- Home

- »

- Next Generation Technologies

- »

-

Supply Chain Analytics Market Size, Industry Report, 2030GVR Report cover

![Supply Chain Analytics Market Size, Share & Trends Report]()

Supply Chain Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Manufacturing, Logistics Analytics), By Deployment (On-premise, Cloud), By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-928-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Supply Chain Analytics Market Summary

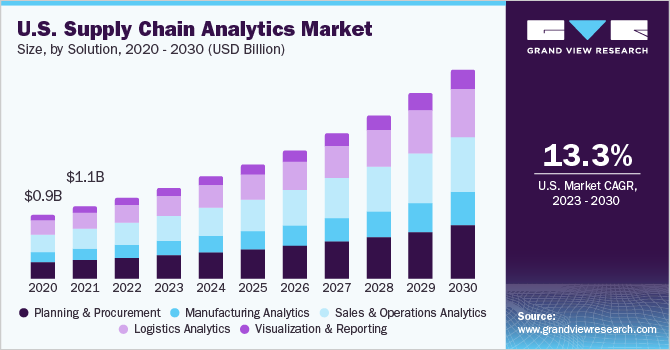

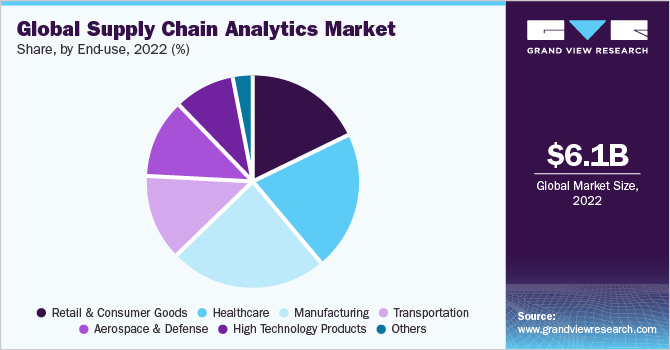

The global supply chain analytics market size was estimated at USD 6.12 billion in 2022 and is projected to reach USD 22.46 billion by 2030, growing at a CAGR of 17.8% from 2023 to 2030. The supply chain analytics (SCA) market is growing in demand due to increased awareness of the benefits of SCA solutions, such as forecasting accuracy, supply chain optimization, waste minimization, and meaningful synthesis of business data.

Key Market Trends & Insights

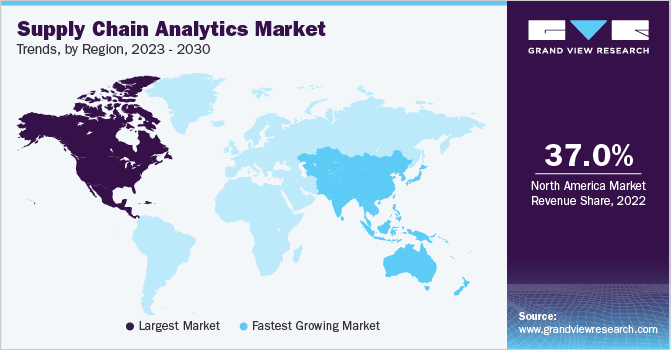

- North America dominated the global supply chain analytics market with the largest revenue share of 37.0% in 2022.

- The Asia Pacific regional market is anticipated to register the fastest CAGR of 21.9%.

- By service, the professional service held the dominant position in the market and accounted for the leading revenue share of 60% in 2022.

- By deployment, the cloud segment held ra evenue share of 62% in 2022.

- By enterprise size, the small & medium enterprises segment is expected to grow at the fastest CAGR of 19.2% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 6.12 Billion

- 2030 Projected Market Size: USD 22.46 Billion

- CAGR (2023 to 2030): 17.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing number of small & medium enterprises and their increasing expenditure on implementing analytics to hold a strong position in the market and compete against other market players are expected to boost the market growth over the forecast period.

The COVID-19 pandemic has long-term influenced economies worldwide, forcing corporate leaders to act and continue their operations. The pandemic underscored the importance of supply chain solutions for long-term economic viability. During these uncertain times, supply chain analytics enabled organizations to identify processes that required immediate attention or products/items that were likely to run out soon, allowing them to manage the demand-supply gap better than before. Furthermore, SCA vendors in the market are working actively and offering solutions to minimize the negative impacts of the pandemic on global supply chains.

Supply chain analytics also helps businesses improve their ability to make decisions regarding technology adoption, organizational infrastructure, strategic relationships, and enterprise resource management. For instance, in April 2023, Accenture PLC completed the acquisition of EINR AS, a logistics solution provider. The acquisition would help Accenture enhance SAP capabilities and speed up supply chain reinvention within consumer electronics and retail industries.

