- Home

- »

- Advanced Interior Materials

- »

-

Technical Insulation Market Size, Industry Report, 2020-2027GVR Report cover

![Technical Insulation Market Size, Share & Trends Report]()

Technical Insulation Market (2020 - 2027) Size, Share & Trends Analysis Report By Type, By Application (Heating & Plumbing, Acoustic), By End Use (Industrial & OEM, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-706-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global technical insulation market size was estimated at USD 7.24 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 2.5% from 2020 to 2027. Increasing demand for efficient use of power and energy across the developing economies on account of rapid industrialization and urbanization is estimated to propel the demand for technical insulation. Stringent regulations related to the use of insulating types are anticipated to promote market growth. In addition, technical insulation is an effective method that is increasingly used in insulating pipes and equipment in the industrial processes. Moreover, the method does not involve high cost which is a major factor promoting its adoption across various applications.

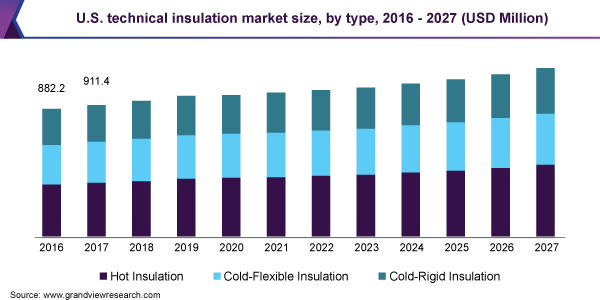

In the U.S., the market was valued at USD 974.9 million in 2019 and is estimated to witness a CAGR of 2.3% from 2020 to 2027. Expansion of the industrial and commercial sectors across the country coupled with the rising demand for HVAC systems, refrigeration, and heating and plumbing systems, is anticipated to propel the growth of the market for technical insulation.

Expansion of the commercial sector is projected to promote the demand for technical insulation of pipes and equipment which is anticipated to benefit market growth. In addition, demand for acoustic insulation in the commercial buildings is projected to further propel growth of the market for technical insulation over the forecast period.

However, volatile raw material prices are projected to have a negative impact on market growth. In addition, low awareness about the benefits of technical insulation is anticipated to restrict industry growth over the forecast period. Moreover, lack of skilled labor for the installation is estimated to limit growth of the market for technical insulation.

Increased infrastructural spending in developing economies such as China, India, Indonesia, and South Korea is estimated to promote market growth over the forecast period. In addition, rapid industrialization across the globe is projected to further fuel the growth of the industry over the forecast period.

Type Insights

In terms of revenue, the hot insulation segment accounted for a market share of 40.6% in 2019 and is estimated to witness a CAGR of 2.9% from 2020 to 2027. Rising industrialization across the globe is projected to propel the demand for hot insulation for pipes and equipment, thereby driving the market for technical insulation. Rising demand for energy conservation coupled with the growing initiatives to reduce the carbon dioxide is estimated to promote segmental growth. In addition, hot insulation eliminates the transfer of heat out from the equipment and systems, thereby improving machine performance. This is estimated to propel industry growth over the forecast period.

The cold-flexible insulation segment is estimated to witness a CAGR of 2.2% on account of the superior properties of the insulating type including strength, durability, and flexibility. In addition, frost protection on the pipes and equipment at low temperatures is estimated to further propel the demand for cold-flexible insulating type.

The cold-rigid insulation type segment includes PUR foam, PIR foam, phenolic foam, EPS, and XPS. The type of technical insulation is increasingly used in commercial buildings for applications including HVAC, acoustic, and refrigeration. The rising adoption of the cold-rigid insulation type across the commercial sector is likely to augment the growth of the segment in the technical insulation market.

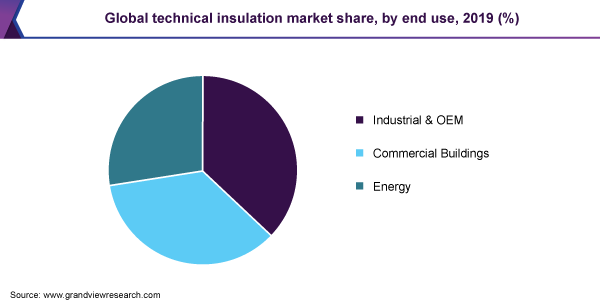

End-use Insights

In terms of revenue, the industrial and OEM end-use segment accounted market share of 37.2% in 2019 and is projected to witness a CAGR of 2.9% from 2020 to 2027. Technical insulation is increasingly used to limit the energy and carbon dioxide loss in chemical industries, refineries, and food processing industries. This is projected to benefit segmental growth over the forecast period.

Technical insulation is an ideal solution for the industrial and OEM end-use as it offers a wide range of material choices for a number of high and low temperature applications. Expansion of the industrial sector in emerging economies on account of increasing foreign investments is likely to boost the demand for technical insulation in economies including China, India, and Brazil.

Rising demand for power and energy across the industrial and commercial sector is anticipated to boost the number of oil and gas and petrochemical industries across the globe. This is projected to promote the product demand for storage and transportation, which is anticipated to augment the growth of the market for technical insulation over the forecast period.

Expansion of the commercial sector across the globe on account of the rising demand for retail outlets, malls, and office spaces is driving the segment. This is projected to fuel the demand for HVAC systems, acoustic insulation facilities, and heating and plumbing insulation. Growing demand for technical insulation across the commercial buildings is projected to benefit the market for technical insulation.

