- Home

- »

- Advanced Interior Materials

- »

-

Synthetic Paper Market Size, Share & Trends Report, 2030GVR Report cover

![Synthetic Paper Market Size, Share & Trends Report]()

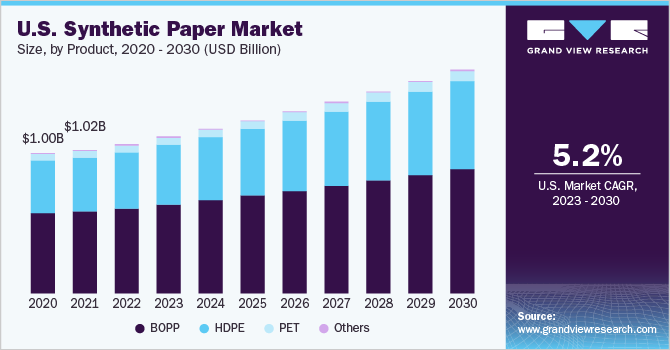

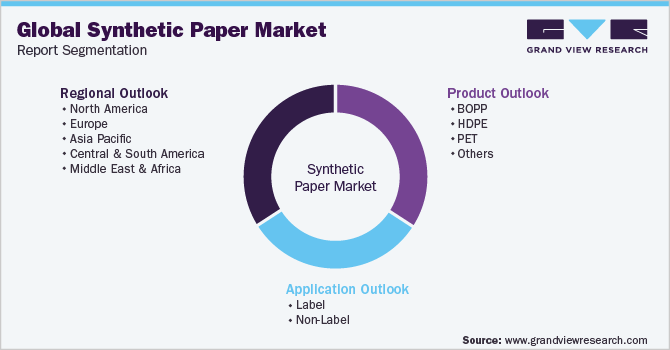

Synthetic Paper Market Size, Share & Trends Analysis Report By Product (BOPP, HDPE, PET & Others), By Application (Label, Non-Label), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-258-7

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Synthetic Paper Market Size & Trends

The global synthetic paper market size was estimated at USD 1.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The market is expected to grow significantly due to the inclination of consumers toward eco-friendly and recycled packaging. Synthetic paper is produced from synthetic resins that are extracted from petroleum. Exceptional properties offered by the material such as resistance against tear, chemicals, moisture and oil, along with better heat seal ability, printability, and high strength is providing it an edge over the conventional paper. It is extensively used in industries, such as packaging, food & beverages, consumer goods, transportation and pharma goods. The U.S. is one of the key markets for synthetic as the increasing awareness regarding the use of environmentally friendly products is expected to propel the use of synthetic paper over vinyl in the coming years. Digital printing is expected to pave the way for new opportunities for the product over the forecast period.

The global pandemic outbreak led to the imposition of lockdown restrictions by governing authorities across various economies to curb the spread of the virus. This, in turn, led to several impacts on retail sales of goods along with a brief halt in transportation and logistics. As a result, it led to a short-term dip in demand for synthetic paper in the year 2020.

Synthetic paper is a good printing medium for indoor advertisements, posters, banners, and other photo printing. The special layer of coating on synthetic paper makes the image more colorful and attractive. In addition to good printability, synthetic paper also exhibits resistance against chemicals, grease, folding, and heat. This makes it suitable for use in the development of toxic-free thermoforming products for food packaging as well as stationery such as holders and covers.

Volatile crude oil prices are expected to affect the revenue as well as profit margins of market players who use crude oil as a captive product for further processing it into petrochemicals. Ascending automotive demand, increasing infrastructural developments, and the growth of healthcare and pharmaceutical industries are factors expected to propel the demand for petrochemicals and polymers over the forecast period.

The market leaders are doing extensive research & development to reduce the cost of synthetic paper production, which would strengthen their market share in the paper industry. In addition, governments across various economies are increasing their efforts to increase sustainability across various industries thus looking for alternatives to reduce waste and increase recyclability. This trend is further expected to positively influence the market for synthetic paper over the forecast period.

