- Home

- »

- Semiconductors

- »

-

Electronic Contract Manufacturing And Design Services Market Report, 2030GVR Report cover

![Electronic Contract Manufacturing And Design Services Market Size, Share & Trends Report]()

Electronic Contract Manufacturing And Design Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Electronic Design Engineering, Electronic Assembly), By End-Use (Healthcare, Consumer Electronics), By Region, And Segment Forecast

- Report ID: GVR-1-68038-840-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Contract Manufacturing And Design Services Market Summary

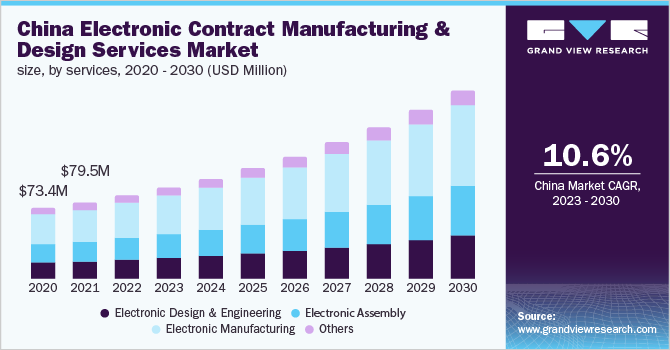

The global electronic contract manufacturing and design services market size was valued at USD 515.1 billion in 2022 and is expected to expand at a CAGR of 9.7% from 2023 to 2030. The functional testing offered by contract manufacturers is subsequently expected to drive growth.

Key Market Trends & Insights

- Asia Pacific held the largest revenue share in 2022.

- By service, the electronic manufacturing emerged as a key service category in 2022 and accounted for 44%.

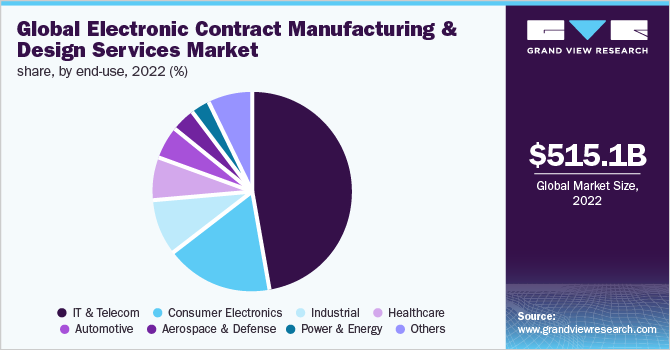

- By end use, IT & telecom segment accounted for over 47% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 515.1 Billion

- 2030 Projected Market Size: USD 1,062.7 Billion

- CAGR (2023-2030): 16.80%

- Asia Pacific: Largest market in 2022

Electronic contract manufacturing is a form of outsourcing services such as manufacturing and engineering that offers a wide range of core manufacturing capabilities. Moreover, outsourcing ancillary activities helps OEMs focus on their core competencies, reducing production costs, capital investment, and improving operational efficiencies.

In the initial phase of the pandemic, electronic manufacturing factories were significantly affected due to travel restrictions and lockdowns imposed by numerous governments worldwide. Since the risk of contagion was high, workers were reluctant to come to work which led to delays in production. For Instance, operations of U.S.-based Benchmark Electronics, Inc. were negatively affected worldwide as its facilities were shut down in 2020, resulting in a loss of productivity. The supply chain environment and delays in shipments also hampered the company’s growth during the period.

The electronic contract manufacturing and design services model is navigated by a contract manufacturer’s ability to specialize in economies of scale in terms of services, raw materials procurement, industrial design expertise, and pooling resources along with offering value-added services such as warranties and repairs. These requirements necessitate OEMs to undertake tedious or complex large-scale industrial operations.

Moreover, OEMs usually outsource their niche requirement such as circuit assembly requirements. This seeks to reduce time-to-volume and time-to-market production through design and engineering services. Furthermore, it is often undertaken with the utilization of advanced technology solutions, and manufacturing services. On account of these factors, the electronic contract manufacturing services industry is expected to gain traction during the forecast period.

The proliferation of electronic gadgets, such as tablets and smartphones, has been the key propeller of the market over the last few years. The medical industry is anticipated to witness significant growth owing to the increasing demand for medical devices. Strict regulatory compliance and advanced technology solutions are required for the manufacturing of medical devices. Thus, outsourcing such activities enables OEMs to accelerate their R&D activities and reduce the cost of devices to gain a competitive advantage, which is expected to spur market growth.

