- Home

- »

- Automotive & Transportation

- »

-

Flight Simulator Market Size & Trend, Industry Report, 2033GVR Report cover

![Flight Simulator Market Size, Share & Trends Report]()

Flight Simulator Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Full Flight Simulator (FFS), Fixed Flight Training Devices (FTD)), By Application (Military & Defense, Civil), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-264-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flight Simulator Market Summary

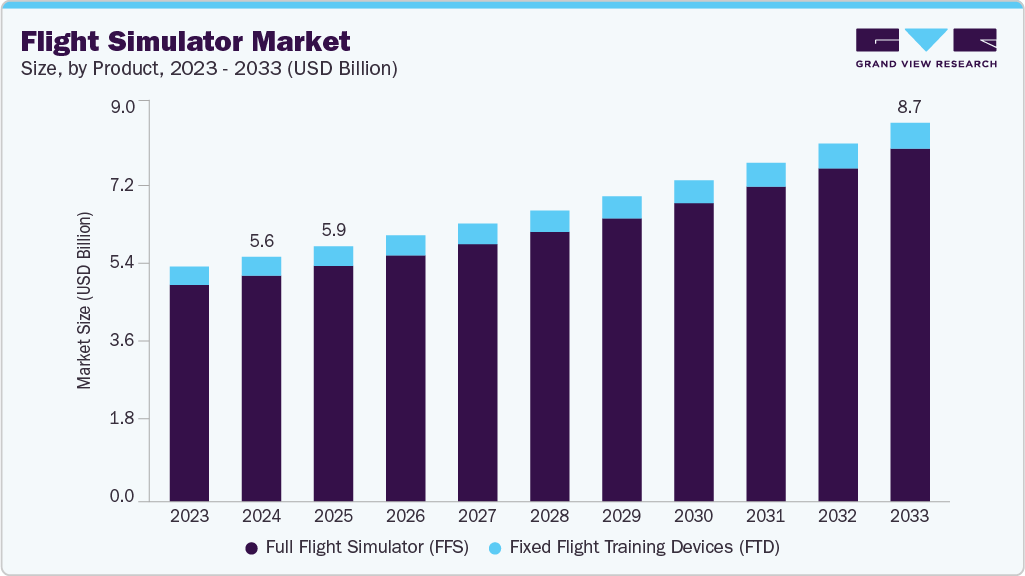

The global flight simulator market size was valued at USD 5.62 billion in 2024 and is projected to reach USD 8.70 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is witnessing steady growth, driven by the increasing demand for smart warehousing, autonomous delivery, and last-mile logistics full flight simulator (FFS).

Key Market Trends & Insights

- Europe held 31.6% revenue share of the global flight simulator market.

- In the UK, the increasing demand for pilot training amid rising global air traffic is driving flight simulator market growth.

- By product, full flight simulator (FFS) segment held the largest revenue share of 92.3% in 2024.

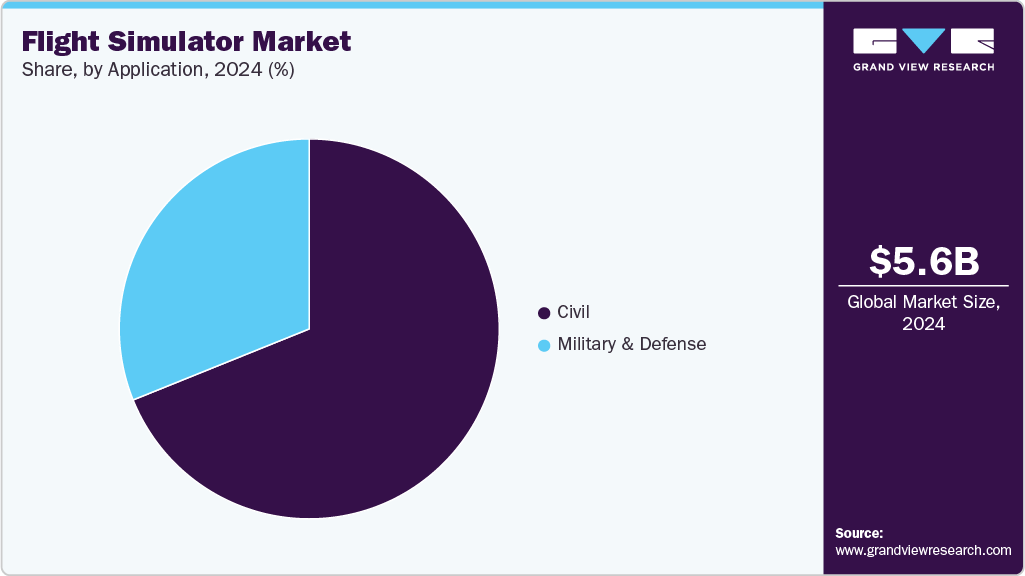

- By application, civil segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.62 Billion

