- Home

- »

- Next Generation Technologies

- »

-

Telecom Managed Services Market Size, Share Report, 2030GVR Report cover

![Telecom Managed Services Market Size, Share & Trends Report]()

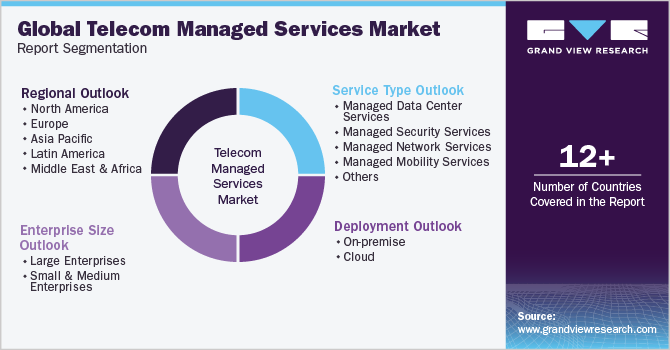

Telecom Managed Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By Enterprise Size (Large, SMEs), By Service Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-120-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom Managed Services Market Summary

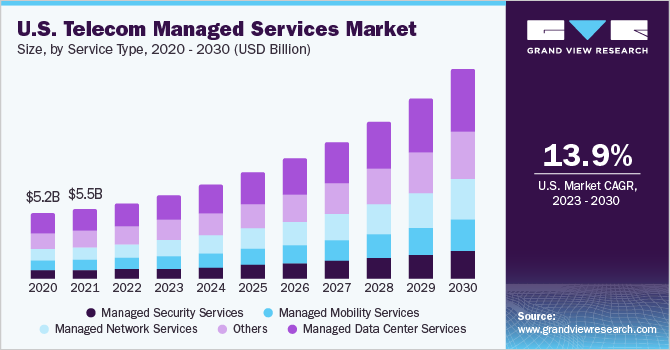

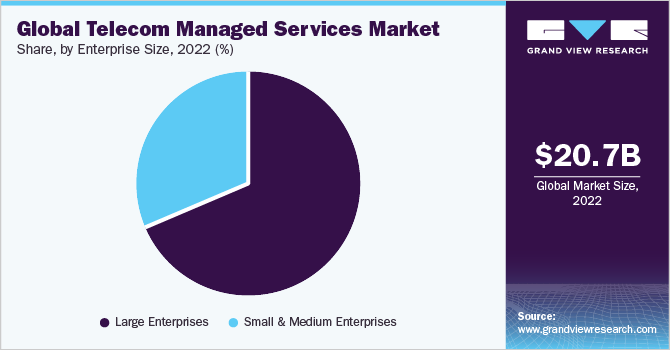

The global telecom managed services market size was estimated at USD 20.67 billion in 2022 and is projected to reach USD 55.29 billion by 2030, growing at a CAGR of 13.4% from 2023 to 2030. The ability of telecom managed services to offer better efficiency, and cost-effectiveness, and cater to the evolving needs of the industry is a significant factor contributing to the growth of the market.

Key Market Trends & Insights

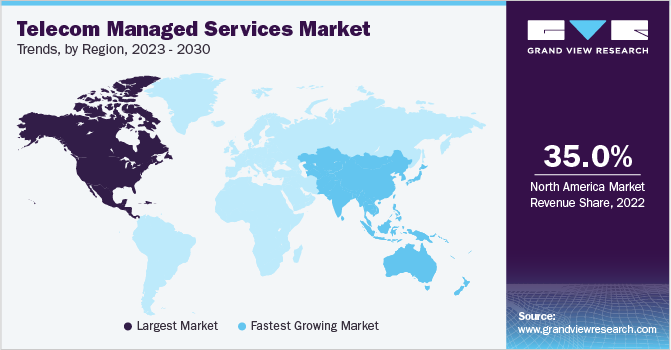

- North America dominated the market in 2022 and accounted for more than 35.0% share of the global revenue.

