- Home

- »

- Next Generation Technologies

- »

-

Term Insurance Market Size, Share & Growth Report, 2030GVR Report cover

![Term Insurance Market Size, Share, & Trends Report]()

Term Insurance Market (2024 - 2030) Size, Share, & Trends Analysis Report By Type (Individual Level Term Life Insurance, Group Level Term Life Insurance), By Distribution Channel (Tied Agents & Branches, Brokers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-935-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Term Insurance Market Summary

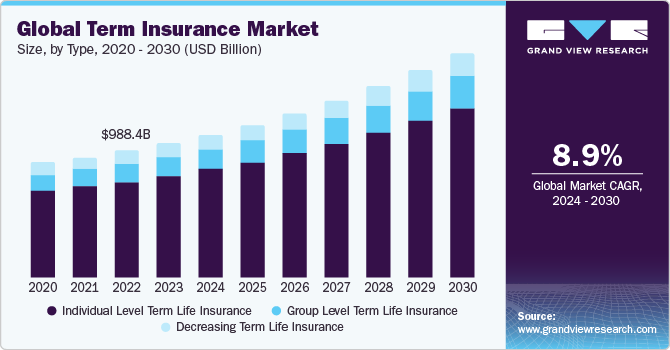

The global term insurance market size was estimated at USD 1,058.08 billion in 2023 and is projected to reach USD 1,897.40 billion by 2030, growing at a CAGR of 8.9% from 2024 to 2030. Term insurance is a type of life insurance policy that provides coverage for a specified period or term. Cost-effectiveness, increased awareness, customization, and flexibility are some of the key factors that are driving the adoption of term insurance.

Key Market Trends & Insights

- The Asia Pacific term insurance marketdominated globally in 2023 with a revenue share of 30.5%.

- The U.S. term insurance marketis expected to grow at a significant CAGR from 2024 to 2030.

- By type, individual-level term life insurance led the market with a global revenue share of 75.9% in 2023.

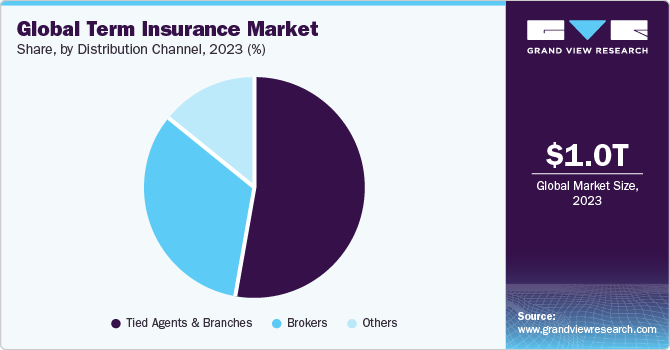

- By distribution channel, the tied agents & branches segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,058.08 Billion

- 2030 Projected Market Size: USD 1,897.40 Billion

- CAGR (2024-2030): 8.9%

- Asia Pacific: Largest market in 2023

In addition, changing demographics, emphasis on financial security, and evolving insurance market trends are further contributing to the market's growth.

Term life insurance offers coverage for a specified duration, in contrast to whole life insurance, which necessitates ongoing payments throughout the consumer's life. Common term life insurance duration includes 10, 20, or 30 years. The increasing number of term life insurance holders across the globe is boosting the segment's growth. Term life insurance is more popular compared to permanent policies. According to the American Council of Life Insurance’s (ACLI) 2023 Life Insurance Fact Book, 39.3% of new policies sold in 2022 were term insurance policies. The growing adoption of term life insurance policies is propelling the market’s growth.

The influence of digital transformation is significantly contributing to the market growth. Digital transformation is enhancing operational efficiency and elevating customer transformation, which is benefitting both insurers and policyholders. A recent survey conducted in February 2023 revealed that 60% of consumers see web-based communication as their primary means of engaging with insurance companies in the future. This growing consumer preference for digital interactions, coupled with the enthusiastic adoption of digital transformation technologies by term insurers, is expected to be a significant driving force for the growth of the market.

InsurTech is proving to be a compelling opportunity within the term insurance industry. By harnessing the latest technological advancements, such as the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics, InsurTech streamlines operations, reduces costs, and enables more competitive pricing of term insurance products. Moreover, InsurTech's impact extends to claims processing, risk assessment, contract drafting, and policy underwriting, making these processes significantly more effective. In an evolving insurance landscape, the rise of InsurTech companies is fundamentally reshaping the way term insurers operate and serve their customers.

