- Home

- »

- Food Additives & Nutricosmetics

- »

-

Tetrahydrogeraniol Market Size, Share, Industry Report 2033GVR Report cover

![Tetrahydrogeraniol Market Size, Share & Trends Report]()

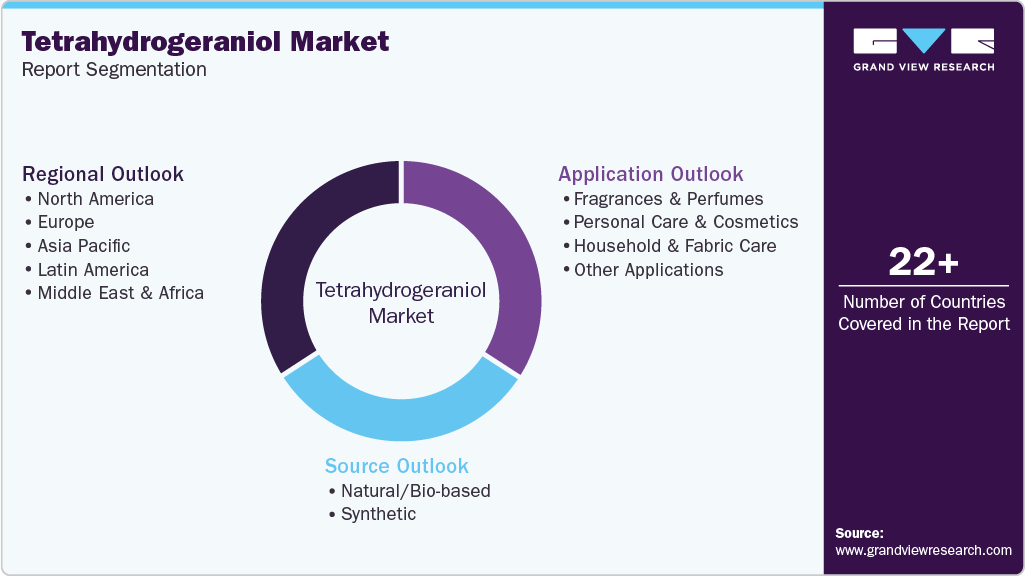

Tetrahydrogeraniol Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural/Bio-based, Synthetic), By Application (Fragrances & Perfumes, Personal Care & Cosmetics, Household & Fabric Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-816-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tetrahydrogeraniol Market Summary