- 2033 Projected Market Size: USD 8.70 Billion

- CAGR (2025-2033): 5.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest market growth in 2024

The benefits offered by flight simulator devices include mission-critical training programs that ensure effective aircraft operation, low operational costs, and visual systems. These benefits offer near real-world experience and are anticipated to create new growth avenues for market growth over the next few years. Rising demand for better and more effective pilot training is anticipated to catapult growth. The growing importance of aircraft safety and the need for substantial training is anticipated to spur demand over the forecast period.

The need for flight handling and safety operations, such as situational awareness and skill competency, promotes industry growth. The industry is witnessing unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs. Additionally, advancements in computing technology have significantly resulted in the incorporation of better visual and motion systems for enhanced fidelity and smoothness, which is also anticipated to drive the market for flight simulators over the forecast period.

The flight simulators are built to replicate the actual aircraft's cockpit and cabin. The dashboard of the flight simulator is equipped with motion and visual systems to create realistic environments for the pilots. It allows the pilots to feel the movement in the aircraft precisely, and the visual systems help them to work out the approach procedures at the airports. The visual systems are designed to offer the pilots a satellite-quality 180-degree view.

Technological advancements resulting in the development of highly advanced flight simulators are expected to drive market growth. Lockheed Martin Corporation offers a flight simulator named Prepar3D, which can recreate the cityscape and night flying illustrations. They have kept it as an open source for private users and software developers to create new applications and environments, thus ensuring the constant evolution of the program. Additionally, advancements in computing technology have resulted in better visual systems offering near-real-world experience, which are likely to drive industry growth over the forecast period.

The rapidly increasing civil aviation industry and escalating government funding to the defense aviation sector worldwide are expected to increase flight simulator demand significantly over the next eight years. Further, rising passenger air travel elevates demand for trained pilots, which positively impacts the flight simulator adoption. Additionally, the development of realistic aircraft system logic with overhead and ECAM displays has resulted in the high adoption of flight simulators.

Rising demand for air travel is expected to propel the global flight simulator market growth over the forecast period. The need to effectively replicate real flying training using motion and visual systems has resulted in the evolution of sophisticated flight simulators in the market. An increase in government spending and growing security concerns, particularly in the military sector, are expected to escalate growth significantly.

The growing importance of aircraft safety and the need for substantial flight training and simulation are anticipated to spur demand over the coming years. Stringent government norms and regulations pertaining to passenger safety are further expected to elevate product demand. The need for flight handling and safety operations, such as situational awareness and flight skill competency, is expected to fuel industry growth. Additionally, increasing demand for better and more effective pilot training is anticipated to catapult growth.

Technological advancements resulting in the development of highly advanced flight simulators are expected to drive market growth. R&D efforts in aerospace technology, coupled with performance evaluation of pilots, are likely to stimulate market growth over the next few years. The high efficiency of simulation technology and the ability to save fuel costs are expected to serve as key drivers for the market.

The development of simulators for Unmanned Aerial Vehicles (UAVs) is expected to offer alternative opportunities for the global market. Advancements in computing technology have resulted in better visual systems offering near real-world experience, which are expected to drive industry growth over the next seven years.

Product Insights

The full flight simulator (FFS) segment dominated the flight simulator market with a revenue share of 92.3% in 2024. FFS refers to high-technical flight simulators that offer high fidelity and reliability. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

The fixed flight training devices (FTD) segment is projected to grow at a CAGR of 3.5% from 2025 to 2033. FTDs are training modules with limited visual display. The primary purpose of these devices is to train where all indicators and switches are on the deck. These devices are extensively used for their low purchase cost and operations. Furthermore, the use of UAV drones has increased the need for the training of drone pilots, which, in turn, is projected to drive market growth.

Application Insights

The civil segment dominated the flight simulator market in 2024. Software-as-a-service (Military & Defense) platforms facilitate seamless interoperability across diverse robotic devices and business applications. The modular architecture of Military & Defense full flight simulators (FFS) allows them to act as central hubs, integrating with other cloud fixed flight training devices (FTD), IoT platforms, and enterprise software like ERP or warehouse management systems. This interoperability is crucial for industries that rely on real-time data synchronization and multi-device coordination across geographically distributed operations. For example, a logistics provider can manage a heterogeneous fleet of autonomous robots at multiple warehouses from a single Military & Defense dashboard, streamlining operations while maintaining consistency and control.