Product Insights

BOPP product segment led the market and accounted for 57.4% of the global revenue in 2022. It is expected to witness a notable growth at a CAGR of 5.6% from 2023 to 2030 owing to better strength offered by the material which makes them suitable for packaging perishable items such as snacks, fast food, vegetables, fruits, and confectionery.

The superior properties exhibited by BOPP have resulted in its extensive use in the packaging of chemicals, textiles, cosmetics, and food & beverages. The growth of the above-mentioned application industries in emerging economies such as India and China are expected to result in high demand for BOPP film in Asia Pacific over the forecast period.

HDPE-based synthetic papers, majorly used in the packaging of powder, cheese, frozen food, and electronic parts, are expected to be the fastest-growing product segment over the forecast period, growing at over 6.2% from 2023 to 2030. The papers exhibit high moisture barrier, and temperature resistance properties, and are non-abrasive, non-scratch, and acid resistant.

HDPE is expected to gain popularity over the forecast period in emerging economies such as Brazil, China, India, and Russia mainly due to its low cost and extensive application scope. HDPE films are also used as release liners and interleaving sheeting, foam-in-place, and box liners owing to their better release property without silicone coating.

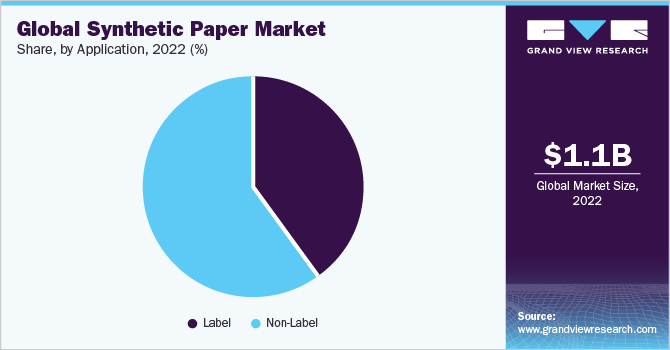

Application Insights

Non-labelling application segment led the market, accounting for approximately 60% of the global revenue in 2022. Exceptional durability and tensile strength to hold heavy items positions synthetic paper as a suitable material for non-labeling applications such as packaging. Moreover, the superior resistance to moisture and extreme heat offered by the material is further expected to drive its growth in the packaging application segment.

The convenience of fine printing over synthetic paper using ink and adhesives contributes to its higher demand in various industries. Ease of printability on the surface of synthetic papers contributes to its application in printing over the packaged item. Moreover, they are scratch and stain resistant and thus facilitate the usage in the packaging of delicate materials.

Labelling application segment is also expected to witness the fastest growth over the forecast period at a CAGR of 6.0%. Medical tags in the label application segment is expected to be the fastest-growing application segment over the forecast period, growing at a CAGR of over 6.9% from 2023 to 2030. Medical tags are used in applications such as blood bags, test samples in pathological labs, test tubes, pharmaceuticals, medical devices, medical machinery, bottles, and first aid.

Healthcare sector is one of the largest growing industries globally and its expansion is expected to surge the demand of medical tags. Synthetic papers are used for medical tags because of its reliable performance in conditions such as tampering and extreme cryogenic temperature.