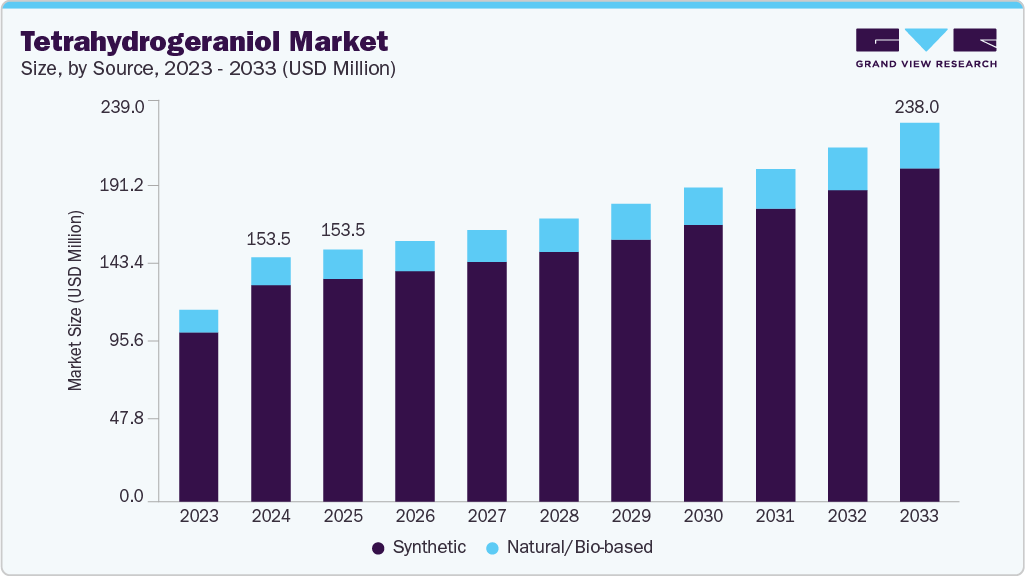

The global tetrahydrogeraniol market size was estimated at USD 153.5 million in 2024 and is projected to reach at USD 238.0 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market is primarily driven by the growing demand for high-stability, long-lasting fragrance ingredients across fine fragrances, personal care, and household & fabric care applications.

Key Market Trends & Insights

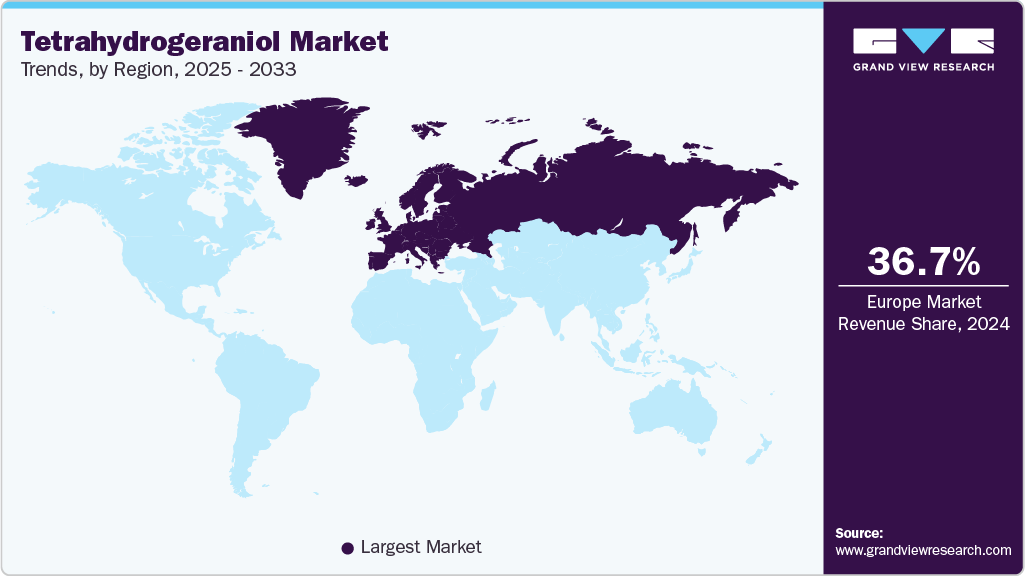

- Europe dominated the tetrahydrogeraniol market with the largest revenue share of 36.7% in 2024.

- Germany remains one of Europe’s key demand hubs due to its robust chemical manufacturing base, strong presence of global FMCG companies, and advanced fragrance formulation ecosystem.

- By source, natural/bio-based segment is expected to grow at the fastest CAGR of 5.7% from 2025 to 2033 in terms of revenue.