Service Insights

Electronic manufacturing emerged as a key service category in 2022 and accounted for 44% of the total revenue share. However, the electronic design & engineering segment is projected to witness higher growth during the forecast period, owing to the surging inclination of OEMs toward outsourcing their designing requirements. The market is witnessing an upsurge in demand for electronic circuit boards due to their growing importance in several key electronic devices, such as mobile phones and tablets.

Furthermore, OEMs can design and test prototypes for new product development. Additionally, the services provided by contractors enable relatively low capital investment and advanced manufacturing techniques for OEMs for new product development. OEMs are increasingly outsourcing their circuit assembly requirements to electronic contract manufacturing and design services service providers, substantially increasing their profit margins. These factors are likely to drive significant growth during the forecast period.

Furthermore, OEMs are aiming to outsource their design and engineering to cut down costs and increase flexibility. They are increasingly investing in R&D activities and other strategic initiatives to streamline their production processes to sustain themselves in the highly competitive environment.

However, the implementation of advanced technologies such as 3D printing and Artificial Intelligence (AI) for automation by electronic contract manufacturers and design service providers results in high initial investment for OEMs. Also, the foundation of in-house production is a key hurdle faced by a majority of manufacturers. Thus, outsourcing is a preferable option for OEMs to keep pace with the growing competitive environment.

End-use Insights

The demand for electronic contract manufacturing services is anticipated to grow owing to rising applications across non-technical end-user segments, such as healthcare, automotive, industrial, and aerospace & defense. The low penetration of electronic contract manufacturing and design services in these segments is creating higher opportunities for contract manufacturers to establish a strong foothold in the segments.

The IT & telecom segment emerged as the largest end-use segment and accounted for over 47% of the total market revenue in 2022. However, growing outsourcing trends in the healthcare, automotive, and other non-technical segments are projected to spur their market shares during the forecast period.

The healthcare segment held the highest CAGR of the overall market in 2022. Healthcare facilities have different types of information systems, including practice management support systems, e-prescription systems, EHR systems, radiology information systems, and clinical decision support systems, which hold many sensitive patient and hospital datasets.

Further, many IoT-enabled systems include smart HVAC systems, remote patient monitoring devices, infusion pumps, smart elevators, and more, which are critical in maintaining daily patient-related activities. Hence, healthcare facilities are expected to adopt cybersecurity solutions to safeguard electronic assets and information from unauthorized use, access, and disclosure, thereby driving market growth.

The upsurge in demand for electrical vehicles has elevated the need to outsource their electronic component manufacturing, thereby spurring the electronic contract manufacturing and design services demand in the automotive sector. The healthcare industry is anticipated to witness significant growth, owing to the rise in demand for medical equipment. This includes blood analyzers, ultrasound imaging systems, computed tomography scanner assemblies, and blood glucose meters, among others.

The low fixed capital investment, escalating need to optimize resources, and improved product development emerged as key factors contributing toward the electronic contract manufacturing and design services industry growth across several end-use industries. The demand remains robust in sectors including medical, automotive, aerospace & defense, and consumer electronics, and IT & telecommunication.

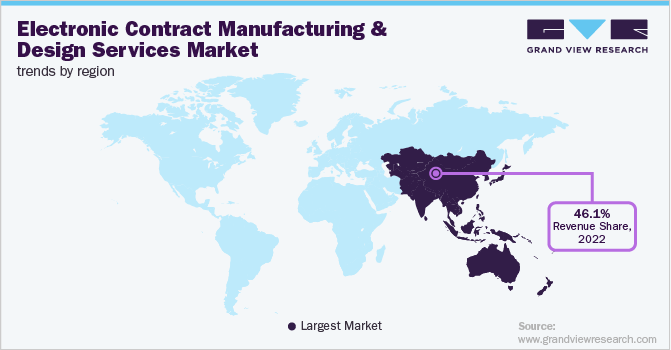

Regional Insights

Asia-Pacific is expected to exhibit the highest growth followed by North America during the forecast period. This is due to the rise of outsourcing activities in these regions. Asia Pacific held the largest revenue share in 2022 and is estimated to remain the fastest-growing region during the forecast period. Moreover, China accounted for more than 35% share in the region and holds a dominant position in electronics manufacturing. The mass availability of raw materials and low-cost labor are the major drivers expected to favor regional industry growth.