- Asia Pacific region is expected to grow significantly over the forecast period.

- By service type, the managed data center services segment dominated the market in 2022 and accounted for more than 30.0% share.

- By deployment, the cloud segment dominated the market in 2022 and accounted for more than 55.0% share of the global revenue.

- By enterprise size, the large enterprises segment dominated the market in 2022 and accounted for more than 68.0% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 20.67 Billion

- 2030 Projected Market Size: USD 55.29 Billion

- CAGR (2023-2030): 13.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

These services encompass a wide range of solutions, including network management, security services, cloud computing, and customer support, all aimed at ensuring seamless and uninterrupted communication for businesses and individuals. The integration of advanced technologies, such as AI-driven automation, has further accelerated this growth, enhancing service quality while reducing operational complexities.As telecom companies continue to embrace AI-based innovations discreetly, the upward trajectory of telecom managed services remains steady, promising a future of enhanced connectivity and customer satisfaction without compromising on data privacy or security.With the rise of 5G technology, managed services are also evolving to cater to the growing demand for ultra-fast and reliable connectivity. In addition, the integration of edge computing in managed services is enabling data processing at the network edge, reducing latency, and unlocking new possibilities for IoT applications. Moreover, security remains a top priority, leading to the implementation of sophisticated cybersecurity solutions in managed services offerings to safeguard against cyber threats.

A rise in the usage of cloud computing is anticipated to have a profound impact on the growth of managed telecom services. Cloud computing offers significant advantages to telecom providers, enabling them to optimize resources, scale operations efficiently, and offer a diverse range of services. Through cloud-based solutions, telecom companies can streamline their network management processes, leading to improved service delivery and reduced downtime. In addition, cloud computing facilitates the deployment of new services and applications rapidly, accelerating time-to-market and enhancing overall customer experience. As the demand for cloud-based services continues to surge, managed telecom services are poised to play a pivotal role in assisting businesses in navigating the complexities of cloud adoption, ensuring seamless integration, robust security, and reliable performance.

Cost minimization in managing enterprise infrastructure is also projected to exert a significant influence on the growth of managed telecom services. As businesses strive to optimize their operations and reduce expenses, they are increasingly turning to managed services providers to handle their complex telecom infrastructure needs. By outsourcing network management, security, and support to specialized telecom service providers, enterprises can benefit from economies of scale and access cutting-edge technologies without substantial capital investments. Managed telecom services offer flexible pricing models, enabling businesses to pay only for the specific services they require, thus minimizing unnecessary expenditures. Technological advancements are also gaining popularity in the market.

For instance, in June 2022, Enea introduced a comprehensive Wi-Fi Software-as-a-Service (SaaS) service management solution tailored for Communication Service Providers (CSPs). The Enea Aptilo Wi-Fi Service Management Platform as a Service (SMP-S) represents an upgraded iteration of the company's existing Aptilo SMP offering and aims to assist CSPs in launching and monetizing Wi-Fi solutions amid the growing challenges of network costs and complexity. Leveraging a pay-as-you-go SaaS model, Enea empowers CSPs to scale their Wi-Fi networks and services at their desired pace, allowing them to choose complementary functions as they expand. This flexible approach provides CSPs with the agility and cost control required to effectively manage their Wi-Fi offerings and meet the evolving demands of their customers.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the market growth. With a sudden surge in remote work, online learning, and virtual collaboration, there has been an unprecedented demand for robust and reliable communication networks. Telecom managed services have played a vital role in ensuring uninterrupted connectivity, assisting businesses in adapting to remote work models, and supporting the increasing data traffic. The pandemic has underscored the importance of agile managed services, prompting telecom providers to focus on enhancing network resilience, security, and customer support.