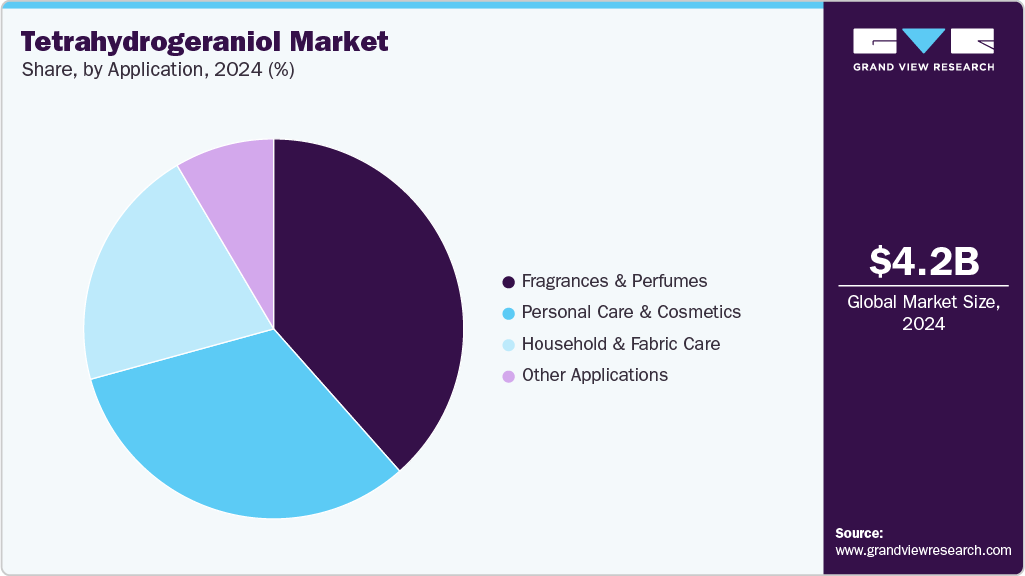

- By application, fragrances & perfumes segment held the largest revenue share of 38.5% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 153.5 million

- 2033 Projected Market Size: USD 238.0 million

- CAGR (2025-2033): 5.2%

- Europe: Largest market in 2024

Manufacturers increasingly prefer tetrahydrogeraniol over traditional rose alcohols such as geraniol due to its superior oxidative stability, compatibility with surfactant-rich formulations, and ability to maintain olfactory performance under harsh processing conditions. Additional momentum comes from rising consumption of premium personal care products in Asia Pacific and sustained innovation in functional fragrances for detergents and homecare categories.Significant opportunities exist in the development of bio-based or renewable-carbon grades, aligned with growing clean-label and sustainability requirements from global fragrance houses and consumer brands. Suppliers can also unlock value by offering high-purity, customizable aroma profiles, enabling tailored solutions for niche perfumery, fabric conditioners, and high-performance personal care formulations. Rapid growth in emerging markets, especially India, Southeast Asia, and Latin America, creates further prospects for market penetration due to expanding middle-class consumption and growing investments in local manufacturing of home & personal care products. Strategic partnerships with fragrance houses and contract manufacturers can also accelerate adoption and strengthen long-term offtake agreements.

Despite robust demand, the market faces challenges related to feedstock price volatility, as tetrahydrogeraniol production depends on geraniol and other terpene derivatives that are sensitive to agricultural output and global supply chain disruptions. Regulatory scrutiny on fragrance ingredients, including IFRA updates and region-specific restrictions on allergen declarations, can create compliance burdens and increase product reformulation costs. In addition, rising competition from low-cost regional manufacturers in China and India intensifies pricing pressure for global players, making differentiation through quality assurance, purity consistency, and sustainability certifications increasingly critical for maintaining market share.

