- Home

- »

- Advanced Interior Materials

- »

-

Technical Textiles Market Size & Share, Industry Report 2030GVR Report cover

![Technical Textiles Market Size, Share & Trends Report]()

Technical Textiles Market (2025 - 2030) Size, Share & Trends Analysis Report By Manufacturing (3D Weaving, Thermo-forming, 3D Knitting), By End-use (Agro Textiles, Hometech Textiles), By Region, And Segment Forecasts

- Report ID: 978-1-68038-154-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Technical Textiles Market Summary

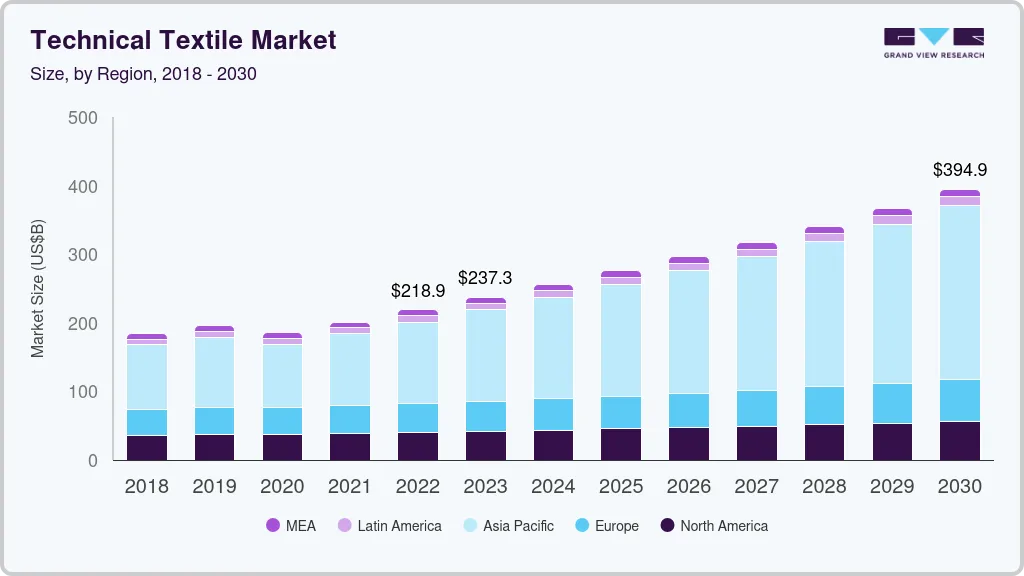

The global Technical Textiles market size was estimated at USD 206.14 billion in 2024 and is projected to reach USD 272.33 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The increasing demand for high-performance materials in sectors such as automotive, construction, and healthcare has significantly boosted the adoption of technical textiles.

Key Market Trends & Insights

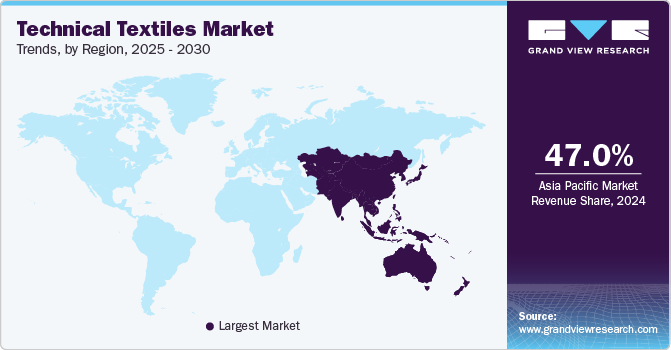

- The Asia Pacific technical textiles market dominated and accounted for 47.0% of global revenue in 2024.

- The U.S. technical textile market is driven by several key factors contributing to its rapid growth.

- Based on manufacturing, the 3D Weaving segment accounted for 23.4% of the revenue share in 2024.

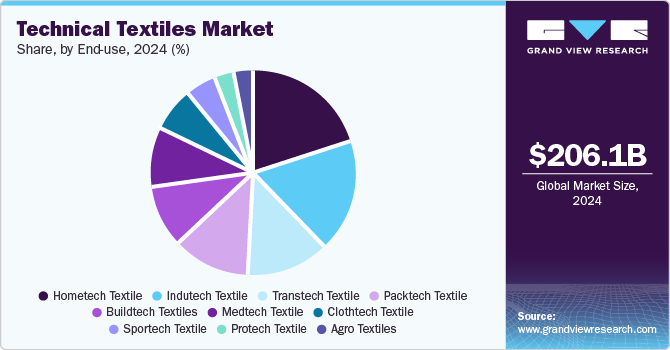

- Based on end-use, the hometech Textile segment accounted for 19.8% of the revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 206.14 Billion

- 2030 Projected Market Size: USD 272.33 Billion

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

These materials offer enhanced properties such as durability, flexibility, and resistance to environmental conditions, making them ideal for applications like geotextiles, protective clothing, and medical textiles.