The term insurance industry encounters its own set of challenges, with regulatory pressures being a significant concern. Regulators globally are pushing for standardized frameworks, requiring term insurance providers to adapt to risk-based organizational structures and demanding substantial resources and adjustments. Moreover, the focus on consumer-centric governance, aimed at protecting policyholders, introduces additional complexities. In addition, cybersecurity threats pose a large risk due to the sensitive and personal data handled by the term insurance companies. Navigating these evolving regulations and data security concerns is imperative for the market's long-term growth.

Market Concentration & Characteristics

The term insurance industry’s growth stage is high with an accelerating pace, driven by transformative innovations. Emerging trends such as customized term plans, accelerated underwriting, and digital platforms are reshaping the landscape. These innovations offer policyholders enhanced convenience, security, and accessibility, revolutionizing the traditional term insurance industry.

Merger and acquisition (M&A) activities play a pivotal role in shaping the term insurance industry. Leading players are strategically leveraging M&A to broaden their product portfolios, harness technological strengths, and fortify their positions in this dynamic industry. This approach is essential for achieving a balance between sustained growth and effective industry integration.

Regulatory dynamics significantly influence the term insurance industry, impacting security standards, underwriting practices, and operational protocol. Stringent regulations play a crucial role in defining product features, determining pricing structures, and ensuring fair practices within the term insurance industry. The evolving regulatory landscape necessitates adaptive strategies to align with compliance requirements, fostering industry resilience and maintaining consumer trust amid a dynamic regulatory environment.

Various substitutes exist for term insurance, including traditional life insurance policies, endowment plans, and investment-linked products. While these alternatives provide diverse options, they may not entirely replicate the unique value proposition offered by term insurance in terms of pure risk coverage and cost-effectiveness.

The term insurance industry exhibits concentrated end-user preference in both personal and commercial sectors. Noteworthy adoption surges are observed in vital industries like finance, healthcare, technology, and retail. Individuals and enterprises are increasingly opting for term insurance to ensure robust financial protection. This trend underscores the industry's adaptability to diverse user needs, shaping a dynamic and responsive industry landscape.

Type Insights

Individual-level term life insurance led the market with a global revenue share of 75.9% in 2023. Individual-level term insurance is a personalized life insurance product that offers coverage for a specified term, often ranging from 10 to 30 years. What sets it apart is that the premiums are determined based on the individual's health, age, and lifestyle factors. This unique approach tailors the policy to the insured person's specific circumstances, ensuring that they receive the most cost-effective coverage. The increasing demand for individualized financial protection, combined with the ease of customization, has fueled the segment's growth.

The group-level term insurance segment is expected to register the fastest CAGR over the forecast period. Group-level term insurance is a specialized form of life insurance designed for members of a particular group, such as employees within a company. It offers a collective coverage arrangement where the premiums and benefits are determined based on the characteristics and needs of the entire group. This results in more affordable rates for individual members due to the group's size and shared risk. The growth in this segment is primarily driven by the cost-efficiency it offers, making it an attractive employee benefit for businesses and organizations. Moreover, the ease of enrollment is further enhancing the segment's adoption.

Distribution Channel Insights

The tied agents & branches segment accounted for the largest market revenue share in 2023. Tied agents are playing a pivotal role as distribution channels in the market. These agents, exclusively affiliated with a single insurance company, are gaining prominence due to their in-depth product knowledge, personalized customer service, and strong brand association. Their deep client relationships, honed over time, foster trust and client loyalty. Tied agents are instrumental in simplifying complex insurance options, making term insurance more accessible and comprehensible, thereby driving the growth of this segment.

The brokers segment is anticipated to register the fastest CAGR over the forecast period. Brokers serve as a significant distribution channel in the market. They offer unbiased advice and access to a wide range of insurance products from multiple providers. Their role in comparing options and finding tailored coverage solutions has gained popularity, especially as consumers seek greater customization and competitive pricing. This transparency and choice, coupled with the increasing consumer demand for comprehensive coverage, are driving the growth of brokers as a prominent and trusted distribution channel in the market.