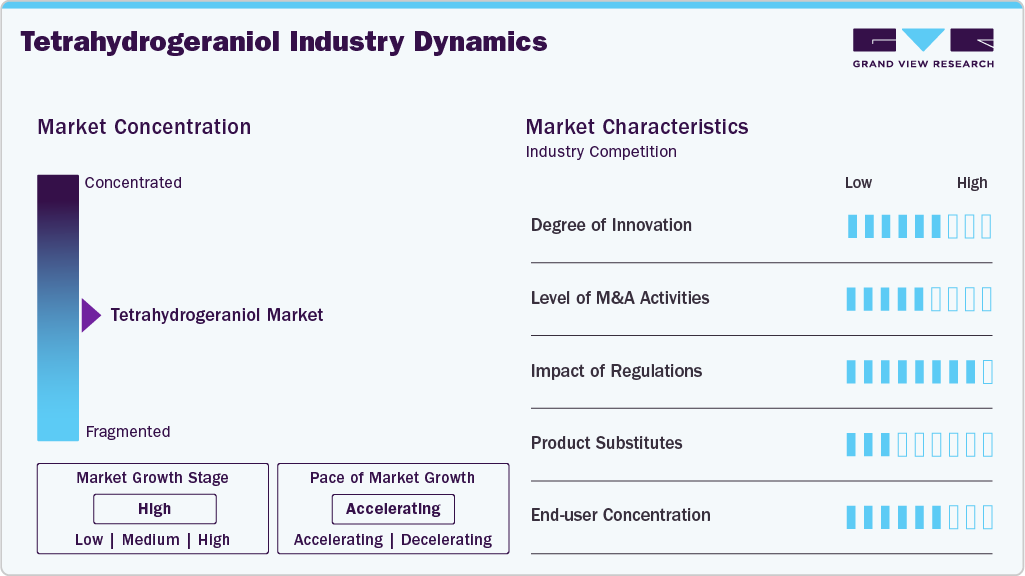

Market Concentration & Characteristics

The market features a competitive landscape dominated by a mix of large integrated aroma-chemical producers and agile regional manufacturers. Leading players such as BASF and DSM-Firmenich compete on high product consistency, technical support, and sustainability-aligned offerings, making them preferred suppliers for multinational fragrance houses and major home & personal care brands. In parallel, mid-sized companies such as DRT and Privi, along with Chinese producers such as NHU, strengthen market fragmentation by offering competitive pricing, flexible packaging, and faster regional lead times, positioning themselves strongly in the value-driven and volume-centric segments.

Competition is further intensified by the role of global distributors, including Vigon and others, who provide regulatory documentation, small-pack formats, and rapid delivery to R&D and contract manufacturing customers. As a result, differentiation in this market hinges on three pillars: reliability of supply, sustainability and purity certifications, and commercial flexibility. Companies that combine high-quality production with responsive customer service and cost-efficient sourcing are best positioned to capture share across both premium fragrance applications and high-volume household care formulations.

Source Insights

The synthetic segment dominated the tetrahydrogeraniol market with an 88.5% revenue share in 2024 primarily due to its consistent quality, cost-efficient production, and reliable large-scale availability. Synthetic tetrahydrogeraniol is produced through controlled hydrogenation processes that ensure high purity, stable olfactory performance, and uniform batch-to-batch characteristics-critical factors for fragrance houses and large FMCG manufacturers. Its strong oxidative stability and compatibility with detergents, shampoos, and fabric care formulations make synthetic grades the preferred choice for high-volume applications, while the robust manufacturing capabilities of global aroma-chemical producers further reinforce its widespread industrial adoption. As a result, the synthetic segment remains the backbone of supply for fine fragrances, personal care, and household care segments.

In contrast, the natural/bio-based segment, while growing, represents a smaller share of the market due to higher production costs, limited feedstock availability, and complexities associated with certifying renewable carbon content. However, this segment is gaining traction as consumer brands increasingly pursue sustainability commitments and demand fragrance ingredients derived from renewable or low-carbon sources. Opportunities exist for suppliers to differentiate through bio-based claims, clean-label positioning, and alignment with corporate ESG strategies, particularly in premium personal care, niche perfumery, and markets with strong regulatory or consumer pressure for natural-origin fragrances. Although currently a niche category, the natural/bio-based segment is expected to grow steadily as technology improves, and brand portfolios shift toward environmentally aligned formulations.

Application Insights

The fragrances & perfumes segment captured the largest revenue share of 38.5% in 2024 due to the strong demand for high-performance, stable aroma ingredients that enhance both olfactory richness and longevity in fine fragrance formulations. Tetrahydrogeraniol’s ability to deliver a clean, rosy-citrus profile with superior oxidative stability makes it a preferred choice for perfumers seeking to reinforce floral accords and improve fragrance lift without compromising stability. Premium fragrance brands, niche perfumers, and luxury personal care manufacturers continue to prioritize molecules that provide consistent performance across varying climates and storage conditions, further strengthening the segment’s revenue contribution. The rising global demand for prestige and artisanal perfumes, particularly across North America, Europe, and emerging Asian markets, also supports the segment’s leadership position.