The military & defense segment is projected to grow at a significant CAGR from 2025 to 2033. Flight simulators provide a safe and controlled training environment for pilots to practice various scenarios and emergency procedures, improving their skills and operational readiness. The complexity of modern military aircraft and the need for extensive training drive the demand for highly immersive simulators. Moreover, simulators help reduce costs associated with live training and contribute to sustainability efforts.

Regional Insights

The North America flight simulator market is projected to grow during the forecast period. In the defense sector, North America maintains the largest military aviation fleet globally, with the U.S. Department of Defense playing a pivotal role in pushing the boundaries of simulator usage. The U.S. Air Force, Navy, and Army all incorporate flight simulators for training pilots on various platforms, including fixed-wing aircraft, helicopters, and fifth-generation fighters like the F-35.

Military training simulations are designed to replicate combat scenarios, electronic warfare, aerial refueling, and mission rehearsal, contributing to operational readiness while preserving resources and personnel safety. With continued defense modernization programs and increasing geopolitical tensions, there is growing investment in synthetic training environments and immersive technologies that enable realistic, scenario-based learning for combat pilots.

U.S. Flight Simulator Market Trends

The U.S. flight simulator market is projected to grow during the forecast period. The U.S. is also a global hub for simulator technology development, hosting manufacturers and developers that innovate across hardware and software platforms. Companies based in the U.S. are pushing the boundaries of simulation fidelity through the integration of artificial intelligence (AI), virtual reality (VR), mixed reality (MR), and cloud-enabled training. These technologies enhance the immersive experience and enable remote, distributed training environments that are particularly useful for both military applications and commercial airline partnerships.

Europe Flight Simulator Market Trends

Europe flight simulator market dominated the global market with a revenue share of 31.6% in 2024. Commercial aviation growth, especially in countries like Germany, the UK, France, and the Netherlands, further fuels the need for advanced flight simulation technologies. Low-cost carriers and full-service airlines alike are expanding their fleets, intensifying the need for efficient training of new and existing pilots.

Flight simulators are essential in meeting these requirements, as they help reduce the cost and environmental footprint of in-air training. Airlines are also investing in simulation technology to train on next-generation aircraft, such as the Airbus A320neo and Boeing 737 MAX, which require updated simulation systems to reflect the latest avionics and cockpit configurations.

The flight simulator market in the UK is expected to grow during the forecast period. The growing demand for helicopter and rotary-wing aircraft simulation, particularly in the offshore energy, search and rescue (SAR), and emergency medical services sectors, is widening the scope of the UK flight simulator market.

These segments require pilots to operate in highly unpredictable and hazardous conditions, making simulation essential for preparing crews without exposing them to actual risk. The UK’s position as a hub for North Sea oil and gas operations, as well as its extensive SAR network, creates a consistent need for specialized simulators that can replicate extreme weather, offshore landing pads, and rapid-response missions.

Asia Pacific Flight Simulator Market Trends

The Asia Pacific flight simulator market is expected to be the fastest-growing segment, with a CAGR of 5.8% over the forecast period, owing to increasing demand for these devices, particularly in developing countries such as India and China. The growth in the Asia Pacific region is attributed to the high demand for air travel due to increased trade and tourism. North America is likely to witness slow growth, primarily due to the apprehensions regarding air safety and strict air safety standards enforced by the FAA in the U.S.

The flight simulator industry in India is projected to grow during the forecast period. The rising consumer demand for smarter, connected products and fixed flight training devices (FTD) also influences the flight simulator market in Japan. Beyond industrial use, flight simulators are expanding into personal assistance, entertainment, and home automation. Robots integrated with cloud platforms can deliver personalized experiences by learning user preferences, updating functionalities remotely, and interacting through natural language processing powered by cloud AI.

As Japanese consumers increasingly embrace smart devices and expect seamless digital integration, flight simulator offers unique opportunities to meet these evolving needs. This consumer-driven momentum complements industrial adoption, creating a comprehensive growth landscape for flight simulators across multiple facets of Japanese society.

Key Flight Simulator Company Insights

Some key companies operating in the market are Leonardo S.p.A. and Boeing, among others.

-

Leonardo S.p.A. is an Italian multinational corporation. Within its extensive aviation portfolio, Leonardo is deeply invested in pilot training and flight simulation. The company develops a comprehensive suite of cockpit simulation technologies that range from PC-based flight training devices to high-fidelity full-flight simulators. Its Cockpit Simulation solutions include modular hardware and software ensembles that faithfully replicate aircraft controls and interfaces, enabling operators to adjust realism and fidelity to different training needs.