Regional Insights

The term insurance market in North America is expected to grow at a significant CAGR of 7.9% from 2024 to 2030. Benefits such as life cover, regular investment, financial protection, financial security, and tax benefits, among others, are driving the adoption of term insurance among consumers in North America, thus driving the market’s growth.

U.S. Term Insurance Market Trends

The U.S. term insurance marketis expected to grow at a significant CAGR from 2024 to 2030. The presence of prominent market players such as MetLife Services and Solutions, LLC., Prudential Financial, Inc., Massachusetts Mutual Life Insurance Company, and American International Group, Inc. in the U.S. is contributing significantly to the term insurance market’s growth in the U.S. These players are harnessing the market’s growth by launching innovative term insurance solutions.

The term insurance market in Canada is expected to grow at a significant CAGR from 2024 to 2030. In April 2021, the Canada Life Assurance Company launched Canada Life My Term life insurance, a customizable term insurance product that allows customers to pick the exact term length they want, ranging from 5 to 50 years. Such initiatives are harnessing innovation and customization in the Canadian term insurance market.

Asia Pacific Term Insurance Market Trends

The Asia Pacific term insurance marketdominated globally in 2023 with a revenue share of 30.5%. The Asia Pacific region is witnessing significant growth in the market due to its large and diverse population, especially in emerging economies such as India and China. With aging demographics, awareness of the importance of life insurance is on the rise. Moreover, the presence of numerous life insurance companies in the region, coupled with government support and the embrace of digital technologies, is creating substantial opportunities for new product development and overall industry advancement.

The term insurance market in China is expected to grow at a significant CAGR from 2024 to 2030. Rapid economic growth, a supportive regulatory environment, the growing adoption of digital technologies, the rise of insurance companies, and favorable government initiatives promoting insurance coverage are some of the major factors driving the growth of the term insurance market in China.

The Japan term insurance market is expected to grow at a healthy CAGR from 2024 to 2030. Japan's population is aging at one of the fastest rates globally as a result of low birth rates and one of the longest life expectancies on a global scale, and the trend is expected to continue in the coming years. Hence, the demand for insurance products in general is growing in the country, benefiting the term insurance market's growth.

The term insurance market in India is expected to grow at a healthy CAGR from 2024 to 2030. According to Insurance Regulatory and Development Authority of India (IRDAI) data, life insurance companies collected 18% more premiums in the fiscal year 2023 compared to the previous year. The growth in adoption of life insurance is significantly contributing to the term insurance market’s growth.

Europe Term Insurance Market Trends

The term insurance market in Europeis anticipated to register significant growth over the forecast period. This significant growth is due to a combination of factors, such as regulatory changes, economic uncertainties, and an aging population, which have prompted individuals to seek financial security, driving increased demand for term insurance. Technological advancements and market competition have also played a pivotal role in the sector's expansion. This growth is indicative of a region increasingly recognizing the importance of term insurance as a valuable tool for financial planning and protection.

The UK term insurance market is expected to grow at a significant CAGR from 2024 to 2030. Term insurance providers in the UK are digitizing their workflows to be in line with the rapid digital transformation. This digitization of insurance and the subsequent rise of insurtech is creating significant growth opportunities for the UK market.

The term insurance market in Germany is expected to grow at a significant CAGR from 2024 to 2030. Term insurance providers in the German market are adopting aggressive growth strategies including business expansions, new product launches, and strategic partnerships, among others, which is driving the term insurance market’s growth in Germany.

MEA Term Insurance Market Trends

The term insurance market in MEA is expected to grow at a significant CAGR from 2024 to 2030. The regional market's growth can be attributed to the growing awareness of affordability and financial coverage, among many other benefits offered by term insurance.

The UAE Term Insurance Market is expected to grow at a significant CAGR from 2024 to 2030. UAE’s growing population, increasing awareness about financial protection, and growing demand for artificial intelligence (AI) based health & wellness products are some of the key trends driving the UAE term insurance market’s growth.

Key Term Insurance Company Insights

Some of the key players operating in the market include MetLife Services and Solutions, LLC., Prudential Financial, Inc., Northwestern Mutual Life Insurance Company, State Farm Mutual Automobile Insurance Company, and American International Group, Inc.

-

MetLife Services and Solutions is renowned for its innovative and customer-centric solutions. MetLife Services and Solutions, LLC, specifically addresses the evolving needs of individuals seeking comprehensive term life insurance, ensuring financial protection with cutting-edge offerings.

