- Home

- »

- Medical Devices

- »

-

Teeth Whitening Market Size, Value, Growth Report, 2030GVR Report cover

![Teeth Whitening Market Size, Share & Trends Report]()

Teeth Whitening Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Whitening Toothpaste, Whitening Gels & Strips, Light Teeth Whitening Device), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-944-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Teeth Whitening Market Summary

The global teeth whitening market size was estimated at USD 7.5 billion in 2023 and is projected to reach USD 10.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. With an increase in the population opting for the improvement of dental aesthetics, this industry has undergone great advancements.

Key Market Trends & Insights

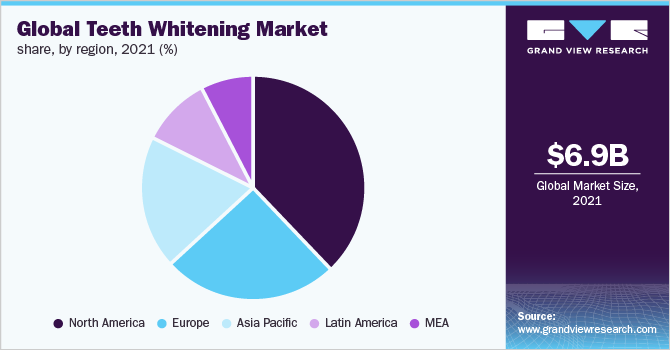

- The industry is led by North America with a revenue share of around 37% in 2021.

- Asia Pacific is set to grow tremendously with the highest CAGR during the forecast period.

- By product, whitening toothpaste accounted for the highest market share of 33% in 2021.

- By distribution channel, the offline distribution segment of the teeth whitening market held the largest revenue share of 61% in 2021.

Market Size & Forecast

- 2023 Market Size: USD 7.5 Billion

- 2030 Projected Market Size: USD 10.6 Billion

- CAGR (2024-2030): 5.0%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Developing countries have generated a large amount of disposable income which is the main reason why the market is flourishing. The geriatric population, in general, has propagated the growth of this industry with old age-related tooth ailments. Factors such as the increasing popularity of cosmetic dentistry, evolving medical tourism of dental treatment, and the introduction of multiple government initiatives for public oral health care, are few growth enablers for the market.

According to a survey conducted by the American Academy of Cosmetic Dentistry, in 2017, 93% of the patients opted for cosmetic dentistry procedures because of the referrals from friends and family who had good results. Moreover, out of this, 75% opted for the procedure because of the increasing online availability of information about cosmetic dentistry. According to a survey conducted in the U.K. in 2018, more women opt for aesthetic procedures due to motivational factors, such as self-esteem, life satisfaction, & self-related physical attractiveness, and all these women had one similarity, they had high media exposure. These factors have led people to opt for beautification and restorative procedures like teeth whitening, which is likely to drive the growth of the market

As stated by Racounter, 67 % of American adults have tried to whiten their teeth in one way or another-either through dentists and professional whitening techniques or with the help of toothpaste and strips. At-home whitening gels have around a 3% concentration of hydrogen peroxide which is approved by the FDA. Teeth whitening is the most popular dental procedure in the U.S., accounting for 32% of in-office practice and this is because 99.7% of people in the country perceive a smile as their most important social asset. This is why teeth whitening is one of today’s most popular dental requests

Social media alone is playing a very crucial role in promoting at-home teeth whitening procedures. According to White Dental Beauty, a 2016 survey by London dental surgery revealed that 84% of respondents felt there was more pressure to have a perfect smile due to the rise in adults and celebrities seeking orthodontic treatment. Forbes article of 2019 states that 5% of the influencers who offer product or service recommendations drive 45% of social influence, this will further strengthen the teeth whitening market.

However, dental services were one of the worst affected at the beginning of the COVID-19 pandemic. Dental practices across the world were halted. With no patient visits and declining revenues, several dental surgeons had to undergo unforeseen challenges. However, telemedicine became a boon for both dental surgeons and patients. An estimated 70% of all dental patients in the U.S. have private dental insurance. With high unemployment levels projected in the coming months, there is a major risk that demand for dental care could stagnate due to economic factors. With the ease of lockdowns in most countries, dental services are also reopening, however, following strict protocols has added to the expenses for several cosmetic dentists.

