This accessibility appeals to a broader consumer base, including budget-conscious shoppers and those seeking value for money. As a result, more consumers are able to purchase athleisure apparel without breaking the bank, driving the demand for mass market offerings.

The premium athleisure segment is anticipated to grow at the fastest CAGR of 10.5% from 2024 to 2030. Premium athleisure brands invest heavily in research and development to innovate and improve performance features in their products. This includes advanced moisture-wicking fabrics, compression technology, and ergonomic designs that enhance comfort, support, and performance during physical activity. Consumers who prioritize performance and functionality are drawn to premium athleisure brands for their cutting-edge innovations and superior performance capabilities.

Distribution Channel Insights

Based on distribution channel, the sporting goods retailers segment led the market with the largest revenue share of 33.5% in 2023. Sporting goods retailers often offer a specialized selection of athleisure products tailored specifically for sports and fitness activities. These retailers carry a wide range of brands and products designed to meet the needs of active individuals, including high-performance activewear, athletic shoes, and accessories. Customers appreciate the comprehensive selection and expertise offered by sporting goods retailers, making them a preferred destination for purchasing athleisure products.

In January 2024, Dick’s Sporting Goods announced its latest innovation with the introduction of the Inspire fabric for its Calia brand. This new collection caters specifically to the global market, offering a range of apparel made from the lightweight Inspire fabric, which bears resemblance to spandex but with added benefits. The collection encompasses a variety of athleisure staples, including leggings, bodysuits, dresses, shorts, tank tops, and sports bras, providing options for various activities and styles. Customers can find sizes ranging from XXS to XXL in stores, with select styles available in extended sizes from 1X to 3X online.

The online segment is anticipated to grow at the fastest CAGR of 11.5% from 2024 to 2030. The convenience offered by online shopping has played a pivotal role in the industry's growth. Consumers can browse a wide range of athleisure products from the comfort of their homes, eliminating the need to visit physical stores. This accessibility has attracted a broader customer base, including those from regions where access to luxury goods might be limited.

End-user Insights

Based on end-user, the women segment led the market with the largest revenue share of 47.06% in 2023. Athleisure has evolved beyond basic workout gear to encompass stylish, fashion-forward designs that cater to women's sense of style. From trendy leggings with unique patterns to chic athleisure tops that can be dressed up or down, athleisure brands offer a wide range of options to suit various tastes and preferences. Women are drawn to athleisure apparel for its ability to keep them looking fashionable and put-together while leading active lifestyles.

According to the Sasakawa Sports Foundation (SSF), 72.4% of the total population in Japan participates in sports at least once a year. Moreover, close to 70% of the total women population in the country participate in sports at least once a year.

The children segment is projected to grow at the substantial CAGR of 8.3% from 2024 to 2030. The increasing participation of children in sports has significantly boosted the sales of sportswear and athleisure worldwide. Growing awareness about the harmful effects of obesity and the growing need to promote confidence in children has driven parents to keep their children engaged in various sports.

The men athleisure segment is anticipated to grow at the fastest CAGR of 9.0% from 2024 to 2030. The market has expanded to include a wide range of stylish options tailored to men's tastes and preferences. From sleek workout gear to athleisure-inspired streetwear, men can find athleisure apparel that not only performs well during workouts but also reflects their style. Athleisure allows men to express themselves fashionably while embracing a casual yet athletic aesthetic, making it appealing for both leisure and exercise.

Regional Insights

North America dominated the athleisure market with the revenue share of 40.81% in 2023. Athleisure wear prioritizes comfort and convenience, making it appealing to busy individuals juggling various responsibilities. With stretchy, moisture-wicking fabrics and ergonomic designs, athleisure apparel provides the comfort and flexibility needed for active lifestyles. In addition, athleisure pieces can easily transition from gym sessions to running errands or meeting friends, offering versatility and convenience for people on the go.

U.S. is one of the key countries in North America when it comes to expenditure on research & development of textiles and ethical apparel materials that are produced using low-impact processes, such as organic cotton and recycled nylon. Such factors are expected to have a positive influence on the growth of the North American athleisure market over the forecast period.

U.S. Athleisure Market Trends

The athleisure market in the U.S. accounted for the largest revenue share of 89.3% in 2023. Numerous athleisure designers and manufacturers are stepping up their efforts to include athleisure wear and brands are moving towards designing comfort and stylish apparel. Various athleisure manufacturers in the U.S. are increasingly employing specialized technique fabrics and dyes to produce athleisure apparel. For instance, in September 2022, Nike Inc. introduced sustainable apparel technology Nike Forward, a whole new fabric aimed to reduce the carbon footprint. The apparel is made without zippers or extra trims to make it easier to recycle.

A growing number of individuals in the country are opting for athleisure since it is comfortable and increasingly being considered an acceptable attire at the workplace. In 2020, according to the Outdoor Participation Report published by the Outdoor Industry Association 2021, 53 percent of Americans aged six and above participated in outdoor recreation at least once. There were 7.1 million more Americans who participated in outdoor recreation in 2020 compared to 2019. Such factors are expected to create a positive outlook for the U.S. market during the forecast period.

Europe Athleisure Market Trends

The athleisure market in Europe is expected to grow at the fastest CAGR of 9.5% from 2024 to 2030. One key driver is the growing emphasis on health and wellness, leading to increased interest in activewear that promotes physical activity and comfort. Additionally, changing lifestyles, including a rise in remote working and flexible schedules, have fueled demand for versatile clothing suitable for both exercise and daily activities. Social trends, such as the prioritization of comfort and casual dressing, have also contributed to the popularity of athleisure among European consumers. Furthermore, the influence of fashion and celebrity endorsements has helped mainstream athleisure, making it a fashionable choice for a wide range of demographics.

