- Home

- »

- Power Generation & Storage

- »

-

Thermal Energy Storage Market Size, Global Report, 2027GVR Report cover

![Thermal Energy Storage Market Size, Share & Trends Report]()

Thermal Energy Storage Market (2020 - 2027) Size, Share & Trends Analysis Report By Product Type, By Technology, By Storage Material, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-668-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Energy Storage Market Summary

The global thermal energy storage market size was valued at USD 4.1 billion in 2019 and is projected to grow at a compound annual growth rate (CAGR) of 9.4% from 2020 to 2027. Shifting preference towards renewable energy generation, including concentrated solar power, and rising demand for thermal energy storage (TES) systems in HVAC are among the key factors propelling the industry growth.

Key Market Trends & Insights

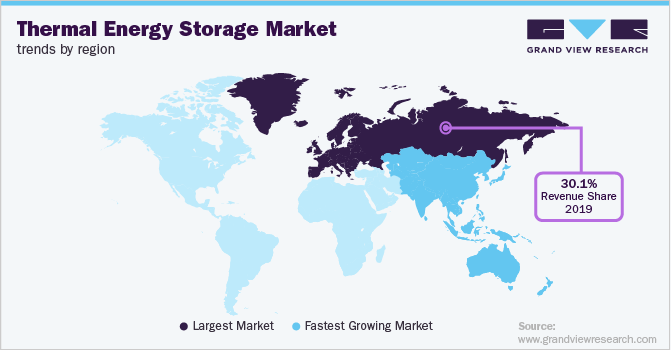

- Europe accounted for the largest revenue share of 30.1% in 2019 and is projected to maintain its lead over the forecast period.

- Asia Pacific is expected to register the fastest CAGR of 14.3% over the forecast period.

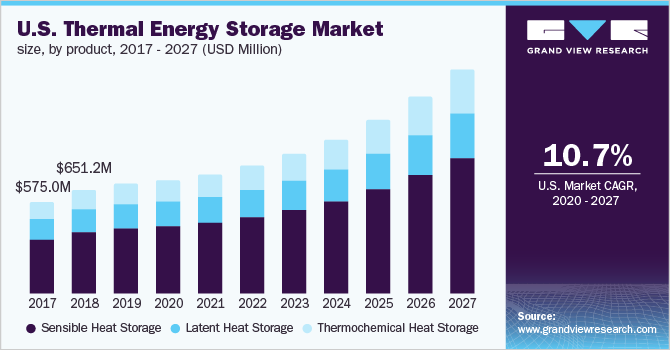

- By product, Sensible heat storage accounted for the largest revenue share of 46.2% in 2019.

- By technology, molten salt technology occupied the largest revenue share of 31.1% in 2019 and is expected to witness significant growth over the forecast period.

Market Size & Forecast

- 2019 Market Size: USD 4.10 Billion

- 2027 Projected Market Size: USD 7.74 Billion

- CAGR (2020-2027): 9.4%

- Europe: Largest market in 2019

Growing need for enhanced energy efficiency, coupled with continuing energy utilization efforts, will positively influence the thermal energy storage demand. For instance, in September 2018, the Canadian government updated a financial incentive plan “Commercial Energy Conservation and Efficiency Program” that offers USD 15,000 worth rebates for commercial sector energy upgrades.

The market in the U.S. is projected to witness substantial growth in the forthcoming years on account of increasing number of thermal energy storage projects across the country. For instance, in 2018, the U.S. accounted for 33% of the 18 under construction projects and 41% of the total 1,361 operational projects globally. Presence of major industry players in the country is expected to further propel the TES market growth in the U.S.

The U.S. Department of Energy (DoE) evaluates thermal energy storage systems for their safety, reliability, cost-effective nature, and adherence to environmental regulations and industry standards. It also stated that Europe and the Asia Pacific display higher fractions of grid energy storage as compared to North America. Rising need for a future with clean energy is prompting governments across the globe to take efforts towards developing innovative energy storage systems.

The primary challenge faced by the thermal energy storage sector is the economical storage of energy. An important advancement in this sector has been the usage of lithium-ion batteries. These batteries exhibit high energy density and long lifespans of 500 deep cycles, i.e. the number of times they can be charged from 20% to their full capacity before witnessing a deterioration in performance. They can also be utilized in electric vehicles, district cooling and heating, and power generation.