Beyond fine fragrances, tetrahydrogeraniol is widely utilized in personal care & cosmetics, household & fabric care, and other specialty applications, driven by its strong stability in surfactant-heavy and high-temperature formulations. In personal care, it is used in shampoos, body washes, soaps, and deodorants to impart long-lasting floral notes. Household and fabric care manufacturers leverage their resistance to oxidation and heat, making it effective in detergents, fabric softeners, and cleaners. The “other applications” category includes industrial fragrances and specialized functional blends. While these segments collectively contribute substantial volume, their revenue share is lower than fine fragrances due to pricing differences and lower per-unit value. Nevertheless, growing consumption of premium homecare products and expanding personal care penetration in emerging markets continue to create solid growth opportunities across these applications.

Regional Insights

Europe dominated the market with a 36.7% share in 2024, supported by the region’s strong concentration of premium fragrance houses, established cosmetics brands, and leading household care manufacturers. The region benefits from mature R&D capabilities, stringent quality standards, and high adoption of stable, performance-driven aroma chemicals in fine fragrances and luxury personal care products. In addition, Europe’s sustained consumer preference for premium and niche perfumes, coupled with increasing investments in clean-label and sustainability-certified ingredients, continues to drive strong demand for high-quality tetrahydrogeraniol grades.

Germany remains one of Europe’s key demand hubs due to its robust chemical manufacturing base, strong presence of global FMCG companies, and advanced fragrance formulation ecosystem. The country’s well-developed industrial infrastructure and focus on high-purity, technically validated aroma molecules make it a significant consumer of tetrahydrogeraniol for both premium perfumery and functional homecare formulations. Germany’s high regulatory compliance standards and preference for consistent, sustainable ingredient sourcing further reinforce its importance within the European market.

Asia Pacific Tetrahydrogeraniol Market Trends

Asia Pacific accounted for 30.5% of the global market in 2024, driven by expanding personal care consumption, rapid urbanization, and strong growth in middle-income populations across China, India, and Southeast Asia. The region’s manufacturing-led ecosystem, combined with rising investments by global and local fragrance houses, has accelerated adoption of cost-efficient yet high-stability aroma chemicals such as tetrahydrogeraniol. Increasing demand for premium skincare, fine fragrances, and high-performance homecare products further strengthens Asia Pacific’s position as a high-growth region.

China held a commanding 52.7% share of the Asia Pacific tetrahydrogeraniol market in 2024, supported by its extensive aroma-chemical production capacity, competitive pricing advantages, and strong domestic demand from personal care and homecare manufacturers. The country’s role as a major global manufacturing hub enables large-scale production and exports of tetrahydrogeraniol, strengthening supply availability for both domestic and international markets. Rising disposable incomes, the proliferation of local beauty brands, and increasing investments in premium fragrance portfolios continue to fuel China’s leadership position.

North America Tetrahydrogeraniol Market Trends

North America captured 24.7% of the global market in 2024, underpinned by its strong presence of multinational CPG companies, mature specialty chemical producers, and high consumer demand for premium home and personal care products. The region shows a high preference for stable, high-performance fragrance ingredients, particularly in detergents, shower products, and fine fragrances. Growing interest in sustainable and clean-label formulations, especially in the U.S., further supports adoption of high-purity tetrahydrogeraniol grades across both mass and prestige product categories.

U.S. Tetrahydrogeraniol Market Trends

The US dominated the North American market with an 80.7% share in 2024, driven by a highly developed beauty and personal care industry, strong uptake of premium fragrance products, and significant demand for stable aroma ingredients in detergents and household care formulations. The country’s advanced R&D capabilities, coupled with investments by global fragrance companies and indie perfume brands, sustain high-volume consumption of tetrahydrogeraniol. Regulatory emphasis on quality, safety, and sustainability further boosts demand for consistently manufactured compliant aroma-chemical inputs.

