- Home

- »

- Healthcare IT

- »

-

Tele-intensive Care Unit Market Size & Share Report, 2030GVR Report cover

![Tele-intensive Care Unit Market Size, Share & Trends Report]()

Tele-intensive Care Unit Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type (Open With Consultant, Intensivist, Co-managed, Open, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-894-7

- Number of Report Pages: 96

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tele-intensive Care Unit Market Trends

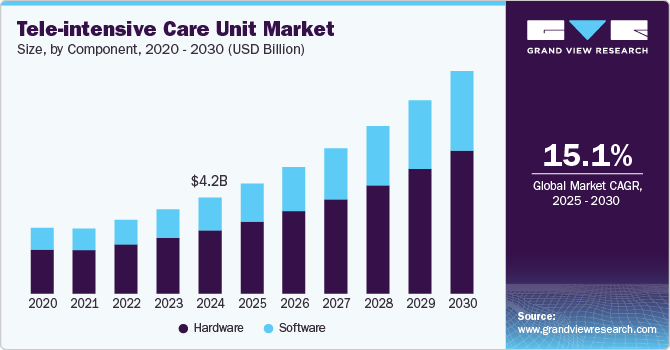

The global tele-intensive care unit market size was estimated at USD 4.24 billion in 2024 and is projected to grow at a CAGR of 15.08% from 2025 to 2030. Demand for remote monitoring in hospitals, increasing prevalence of chronic conditions, and growing awareness of virtual care platforms among healthcare providers and patients are the driving the market growth. Tele-intensive care units (ICU) enable healthcare practitioners to closely monitor ICU patients and permit caregivers to manage patients' care in multiple distant units. Similarly, reducing hospital stays minimizes unnecessary burdens on the patient and reduces the patient's healthcare expenses, further driving the market growth.

Increasing investment for the expansion of tele ICU services in rural areas is supplementing market growth. In March 2023, Critical Care Hope received a commitment of USD 380,680 from the SAMRIDH Healthcare blended financing facility. The funding is intended to support the expansion of its Tele-ICU platform for healthcare providers in tier 2 and 3 cities to provide critical care services. Through this partnership, Critical Care Hope aims to enlist 12 partner hospitals in tier-2 and 3 towns in Haryana, Rajasthan, Uttar Pradesh, Punjab, and Madhya Pradesh to offer critical care services. Similarly, in October 2024, Senate Deputy Leader Michael Gianaris, alongside Mount Sinai Queens President David L. Reich, MD, and Executive Director Cameron R. Hernandez, MD, announced the allocation of USD 6 million in funds for the construction and outfitting of a new Intensive Care Unit (ICU) at Mount Sinai Queens.

Moreover, adopting this tele-ICU software and hardware in hospitals improves patient care. Product offerings provide several advantages, such as reduced ICU complication rates, improved clinical staff productivity, and efficient care delivery. Similarly, this technology helps deliver patient care remotely with continuous real-time monitoring and remote access to patient data, reducing the need for department visits and the rate of hospitalizations. For instance, in February 2024, the VA Loma Linda introduced TeleCritical Care services in the Jerry L. Pettis Memorial Veterans' Hospital's intensive care unit in California. This Tele-ICU initiative strengthens the existing care by providing continuous access to cutting-edge technology and expert collaboration with highly skilled critical care nurses and intensivists.

Furthermore, as per the PCR Online article, in 2023, approximately 620 million individuals worldwide have heart and circulatory diseases. Every year, around 60 million people develop heart or circulatory disease. It is estimated that globally, 1 in 13 individuals live with heart or circulatory disease. Such increasing cases of chronic conditions are driving ICU admissions. For instance, according to an article in the Society of Critical Care Medicine, over 5 million patients are admitted to ICUs in the U.S. every year. Thus, such factors boost market growth.

Moreover, introducing different tele-intensive care unit programs and delivering care to users is expected to boost the industry's growth. Tele-ICU supports improving patient outcomes, leverages the use of intensivists for managing patient care, and decreases cost. For instance, in February 2023, CLEW, a provider of artificial intelligence analytics platforms for the healthcare sector, announced the launch of the CLEW tele-ICU conversion and accelerator program. It includes an ICU workflow platform, FDA-cleared AI predictive models; & packaged integrations to monitoring, AV, and EMR equipment.

