- Home

- »

- Consumer F&B

- »

-

Synbiotic Product Market Size & Share, Industry Report, 2030GVR Report cover

![Synbiotic Product Market Size, Share & Trends Report]()

Synbiotic Product Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Functional Food & Beverages, Dietary Supplements), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-207-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synbiotic Product Market Size & Trends

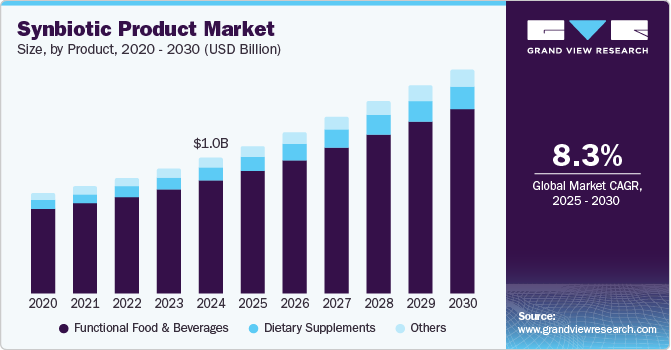

The global synbiotic product market size was valued at USD 1.02 billion in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2030. The increasing health consciousness among consumers is leading to a higher demand for functional foods and beverages containing prebiotics and probiotics. Additionally, the rising trend of nutritional supplementation due to changing lifestyles and eating habits is propelling market growth. The fortification of functional foods with prebiotics and probiotic ingredients is also contributing to market growth. Moreover, the growing awareness of the benefits of symbiotic products, such as improved gut health, immunity, and overall well-being, is encouraging consumers to incorporate these products into their daily routines.

The growing awareness of the benefits of symbiotic products, such as improved gut health, immunity, and overall well-being, is encouraging consumers to incorporate these products into their daily routines. Furthermore, increasing consumer awareness about gut health, rising incidences of digestive disorders, and continuous innovation in product offerings are attracting a wider consumer base. The global shift towards healthier lifestyles, an aging population, support from healthcare professionals, and the expansion of retail channels, especially e-commerce, are further driving market expansion. Supportive government initiatives and policies, along with cultural acceptance and integration of symbiotic products into traditional diets, are also contributing to the robust growth of the global symbiotic product market.

Product Insights

Functional food & beverages dominated the market with the largest revenue share of 83.4% in 2024. Functional foods and beverages, which are fortified with prebiotics and probiotics, have become increasingly popular due to their ability to enhance gut health and overall well-being. Consumers are actively seeking out these products as part of their daily diet to improve digestion, boost immunity, and maintain a healthy microbiome. The growing trend of health and wellness, coupled with the increasing awareness of the benefits of functional ingredients, is driving demand for symbiotic products in this segment. Additionally, the convenience and variety of functional food and beverage options available in the market, including yogurts, synbiotic products, fortified drinks, and snack bars, cater to diverse consumer preferences.

Dietary supplements are expected to grow at the fastest CAGR of 9.7% over the forecast period. The increasing awareness of the health benefits associated with synbiotic dietary supplements, such as improved digestion, enhanced immunity, and overall well-being, is significantly boosting demand. Consumers are becoming more proactive about their health and are seeking convenient ways to incorporate prebiotics and probiotics into their daily routines. The flexibility and convenience of dietary supplements, which come in various forms, such as capsules, tablets, powders, and gummies, make them a popular choice among health-conscious individuals. Additionally, the rise of personalized nutrition and the trend toward preventive healthcare propel the market forward. The expanding availability of dietary supplements through various retail channels, including pharmacies, health food stores, and online platforms, is making them more accessible to a broader audience.

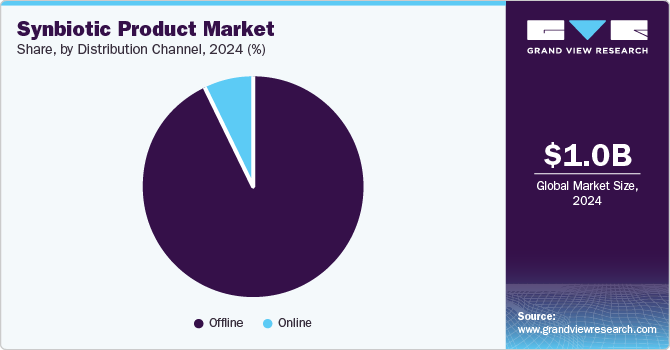

Distribution Channel Insights

The offline channel dominated the market with the largest revenue share in 2024. Physical retail stores, such as supermarkets, health food stores, and pharmacies, allow consumers to personally inspect and purchase symbiotic products. This in-store experience allows customers to seek advice from knowledgeable staff, enhancing their confidence in their product choices. Additionally, promotional activities, in-store discounts, and product demonstrations attract a significant customer base. The convenience of purchasing symbiotic products during regular grocery shopping trips further boosts the popularity of the offline channel. The extensive availability of these products in brick-and-mortar stores ensures they are easily accessible to a wide range of consumers.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing popularity of e-commerce platforms and their convenience make it easier for consumers to purchase symbiotic products from the comfort of their homes. Online platforms provide various options, detailed product descriptions, customer reviews, and ratings, helping consumers make informed decisions. The influence of digital marketing and social media advertising is effectively reaching a broader audience and boosting online sales. Exclusive online discounts, promotions, and subscription services further incentivize consumers to shop for symbiotic products online. The rise of tech-savvy consumers who prefer the convenience and flexibility of online shopping is also contributing to the growth of the online channel.