Service Type Insights

The managed data center services segment dominated the market in 2022 and accounted for more than 30.0% share of the global revenue.Increasing adoption of edge data centers, driven by the proliferation of IoT devices and the need for low-latency applications, is a major factor contributing to the growth of the segment. Edge data centers enable data processing closer to the source, reducing network congestion and improving overall performance. In addition, the growing focus on sustainability and energy efficiency in data center operations is also contributing to the growth of the segment. Telecom providers are exploring innovative technologies and green practices to minimize energy consumption and carbon footprint, aligning with global environmental goals.

The managed mobility services segment is projected to witness remarkable growth over the forecast period owing to its capability to enable employees to access enterprise data from any smart device, regardless of location. These services facilitate seamless connectivity by providing configuration, deployment, and smart device management for both in-office and remote workers. Managed mobility services encompass IT and process management services necessary for businesses to procure, deploy, and support smartphones, tablets, and other field force devices. The main goal of managed mobility services is to connect mobile out-of-office workers with databases, servers, management, and other employees securely and efficiently.

Deployment Insights

The cloud segment dominated the market in 2022 and accounted for more than 55.0% share of the global revenue.The segment growth can be attributed to the increasing demand for flexible and scalable communication solutions. As businesses across various industries transition their operations to the cloud, the need for reliable and efficient telecom services has become paramount. Managed services providers in the telecom sector are capitalizing on this trend by offering comprehensive solutions encompassing cloud-based voice, data, and messaging services. Moreover, integrating advanced technologies, such as AI-driven automation and analytics, discreetly enhances service quality and customer experience.

Cloud telecom managed services are expected to grow as businesses seek cost-effective, secure, and innovative solutions to address their communication needs in the ever-evolving digital landscape. The on-premise segment is anticipated to drive significant growth over the forecast period. While cloud-based solutions have gained popularity, on-premise managed services continue to cater to organizations that prioritize data control, compliance requirements, or unique networking setups.

These services offer businesses the ability to have their telecom infrastructure and services managed within their own premises, providing a higher level of customization and security. On-premise telecom managed service providers discreetly tailor solutions to meet the specific demands of their clients, ensuring seamless integration with existing systems and facilitating efficient communication. As companies embrace hybrid IT environments, on-premise managed services remain a viable choice in use cases, contributing to the continued growth of this segment in the telecom industry.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for more than 68.0% share of the global revenue owing to the advantages these services offer in managing complex communication infrastructures. As organizations expand in size and complexity, the need for streamlined and efficient telecom solutions becomes crucial. Managed serviceproviders cater discreetly to the specific requirements of large enterprises, offering comprehensive network management, security, and support solutions.

These services optimize communication processes and enable companies to focus on their core business activities, driving productivity and innovation. Moreover, integrating AI-driven technologies in managed services discreetly enhances service quality, automates routine tasks, and delivers real-time insights for better decision-making. As large enterprises seek to stay competitive and agile in a fast-paced digital landscape, the growth of telecom-managed services for this segment is expected to remain robust. The small & medium enterprises segment is expected to grow significantly over the forecast period.

Managed telecom services offer small & medium enterprises a cost-effective and scalable solution for managing their communication needs, allowing them to access advanced technologies and services that might otherwise be financially out of reach. These services subtly cater to the specific requirements of SMEs, providing tailored solutions for efficient network management, security, and support. At the same time, SMEs focus on their core operations, and outsourcing telecom management to experts enables them to enhance productivity and streamline operations. Furthermore, as the demand for reliable and adaptable communication solutions increases among SMEs, the growth of telecom managed services for this segment is expected to continue to thrive.

Regional Insights

North America dominated the market in 2022 and accounted for more than 35.0% share of the global revenue. As businesses in the region aim to stay competitive and agile in a rapidly evolving digital landscape, the demand for efficient and reliable communication solutions has surged. Managed service providers in North America offer comprehensive solutions, including network monitoring, security services, cloud computing, and customer support, enabling businesses to focus on their core operations while entrusting their telecom needs to experts. With a strong emphasis on data privacy and security, managed services have gained significant traction in North America, as they offer a cost-effective and scalable approach to managing complex communication infrastructures. As the region continues to embrace advanced technologies and digital transformation, the growth of telecom managed services is expected to remain robust in North America.

