- Home

- »

- Next Generation Technologies

- »

-

Swarm Robotics Market Size, Share, Industry Report 2033GVR Report cover

![Swarm Robotics Market Size, Share & Trends Report]()

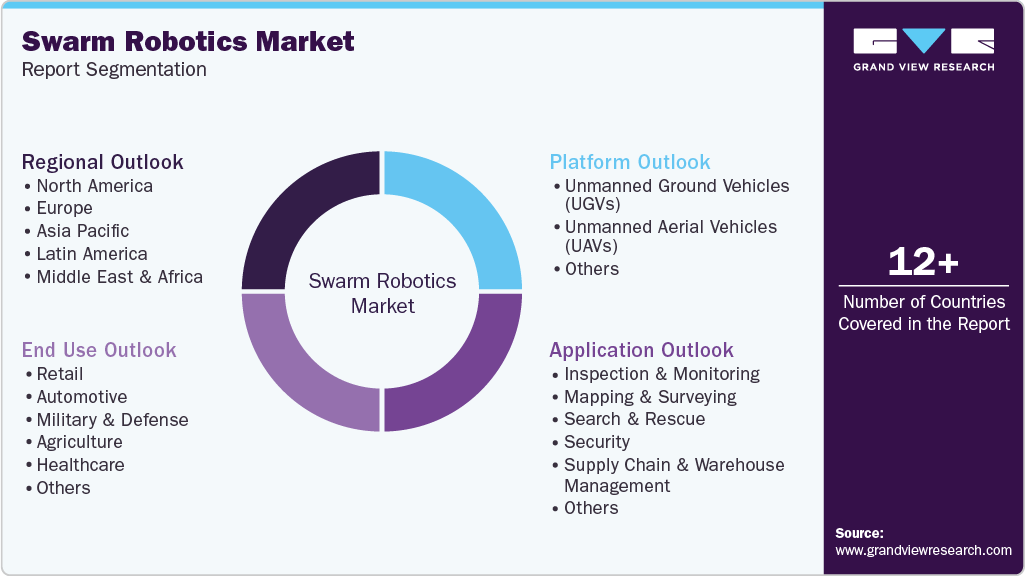

Swarm Robotics Market (2025 - 2033) Size, Share & Trends Analysis Report, By Platform (Unmanned Ground Vehicles (UGVs), Unmanned Aerial Vehicles (UAVs)), By Application (Inspection & Monitoring, Mapping & Surveying), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-640-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Swarm Robotics Market Summary