-

Prudential Financial stands as a key player in the market, offering a broad spectrum of insurance solutions. Globally recognized for its diverse portfolio, Prudential Financial specializes in providing tailored term life insurance products, contributing to the financial well-being of its vast customer base.

Aegon Life Insurance Company Limited, Massachusetts Mutual Life Insurance Company, Lincoln National Corporation, John Hancock, and Bajaj Allianz Life Insurance Co. Ltd. are some of the emerging market participants in the market.

-

Aegon Life Insurance Company Limited is a prominent player in the term life insurance market, leveraging its global expertise as part of the Aegon Group. Known for its customer-centric approach, Aegon Life Insurance Company delivers innovative and customizable term insurance solutions to address the unique requirements of individuals and families.

-

Massachusetts Mutual Life Insurance Company (MassMutual) is a distinguished mutual life insurer in the market landscape. MassMutual's comprehensive suite of term life insurance products reflects its commitment to long-term financial well-being, providing stability and customer-focused solutions for individuals and families alike.

Key Term Insurance Companies:

The following are the leading companies in the term insurance market. These companies collectively hold the largest market share and dictate industry trends.

- MetLife Services and Solutions, LLC.

- Aegon Life Insurance Company Limited

- Prudential Financial, Inc.

- The Northwestern Mutual Life Insurance Company

- State Farm Mutual Automobile Insurance Company

- Massachusetts Mutual Life Insurance Company

- American International Group, Inc.

- Lincoln National Corporation

- John Hancock

- China Life Insurance (Overseas) Company Limited

- Bajaj Allianz Life Insurance Co. Ltd.

Recent Developments

- In December 2023, Max Life Insurance Company Ltd. announced the Smart Total Elite Protection Plan, a contemporary life insurance term plan designed to align with evolving consumer preferences. This non-linked, non-participating pure-risk premium plan provides instant claim payment, cover continuance benefits, and special exit value, catering to the modern consumer's demand for heightened financial security with increased coverage solutions.

-

In June 2023, Policygenius announced its partnership with Labyrinth Financial Services (LFS). This partnership enables LFS partners to utilize Policygenius Pro, the term life fulfillment platform, streamlining the term life insurance process and enhancing client application simplicity.

-

In May 2023, New York Life, the mutual life insurer in America, introduced a wide range of competitively priced term life products. These offerings deliver enhanced value for clients' protection investments while fostering readiness for financial uncertainties and opportunities. Designed for small business owners and individuals, New York Life's updated term life suite includes level term, yearly renewable term, and options to purchase additional living benefits.

Term Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,137.98 billion

Revenue forecast in 2030

USD 1,897.40 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2017 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

MetLife Services and Solutions, LLC.; Aegon Life Insurance Company Limited; Prudential Financial, Inc.; The Northwestern Mutual Life Insurance Company; State Farm Mutual Automobile Insurance Company; Massachusetts Mutual Life Insurance Company; American International Group, Inc.; Lincoln National Corporation; John Hancock; China Life Insurance (Overseas) Company Limited; Bajaj Allianz Life Insurance Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Term Insurance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global term insurance market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Individual Level Term Life Insurance

-

Group Level Term Life Insurance

-

Decreasing Term Life Insurance

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tied Agents & Branches

-

Brokers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the term insurance market with a share of 30.51% in 2023. The Asia Pacific region is witnessing significant growth in the term insurance market due to its large and diverse population, especially in emerging economies like India and China.

b. Some key players operating in the term insurance market include MetLife Services and Solutions, LLC., Aegon Life Insurance Company Limited, Prudential Financial, Inc., The Northwestern Mutual Life Insurance Company, State Farm Mutual Automobile Insurance Company, Massachusetts Mutual Life Insurance Company, American International Group, Inc., Lincoln National Corporation, John Hancock, China Life Insurance (Overseas) Company Limited, Bajaj Allianz Life Insurance Co. Ltd.

b. Key factors that are driving the term insurance market growth include increasing privatization of the sector, increasing middle-class population, and new digital sales channels.

b. The global term insurance market size was estimated at USD 1,058.08 billion in 2023 and is expected to reach USD 1,137.98 billion in 2024.

b. The global term insurance market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 1,897.40 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.