Manufacturers are increasingly investing in the development of biodegradable and recyclable technical textiles to meet the growing environmental concerns and stringent regulations. This trend aligns with the global push toward circular economies, particularly in Europe and North America, where regulations favor sustainable manufacturing practices.Additionally, rapid advancements in technology have enabled the production of innovative technical textiles with multifunctional properties. Smart textiles integrated with sensors and electronic components are gaining traction in sectors like healthcare for patient monitoring and in sportswear for performance tracking. These innovations are expanding the market's scope and application, driving further demand.

Growing industrialization and urbanization in emerging economies, especially in Asia-Pacific, is also propelling the technical textiles industry. Countries like China and India are witnessing increased construction activities and expanding automotive and defense sectors, where technical textiles are extensively used. This is complemented by government initiatives promoting domestic manufacturing, which further bolsters the market growth.The ongoing R&D efforts to develop cost-effective and high-quality technical textiles are encouraging their adoption across price-sensitive markets. With increasing awareness about their benefits, industries are replacing conventional materials with technical textiles, contributing to a robust growth trajectory globally.

Manufacturing Insights

3D Weaving segment accounted for 23.4% of the revenue share in 2024. The 3D weaving segment of the market is driven by advancements in manufacturing technologies and the rising demand for high-performance materials across industries. The ability of 3D weaving to create complex, seamless, and highly durable structures has made it a preferred choice in aerospace, automotive, and defense applications. This process allows for the production of textiles with enhanced mechanical properties, such as superior strength-to-weight ratios, which are critical for high-stress environments.

Finishing Treatments segment is expected to grow at fastest CAGR of 6.0% over the forecast period. The finishing treatments segment in the technical textile industry plays a pivotal role in enhancing the functionality and performance of textiles, driving its demand across various industries. Finishing treatments include processes such as coating, laminating, dyeing, and adding chemical finishes, which imbue textiles with properties like water resistance, flame retardancy, antibacterial effects, and UV protection. The increase in demand for high-performance textiles in sectors like automotive, healthcare, construction, and protective clothing significantly fuels the adoption of advanced finishing treatments.

End use Insights

Hometech Textile segment accounted for 19.8% of the revenue share in 2024. The Hometech textile segment has experienced significant growth, driven by increasing demand for advanced home furnishings and decor materials that prioritize functionality, durability, and aesthetics. The growing consumer preference for textiles with enhanced properties such as fire resistance, moisture management, and antibacterial characteristics has significantly boosted the adoption of technical textiles in residential and commercial spaces. As urbanization accelerates, especially in emerging markets, there is a heightened demand for innovative and sustainable home textile solutions, further fueling this segment's expansion.

Packtech Textile segment is expected to grow at fastest CAGR of 6.2% over the forecast period. The Packtech textile segment in the market is witnessing robust growth driven by its diverse applications and evolving industry needs. These textiles are primarily used in packaging solutions across various sectors, including agriculture, food & beverage, pharmaceuticals, and industrial products. The increasing demand for flexible, durable, and lightweight packaging materials has been a major drive for the adoption of Packtech textiles. Their ability to provide superior protection against environmental factors such as moisture, UV rays, and chemicals makes them a preferred choice over conventional materials.

Regional Insights

Asia Pacific technical textiles market dominated and accounted for 47.0% of global revenue in 2024. Asia Pacific countries, especially China and India, are experiencing rapid industrial growth and urbanization, leading to an increasing demand for specialized textiles across multiple sectors. As industries such as automotive, construction, healthcare, and packaging expand, the need for technical textiles in applications like automotive upholstery, geotextiles, and medical textiles grows. The region’s expanding infrastructure projects and growing industrial base are major drivers of this trend.

China Technical Textiles Market Trends

China’s robust industrial and infrastructure development is one of the primary drivers for the demand for technical textiles. As the country continues to urbanize and invest heavily in infrastructure, the need for materials that offer high performance, durability, and specialized properties increases. These textiles are widely used in construction, transportation, and agriculture, including in geotextiles for road construction, automotive textiles, and protective clothing for construction workers.

North America Technical Textiles Market Trends

North America technical textiles market is driven by the automotive and aerospace industries. Technical textiles are widely used in these industries for components like airbags, seatbelts, insulation, and reinforcement materials. As both sectors continue to evolve with advanced technologies, including electric vehicles (EVs) and next-generation aircraft, there is a rising need for lightweight, durable, and high-performance textile materials to meet the stringent requirements of safety, comfort, and efficiency.