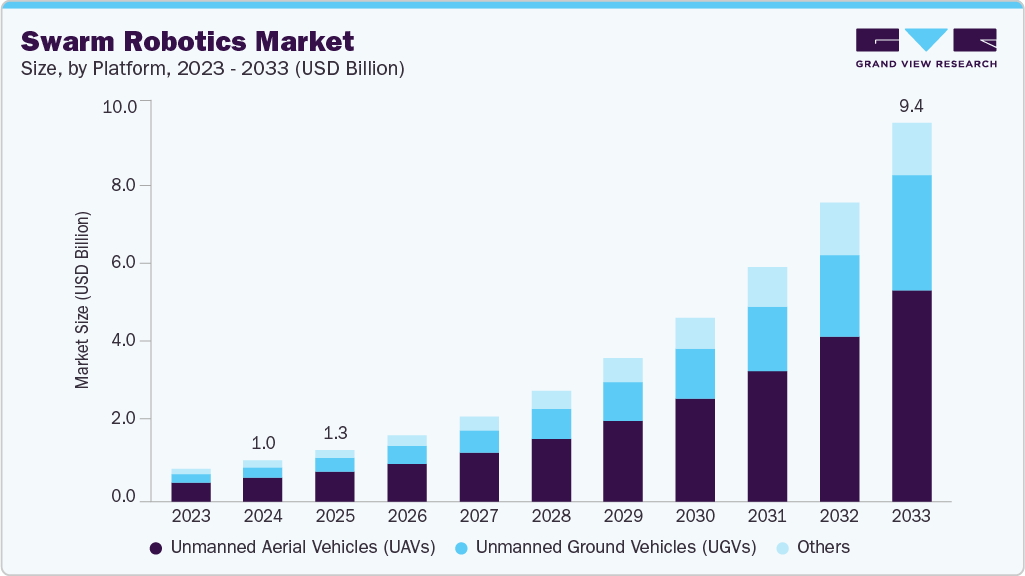

The global swarm robotics market size was estimated at USD 1.03 billion in 2024 and is projected to reach USD 9.44 billion by 2033, growing at a CAGR of 28.1% from 2025 to 2033. The market growth is primarily driven by the rising need for decentralized multi-robot systems in industrial automation.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 46.5% in 2024.

- Country-wise, the U.S. led the North America market and held the largest revenue share in 2024.

- By platform, the unmanned aerial vehicles (UAVs) segment led the market, holding the largest revenue share of 59.0% in 2024.

- By application, the inspection & monitoring segment held the dominant position in the market and accounted for the leading revenue share of 29.2% in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 30.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2033 Projected Market Size: USD 9.44 Billion

- CAGR (2025-2033): 28.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The market is gaining traction due to the growing demand for scalable robotic coordination across manufacturing, logistics, and smart warehouses. The growing demand for autonomous fleet coordination in warehouse and logistics operations is accelerating innovation in the swarm robotics industry. Companies are increasingly relying on fleets of mobile robots to streamline inventory movement, order fulfillment, and real-time tracking. These robotic swarms operate collaboratively, reducing human intervention and operational delays. As a result, the swarm robotics industry is experiencing strong growth in retail and e-commerce sectors, looking to optimize last-mile delivery and warehouse efficiency.

The increasing demand for precision agriculture is transforming farming practices through the deployment of swarm robotics solutions. Swarms of autonomous ground and aerial robots are being used for tasks such as weeding, crop monitoring, and fertilizer application. This approach not only improves yield and reduces chemical usage but also addresses the labor shortages common in rural agricultural areas. The swarm robotics industry is thus becoming a key enabler of sustainable and intelligent farming systems.

The swarm robotics industry is witnessing increased momentum due to the integration of artificial intelligence and machine learning into real-time swarm behavior. Enhanced algorithms now enable autonomous agents to make collective decisions, self-organize, and adapt to environmental variables without centralized control. This evolution is particularly critical in mission-critical applications such as search and rescue, hazardous environment exploration, and disaster response. As a result, AI-driven autonomy is redefining the capabilities and commercial potential of the swarm robotics industry.

The growing demand for intelligent inspection and monitoring in the infrastructure and energy sectors is creating new opportunities for swarm robotics. Coordinated drone and ground robot swarms are being used for inspecting pipelines, transmission lines, bridges, and offshore facilities. These systems reduce manual inspection time and enhance safety by accessing hard-to-reach or hazardous areas. The swarm robotics industry is now expanding its footprint in industrial asset management and predictive maintenance.

Platform Insights

The unmanned aerial vehicles (UAVs) segment dominated the market with a share of 59% in 2024. The growing demand for coordinated aerial systems in commercial and defense sectors is fueling the rapid adoption of UAVs within the swarm robotics industry. Swarms of UAVs are increasingly deployed for surveillance, mapping, environmental monitoring, and tactical missions, offering enhanced coverage, scalability, and redundancy. These systems enable decentralized decision-making and real-time collaboration, making them ideal for dynamic and large-scale operational environments. As a result, the UAVs segment is emerging as the fastest-growing platform in the market, supported by advancements in AI, edge computing, and autonomous navigation.

The unmanned ground vehicles (UGVs) segment is expected to register the fastest CAGR of over 30% from 2025-2033. The increasing demand for autonomous mobility in defense, mining, and industrial sectors is driving growth in the UGVs segment of the swarm robotics industry. UGV swarms are being deployed for tasks such as perimeter security, material transport, and hazardous environment navigation, offering high operational safety and efficiency. Their ability to operate collaboratively without centralized control allows them to adapt to terrain changes and mission requirements in real time. As industries prioritize resilience and automation, the UGVs segment is gaining momentum as a key enabler of multi-agent ground operations within the swarm robotics industry.