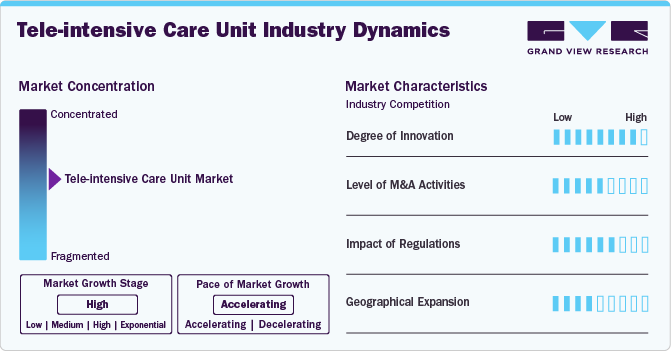

Market Concentration & Characteristics

The market for tele-intensive care unit is characterized by a high degree of innovation due to the rapid technological advancements driven by factors such as advancements in remote patient monitoring technologies and the availability of the internet (5G) connection system. Subsequently, innovative telemedicine applications are constantly emerging, disrupting existing industries and creating new ones.

The market is characterized by a medium level of merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain access to new telehealth technologies and the increasing strategic importance of telehealth. This strategy enables access to complementary technologies and distribution channels to capture a larger market share.

A robust medical-legal framework, including reimbursement, governance, and medical liability, was implemented to regulate tele-ICU care. These eased regulations for telehealth services have expanded access to tele-ICU and other services, which has supported the market growth. In the U.S., the American Telemedicine Association provides guidelines for tele-ICU operations.

Several market players are expanding their business by entering new regions to expand their product portfolio and strengthen their market position. For instance, in March 2024, iMDsoft, a software company, collaborated with Reliable de México to market and sell licenses for MetaVision and offer implementation and support services to MetaVision users across Mexico.

Component Insights

By component, the hardware segment dominated the tele-intensive care unit market in 2024 with a revenue share of 65.9%. Rising technological advances and increasing digital health and telehealth adoption drive market growth. Besides, remote patient monitoring heavily relies on telemedicine devices such as blood pressure, wearable EKG/ECG, biosensors, blood glucose monitors, digital medical scopes and accessories, and wearable activity trackers such as smartwatches and wristbands. Thus, innovation in hardware is expected to create potential growth for the market in coming years.

The software segment is expected to grow at the fastest rate over the forecast period. As healthcare facilities increasingly adopt telehealth solutions, specialized software platforms have emerged to support the complexities of critical care management. These platforms facilitate real-time data sharing, allowing intensivists to efficiently access patient information, vital signs, and treatment histories. They also incorporate advanced analytics and machine learning algorithms, enhancing decision-making capabilities and predictive outcomes for critically ill patients. For instance, Philips eICU, offered by Koninklijke Philips N.V., utilizes predictive algorithms to identify and prioritize patients for earlier interventions.

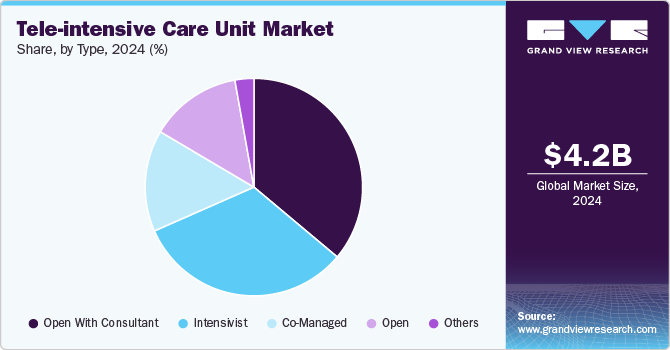

Type Insights

By type, the open with consultant segment dominated the market in 2024 with a revenue share of 36.1%. This segment provides consultation demonstrating the potential and feasibility of tele-ICU consultation and scheduled rounds. It enables bedside teams to engage with global specialists, discuss patient cases, and receive care recommendations. For instance, Inova offers enVision teleICU to support hospital teams in providing care for critically ill patients, driving the market's growth.