Asia Pacific Athleisure Market Trends

The athleisure market in Asia Pacific is expected to grow at a CAGR of 10.1% from 2024 to 2030. Booming textile markets in countries such as China, India, Japan, Indonesia, Vietnam, and Bangladesh have resulted in the abundant availability of textiles and fabrics for athleisure wear, thereby boosting the adoption of athleisure wear in the region. The increasing focus on health and fitness, the rising disposable income of consumers, and the expansion of international players in the region are also acting as major drivers for market growth.

Central & South America Athleisure Market Trends

The athleisure market in Central & South America accounted for a market share of 2.6% in 2023. The growing participation in daily physical activities and outdoor activities, such as running, exercising at the gym, and cycling, is the major factor driving the market growth in the region. Moreover, the rising trend of athleisure wear, coupled with the emergence of sustainable manufacturing methods, is expected to boost this market in the upcoming years.

Middle East & Africa Athleisure Market Trends

The athleisure market in the Middle East & Africa accounted for a market share of 1.7% in 2023. The market in the region is at a nascent stage; it has immense growth potential owing to the presence of a large customer base that is young and wealthy and is attracted to the growing trend of sports as a leisure pursuit and a status symbol. Many brands in the region are launching products in the athleisure wear category. Some of the well-known athleisure wear retailers in Dubai are yApparel, Alo Yoga, SSSports, Noon, Amazon AE, Gulfissimo, and Tonic UAE.

Key Athleisure Company Insights

Major companies in the market are primarily focusing on product innovation and partnerships as their key strategies. These strategies are effective when combined, as companies often collaborate with other firms and well-known personalities to launch new products. For instance, in June 2023, Adidas AG partnered with Macklemore’s Bogey Boys to introduce Adidas x Bogey Boys collection, including vintage and classic golf style looks.

Key Athleisure Companies:

The following are the leading companies in the athleisure market. These companies collectively hold the largest market share and dictate industry trends.

- Lululemon Athletica Inc.

- Adidas AG

- Under Armour, Inc.

- Hanesbrands Inc.

- Hanesbrands Inc.

- EILEEN FISHER

- Vuori

- Outerknown.

- PANGAIA

- Wear Pact, LLC

Recent Developments

-

In September 2023, Peloton and leading athletic wear brand Lululemon revealed a strategic five-year partnership, marking a significant development in the fitness industry. This collaboration signaled the end of Lululemon's venture into connected fitness devices, particularly its recently acquired Mirror platform. Under the terms of the partnership, Peloton will serve as the exclusive digital fitness content provider for Lululemon, while Lululemon will become the primary athletic apparel partner

-

In August 2023, Patagonia, Inc. launched its first circular T-shirt using discarded tees and cotton scraps. Tee-Cycle shirts are part of Patagonia’s commitment to creating a circular economy and are made of discarded tees destined for the landfill, with a mind to helping solve the textile waste problem

-

In June 2023, California-based activewear brand Vuori partnered with fitness equipment brand Bala to launch a limited-edition collection. This exclusive collection is only available through Vuori's website and select U.S. store locations. The move was aimed at offering fans Vuori's "California cool" aesthetic with a stylish workout accessory. The collaboration between Vuori and Bala, known for a fusion of fashion and fitness, is a natural fit and promises to resonate with consumers seeking both style and functionality in their workout gear

-

In May 2023, PANGAIA expanded its Motion collection to include a new capsule collection for men and added colorways for women. The collection features bio-based activewear made with plant-based materials, including EVO Nylon and creole elastane. The men's collection includes t-shirts, tops, and tights in volcanic grey and black, while the women's collection offers sports bras, tank tops, t-shirts, shorts, and leggings in new taupe and cobalt blue, along with existing colors. The brand's collaboration with Hyosung-a completely sustainable textile solutions provider-introduces bio-based elastane to reduce its carbon footprint

Athleisure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 388.3 billion

Revenue forecast in 2030

USD 662.56 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Lululemon Athletica Inc.; Adidas AG; Under Armour, Inc.; Hanesbrands Inc.; Patagonia, Inc.; EILEEN FISHER; Vuori; Outerknown.; PANGAIA; Wear Pact, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Athleisure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global athleisure market report based on product, category, end user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Yoga Apparel

-

Tops

-

Pants

-

Shorts

-

Unitards

-

Capris

-

Others

-

-

Shirts & T-Shirts

-

Leggings

-

Shorts

-

Others

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Sporting Goods Retailers

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global athleisure market size was estimated at USD 358.07 billion in 2023 and is expected to reach USD 388.30 billion in 2024.

b. The global athleisure market is expected to grow at a compounded growth rate of 9.3% from 2024 to 2030 to reach USD 662.56 billion by 2030.

b. North America dominated the athleisure market with a share of 40.8% in 2023. This is attributable to the growing apparel & textile sector and the rising frequency of fashion events, most notably in the U.S. and Canada.

b. Some key players operating in the athleisure market include Lululemon Athletica, Inc.; Adidas AG; TPUMA SE; Nike, Inc.; HUMAN PERFORMANCE ENGINEERING; and Under Armour, Inc.

b. Key factors that are driving the athleisure market growth include increased passion for sports and outdoor recreational activities among the country's young population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.