- Home

- »

- Next Generation Technologies

- »

-

Targeting Pods Market Size & Share, Industry Report, 2030GVR Report cover

![Targeting Pods Market Size, Share & Trends Report]()

Targeting Pods Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (FLIR & Laser Designator, Laser Designator, Laser Spot Tracker Pods), By Component (OEM Fit), By Fit (FLIR Sensor, MMS), By Platform, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-913-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Targeting Pods Market Size & Trends

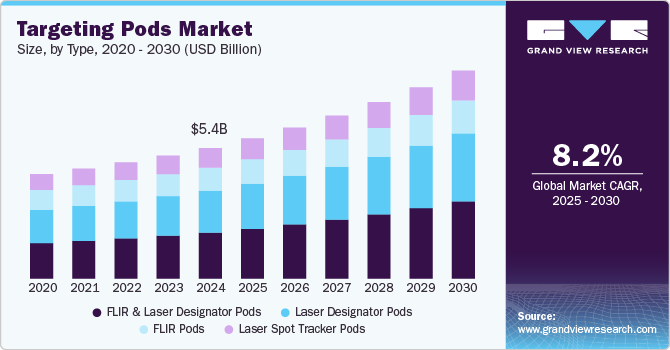

The global targeting pods market size was valued at USD 5.36 billion in 2024 and is expected to grow at a CAGR of 8.2% from 2025 to 2030. This growth is attributed to rising military spending, geopolitical tensions, and the increasing demand for precision-guided munitions to minimize collateral damage. In addition, advancements in sensor technologies, including electro-optical and infrared systems, as well as integration with AI and machine learning, are enhancing target identification and engagement capabilities. Furthermore, the growing use of UAVs for reconnaissance and strikes, alongside the modernization of aging military aircraft fleets, also fuels demand. Moreover, regional defense investments and adoption of fifth-generation aircraft support market growth.

Targeting pods are sophisticated systems used by military aircraft to identify and engage targets with precision-guided munitions. These systems are crucial for enhancing the effectiveness of modern combat aircraft. The growth of the targeting pods market is significantly driven by the increase in global defense budgets, which facilitates military modernization efforts. As governments allocate more resources to defense, they prioritize upgrading existing aircraft and acquiring new platforms such as fighter jets, helicopters, and unmanned aerial vehicles (UAVs), all of which require targeting pods for optimal performance. Consequently, heightened defense spending directly boosts the demand for these advanced systems.

In addition, the evolving geopolitical landscape prompts nations to invest in cutting-edge targeting pod technology to maintain a technological edge. For instance, in July 2023, the U.S. Departments of Commerce and Defense signed a MoA to strengthen the domestic semiconductor industry, ensuring that critical components meet national security needs. This strategic partnership underscores the importance of advanced technology in defense.

Furthermore, advancements in targeting pod technology, such as the Sniper Advanced Targeting Pod, offer enhanced capabilities like real-time data sharing and improved target identification. These features are expected to drive demand as military forces seek to modernize their capabilities. For instance, in October 2024, Poland enhanced its FA-50 fighter jets with Sniper Advanced Targeting Pods, securing a contract that includes system support and spare parts to ensure long-term operational readiness. Moreover, the expansion of aircraft manufacturing facilities is poised to create new opportunities for the targeting pods market, as these facilities increasingly require advanced systems to support the production of sophisticated aircraft.

Type Insights

FLIR & laser designator pods led the market and accounted for the largest revenue share of 35.2% in 2024, primarily driven by advancements in infrared and laser-based technologies that enable precise target detection and engagement. In addition, these systems utilize thermographic cameras to sense infrared radiation and laser light sources for accurate target designation. Increasing military aircraft upgrades, adoption of payload-based targeting systems, and the integration of short-wave infrared (SWIR) technology are key factors.

Laser designator pods are expected to grow at a CAGR of 8.5% over the forecast period, owing to their critical role in precision-guided munitions. These systems emit coded laser pulses to mark targets, enabling munitions to home in with high accuracy. In addition, rising military aircraft modernization programs and the need for advanced targeting capabilities in all-weather conditions drive their adoption.

Component Insights

OEM fit dominated the global targeting pods market, with the largest revenue share of 65.1% in 2024. This growth is attributed to the increasing defense spending and the need for advanced airborne targeting systems. Governments are prioritizing the integration of targeting pods during aircraft manufacturing to ensure seamless compatibility and enhanced operational efficiency. In addition, technological advancements, such as systems with laser-assisted autofocus and Wi-Fi connectivity, further boost demand.

The upgrades segment is expected to grow at a lucrative CAGR of 9.2% over the forecast period, driven by the rising demand for post-sale enhancements tailored to customer requirements. In addition, military forces increasingly opt for upgrades to modernize existing targeting pods with advanced features like improved sensors, real-time data sharing, and modular designs. This approach ensures operational readiness while reducing costs compared to acquiring new systems. Furthermore, advancements in technology allow targeting pod providers to offer customizable upgrades, creating a recurring revenue stream as nations focus on maintaining cutting-edge capabilities in evolving combat scenarios.

Fit Insights

The FLIR sensor segment held the largest revenue share of 22.6% in 2024, primarily due to its capability to detect and track targets using infrared imaging, even in challenging conditions. This technology is crucial for modern military operations, enabling long-range target acquisition. Furthermore, the increasing use of forward-looking infrared systems across various military platforms, combined with advancements in thermally cooled infrared devices, drives demand for FLIR sensors in targeting pods.