Thermal Energy Storage Market Trends

Governments, associations, universities across the globe are taking various steps to invest actively in R&D, to come up with innovative storage mediums which have a low or zero impact on the environment. The ongoing R&D is also focused on implementing the thermal energy storage techniques to be implemented in building walls by employing the PCMs in air vents and plasters. The increasing government initiatives coupled with technological advancement initiatives adopted by various vendors are anticipated to boost the market over the forecast period. Also, efforts are being taken to utilize thermal energy for transportation purposes as well.

Rise in environmental concerns regarding increase in carbon emissions owing to usage of conventional fuels for power generation purpose have resulted countries around the world to opt towards cleaner and efficient sources of power. Further, many countries in North American, European and Asia Pacific region have given impetus to growth of clean energy technologies in the long-term goals of respective countries.

Renewable power generation and green energy storage has emerged as some of the major alternative to fossil fuels, thus reducing the dependency on them. This, in turn, has resulted as a viable solution for countries around the world to opt for them to meet their carbon reduction targets and to make a switch towards cleaner energy technologies. Rise in deployment of renewable energy in the last decade has been witnessed on account of these scenarios. However, renewable energy sources such as solar and wind have intermittent nature of supply. To counter this intermittency nature of large-scale renewable deployment, thermal energy storage systems provide a viable solution as they can be integrated with CSP projects.

Energy storage can be done through various methods apart from thermal energy storage such lithium-ion batteries. Economies of scale in the manufacturing of lithium-ion battery has reduced the cost of manufacturing lithium-ion batteries by 70%. This factor has majorly driven its use for energy storage as compared to other available battery technologies

Product Type Insights

Sensible heat storage accounted for the largest revenue share of 46.2% in 2019. This can be attributed to rising demand for solar thermal systems, along with applicability across large scale HVAC systems. Provision of reversible charging and discharging facility for an infinite number of cycles is a key feature of the technology that will further enhance the product penetration.

The thermochemical heat storage segment is anticipated to exhibit the fastest CAGR of 13.8% over the forecast period. In this storage, the heat stored by different mediums is released when a reverse reaction takes place between them. Thermochemical storage systems provide high energy density as compared to latent or sensible heat storage systems. This form of heat storage is preferable for long-term storage as losses do not occur overtime, but only during charging and discharging phases.

Technology Insights

Molten salt technology occupied the largest revenue share of 31.1% in 2019 and is expected to witness significant growth over the forecast period. The growth of the segment can be attributed to its high technological efficiency, along with its usage in several solar energy projects. Molten salt is used to store the heat collected by means of solar troughs and solar towers. The heat collected by means of this technology is used to enable steam turbines by converting it to superheat steam.

Ice-based technology is anticipated to grow at a significant rate over the forecast period. Ice is used in ice storage air conditioning for the storage of thermal energy. The process is highly feasible as the heat of fusion of water is sufficiently high and can contain approximately 317,000 BTU or 334 mega joules (MJ) of energy in one metric ton of water. This energy is equivalent to approximately 26.5 ton-hours or 93 kWh. This application can be utilized to provide chilled water and air conditioning to a large number of commercial and residential buildings.

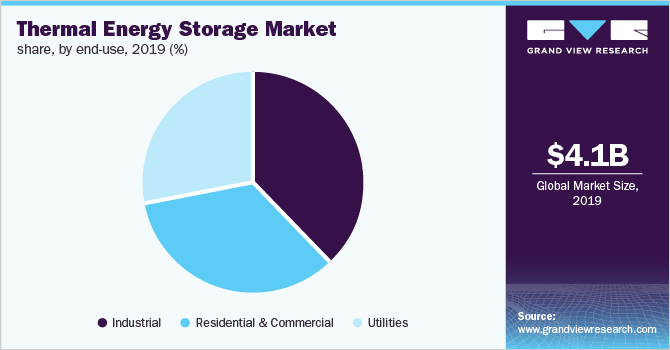

End-user Insights

The industrial segment accounted for the largest revenue share of 39.7% in 2019 and is projected to maintain its lead over the forecast period. Rising spending on infrastructure development and establishment will propel the demand for HVAC systems, which, in turn, will drive the industrial segment. Furthermore, growing adoption of these systems across several industries using large quantities of hot water for economic purposes will boost the segment growth.