SCA helps organizations get a broader view of supply chain activities, allowing them to efficiently manage any issues that may impact the profitability or sustainability of the business. Mobile-based solutions help companies track inefficient supplier networks, elevated warehousing costs, and incorrect forecasts, among others. Analytics solutions also play a pivotal role in analyzing business operations that may help improve inventory management and subsequently help reduce associated cost components that may hinder business growth. In recent times, a surge in the adoption of mobile-based solutions is expected to create avenues for industry growth.

Unethical activities and increasing incidences of cyber threats could raise concerns among businesses and may challenge the adoption of SCA solutions to a certain extent. Although the prospects of tech inclusion in supply chain operations look bright, industry incumbents are still concerned about possible security/data breaches. These concerns may be unfavorable for future growth. However, by selling secure products, SCA solution providers have been working tirelessly to reduce the effect of these breaches. These initiatives may help the market grow at a healthy rate in the coming years.

Solution Insights

In terms of solution, the sales & operations analytics segment captured the largest market share exceeding 28% in 2022. The need to optimize resource utilization and cost were vital considerations contributing to the overall segment growth in 2022. The client benefits from a flexible and customized SCA solution that adapts to dynamic requirements while being cost-efficient. This is expected to aid the growth of the sales & operations segment over the forecast period.

Logistics analytics solutions assist in connecting transportation networks to forecast market demand and locate product supply points. The utilization of big data in SCA helps improve supply chain and logistics operations, effectively addresses customer requirements, and enhances customer satisfaction and loyalty. This is anticipated to drive the growth of the logistics analytics segment over the forecast period.

The planning & procurement segment is anticipated to register considerable growth over the forecast period. Demand forecast in supply chain planning analytics includes freight cost, production, distribution, and budgeting, which help users efficiently manage their logistics operations. This is expected to drive the growth of the planning & procurement segment over the forecast period.

Service Insights

Based on service, the professional service segment has registered the largest market share of over 60% in 2022. To avoid data loss or theft, professional services must ensure that the new systems are compatible with the existing systems of numerous departments and integrate the new systems with the existing ones, contributing to the growth of the segment. There is an increased demand for professional services for the analysis and preservation of important data and professional assistance on emerging technologies. However, data scientist teams require specific abilities to identify and uncover trends that help marketers make better decisions; therefore, the supply chain business lacks skilled or professional services and individuals.

The support & maintenance segment is anticipated to register the fastest CAGR over the forecast period. Third-party support can help in cost savings while also providing the expertise of well-trained and experienced professionals. Understanding the technicalities of the software, maintaining & fixing the system during breakdowns, smoothly importing/exporting data, and routinely updating the software are all issues that are considered while implementing SCA solutions. Lack of attention to these elements may result in a decrease in production. Therefore, over the forecast period, demand for support and maintenance services is expected to grow.

Deployment Insights

Based on deployment, the cloud segment captured the largest market share of more than 62% in 2022. Technological proliferation has led to the large-scale adoption of IoT devices and has subsequently increased the OEM customers’ dependence on cloud-based platforms. Cloud deployment increases flexibility and allows the large-scale customization of products and services for organizations. The industry is particularly opting for big data analytics solutions due to their benefits in data safety and risk analysis. Enhanced mobility and the ease of using cloud services have resulted in the aggressive deployment of supply chain analytics solutions on cloud-based platforms.

Cloud-based deployment is also preferred due to the vast advances in technology. Enterprises based in economies, in the Middle East & Africa (MEA) and the Asia Pacific, most developing nations, are expected to prefer solutions deployed on the cloud. A lack of in-house IT expertise would prompt these enterprises to opt for cloud-based deployment. The increased availability of cloud-based SCA solutions has triggered their demand across small & medium business enterprises owing to benefits such as easy deployment, shorter implementation window, effective use of IT resources, and the flexibility and mobility offered by these solutions.

Enterprise Size Insights

In terms of enterprise size, the large enterprise segment held the largest market share in 2022 at over 59%. The increased demand for strong monitoring solutions and automation capabilities for resource allocation and strategic decision-making boosted segment growth in 2022. The small & medium enterprises segment is anticipated to register the fastest CAGR of 19.2% over the forecast period owing to the increasing number of small and medium enterprises (SMEs) in developing economies, such as Mexico and India. The need for internal network architecture for data storage is expected to drive the demand for SCA solutions.

The growing adoption of information technology infrastructure by SMEs to enable digital services across different business channels in SMEs is also expected to drive the growth of the segment over the forecast period. The increasing number of government initiatives through various digital SME campaigns globally is also expected to drive the growth of the SMEs segment over the forecast period.

End-use Insights

In terms of end-use, the manufacturing segment held the largest market share in 2022 at over 23%.In the manufacturing industry, SCA solutions can help improve performance as they can provide access to real-time data across the value chain and reflect the updates made to any region or process throughout the organization. Moreover, growing customer demand and the requirement to ensure product availability and timely delivery are propelling demand for supply chain efficiency improvements. For instance, in April 2023, Snowflake, a data cloud company, announced the launch of the Manufacturing Data Cloud for the automotive, technology, and industrial sector. The Manufacturing Data Cloud allows manufacturers to collaborate with suppliers, partners, and customers and allows businesses to improve supply chain performance and propel smart manufacturing initiatives.