The intensivist segment in the market is anticipated to witness the fastest growth over the forecast period. The intensivist model employs a full-time intensive-care expert to handle the tele-ICU system. In this model, the patient’s problems are managed directly. This segment provides efficient clinical decisions to address any complications. The availability of intensivists is expected to rise over the forecast period, fueling the segment’s growth.

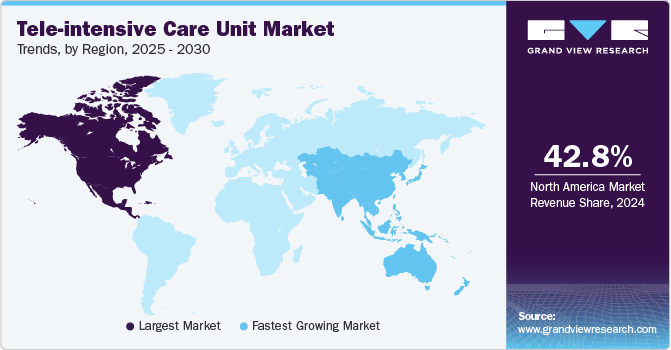

Regional Insights

The North America tele-intensive care unit market held the largest revenue share of 42.8% in 2024. Factors such as advanced IT infrastructure, high-speed internet connectivity, and robust communication networks propel regional growth. Moreover, rising new product launches and the presence of established key players operating in North America have boosted market growth. For instance, in March 2022, Hicuity Health, a provider of telemedicine services, partnered with Baptist Health, a 9-hospital system, to expand its telemedicine services. Under this strategy, Hicuity Health has introduced its tele-ICU services at the Madisonville facility, providing critical care support to Baptist Health team members and their patients.

U.S. Tele-intensive Care Unit Market Trends

The tele-intensive care unit market in U.S. held the largest market share in 2024. Increasing adoption of various strategies by key market players is anticipated to boost market growth. In June 2024, the first UAB Tele-Intensive Care Unit expanded hospital was established through a collaboration between Whitfield Regional Hospital and the University of Alabama at Birmingham. With this partnership, Whitfield now has access to continuous Tele-ICU support, which includes a team of experienced tele-intensivists and ICU nurses stationed at UAB.

Europe Tele--intensive Care Unit Market Trends

Europe tele-intensive care unit market is anticipated to register a considerable growth rate during the forecast period. European market & governments focus on digitalization of monitoring services linked with chronic diseases and offer solutions that would ease access to health records, reduce burden on healthcare facilities & resources, and minimize repetition of unwanted prescriptions & tests.

Germany tele-intensive care unit market is anticipated to register a considerable growth rate during the forecast period. Increase in the importance of tele-intensive care unit due to the efficient utilization of resources, improvement in workflow & delivery of services, and increased patient centricity are significant contributing factors for the growing adoption of these technologies in hospitals and other healthcare systems. For instance, in December of 2021, physicians at the University Medical Center Hamburg-Eppendorf (UKE) are providing guidance to other hospitals in northern Germany on intensive care medicine through video sessions.

The UK tele-intensive care unit market is expected to register a considerable growth rate during the forecast period. Factors such as support from the government and equal adoption of digital health technology by the National Health Service (NHS) and private physicians to improve accessibility & affordability of healthcare attributed to the high market share of the country.

Asia Pacific Tele-intensive Care Unit Market Trends

The Asia Pacifictele-intensive care unit market is anticipated to witness the fastest growth over the forecast period. Increasing acceptance of telehealth solutions in the region is driving market growth. In August 2024, Aster Digital Health, a branch of Aster DM, introduced Tele-ICU following a trial period four months earlier. This technology remotely oversees patient information, delivering specialized knowledge and continuous supervision, which enhances results and lowers mortality rates for critically ill patients, especially in medium and high-risk scenarios.

India tele-intensive care unit market is anticipated to register a considerable growth during the forecast period. Rising disposable income, rising adoption of strategic initiatives by market players, and the high burden of chronic diseases in India are expected to impact market growth positively. For instance, in July 2023, Medanta Hospital Group, a prominent healthcare provider, announced the introduction of tele-ICU services in India through the Medanta e-ICU project, in collaboration with GE HealthCare, aiming to promote specialized critical care practices.