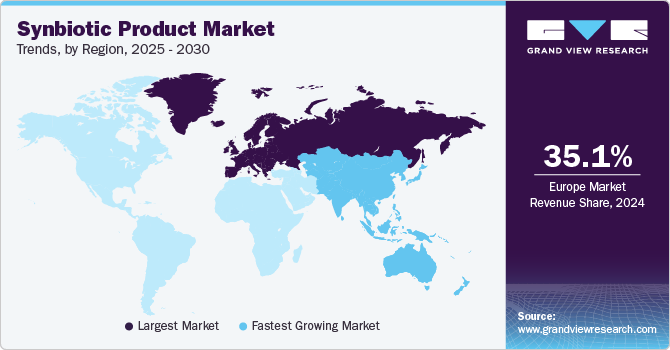

Regional Insights

North America synbiotic product industry held a considerable share in 2024. The presence of key market players in the region fosters innovation and competition, boosting market growth. Moreover, the high incidence of digestive issues in the population increases the demand for synbiotic solutions. In addition, the trend towards preventive healthcare is a significant driver, as consumers actively seek products that support long-term health.

U.S. Synbiotic Product Market Trends

The U.S. synbiotic product industry is expected to grow significantly over the forecast period, owing to consumers becoming more health-conscious and seeking functional foods and beverages that contain synbiotics. The rising prevalence of digestive disorders such as inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS) is also propelling demand for synbiotic products. Additionally, the innovation in functional foods that incorporate synbiotics is appealing to a wide range of health-conscious consumers.

Europe Synbiotic Product Market Trends

Europe synbiotic product industry dominated the global market with the largest revenue share of 35.1% in 2024. European consumers have a strong awareness of health and wellness, driving demand for functional foods and beverages that promote gut health and overall well-being. The region's stringent regulations and standards for food safety and quality ensure that symbiotic products meet high standards, increasing consumer trust and adoption. Additionally, the widespread availability of symbiotic products in various retail channels, including supermarkets, health food stores, and pharmacies, makes them easily accessible to consumers. The influence of cultural trends emphasizing natural and organic products further boosts the popularity of symbiotic products in Europe.

Asia Pacific Synbiotic Product Market Trends

Asia Pacific synbiotic product industry is expected to grow at the fastest CAGR of 9.5% over the forecast period. The rising middle class in countries such as China and India drives the demand for health and wellness products, including synbiotics. Rapid urbanization and changing lifestyles contribute to increased health consciousness and a preference for functional foods. Government initiatives and activities by non-governmental organizations (NGOs) promoting the benefits of synbiotics are also supporting market growth.

Key Synbiotic Product Company Insights

Some key companies in the synbiotic product market include Daflorn Ltd, Sabinsa, Danone, Yakult Honsha Co. Ltd., Probiotical S.p.A., and others.

-

Danone is a global food and beverage industry leader, with a strong focus on health and nutrition. The company has been producing fermented foods containing probiotics for nearly 100 years. Danone's synbiotic offerings include a combination of prebiotics and probiotics that work synergistically to promote gut health. The patented prebiotic mixture, scGOS/lcFOS (9:1), is designed to mimic the complexity of human milk oligosaccharides and has shown clinical benefits such as reducing the risk of allergies and infections.

-

Yakult Honsha Co. Ltd. is a Japanese company renowned for its probiotic drinks, particularly Yakult. Yakult Honsha's products are widely available through various retail channels, including grocery stores, e-commerce platforms, and a unique distribution network of Yakult Ladies who deliver the product directly to consumers.

Key Synbiotic Product Companies:

The following are the leading companies in the synbiotic product market. These companies collectively hold the largest market share and dictate industry trends.

- Daflorn Ltd

- Sabinsa

- Danone

- Yakult Honsha Co. Ltd

- Probiotical S.p.A

- United Naturals

- Pfizer Inc.

- Synbiotic Health

- NUtech Ventures

- Asmara (NU3x)

Recent Developments

-

In October 2024, Saya Suka launched its innovative Synbiotic Water at SIAL Paris, aligning with the growing global emphasis on gut health and the gut-brain connection. This groundbreaking beverage combines prebiotics and probiotics to enhance digestion, bolster immune function, and support mental well-being.

-

In May 2024, Clasado Biosciences, a UK functional ingredients R&D company, showcased its innovative functional beverage containing prebiotics and probiotics at the Vitafoods Europe trade show in Geneva.

-

In May 2024, DSM-Firmenich and Lallemand Health Solutions announced a pioneering partnership to create innovative synbiotic solutions for early-life nutrition. This collaboration combined probiotics and human milk oligosaccharides (HMOs) to enhance infant health and development.

-

In January 2024, Evonik introduced a new category of nutraceuticals, IN VIVO BIOTICS, which combines probiotics with additional health ingredients. These synbiotics are grounded in scientific research and leverage Evonik's expertise in biotechnology and formulation.

Synbiotic Product Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.68 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Daflorn Ltd; Sabinsa; Danone; Yakult Honsha Co. Ltd; Probiotical S.p.A; United Naturals; Pfizer Inc.; Synbiotic Health; NUtech Ventures; Asmara (NU3x)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synbiotic Product Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synbiotic product market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Functional Food & Beverages

-

Dietary Supplements

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.