The Manufacturing Data Cloud gives manufacturers the tools to work safely with partners, suppliers, and customers, enhancing agility and visibility along the entire value chain. In today's digital-industrial environment, businesses may strengthen the performance of their supply chains, implement smart manufacturing projects, and develop a data foundation for their operations with the help of Snowflake's Manufacturing Data Cloud.

Planning an efficient supply chain has become more crucial as the online retail industry expands and companies compete to offer customers a flawless delivery experience. The booming e-commerce sector and the incorporation of big data and artificial intelligence learning into SCA will be the primary drivers of the global demand for effective supply networks. This is anticipated to fuel the retail and consumer goods segment during the forecast period.

Regional Insights

In terms of region, the North America region dominated the global market in 2022 with a revenue share of over 37%.Due to the complexity of corporate processes, industrial organizations in North America are putting a greater focus on the visual display of operational data. This allows businesses to quickly assess the current health of their supply chain from a data standpoint, allowing for better strategic decision-making. Over the forecast period, the European regional market is expected to rise at a promising rate. The European Commission's single market strategy allows commodities, services, people, and capital to travel freely within the region. It broadens the geographical market for European businesses and expands the possibilities for SCA solutions acceptance and deployment.

Over the forecast period, the Asia Pacific regional market is anticipated to register the fastest CAGR of 21.9%. The growth might be ascribed to a growing awareness of the benefits of analytics solutions among businesses. Furthermore, the constantly expanding number of small and medium-sized businesses (SMBs) and their increasing expenditure on deploying cutting-edge technology to expand their enterprises may add to the growth of the regional SCA market.

Key Companies & Market Share Insights

SAP SE, Oracle Corporation, Maersk Group, Accenture PLC, and JDA Software Group, Inc. are major players offering SCA software solutions to various industry verticals. As a result of the tendency to optimize the delivery mechanism from the point of production to the end of consumption, businesses have started using unified advanced analytics software. Due to the advancement of supply chain solutions employing artificial intelligence, predictive analytics, big data, and leveraging interactive software solutions and useful dashboards, market participants are motivated to develop sophisticated SCA solutions. For instance, in June 2023, an automobile company, Jaguar Land Rover (JLR) announced a collaboration with Everstream Analytics, a supply chain solution provider, which embedded AI into JLR’s supply chain management allowing JLR to monitor the supply chain in real-time and avoid supply-related issues.

Furthermore, market players are resorting to growth strategies such as collaborations, new joint ventures, mergers & acquisitions, and product development to stay competitive and expand their reach in the global market. In March 2023, EY partnered with o9 Solutions, a supply chain management solution provider, to offer supply chain planning solutions powered by big data, cloud computing, machine learning, and AI. Some prominent players in the global supply chain analytics market include:

-

Accenture PLC

-

Aera Technology

-

Birst, Inc.

-

Capgemini SA

-

Genpact Limited

-

International Business Machines Corporation

-

JDA Software Group, Inc.

-

Kinaxis

-

Lockheed Martin Corporation

-

Maersk Group

-

Manhattan Associates, Inc.

Supply Chain Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.15 billion

Revenue forecast in 2030

USD 22.46 billion

Growth rate

CAGR of 17.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture PLC; Aera Technology; Birst, Inc.; Capgemini SA; Genpact Limited; International Business Machines Corporation; JDA Software Group Inc.; Kinaxis; Lockheed Martin Corporation; Maersk Group; Manhattan Associates, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Supply Chain Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global supply chain analytics market report based on solution, service, deployment, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Logistics Analytics

-

Manufacturing Analytics

-

Planning & Procurement

-

Sales & Operations Analytics

-

Visualization & Reporting

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Support & Maintenance

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

Transportation

-

Aerospace & Defense

-

High Technology Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global supply chain analytics market size was estimated at USD 6.12 billion in 2022 and is expected to reach USD 7.15 billion in 2023.

b. The global supply chain analytics market is expected to grow at a compound annual growth rate of 17.8% from 2023 to 2030 to reach USD 22.46 billion by 2030.

b. North America dominated the supply chain analytics market with a share of over 35% in 2022. This is attributable to several providers of supply chain analytics solutions that are concentrated in the region.

b. Some of the key players operating in the supply chain analytics market include Accenture PLC, Aera Technology, Birst, Inc., Capgemini SA, Genpact Limited, IBM, JDA Software Group, Inc., Kinaxis, Lockheed Martin Corporation, Maersk Group, and Manhattan Associates, Inc.

b. Key factors that are driving the supply chain analytics market include the rapid increase in volumes of business data being generated across various industries are prompting enterprises to adopt analytics solutions for converting raw data into meaningful insights.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.