Application Insights

The inspection & monitoring segment dominated the market in 2024, owing to the rising need for efficient, real-time infrastructure assessment. The inspection & monitoring segment is gaining strong traction within the swarm robotics industry. Coordinated robotic swarms are being deployed to inspect complex assets such as oil rigs, power grids, and transportation networks, significantly reducing human risk and operational downtime. These systems offer scalable, autonomous solutions that can navigate challenging environments and provide continuous data streams for predictive maintenance. As industries shift toward automation and digital asset management, swarm robotics is becoming an essential tool in the modernization of inspection processes.

The supply chain and warehouse management segment is expected to grow at the fastest CAGR in the coming years, driven by the need for high-throughput logistics and operational efficiency. The segment is accelerating its integration of swarm robotics technologies. Companies are deploying coordinated fleets of autonomous mobile robots to streamline inventory handling, order picking, and dynamic warehouse navigation. These swarm-based systems reduce processing time, enhance scalability during peak demand, and offer real-time adaptability in layout and workflow. As fulfillment centers strive for greater automation and responsiveness, the swarm robotics industry is becoming a critical enabler of next-generation supply chain transformation.

End Use Insights

The retail segment dominated the market in 2024, driven by the need for faster fulfillment and seamless in-store automation. The retail segment is increasingly adopting swarm robotics to optimize operations. Retailers are leveraging coordinated robot swarms for tasks such as shelf scanning, real-time inventory tracking, and autonomous restocking, improving both accuracy and customer satisfaction. These systems enable high agility during demand spikes, especially in omnichannel and e-commerce-driven environments. As consumer expectations rise and margins tighten, the swarm robotics industry is emerging as a key technology partner in retail supply chain and floor management transformation.

The automotive segment is expected to grow at the fastest CAGR in the coming years, owing to the rising demand for automation and production agility. The automotive segment is increasingly embracing swarm robotics in manufacturing and logistics operations. Swarms of autonomous mobile robots are being used for tasks such as parts transportation, inventory management, and real-time coordination on assembly lines. These systems enhance efficiency by enabling decentralized decision-making and adaptive routing in dynamic factory environments. As automakers invest in smart factory transformation, the swarm robotics industry is playing a crucial role in redefining operational workflows across automotive production lines.

Regional Insights

North America swarm robotics industry dominated globally with a share of over 46.0% in 2024, driven by advanced defense modernization programs. North America remains at the forefront of swarm robotics deployment, particularly in military and homeland security applications. The region benefits from strong government funding for autonomous systems and R&D collaborations between defense agencies and tech startups. Swarm robotics is increasingly integrated into reconnaissance, search-and-rescue, and coordinated surveillance systems. In addition, commercial interest is growing across logistics and warehouse automation, reinforcing North America’s leading position.

U.S. Swarm Robotics Market Trends

The U.S. swarm robotics industry dominated the North American region with a share of over 66% in 2024. owing to robust investment in industrial automation and AI. The United States is witnessing a significant uptake of swarm robotics in sectors such as e-commerce, agriculture, and logistics. Tech giants and innovative startups are accelerating swarm software platforms that enable coordination between large robotic fleets. In the agricultural space, swarm robotics is being used for crop spraying, weeding, and yield monitoring. The country’s regulatory support for UAV trials also fosters the scalability of swarm-based drone operations.

Europe Swarm Robotics Market Trends

The Europe swarm robotics industry is expected to grow at a CAGR of 26.4% from 2025 to 2033, primarily driven by collaborative EU-funded robotics projects. Europe is cultivating a vibrant ecosystem for swarm robotics innovation across academic, industrial, and public sectors. Several initiatives, such as Horizon Europe programs, support pilot projects in autonomous transportation, infrastructure monitoring, and public safety. Europe also emphasizes ethical AI and safety frameworks, shaping the way swarm robotics is developed and deployed. These coordinated efforts are accelerating cross-border experimentation and application in diverse industries.