Latin Tele-intensive Care Unit Market Trends

Latin America is witnessing steady growth in the tele-intensive care unit market, owing to the high prevalence of chronic diseases, such as cardiovascular disease, arthritis, & cancer, which necessitate ongoing medical supervision, is fueling demand for tele-ICU services in Latin America. Furthermore, the aging population, which is more vulnerable to serious medical conditions, is driving the demand for tele-ICU solutions, propelling market growth in the region.

Brazil tele-intensive care unit market is anticipated to register a considerable growth during the forecast period. Future opportunities for the Brazilian healthcare IT industry are promising since hospitals in the nation are investing heavily in information technology and conducting clinical trials for telemedicine in the ICU. For instance, in October 2024, Brazil conducted the first randomized clinical trial to investigate whether telemedicine in ICU improves clinical outcomes. Such factors are aniticipated to fuel market growth over the forecast period.

Middle East & Africa Tele-intensive Care Unit Market Trends

The MEA region are experiencing lucrative growth in the tele-intensive care unit market, owing to the changing reforms and government initiatives supporting the adoption of healthcare IT systems are expected to drive the market. With an increase in the population's health requirements, the tele-ICU sector is anticipated to gain more importance in the region. In addition, to alleviate pressure on current healthcare facilities, such as hospitals and special care units, the government supports the growth of tele-ICU and telemedicine services.

Saudi Arabia tele-intensive care unit market is anticipated to register a considerable growth rate during the forecast period. Several hospitals in the country have launched their tele-ICU services to cater to the growing demand for tele-ICU consultation. For instance, in September 2023, Ras Tanura General Hospital, located in eastern Saudi Arabia, introduced a Tele-ICU service to enhance the healthcare quality and maximize the use of available resources, eliminating the need to refer patients to central hospitals.

Key Tele-intensive Care Unit Company Insights

Key participants in the market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Tele-intensive Care Unit Companies:

The following are the leading companies in the tele-intensive care unit market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Inova

- Banner Health

- iMDsoft

- UPMC (University of Pittsburgh Schools of the Health Sciences)

- RemoteICU

- Hicuity Health

- VeeOne Health

- GE HealthCare

- EQUUM Medical

Recent Developments

-

In October 2024, iMDsoft collaborated with Viridian Polska Sp. z o.o to market and sell licenses for MetaVision and offer implementation and support services to MetaVision users across Poland.

-

In September 2024, Equum Medical introduced its Collaborative Shared Services Program for Critical Access Hospitals. This initiative addresses the demand for improved healthcare access in rural communities, providing a platform for rural hospitals to connect and tackle healthcare challenges in these areas.

-

In July 2023, Medanta Group of hospitals, a healthcare service provider, in collaboration with GE HealthCare, introduced Tele-ICU services in India to expand access to super-specialty critical care medicine.

Tele-Intensive Care Unit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.86 billion

Revenue forecast in 2030

USD 9.80 billion

Growth rate

CAGR of 15.08% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France, Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Inova; Banner Health; iMDsoft; UPMC (University of Pittsburgh Schools of the Health Sciences); RemoteICU; Hicuity Health; VeeOne Health; GE HealthCare; EQUUM Medical

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail cust/omized purchase options to meet your exact research needs. Explore purchase options. Global Tele-intensive Care Unit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global tele-intensive care unit market report on the basis of component, type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Computer System

-

Communication Lines

-

Physiological Monitors

-

Therapeutic Devices

-

Video Feed

-

Display Panels

-

-

Software

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open With Consultant

-

Intensivist

-

Co-managed

-

Open

-

Others

-

-

Regional Outlook Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tele-intensive care unit market size was valued at USD 4.24 billion in 2024 and is expected to reach USD 4.86 billion in 2025.

b. The global tele-intensive care unit market is expected to grow at a compound annual growth rate of 15.08% from 2025 to 2030 to reach USD 9.80 billion by 2030.

b. The hardware segment dominated the tele-ICU market with a share of 65.9% in 2024. This is attributable to rising technological advances, and increasing adoption of digital health and telehealth.

b. Key players operating in the tele-ICU market include Koninklijke Philips N.V., Inova, Banner Health, iMDsoft, UPMC (University of Pittsburgh Schools of the Health Sciences), RemoteICU, Hicuity Health, VeeOne Health, GE HealthCare, EQUUM Medical.

b. Key factors that are driving the market growth include continuous rise in the demand for remote monitoring and growing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.