The moving map system (MMS) is expected to grow at a CAGR of 10.1% from 2025 to 2030 as it enhances situational awareness and navigation during missions by integrating real-time geospatial data with targeting systems. This allows operators to accurately locate and engage targets. In addition, the rising demand for precision-guided munitions and mission planning capabilities fuels the adoption of MMS in targeting pods.

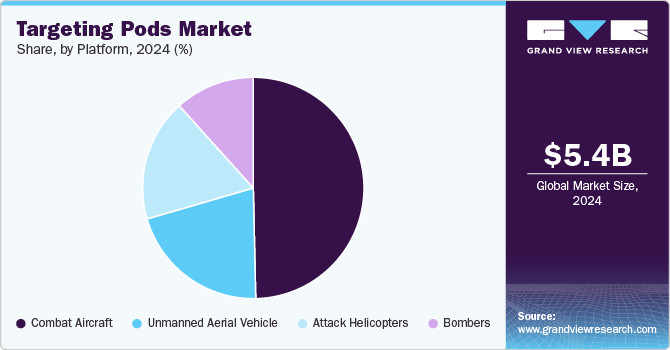

Platform Insights

The combat aircraft held the dominant position in the market, with the largest revenue share of 49.6% in 2024, driven by the increasing demand for precision strike capabilities in modern warfare. Combat aircraft equipped with targeting pods enhance mission success rates by enabling accurate target detection, tracking, and engagement. Furthermore, rising global defense budgets and military modernization programs are leading to the procurement of advanced fighter jets such as F-35 and Rafael, which rely on targeting pods for improved operational efficiency.

The Unmanned Aerial Vehicle (UAV) segment is expected to be the fastest-growing segment, with a CAGR of 9.2% over the forecast period due to the growing use of drones for reconnaissance, surveillance, and precision strikes. Targeting pods enhance UAV capabilities by providing real-time data and accurate target designation, even in complex environments. In addition, the increasing deployment of UAVs in military operations, driven by their cost-effectiveness and reduced risk to human life, fuels demand for advanced targeting systems.

Regional Insights

North America targeting pods market dominated the global market and accounted for the largest revenue share of 32.8% in 2024. This growth is attributed to the substantial defense budgets and continuous modernization initiatives. The region’s focus on integrating advanced technologies, such as AI and machine learning, into targeting systems enhances operational efficiency. Furthermore, the growing demand for precision-guided munitions and the adoption of UAVs for reconnaissance and strikes further boost market growth.

U.S. Targeting Pods Market Trends

The targeting pods market in the U.S. dominated the North American market and held the largest revenue share in 2024, driven by extensive military spending and a strong focus on technological superiority. In addition, the country’s procurement of advanced combat aircraft, such as F-35s, equipped with cutting-edge targeting pods drives growth.

Asia Pacific Targeting Pods Market Trends

Asia Pacific targeting pods market is expected to grow at the fastest CAGR of 11.3% over the forecast period, owing to the rising defense expenditures and increasing geopolitical tensions in the region. Countries are investing heavily in modernizing their military forces, including acquiring advanced combat aircraft equipped with targeting pods. In addition, the growing adoption of UAVs for surveillance and precision strikes further accelerates demand.

Europe Targeting Pods Market Trends

The growth of Europe targeting pods market is expected to be driven by robust defense collaborations among nations and consistent investments in military modernization programs. The region’s procurement of advanced aircraft, such as the Eurofighter Typhoon equipped with sophisticated targeting systems, drives demand. Furthermore, Europe’s emphasis on reducing collateral damage through precision-guided munitions fosters the adoption of cutting-edge technologies such as FLIR sensors and laser designators.

Key Targeting Pods Company Insights

Key players in the global targeting pods market include Lockheed Martin, Raytheon Technologies, BAE Systems, and others. These companies adopt and employ strategies such as continuous innovation in sensor technologies, integration of AI and machine learning for enhanced targeting accuracy, and expansion into emerging markets.

-

BAE Systems manufactures and deals in electronic warfare advanced countermeasure pods, such as those designed for the P-8 Poseidon aircraft. BAE Systems operates in the defense and aerospace segments, focusing on developing innovative technologies for threat detection, countermeasures, and aircraft survivability.

Key Targeting Pods Companies:

The following are the leading companies in the targeting pods market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Thales Group

- Leonardo DRS

- L3Harris Technologies

- General Dynamics

- SAAB Group

- Elbit Systems

- FLIR Systems, Inc.

- ASELSAN A.S.

Recent Developments

-

In July 2024, Lockheed Martin enhanced military interoperability with its Sniper Networked Targeting Pod. This advanced pod enabled seamless communication between F-35s, fourth-generation jets, and missile systems, creating unprecedented deterrence capabilities.

Targeting Pods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.77 billion

Revenue forecast in 2030

USD 8.55 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, fit, platform, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Lockheed Martin; Raytheon Technologies; Northrop Grumman; BAE Systems; Thales Group; Leonardo DRS; L3Harris Technologies; General Dynamics; SAAB Group; Elbit Systems; FLIR Systems, Inc.; ASELSAN A.S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Targeting Pods Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global targeting pods market report based on type, component, fit, platform, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FLIR & Laser Designator Pods

-

Laser Designator Pods

-

FLIR Pods

-

Laser Spot Tracker Pods

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM Fit

-

Upgrades

-

-

Fit Outlook (Revenue, USD Million, 2018 - 2030)

-

FLIR Sensor

-

Charge Coupled Device (CCD) Camera

-

Environmental Control Unit (ECU)

-

Moving Map System (MMS)

-

Video Datalink

-

Digital Data Recorder

-

Processor

-

High Definition (HD) TV

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Combat Aircraft

-

Unmanned Aerial Vehicle (UAV)

-

Attack Helicopters

-

Bombers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.