The Germany swarm robotics industry is expected to grow at a significant rate in the coming years, driven by the country’s strong manufacturing base and Industry 4.0 adoption. Germany is exploring swarm robotics for automated production lines, quality control, and predictive maintenance. German firms are integrating multi-robot collaboration into automotive and heavy machinery manufacturing to improve precision and reduce downtime. Swarm robotics also supports autonomous navigation in logistics and smart warehousing across industrial hubs. Research institutions like Fraunhofer are actively collaborating with enterprises to industrialize swarm intelligence.

The UK swarm robotics industry is expected to grow at a significant rate in the coming years. The growing demand for smart logistics and disaster response systems is propelling the adoption of swarm robotics in the United Kingdom. The country is leveraging AI-driven robot fleets to optimize warehousing, transport coordination, and emergency response. Startups and universities are playing a key role in creating flexible swarm platforms for real-time decision-making and resilience in unpredictable environments. The UK’s focus on robotics as part of its National AI Strategy further enhances adoption opportunities.

Asia Pacific Swarm Robotics Market Trends

Asia Pacific swarm robotics industry is expected to grow at the fastest CAGR of 33.1% from 2025 to 2033.The increasing demand for drone-based agricultural automation is accelerating the adoption of swarm robotics across the Asia Pacific. The region, with its large-scale farming operations and labor shortages, is investing in swarms of UAVs for crop spraying, soil analysis, and irrigation management. In addition, smart city projects in countries like Singapore and South Korea are experimenting with coordinated robotic systems for urban surveillance and delivery. The convergence of AI, 5G, and robotics fuels market is helping expand the market in the region.

The China swarm robotics industry is witnessing growing demand for national security and urban monitoring systems, which is driving China’s investments in swarm robotics technology. The Chinese government has prioritized autonomous systems in its “New Infrastructure” strategy, leading to massive funding and pilot programs involving coordinated drones and ground robots. In urban areas, swarm robots are used for surveillance, traffic monitoring, and emergency management. Domestically developed AI chips and control systems strengthen China’s edge in deploying swarms at scale.

The Japan swarm robotics industry is owing to labor shortages and an aging population pressures, Japan is advancing swarm robotics to automate tasks in agriculture, eldercare, and infrastructure inspection. The country emphasizes the use of small, coordinated robot fleets in rice fields, greenhouses, and elderly support facilities. Swarm robotics is also deployed in rail and tunnel maintenance, minimizing downtime in national transportation networks. Japan’s government is fostering public-private collaboration to scale these applications efficiently.

Key Swarm Robotics Company Insights

Some of the key players operating in the market include DJI and Boston Dynamics, among others.

-

DJI is a global leader in drone manufacturing and autonomous aerial systems, headquartered in China. The company is at the forefront of integrating swarm intelligence into unmanned aerial vehicles (UAVs) for commercial, agricultural, and security applications. DJI’s high-performance drone platforms and AI-driven flight control systems position it as a dominant force in coordinated UAV deployments. Its continuous investment in R&D supports scalability and advanced fleet coordination, critical to swarm robotics evolution.

-

Boston Dynamics is a leading robotics company known for developing advanced mobile robots with dynamic movement, balance, and coordination. In the swarm robotics industry, the company is exploring multi-agent robotic systems that can collaborate in logistics, inspection, and defense-related applications. While traditionally focused on individual robots like Spot and Stretch, Boston Dynamics is increasingly investing in collective robotic intelligence and fleet coordination capabilities. Their innovations in mobility and AI-driven autonomy position them as a key player in advancing practical swarm robotics solutions for complex environments.

SwarmFarm Robotics and Blue River Technology are some of the emerging market participants in the swarm robotics industry.

