- Home

- »

- Medical Devices

- »

-

Switzerland Healthcare & Medical Tourism Market Report 2030GVR Report cover

![Switzerland Healthcare & Medical Tourism Market Size, Share & Trends Report]()

Switzerland Healthcare & Medical Tourism Market Size, Share & Trends Analysis Report By Service (Radiology, Orthopedics), By End-use (Private Care, Public Care), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-526-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

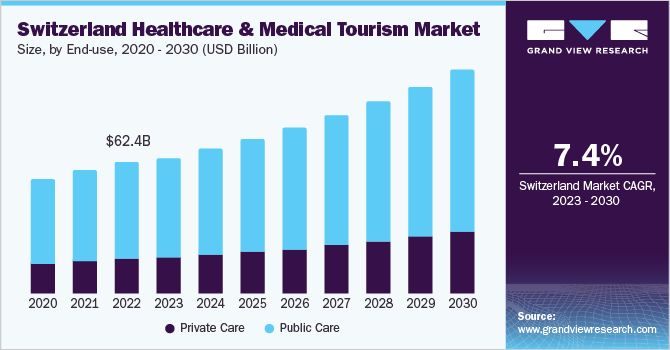

The Switzerland healthcare & medical tourism market size was estimated at USD 62.4 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The increasing adoption of initiatives to promote medical tourism, along with the high quality of medical care, is expected to boost the growth of the market. The Switzerland healthcare industry has established a reputation for good and efficient healthcare services. Although there is a regional disparity in healthcare-related satisfaction among citizens, the overall scenario seems to be positive in the country. Moreover, the established healthcare system in the localities enables the health industry to focus on the incoming medical tourists.

Switzerland is one of the major medical tourism destinations, and efforts are being made to improve medical tourism services. Switzerland Tourism (ST) took the initiative to partner with hospitals and clinics, with a focus on the quality of infrastructure, medical expertise, and location in a relaxing environment and natural setting. In 2019, ST successfully partnered with 26 hospitals and clinics in the region, and with the help of its 33 regional offices worldwide, it offers its partners an opportunity to increase their visibility in foreign markets. Moreover, in 2020, ST launched its magazine and website, contributing to its marketing strategy and further plans to participate in various events in Russia, China, and Gulf countries to showcase Switzerland's health tourism facilities. Such activities have helped establish Switzerland as a medical tourist destination on the global platform.

Switzerland is home to numerous medical offices, hospitals, and wellness facilities that provide patient-centered care.H+ Swiss Hospitals is a leading association in Switzerland comprising both public and private hospitals, clinics, and institutions for special care. It has 263 hospitals, clinics, and institutes for special care, spread across 369 different locations.

Even though the cost of medical care is high compared to other European countries, Switzerland has always been a popular destination for medical tourism. This can be attributed to the well-established healthcare infrastructure with the presence of trained healthcare professionals, high-quality care, high patient privacy standards, and beautiful locations.

Access to technologically advanced medical devices, diagnostic procedures, and robot-assisted minimally invasive surgeries, the availability of luxurious facilities are the primary factors for patients visiting Switzerland for medical treatment. For example, Hirslanden Klinik Aarau provides surgical robotic procedure services for international patients. Innovations in surgical techniques can help in reducing the cost of medical treatment in Switzerland. As per the Organization for Economic Co-operation and Development (OECD), Switzerland has one of the longest durations of hospital stay. Technological advancements in minimally invasive surgeries can result in a significant reduction in length of stay and in-patient costs.

End-use Insights

In terms of end-use, the public care segment held the largest revenue share of 73.7% in 2022. This is attributed to strong government support and increased healthcare spending. Medical tourists have given a major boost to the country’s medical tourism industry, and they prefer public centers as compared to private care providers. Initiatives by Switzerland Tourism such as business partnerships to support targeted marketing campaigns contribute to the increase in medical tourists.

The private care segment is anticipated to grow at the fastest CAGR of 8.1% during the forecast period. The presence of large private hospital groups with dozens of private clinics and hospitals at various sites with world-class healthcare facilities is favoring the demand for private hospitals in Switzerland. For instance, Hirslanden Private Hospital Group comprises 17 private hospitals across various locations in Switzerland. Similarly, the Swiss leading hospitals are a network of 18 private hospitals and 236 doctors across Switzerland. These hospitals are renowned for their medical expertise and quality among international patients. The growing network of these large hospitals by the establishment of more clinics and centers is fueling the growth of the private care segment.