Product Insights

Whitening toothpaste accounted for the highest market share of 33% in 2021. Based on product the industry is segmented into whitening toothpaste, whitening gels and strips, light teeth whitening device, and others. Whitening toothpaste accounted for the largest market share as they are affordable and there is a presence of key players like P&G and Colgate Palmolive in the market. Moreover, the introduction of active charcoal toothpaste is highly absorbent and is effective in removing dental stains. However, whitening toothpaste contains less amount of hydrogen peroxide and therefore only whitens the teeth 2 times the color of the original teeth.

Teeth whitening gels and devices are the fastest-growing product segment. This is because teeth whitening gels are efficient in removing pigmentation and provide dramatic results. The amalgamation of teeth whitening gel along with LED whitening devices is proving to be effective as light devices speed up p the chemical reactions that remove the stains from teeth. Therefore, this segment is experiencing high growth.

Distribution Channel Insights

The offline distribution segment of the teeth whitening market held the largest revenue share of 61% in 2021. Products like whitening toothpaste and strips are mostly brought through offline channels like retail stores and therefore account for a high market share. According to semantics, offline sales of toothpaste account for 95% of global sales.

However, sales through the online network are increasing at a tremendous pace and are growing six times faster. Companies like Colgate and P&G have witnessed an increase in whitening products through online channels. In 2019, Colgate’s eCommerce sales increased by 26% globally with strong growth in North America. Moreover, online channels offer a variety of products at a cost-effective price. Hence their popularity is rising. Furthermore, to strengthen its online channel, in 2019, Colgate opened its first Online Acceleration center in the U.K. which produces digital content for the company.

Regional Insights

The industry is led by North America with a revenue share of around 37% in 2021, owing to the technological advancement and increase in the number of individuals opting for procedures involved in the teeth whitening market. The region has high awareness regarding oral health and the people opting for cosmetic procedures have also seen a surge.

Asia Pacific is set to grow tremendously with the highest CAGR during the forecast period. This is mainly due to the increasing amount of disposable income that is being generated in developing countries like India and China. With huge populations in this region, many individuals are inclined towards aesthetically improving dental health. Moreover, the high prevalence of dental conditions like periodontitis which assists in teeth staining is compelling people to opt for teeth whitening procedures and adding to the industry’s market share.

Key Companies & Market Share Insights

Most of these companies are involved in the modification of already launched products thereby enhancing their product portfolios. Consolidated partnerships between companies in this industry are a frequent phenomenon to keep ahead of other competitors.

For instance, In February 2020, P&G launched Crest Whitening Emulsions in two varieties-With Built-in Applicator for On the Go and With Whitening Wand with 5 times more active hydrogen peroxide. It also launched a teeth-whitening applicator that looks like a pen and works to remove surface teeth stains that includes ingredients like bleaching agent hydrogen peroxide as well as the teeth whitener sodium hydroxide, the anti-tartar agent disodium pyrophosphate. Some prominent players in the global teeth whitening market include:

-

Colgate Palmolive

-

GlaxoSmithKline Plc

-

Johnson & Johnson

-

Procter & Gamble

-

Brodie & Stone

-

Unilever

-

Church & Dwight Co.

Teeth Whitening Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.9 billion

Revenue forecast in 2030

USD 10.6 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Colgate Palmolive; GlaxoSmithKline Plc; Johnson & Johnson; Procter & Gamble; Brodie & Stone; Unilever; Church & Dwight Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global teeth whitening market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whitening Toothpaste

-

Whitening Gels & Strips

-

Light Teeth Whitening Device

-

Other Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global teeth whitening market size was estimated at USD 6.9 billion in 2021 and is expected to reach USD 7.2 billion in 2022.

b. The global teeth whitening market is expected to grow at a compound annual growth rate of 5.0% from 2022 to 2030 to reach USD 10.7 billion by 2030.

b. North America dominated the teeth whitening market with a share of 38% in 2021 owing to technological advancements and an increase in patients opting for procedures to improve dental aesthetics.

b. Some key players operating in the teeth whitening market include Colgate Palmolive; GlaxoSmithKline Plc; Johnson & Johnson; Procter & Gamble; Brodie & Stone; Unilever; Church & Dwight Co

b. Key factors that are driving the teeth whitening market growth include the increasing popularity of cosmetic dentistry, evolving medical tourism of dental treatment, and the introduction of multiple government initiatives for public oral health care

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.