The utilities segment is expected to witness the fastest growth over the forecast period. The segment comprises public services, such as broadband internet, transportation, telephone, sewage, water, natural gas, and electricity. Thermal energy is utilized to provide these public services at an extremely low cost. Cogeneration plants are employed to derive thermal energy and then convert it to the required form of energy.

The residential and commercial segment held a significant market share in 2019. Thermal energy plants are utilized to generate electrical energy to suffice the energy demand of the residential and commercial sectors. Electrical storage heaters and home storage units are also employed to store thermal energy in order to provide residential and commercial buildings with heating and cooling capacity as required.

Storage Material Insights

Molten salt accounted for the largest revenue share of 35.0% in 2019 owing to its usage as a thermal energy storage medium across several applications, including concentrated solar power plants. The molten salt stores solar energy for longer durations, thereby overcoming the short energy cycle restraint of thermal energy storage. Growing demand for concentrated solar power technology is expected to positively influence the TES market growth.

Water is the most commonly utilized material to store heat energy as it has a heat capacity of 4.2 J/(cms.K), which is considered to be one of the highest. It is often utilized in systems such as heat storage tanks, pebbles, concrete, and hot rocks. The steam generated is then utilized to power the turbines, which eventually generate low cost and efficient electricity.

Application Insights

The district heating and cooling segment accounted for the largest revenue share of 35.2% in 2019. The application of district cooling and heating is utilized to distribute the generated power in order to suffice commercial and residential requirements. This distributed energy is utilized for water heating, space heating, and air conditioning. The stored power is derived in cogeneration plants by burning biomass and fossil fuels. Various systems utilized for the generation of energy for district heating and cooling applications include central solar power and boiler stations.

The power generation segment is anticipated to witness the highest growth over the forecast period. Rising demand for uninterrupted and cost-efficient power supply from off grid and remote areas will drive the segment. Introduction of several government schemes regarding electricity generation from solar power plants will boost the power generation segment growth. The renewable power generation supplier receives retail electricity price for each unit generated and the extra power sold back to the grid under the feed-in tariff scheme.

Thermal energy is utilized for process heating and cooling application in order to change the chemical and physical properties of the desired material. Heat treatment is utilized for metalworking, industrial, and manufacturing processes. These processes require extreme cooling and heating in order to harden or soften the desired material. Various types of process include quenching, normalizing, tempering, strengthening, precipitation, case hardening, and annealing.

Regional Insights

Europe accounted for the largest revenue share of 30.1% in 2019 and is projected to maintain its lead over the forecast period. The region is characterized by a large number of thermal energy storage systems, which are utilized for space heating, water heating, district heating and cooling, and power generation. Spain is the largest contributor to the regional market growth owing to the large number of operational TES projects across the country, along with presence of major players, such as Abengoa Solar.

The government of Europe has developed a model which stores and distributes the energy as per the density of population in a specific region. This model is widely known as the European model. The federal government of Germany heavily invests in advanced research for the electrical energy storage field, pertaining to the storage field’s use in solar panels utilized for residential purposes.

The Engineering and Physical Sciences Research Council (EPSRC), UK, established the SUPERGEN Energy Storage Hub, for the research & development in energy storage technologies. The organization comprises of the participation of 7 universities & 14 companies. The various companies involved in this organization include, EDF Energy, Highview Power Storage, National Grid, Scottish & Southern Energy (SSE), UK Power Networks, PNU Power, Johnson Matthey, GDF SUEZ (UK), Department for Transport UK, Sharp Laboratories of Europe Ltd., Nexeon Ltd., Jaguar Land Rover, Energy Technologies Institute (ETI), and Arup (Ove Arup and Partner Ltd.) UK.

North America accounted for the second largest revenue share in 2019 owing to reduction in requirement for more extensive generation equipment during peak hour demand. Positive outlook towards renewable based power generation, along with increasing research and development activities aimed at energy storage systems, will augment the U.S. market growth.

The U.S. government is actively investing in renewable energy plants in order to achieve a future with sustainable energy. According to IEA, the government of the U.S. has introduced multi-year extension on tax credits for installation and operation of energy plants employing renewable energy, such as concentrating solar power (CSP), and thermal energy storage stations. Supportive government environment policies for the installation and operation of renewable energy plants & power stations are thereby boosting the regional demand for thermal energy storage.

The Government of the State of New York has established the Battery and Energy Storage Technology (NY-BEST) commercialization and test center in Rochester. The facility encompasses an area of 18,000 sq. ft. and costed approximately USD 23 million. The facility includes a collaboration of Rensselaer Polytechnic Institute, Troy, and Cornell University, Ithaca, which pull their resources together for validating various forms of energy storage for residential & commercial use.