Medical tourists coming from Gulf countries have given a major boost to the country’s medical tourism industry. Switzerland Tourism is taking active steps and measures such as collaboration with clinics and sponsorships to attract medical tourists to Switzerland. For instance, in 2020, Switzerland Tourism generated USD 7.2 million through business partnerships to support targeted marketing campaigns. However, the high cost of medical care, high tariffs for surgical procedures, and increased out-of-pocket expenses are important factors restricting the segment growth.

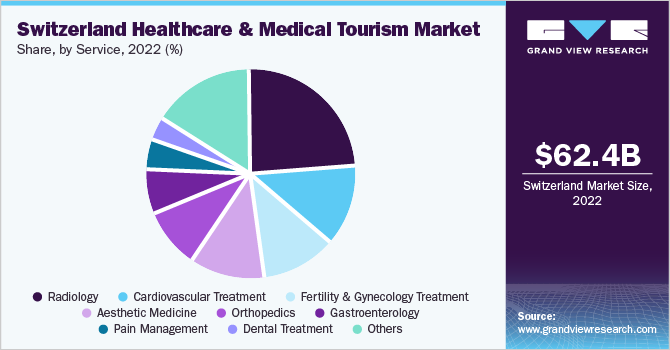

Service Insights

In terms of service, the radiology segment held the largest revenue share of 24.0% in 2022. Among various techniques, Computed Tomography (CT) has observed an increase due to its application in minimally invasive surgeries, such as percutaneous biopsy and percutaneous abscess drainage, along with diagnostics. Health services are benefiting from the availability of innovative products in the market, thus increasing the efficiency of treatment.

The service segment faces certain challenges such as a shortage of local healthcare workers due to the inadequate supply of workforce from training institutes, difficulty in maintaining work-life balance due to overwork, and a continuous increase in demand for healthcare services. Specifically, a significant shortage of nurses in long-term care facilities is a concern, considering the continuously increasing geriatric population in the country.

The cardiovascular treatment segment is anticipated to register the fastest CAGR of 8.8% over the forecast period. Switzerland offers a wide range of cardiovascular treatment services, including diagnosis, prevention, and intervention for various cardiovascular conditions. Switzerland boasts of highly skilled healthcare professionals and renowned cardiovascular specialists who are trained in the latest techniques and advancements in cardiovascular care. The country's hospitals and clinics are equipped with state-of-the-art technology and facilities to provide cutting-edge treatments.

Switzerland Healthcare And Medical Tourism Insights

Switzerland has a reputation for delivering high-quality healthcare services, with a focus on patient safety, precision, and personalized care. The country consistently ranks among the top in global healthcare quality indices, assuring patients seeking services such as cardiovascular treatment, dental treatment, fertility, and gynecology treatment, pain management, and others.

The medical tourism industry in Switzerland is witnessing remarkable growth owing to the influx of international patients in the country for medical purposes. As the majority of private hospitals are located in Zurich, Geneva, Bern, Basel, and Lausanne, these regions receive the most medical tourists. Both private and public hospitals in the country have established their reputation for the quality of care.

According to the OECD, in Switzerland, 100% of the population is eligible for core healthcare services. Furthermore, there are 4.3 practicing physicians per 1,000 inhabitants, which is close to the OECD average, and 17.2 practicing nurses per 1,000 inhabitants, which is above the OECD average. Thus, the well-developed healthcare infrastructure and the growing popularity of Switzerland for medical tourism are anticipated to drive the market.

Key Companies & Market Share Insights

The Switzerland market for healthcare and medical tourism is fragmented with several players operating in the market. The expansion of the services portfolio, the launch of new facilities, and partnerships and collaborations are the key strategic undertakings of the companies to increase market share. For instance, in January 2020, Clinique de Montchoisi announced extending its orthopedic services by opening a new physiotherapy and occupational therapy department. Some prominent players in the Switzerland healthcare & medical tourism market include:

-

Klinik Hirslanden

-

Swiss Medica XXI Century S.A.