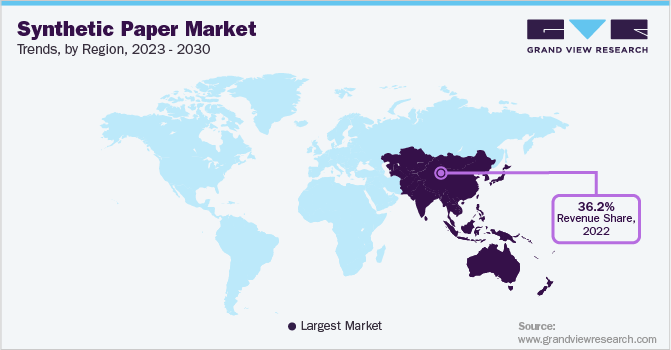

Regional Insights

The Asia-Pacific region segment led the market and accounted for 36.2% of the global revenue in 2022. The demand for the product in Asia-Pacific was valued at over USD 389.2 million in 2022 on account of the growing demand in the pharmaceutical, printing & packaging industry. In addition, the exponential growth witnessed by e-commerce retail in the region is expected to be a major growth factor for synthetic paper over the forecast period.

The growth in Asia Pacific can be attributed to the growing end-user industries like pharmaceuticals, cosmetics, consumer goods, and food & beverages due to the increasing disposable income and improved standard of living of the working-class population in developing countries such as India and China.

Europe accounted for a significant revenue share of the market valued at over 28% in 2022. The demand for synthetic paper in the U.K. is likely to register the fastest growth in label application on account of the increasing use of the product in food & beverage and pet food labeling industries. Numerous companies including Harrier Packaging are using synthetic paper for the packaging of pet food.

North America also accounted for a notable revenue share of the market valued at 22.9% in 2022. Wrap-around labels are increasingly used in beverage packaging including fruit juices and functional drinks, diversifying from bottled water, which is expected to drive the growth of label industry in North America, thus positively affecting the growth of the synthetic paper market.

Key Companies & Market Share Insights

Major market players are adopting growth strategies to get a strong hold in the market. New product development, merger & acquisition, and expansion are some of the strategies adopted by companies to enhance their regional presence & product offering to meet the growing demand for to synthetic paper from emerging economies.

All the key players present in the synthetic paper industry are concentrating on going into long-haul supply associations with selected business partners, on acquiring an aggressive edge. With the rise in market demand, many companies, have emerged to establish their position in the market. The companies are well established in the market and produce a wide range of products. Some prominent players in the global synthetic paper market include:

-

Formosa Plastics Group

-

SIHL Group

-

B&F Plastics, Inc.

-

Jindal Poly Films Ltd.

-

Cosmo Films Ltd.

-

Granwell Products, Inc.

-

Transcendia, Inc.

-

Valéron Strength Films

-

Toyobo Co., Ltd.s

-

TechNova

Synthetic Paper Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.13 billion

Revenue forecast in 2030

USD 1.66 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Japan; China; India; Taiwan; Australia

Key companies profiled

Formosa Plastics Group; SIHL Group; B & F Plastics; Inc.; Jindal Poly Films Ltd.; Cosmo Films Ltd.; Granwell Products, Inc.; Transcendia, Inc.; Valéron Strength Films; Toyobo Co., Ltd.; TechNova

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Paper Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the synthetic paper market based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

BOPP

-

HDPE

-

PET

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Label

-

Hand Tags

-

Medical Tags

-

Others

-

-

Non-Label

-

Packaging

-

Documents

-

Others

-

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global synthetic paper market size was estimated at USD 1.07 billion in 2022 and is expected to reach USD 1.13 billion in 2023.

b. The synthetic paper market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 1.66 billion by 2030.

b. BOPP product segment dominated the market and accounted for more than 57.4% share of the global revenue in 2022. BOPP is extensively used in applications that require heat stabilities, water and fatigue resistance, high tensile strength, and ease of printing. In addition, BOPP is environmental friendly and low in toxicity, making this synthetic paper used to pack food items and beverages.

b. Some of the key players operating in the synthetic paper market include Formosa Plastics Group, SIHL Group, B & F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Films, Toyobo Co., Ltd., TechNova

b. The key factors driving the synthetic paper market includes the growing awareness of climate change, the global increasing demand for paper and the efforts made to decrease the dependency on plant based paper. Its sustainable production along with recyclable nature also positively drives the market share.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."