Middle East & Africa Tetrahydrogeraniol Market Trends

The Middle East & Africa market is expanding steadily, supported by growing consumption of premium and luxury fragrances, particularly in GCC countries where perfume usage per capita is among the highest globally. Rising investments in beauty, personal care, and home fragrance categories, along with the region’s preference for long-lasting, floral-oriented fragrance profiles, generate sustained demand for high-stability aroma ingredients such as tetrahydrogeraniol. While overall market size is smaller compared to other regions, increasing retail penetration and emerging local brand activity are creating new opportunities for suppliers.

Latin America Tetrahydrogeraniol Market Trends

Latin America shows consistent demand growth for tetrahydrogeraniol, driven by the strong presence of regional personal care and homecare manufacturers in Brazil, Mexico, and Colombia. The region’s rising middle-class consumption, growing fragrance culture, and preference for affordable yet high-performing household products support greater adoption of stable aroma chemicals. Market growth is further supported by expanding local manufacturing capacity and increasing investments in mass-market beauty and hygiene products, positioning Latin America as an emerging opportunity for cost-effective supply and distribution strategies.

Key Tetrahydrogeraniol Company Insights

Key players, such as Givaudan, Symrise, dsm-firmenich, BASF SE, Privi Specialty Chemicals Limited., and The Good Scents Company are dominating the market.

BASF SE

- BASF SE is one of the key players in the aroma chemicals and personal care ingredients space, leveraging its extensive chemical manufacturing capabilities, backward integration, and strong R&D infrastructure to deliver high-quality, consistent, and scalable ingredients such as tetrahydrogeraniol. The company focuses on high-purity production, robust regulatory compliance, and sustainability-driven innovations, offering bio-based and mass-balance certified solutions under its broader Aroma Ingredients and Care Chemicals portfolio. BASF’s global manufacturing footprint, advanced quality systems, and long-standing relationships with major fragrance houses and multinational FMCG companies position it as a preferred supplier for stable, high-performance fragrance molecules used across fine fragrances, personal care, and household care formulations. Its continued investments in green chemistry and renewable feedstocks further strengthen its competitive differentiation in a market increasingly shifting toward environmentally aligned ingredient sourcing.

Key Tetrahydrogeraniol Companies:

The following are the leading companies in the tetrahydrogeraniol market. These companies collectively hold the largest Market share and dictate industry trends.

- Givaudan

- Symrise

- dsm-firmenich

- BASF SE

- DRT

- Privi Specialty Chemicals Limited

- Vigon International

- The Good Scents Company

- NHU Zhejiang

- MANE SA

Global Tetrahydrogeraniol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 158.1 million

Revenue forecast in 2033

USD 238.0 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Givaudan; Symrise; dsm-firmenich; BASF SE; Privi Speciality Chemicals Limited; Vigon International; DRT; NHU Zhejiang; MANE SA, The Good Scents Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tetrahydrogeraniol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global tetrahydrogeraniol market report based on source, application, and region.

-

Source Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Natural/Bio-based

-

Synthetic

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Fragrances & Perfumes

-

Personal Care & Cosmetics

-

Household & Fabric Care

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global tetrahydrogeraniol market size was estimated at USD 153.5 million in 2024 and is expected to reach USD 158.1 million in 2025.

b. The global tetrahydrogeraniol market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 238.0 million by 2033.

b. The fragrances & perfumes segment dominated the tetrahydrogeraniol market with a 38.5% revenue share in 2024, primarily due to tetrahydrogeraniol’s superior scent stability, longevity, and clean floral aroma make it a preferred ingredient in high-end fragrance formulations, driving its dominant use in the fragrances & perfumes segment.

b. Some of the key players operating in the tetrahydrogeraniol market include Givaudan; Symrise; dsm-firmenich; BASF SE; Privi Speciality Chemicals Limited; Vigon International; DRT; NHU Zhejiang MANE SA, and The Good Scents Company

b. Key factors driving the tetrahydrogeraniol market include the rising demand for premium and long-lasting fragrances across personal care and household products, increasing consumer preference for natural and bio-based aroma ingredients, and growing innovation in sustainable chemical synthesis supported by strong R&D and regulatory emphasis on eco-friendly formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.