-

Biologic Aesthetic Dentalcare

-

Berit Klinik

-

Clinique de Genolier

-

Clinique de Montchoisi

-

Hirslanden Clinique Cecil

-

Private Clinic Mentalva

-

Rehabilitation Clinic Zihlschlacht

-

Grand Resort Bad Ragaz

-

Clinica Sant’Anna

-

The Waldhotel

-

Swiss Medical Network

-

The Swiss Leading Hospital

-

Privatklinik Hohenegg AG

-

Klinik Im Park

-

Private Clinic Meiringen

-

Hirslanden Klinik Aarau

-

Pyramide am See Clinic

-

Salem-Spital

-

Schmerzklinik Basel

-

Klinik Beau-Site

-

Clinique La Colline

-

SW!SS REHA

-

Berit Klinik

-

BESAS Bern Hospital Center for Geriatric Medicine

-

Cereneo Schweiz AG

-

CLINIC BAD RAGAZ

-

LEUKERBAD CLINIC

-

Clinique de Maisonneuve

-

Clinique Valmont

-

Hochgebirgsklinik Davos

-

Hof Weissbad AG

-

Klinik Schloss Mammern

-

Oberwaid AG

-

Rehaklinik Dussnang AG

-

Salina Rehabilitation Clinic

Switzerland Healthcare & Medical Tourism Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 106.3 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, service

Country scope

Switzerland

Key companies profiled

Klinik Hirslanden; Swiss Medica XXI Century S.A.; Biologic Aesthetic Dentalcare; Berit Klinik; Clinique de Genolier; Clinique de Montchoisi; Hirslanden Clinique Cecil; Private Clinic Mentalva; Rehabilitation Clinic Zihlschlacht; Grand Resort Bad Ragaz; Clinica Sant’Anna; The Waldhotel; Swiss Medical Network; The Swiss Leading Hospital; Privatklinik Hohenegg AG; Klinik Im Park; Private Clinic Meiringen; Hirslanden Klinik Aarau; Pyramide am See Clinic; Salem-Spital; Schmerzklinik Basel; Klinik Beau-Site; Clinique La Colline; SW!SS REHA; Berit Klinik; BESAS Bern Hospital Center for Geriatric Medicine; cereneo Schweiz AG; CLINIC BAD RAGAZ; LEUKERBAD CLINIC; Clinique de Maisonneuve; Clinique Valmont; Hochgebirgsklinik Davos; Hof Weissbad AG; Klinik Schloss Mammern; Oberwaid AG; Rehaklinik Dussnang AG; Salina Rehabilitation Clinic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Switzerland Healthcare & Medical Tourism Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Switzerland healthcare & medical tourism market report based on end-use and service:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Care

-

Public Care

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiology

-

Orthopedics

-

Aesthetic Medicine

-

Cardiovascular Treatment

-

Pain Management

-

Fertility And Gynecology Treatment

-

Gastroenterology

-

Dental Treatment

-

Others

-

Frequently Asked Questions About This Report

b. The Switzerland healthcare & medical tourism market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 106.2 billion by 2030.

b. The Switzerland healthcare & medical tourism market size was estimated at USD 62.4 billion in 2022 and is expected to reach USD 64.5 billion in 2023.

b. The public care segment dominated the market for healthcare & medical tourism market in Switzerland and accounted for the largest revenue share in 2022.

b. The radiology segment dominated the market for healthcare & medical tourism market in Switzerland and accounted for the largest revenue share in 2022.

b. Some key players operating in the Switzerland healthcare & medical tourism market Klinik Hirslanden; Swiss Medica XXI Century S.A.; Biologic Aesthetic Dentalcare; Berit Klinik; Clinique de Genolier; Clinique de Montchoisi; Hirslanden Clinique Cecil; Private Clinic Mentalva; Rehabilitation Clinic Zihlschlacht; Grand Resort Bad Ragaz; Clinica Sant’Anna; The Waldhotel; Swiss Medical Network; The Swiss Leading Hospital; Privatklinik Hohenegg AG; Klinik Im Park; Private Clinic Meiringen; Hirslanden Klinik Aarau; Pyramide am See ClinicSalem-Spital; Schmerzklinik Basel; Klinik Beau-Site; Clinique La Colline; SW!SS REHA; Berit Klinik; BESAS Bern Hospital Center for Geriatric Medicine; cereneo Schweiz AG; CLINIC BAD RAGAZ; LEUKERBAD CLINIC; Clinique de Maisonneuve; Clinique Valmont; Hochgebirgsklinik Davos; Hof Weissbad AG; Klinik Schloss Mammern; Oberwaid AG; Rehaklinik Dussnang AG; Salina Rehabilitation Clinic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."