The Asia Pacific region is expected to grow significantly over the forecast period. The region embraces emerging technologies, such as 5G and the Internet of Things (IoT), which fuels the demand for managed services to optimize and support these advanced communication technologies. In addition, integrating AI-driven solutions enhances service performance and reduces operational complexities. With a focus on scalability and flexibility, telecom managed services have become an attractive option for businesses in Asia Pacific seeking to streamline their operations while staying competitive in the rapidly evolving digital landscape. As the region continues to witness rapid economic growth and digital transformation, the telecom managed services sector is expected to experience continued expansion in Asia Pacific.

Key Companies & Market Share Insights

The market is characterized by fragmentation with numerous prominent players driving competition through various strategies aimed at securing long-term market sustainability. As a result, new entrants may find it challenging to establish a foothold in the market. Key strategies adopted by these players include geographical expansions, continuous product innovations, and a strong emphasis on customer-centric approaches. These tactics collectively contribute to the competitive landscape, making it dynamic and evolving for all participants in the market. Many companies are forming partnerships and collaborations with other industry players.

By leveraging each other's capabilities and resources, these collaborations enable companies to offer comprehensive and integrated solutions to their clients. Moreover, businesses are strategically launching products and introducing innovative products tailored for managed services applications. These strategic moves are geared toward meeting the increasing demand for advanced solutions and driving growth opportunities in the evolving market landscape. For instance, in March 2023, NTT Data, a telecom company, launched Sentient Platform for Network Transformation (SPEKTRA), as the next-generation platform for NTT Managed Network solutions.

With SPEKTRA, customers gain access to a direct pathway for network transformation, tapping into NTT's extensive managed services experience, expertise, and technical resources. A recent survey by NTT highlighted the significance of the network as the foundation of digital transformation, with 93% of organizations acknowledging its critical role. The launch of SPEKTRA reinforces NTT's commitment to providing cutting-edge solutions that empower businesses to achieve their digital transformation objectives. Some of the prominent players in the global telecom managed services market include:

-

Cisco Systems, Inc.

-

Huawei Technologies Co., Ltd.

-

Telefonaktiebolaget LM Ericsson

-

Acuity Technologies

-

Verizon Communications Inc.

-

AT&T Inc

-

NTT DATA

-

Comarch SA

-

Nokia

-

Fujitsu Ltd.

Telecom Managed Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.86 billion

Revenue forecast in 2030

USD 55.29 billion

Growth rate

CAGR of 13.4% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment, enterprise size, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Telefonaktiebolaget LM Ericsson; Acuity Technologies; Verizon Communications Inc.; AT&T Inc.; NTT DATA; Comarch SA; Nokia; Fujitsu Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom Managed Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global telecom managed services market report based on service type, deployment, enterprise size, and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Managed Data Center Services

-

Managed Security Services

-

Managed Network Services

-

Managed Mobility Services

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global telecom managed services market size was estimated at USD 20.67 billion in 2022 and is expected to reach USD 22.86 billion by 2023.

b. The global telecom managed services market is expected to grow at a compound annual growth rate of 13.4% from 2023 to 2030 to reach USD 55.29 billion by 2030.

b. The managed data center services segment dominated the telecom managed services market with a share of more than 30.0% in 2022. This is attributed to the increasing adoption of edge data centers, driven by the proliferation of IoT devices and the need for low-latency applications, which is a major factor contributing to the growth of the segment

b. Some of the key players in the telecom managed services market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Acuity Technologies., Verizon Communications Inc., AT&T Inc., NTT DATA, Comarch SA., Nokia and Fujitsu Limited.

b. The rapid deployment and adoption of 5G networks fuel the demand for telecom managed services. 5G technology requires specialized expertise to optimize network performance, handle increased data traffic, and support new use cases like IoT and augmented reality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.