-

Airbus is a global company specializing in aerospace and defense designing, manufacturing, and selling civil and military aerospace products. Airbus’s commitment to flight simulation is evident in its global network of Airbus Training Centres strategically located in Europe, Asia, the Middle East, and the Americas. These facilities offer high-fidelity, full-flight simulators (FFS) certified by international aviation authorities such as the EASA, FAA, and local regulators. These simulators, purpose-built to replicate Airbus cockpit environments, provide critical support for type-rating training, recurrent training, and proficiency checks.

VirTra, Inc., and Meggitt PLC are some emerging market participants in the flight simulator market.

-

VirTra, Inc. specializes in immersive use-of-force training simulators for law enforcement, military, educational, and commercial clients worldwide. Their simulator lineup includes compact single-screen systems like the V-100, mid-range setups such as the V-180, and immersive V-300 units with 180‑ to 300‑degree screens alongside the portable V‑XR headsets. Central to VirTra’s innovation is its integration of patented hardware and software features that enhance realism and training outcomes. Their tetherless recoil kits, V-Threat-Fire return‑fire devices, and proprietary marksmanship software (V‑Marksmanship) replicate live-fire stress and physiological feedback.

-

Meggitt PLC is a UK-based aerospace and defense technology firm that specializes in simulation and training systems. Meggitt also operates a specialized division, Meggitt Training Systems, which delivers high-fidelity simulators for military and defense training purposes. These include the FATS M100 virtual training systems, which blend immersive graphics and advanced wireless weapon simulators (BlueFire) to deliver realistic marksmanship and judgmental training at scale.

Key Flight Simulator Companies:

The following are the leading companies in the flight simulator market. These companies collectively hold the largest market share and dictate industry trends.

- AIRBUS

- Boeing

- CAE Inc.

- Collins Aerospace

- Exail Technologies

- Fidelity Technologies Corporation

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Meggitt PLC

- Saab AB

- Teledyne Brown Engineering

- Thales

- The DiSTI Corporation

- VirTra, Inc

Recent Developments

-

In May 2025, Exail Technologies partnered with Babcock France for the Mentor 2 program. The company will design and deliver simulators tailored to the Pilatus PC-7 MKX aircraft. This comprehensive suite will feature multiple mixed-reality flight training devices, incorporating XR headsets, interactive touchscreens, and high-fidelity simulation software. Additionally, an ejection training simulator will be included to facilitate safe and realistic emergency procedure drills.

-

In April 2024, Leonardo S.p.A. signed a contract with ST Engineering Antycip to develop a customized Image Generator leveraging Unreal Engine, the advanced real-time 3D creation platform from Epic Games. By utilizing Unreal Engine, Leonardo aims to deliver immersive real-time experiences that enable highly realistic virtual environments, significantly enhancing the number and complexity of entities within simulation scenarios. This cutting-edge technology will be integrated across Leonardo’s full suite of training systems, including full-flight simulators, flight training tools, procedural trainers, and more.

-

In February 2024, Thales signed an agreement with Airbus Helicopters to provide support to the German Armed Forces through the delivery of eight Full Flight Simulators Reality H, designed to instruct H145M helicopter pilots in mission preparation and other critical skills. As part of the agreement, Thales will offer comprehensive support for an initial period of three years, with a dedicated team stationed on-site at the Bückeburg International Helicopter Training Center (IHTC), the largest helicopter training facility in Europe.

Flight Simulator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.86 billion

Revenue forecast in 2033

USD 8.70 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Leonardo S.p.A.; Boeing; CAE Inc.; AIRBUS; The DiSTI Corporation; Fidelity Technologies Corporation; Havelsan Air Electronic Industry; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Meggitt PLC; Collins Aerospace; Saab AB; Teledyne Brown Engineering; Thales; VirTra, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flight Simulator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flight simulator market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Full Flight Simulator (FFS)

-

Fixed Flight Training Devices (FTD)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military & Defense

-

Civil

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flight simulator market size was estimated at USD 5.62 billion in 2024 and is expected to reach USD 5.86 billion in 2025.

b. The global flight simulator market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 8.70 billion by 2033.

b. The full flight simulator (FFS) segment dominated the flight simulator market with a revenue share of over 92.0% in 2024. FFS refers to high-technical flight simulators that offer high fidelity and reliability. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

b. Some key players operating in the flight simulator market include Leonardo S.p.A., Boeing, CAE Inc., AIRBUS, The DiSTI Corporation, Fidelity Technologies Corporation, Havelsan Air Electronic Industry, Kratos Defense & Security Solutions, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Meggitt PLC, Collins Aerospace, Saab AB, Teledyne Brown Engineering, Thales, VirTra, Inc.

b. Key factors that are driving the market growth include the unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.