Application Insights

The heating and plumbing application segment held market share of 35.4% in 2019. The segment is anticipated to witness a CAGR of 2.9% from 2020 to 2027 and is expected to reach USD 3.2 billion in 2027. Rising use of insulated pipes and equipment for industrial purposes in order to avoid the loss of heat is projected to result in rising demand for technical insulation in the heating and plumbing application.

Growing use of HVAC systems in the commercial sector on account of the growing emphasis on energy efficiency is anticipated to drive the segment. In addition, the effectiveness of the HVAC system in optimizing cost and energy is projected to further benefit the segmental growth. Moreover, modern systems such as air filtration and cleaning elements can be added in the HVAC systems, which further propel its growth.

Rising demand for soundproofing in commercial buildings in order to avoid the transmission of sound is projected to propel the growth of the segment over the forecast period. Increasing number of office spaces, retail outlets, malls, and others across the globe is projected to promote the demand for acoustic insulation, thereby driving the market for technical insulation.

Increasing demand for refrigeration from the food processing industries is projected to boost market growth. In addition, use of refrigeration to preserve foodstuffs in the cold chain is anticipated to further benefit industry growth over the forecast period. Moreover, the regulations related to the preservation of food are projected to augment the growth of the market for technical insulation.

Regional Insights

In terms of revenue, Asia Pacific accounted for the highest market share of 34.2% in 2019 and is projected to witness a CAGR of 3.0% from 2020 to 2027. Factors such as increasing population and rapid urbanization across the region are estimated to fuel market growth over the forecast period. In addition, the rising foreign investment in the region is estimated to drive the market for technical insulation in the region.

Availability of raw material at lower cost coupled with an abundant supply of raw material in the economies including China, India, Indonesia, and South Korea is projected to propel the expansion of the industrial and commercial sectors in the region. This is anticipated to propel the demand for technical insulation, thereby propelling market growth.

Rising industrial and OEM facilities in Europe is projected to propel the demand for heating and plumbing systems, HVAC, acoustic insulation, and refrigeration. In addition, stringent regulations in the region pertaining to insulating type and its usage are projected to further augment market growth.

Expansion of the commercial building on account of the rising demand for office spaces, hotels, malls, health institutes, and retail stores in the economies such as Germany, the U.K., and Spain is estimated to propel the demand for technical insulation. This is anticipated to promote the market for technical insulation over the forecast period.

Key Companies & Market Share Insights

The key players are engaged in expanding their production capacities by establishing manufacturing facilities across economies such as Brazil and Indonesia. In addition, these manufacturers are also involved in implementing marketing strategies such as mergers and acquisitions and partnerships to establish a strong market position. Huntsman Corporation in December 2019 announced its agreement to acquire Icynene-Lapolla that operates a manufacturer and distributor of spray polyurethane foam-based insulating systems. This helps the company to gain a higher market share. Other industry participants include Zotefoams Plc, Kingspan Group Plc, Rockwool International A/S, and Morgan Advanced Type plc. Some of the prominent players in the technical insulation market include:

-

Zotefoams Plc

-

Owens Corning

-

Kingspan Group Plc

-

Rockwool International A/S

-

Recticel NV/SA

-

Morgan Advanced Materials plc

-

Armacell International S.A.

-

Aspen Aerogels, Inc.

-

Knauf Insulation

-

Saint-Gobain

-

Palziv Inc.

Technical Insulation Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 7.29 billion

Revenue forecast in 2027

USD 8.8 billion

Growth rate

CAGR of 2.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; Italy; China; India; Japan; Brazil

Key companies profiled

Zotefoams Plc; Owens Corning; Kingspan Group Plc; Rockwool International A/S; Recticel NV/SA; Morgan Advanced Materials plc; Armacell International S.A.; Aspen Aerogels, Inc.; Knauf Insulation; Saint-Gobain; Palziv Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global technical insulation market report on the basis of type, application, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Hot Insulation

-

Cold-Flexible Insulation

-

Cold-Rigid Insulation

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Heating & Plumbing

-

HVAC

-

Acoustic

-

Refrigeration

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Industrial & OEM

-

Energy

-

Commercial Buildings

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

The U.K.

-

Spain

-

Italy

-

Asia Pacific

-

China

-

India

-

Japan

-

Central & South America

-

Brazil

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global technical insulation market size was estimated at USD 7,246.4 million in 2019 and is expected to reach USD 7,291.4 million in 2020.

b. The global technical insulation market is expected to grow at a compound annual growth rate a CAGR of 2.5% from 2020 to 2027 to reach USD 8.8 billion by 2027.

b. Asia-Pacific dominated the technical insulation market with a share of 34.25% in 2019. This is attributable to the rapid expansion of the industrial and commercial sector in the region on account of the rising population across economies including China, India, and others.

b. Some key players operating in the technical insulation market include Zotefoams Plc, Owens Corning, Kingspan Group Plc, Rockwool International A/S, Recticel NV/SA, Morgan Advanced Materials plc, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Saint-Gobain, Palziv Inc., and others.

b. Key factors that are driving the market growth include the expansion of the industrial and commercial sectors across the developing regions coupled with the implementation of stringent regulations pertaining to the insulation materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.