The U.S. technical textile market is driven by several key factors contributing to its rapid growth. One significant driver is the increasing demand across various industries for high-performance materials. As sectors such as automotive, construction, aerospace, and healthcare continue to innovate, the need for textiles with specialized properties like durability, strength, and resistance to extreme conditions has surged. For instance, in the automotive industry, lightweight and high-strength textiles are required to improve fuel efficiency, which boosts the demand for advanced materials such as nonwoven fabrics and composites.

Europe Technical Textiles Market Trends

Sustainability has become a major driver for the European market, with an increasing focus on eco-friendly, biodegradable, and recyclable textiles. The European Union's environmental regulations and initiatives aimed at reducing carbon footprints have spurred the growth of sustainable technical textiles, including those made from recycled fibers or natural materials. This is particularly evident in the fashion, automotive, and home textiles sectors.

Central & South America (CSA) Technical Textiles Market Trends

Government initiatives and investments aimed at developing the textile sector are providing a strong push for the market. Various governments in CSA are increasingly focused on the development of the industrial and manufacturing sectors, with initiatives that promote the use of innovative materials, including technical textiles. These investments are boosting research and development efforts and fostering collaborations between industry players, driving the regional adoption of technical textiles across different applications.

Key Technical Textiles Company Insights

Some of the key players operating in the market include Low & Bonar PLC, Berry Global Group, Inc., Others

-

Low & Bonar PLC is a global manufacturer of technical textiles, specializing in the design, production, and innovation of advanced materials for a variety of industries, including construction, automotive, agriculture, and infrastructure. The company offers a broad range of high-performance products, such as geosynthetics, filtration media, coated fabrics, and nonwoven textiles. These products are designed to enhance durability, efficiency, and sustainability in various applications.

-

Berry Global Group, Inc. is a global manufacturer of engineered materials and consumer packaging solutions. The company specializes in providing a wide range of products, including sustainable packaging, nonwoven fabrics, and specialty films, primarily serving markets such as healthcare, personal care, agriculture, and industrial sectors. In the technical textile space, Berry Global offers products such as protective fabrics, filtration media, geotextiles, and automotive textiles.

Key Technical Textiles Companies:

The following are the leading companies in the technical textiles market. These companies collectively hold the largest market share and dictate industry trends.

- Low & Bonar PLC

- Freudenberg Group

- Berry Global Group, Inc.

- Ahlstrom-Munksjo

- Asahi Kasei Advance Corp.

- Kimberly-Clark Corp.

- Mitsui Chemicals, Inc.

- Huntsman International LLC

- Toray Industries, Inc.

Technical Textiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 215.58 billion

Revenue forecast in 2030

USD 272.33 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Greece; China; India; Brazil

Segments covered

Manufacturing, end use, region

Key companies profiled

Low & Bonar PLC; Freudenberg Group; Berry Global Group, Inc.; Ahlstrom-Munksjo; Asahi Kasei Advance Corp.; Kimberly-Clark Corp.; Mitsui Chemicals, Inc; Huntsman International LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Technical Textile Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global technical textiles market report on the basis of manufacturing, end use, and region:

-

Manufacturing Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermo-forming

-

3D Weaving

-

3D Knitting

-

Nanotechnology

-

Heat-set Synthetics

-

Finishing Treatments

-

Hand-made Elements

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agro Textiles

-

Buildtech Textiles

-

Indutech Textile

-

Hometech Textile

-

Medtech Textile

-

Packtech Textile

-

Protech Textile

-

Transtech Textile

-

Sportech Textile

-

Clothtech Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Itay

-

Spain

-

Greece

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The technical textiles market size was estimated at USD 206.14 billion in 2024 and is expected to reach USD 215.58 billion in 2025.

b. The technical textile market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 272.33 billion by 2030.

b. 3D weaving dominated the technical textile market with a revenue share of 23.4% in 2024, owing to its wide on automotive, aerospace, military, and medical & healthcare industries.

b. Some of the key players operating in the technical textile market include Low & Bonar PLC, Freudenberg Group, Berry Global Group, Inc., Ahlstrom-Munksjo, Asahi Kasei Advance Corporation, Kimberly-Clark Corporation, Mitsui Chemicals, Inc., Huntsman International LLC, among others.

b. The key factors that are driving the technical textile market include growing product demand for agro-textile products, rising product use for production of indutech textiles, and an increase in demand for technical textiles for disposable protective gears for medical end-uses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.