-

SwarmFarm Robotics, based in Australia, is a pioneering startup in agricultural swarm robotics. The company develops autonomous farm machinery that works collaboratively for tasks like weeding, spraying, and crop monitoring. Their swarm approach increases farming precision and productivity while reducing chemical usage. As precision agriculture gains momentum, SwarmFarm is emerging as a key innovator in decentralized robotic farming systems.

-

Blue River Technology, a subsidiary of John Deere, specializes in agricultural robotics with emerging capabilities in swarm coordination. The company’s “See & Spray” technology uses computer vision and machine learning to enable multiple units to operate in parallel across large farms. Its focus is on reducing herbicide usage and improving field productivity through robotic precision. Blue River’s work in scalable, multi-robot field systems marks its ascent in the swarm robotics space.

Key Swarm Robotics Companies:

The following are the leading companies in the swarm robotics market. These companies collectively hold the largest market share and dictate industry trends.

- DJI

- Clearpath Robotics

- SwarmFarm Robotics

- Robotic Research

- HYDROMEA

- Boston Dynamics

- Blue River Technology

- Velodyne Lidar

- Zebra Technologies

- AgEagle Aerial Systems

Recent Developments

-

In April 2025, H2 Clipper was granted a U.S. patent for its innovative swarm robotics system for aerospace manufacturing. Technology leverages autonomous, AI-powered robots to replace traditional assembly lines, cutting production time by up to 60% and costs by over 40%. This system also enhances operational safety and precision through real-time sensor data and autonomous quality control.

-

In March 2025, UBTECH completed the world’s first collaborative training of multiple humanoid robots at Zeekr’s smart factory in Ningbo. Using advanced AI systems like BrainNet and Internet of Humanoids, the robots autonomously performed complex tasks including assembly, logistics, and heavy lifting. This breakthrough showcases the potential of swarm intelligence in real-world manufacturing, setting a new benchmark for industrial automation.

-

In December 2024, Mecalux and MIT’s Center for Transportation & Logistics launched the Intelligent Logistics Systems Lab to drive innovation in AI-powered logistics. The initiative focuses on developing swarm-intelligent mobile robots and self-learning AI for warehouse optimization and demand forecasting. This partnership aims to enhance operational efficiency, reduce environmental impact, and improve service quality in global supply chains.

Swarm Robotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2033

USD 9.44 billion

Growth rate

CAGR of 28.1% from 2025 to 2033

Base Year of Estimation

2024

Actual Data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

DJI; Clearpath Robotics; SwarmFarm Robotics; Robotic Research; HYDROMEA; Boston Dynamics; Blue River Technology; Velodyne Lidar; Zebra Technologies; AgEagle Aerial Systems.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Swarm Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global swarm robotics market report based on platform, application, end use, and region.

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Unmanned Ground Vehicles (UGVs)

-

Unmanned Aerial Vehicles (UAVs)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Inspection & Monitoring

-

Mapping & Surveying

-

Search & Rescue

-

Security

-

Supply Chain and Warehouse Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

Automotive

-

Military & Defense

-

Agriculture

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global swarm robotics market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global swarm robotics market is expected to grow at a compound annual growth rate of 28.1% from 2025 to 2033 to reach USD 9.44 billion by 2033.

b. North America dominated the swarm robotics market with a share of 46.5% in 2024, driven by advanced defense modernization programs. North America remains at the forefront of swarm robotics deployment, particularly in military and homeland security applications. The region benefits from strong government funding for autonomous systems and R&D collaborations between defense agencies and tech startups.

b. Some key players operating in the swarm robotics market include DJI, Clearpath Robotics, SwarmFarm Robotics, Robotic Research, HYDROMEA, Boston Dynamics, Blue River Technology, Velodyne Lidar, Zebra Technologies, and AgEagle Aerial Systems.

b. Key factors that are driving the market growth include the increasing adoption in defense and surveillance applications, the growing demand for automation in agriculture and industrial sectors, and advancements in AI algorithms enabling efficient decentralized coordination.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.