Furthermore, growth in the North America region is majorly driven by the healthcare and automotive industries. The healthcare industry is a high-mix-low-volume sector, that offers higher gross profit margins to electronic contract manufacturing and design services players in this region. Several R&D centers and medical institutes in North America work on advanced and portable diagnostic products, which they plan to source through contract manufacturers. All these factors are cumulatively expected to spur the North American contract manufacturing market growth during the forecast period.

Key players such as FLEX; Sanmina Corp; and Jabil Circuit, Inc. are planning to expand their manufacturing facilities in Europe, thereby increasing their production capacity. In addition, a shift to advanced manufacturing techniques in America and Europe is estimated to spur the electronic contract manufacturing and design services demand in these regions during the forecast period.

Key Companies & Market Share Insights

The competitive rivalry in the market is high, owing to the presence of several dominant players. The presence of well-established players has intensified the industry rivalry, taking the competition to an entirely new level. These market players particularly focus on entering into mergers & acquisitions and joint ventures/collaborations to enhance their market presence.

For instance, in February 2022, Taiwan-based Compal Electronics, Inc., approved the acquisition of 65% shares of Poindus System Corporation, a hardware manufacturer of Point-of-Sale (POS) systems. Compal Electronics aims to increase its product portfolio and expand its market exposure with this acquisition.

Market players in developing economies are aiming to offer low-cost, outsourced services to the production and design sectors. Thus, economical subcontracted services for manufacturing have resulted in increased competition between the market players. Moreover, the major operating players are investing in research & development to offer better outsourcing services. Additionally, giant market players are focusing on improving their supply chain and operational efficiency to gain a competitive edge in the market. Some prominent players in the global electronic contract manufacturing and design services market include:

-

Benchmark Electronics Inc.

-

Celestica Inc.

-

Compal Electronics Inc.

-

Creating Technologies LP

-

Flextronics International Ltd.

-

Hon Hai Precision Industry Co. Ltd.

-

Jabil Circuit Inc.

-

Plexus Corporation

-

Fabrinet

-

Venture Corporation Limited.

Electronic Contract Manufacturing And Design Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 556.9 billion

Revenue forecast in 2030

USD 1,062.7 billion

Growth rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Benchmark Electronics, Inc.; Celestica, Inc.; Compal Electronics, Inc.; Creating Technologies LP; Fabrinet, Flextronics International, Ltd.; Hon Hai Precision Industry Co., Ltd; Jabil Circuit, Inc.; Plexus Corporation; Sanmina Corporation; Venture Corporation Limited

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Electronic Contract Manufacturing And Design Services Market Segmentation

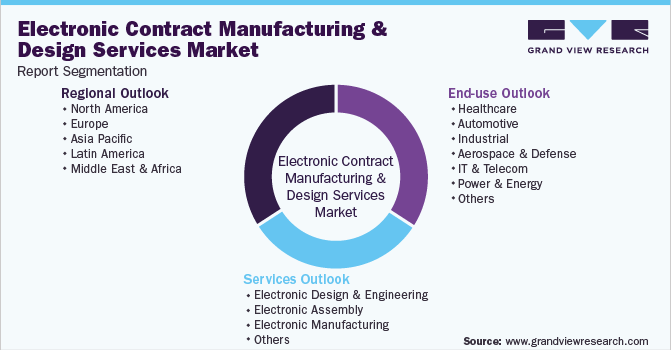

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic contract manufacturing and design services market report based on service, end-use, and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electronic Design & Engineering

-

Electronic Assembly

-

Electronic Manufacturing

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Automotive

-

Industrial

-

Aerospace & Defense

-

IT & Telecom

-

Power & Energy

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electronic contract manufacturing and design services market size was estimated at USD 515.1 million in 2022 and is expected to reach USD 556.9 billion in 2023.

b. The global electronic contract manufacturing and design services market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 1,062.7 billion by 2030.

b. Asia Pacific dominated the electronic contract manufacturing and design services market with a share of 46.16% in 2022. This is attributable to the mass availability of raw materials and low-cost labor in the region.

b. Some key players operating in the electronic contract manufacturing and design services market include Hon Hai Precision Industry Co., Ltd.; Flextronics International, Ltd.; Jabil Circuit, Inc.; Sanmina Corporation; Venture Corporation; and Benchmark Electronics, Inc.

b. Key factors that are driving the electronic contract manufacturing and design services market growth include increasing services offered by contract manufacturers with respect to component assembly, engineering & design of printed circuit boards, sub-assembly manufacturing, and functional testing among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.