The market in the Asia Pacific is anticipated to expand at the highest CAGR of 14.3% over the forecast period. Developing nations such as China, India, South Korea, Japan, Indonesia, and Malaysia are witnessing rapid growth in urbanization and population. These developing nations have many unreliable power grids and fundamental infrastructure systems. This factor is expected to compel industry participants to invest in these nations, and thus boost the growth of installations of thermal energy storage and distribution grids.

In India, the solar energy system capacity addition in 2017-18 was greater than that of all other energy sources, both renewable and conventional. The onshore wind energy capacity also experienced an increase in the region. Coal and wind energy added 4.6GW and 1.7GW respectively in 2017-18. The developing nation is expected to witness a rise in its thermal energy storage systems over the forecast period.

Key Companies & Market Share Insights

Industry participants are integrating advanced technologies into the existing technology to enhance the product demand through the provision of improved thermal energy management systems. Furthermore, eminent players are emphasizing on inorganic growth ventures as a part of their strategic expansion. Some of the prominent players in the global thermal energy storage market include:

-

BrightSource Energy Inc.

-

SolarReserve LLC

-

Abengoa SA

-

Terrafore Technologies LLC

-

Baltimore Aircoil Company

-

Ice Energy

-

Caldwell Energy

-

Cryogel

-

Steffes Corporation

Thermal Energy Storage Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.2 billion

Revenue forecast in 2027

USD 7.74 billion

Growth Rate

CAGR of 9.45% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, storage material, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Russia; Germany; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

BrightSource Energy Inc.; SolarReserve LLC; Abengoa SA; Terrafore Technologies LLC; Baltimore Aircoil Company; Ice Energy; Caldwell Energy; Cryogel; Steffes Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Thermal Energy Storage Market Segmentation

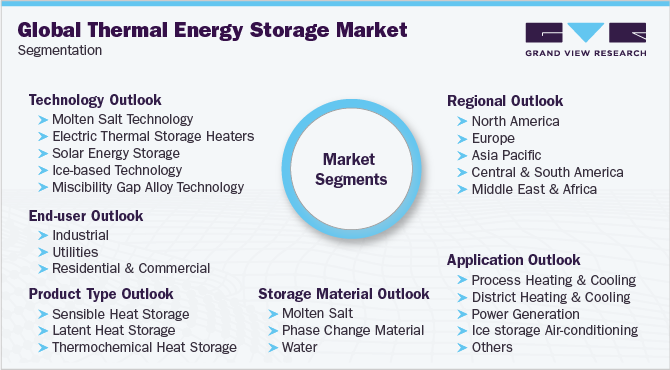

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global thermal energy storage market report on the basis of product type, technology, storage material, application, end user, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Sensible Heat Storage

-

Latent Heat Storage

-

Thermochemical Heat Storage

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

Molten Salt Technology

-

Electric Thermal Storage Heaters

-

Solar Energy Storage

-

Ice-based Technology

-

Miscibility Gap Alloy Technology

-

-

Storage Material Outlook (Revenue, USD Million, 2016 - 2027)

-

Molten Salt

-

Phase Change Material

-

Water

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Process Heating & Cooling

-

District Heating & Cooling

-

Power Generation

-

Ice storage air-conditioning

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2027)

-

Industrial

-

Utilities

-

Residential & Commercial

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Russia

-

Germany

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global thermal energy storage market size was estimated at 4.38 Billion in 2019 and is expected to reach USD 4.78 billion in 2020.

b. The global thermal energy storage market is expected to witness a compound annual growth rate of 12.6% from 2020 to 2027 to reach USD 10.1 billion by 2027.

b. Sensible heat storage was the largest segment accounting for 46.22% of the total volume in 2019 owing to applicability across large scale heating, ventilation, and air conditioning (HVAC) systems.

b. Some key players operating in the thermal energy storage market include BrightSource Energy Inc., SaltX Technology Holding AB, Aalborg CSP A/S, SolarReserve LLC, Terrafore Technologies LLC, Abengoa SA, and Baltimore Aircoil Company.

b. Key factor driving the growth of the thermal energy storage market include growing thermal energy storage demand in end-use industries such as power generation and heating, ventilation, & air conditioning (HVAC) applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.