- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastic Polyester Elastomer Market Size Report, 2030GVR Report cover

![Thermoplastic Polyester Elastomer Market Size, Share & Trends Report]()

Thermoplastic Polyester Elastomer Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Injection Molding, Extrusion Molding), By End-use (Medical, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-976-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

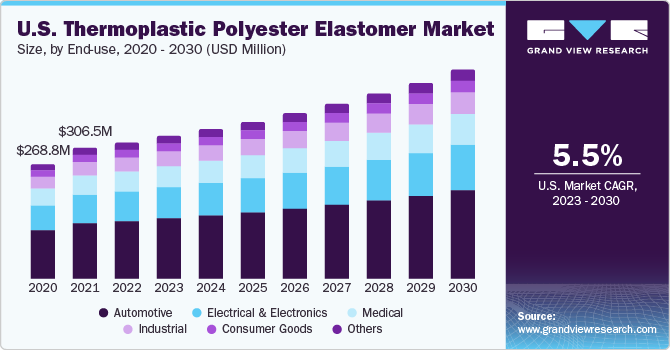

The global thermoplastic polyester elastomer market size was estimated at USD 1.52 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.34% from 2023 to 2030. Increasing adoption of lightweight products in several end-use industries including automotive, medical, and consumer goods, among others is expected to boost the market growth over the forecast period. The growing demand for thermoplastic polyester elastomer (TPEE) in electronic devices, electronic housings, gadgets, and others is expected to contribute to the growth of the market. The increasing preferences for lightweight electronics and wearables are expected to propel the demand for TPEE in the coming years.

The market in the U.S. is predicted to experience significant growth in recent years, with several factors driving the market. Increasing demand for automotive components is predicted to be a primary driver of the global market throughout the forecast period. The surge in technological developments in TPEE production processes, along with consumer awareness of the health and environmental repercussions of plastics, are also predicted to boost the market growth.

The U.S. medical industry has witnessed significant growth in the thermoplastic polyester elastomer (TPEE) market. It is used in catheters, tubing, and seals owing to their several properties such as flexibility, lightweight, anti-fatigue, heat resistance, and others. The increasing use of TPEE in medical devices, instruments, and equipment is expected to boost production and development in the market.

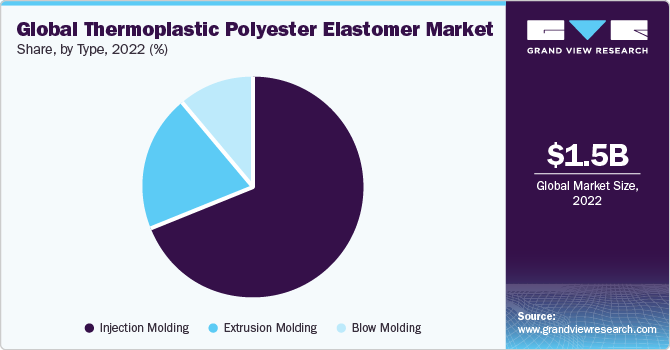

Type Insights

Based on type, the injection molding vehicle segment accounted for the largest revenue share of over 68.0% in 2022. Injection molding is one of the most common techniques for processing TPEE. Injection molding grade TPEE is utilized in a variety of applications, including automotive parts, electrical and electronic components, and consumer items. The injection molding technology for thermoplastic polyester elastomers (TPEEs) is expected to drive growth in the TPEE market.

The growing demand for high-performance materials in a variety of end-use sectors is likely to boost the demand for injection molding grade TPEE. Injection molding provides high precision and repeatability to the resin, making it an ideal material for several end-use applications.

The extrusion molding is expected to grow at a significant rate over the forecast period. Extrusion molding for thermoplastic polyester elastomers is an integral process that is expected to contribute to the TPEE market growth. Extrusion molding helps to manufacture objects such as tubes, hoses, profiles, and films. Extruded TPEE weather-stripping, seals, and gaskets are employed in the construction industry, particularly in energy-efficient and green building designs.

End-use Insights

Based on end-use, the automotive segment dominated the market and accounted for the largest revenue share of over 129% in 2022. Increasing plastics usage in automotive components, as well as concurrent increases in heavy-duty vehicle production, passenger car production, and increased demand for electric vehicles, are likely to fuel growth over the projection period.

The rising penetration of electrical vehicles across the globe owing to the biocompatibility offered by the product is expected to boost the consumption and manufacturing of TPEE in the automotive industry. TPEE are used in a variety of applications in the automotive industry, including the production of high-quality automotive instrument panels, seat backs, airbag deployment doors, air intake ducting, wheel covers, dashboard components, door liners and handles, pillar trim, and consumer goods components, among others. In addition, TPEE is increasingly used to replace vulcanized rubber and flexible polyvinyl chloride (PVC), with the goal of reducing vehicle weight for higher fuel efficiency and lower CO2 and NOx gas emissions, along with achieving greater recyclability for environmental sustainability.

Medical and healthcare expenditures have also risen significantly in recent years, demanding rapid production of lightweight and durable medical equipment and gadgets. The segment is expected to increase at an exponential rate, mainly in emerging economies such as India, Indonesia, Thailand, Argentina, and Mexico.

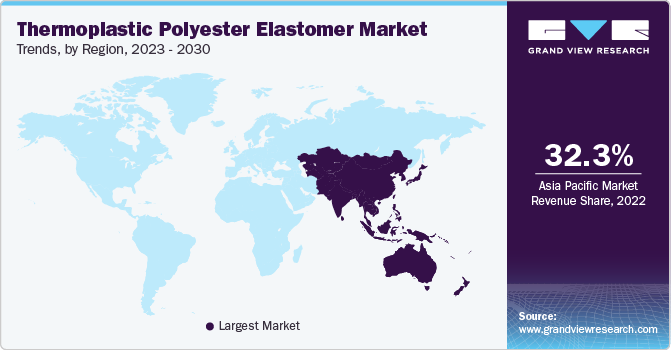

Regional Insights

The Asia Pacific region dominated the market and accounted for the largest revenue share of over 32.30% in 2022. The increasing manufacturing sector is expected to fuel the demand for TPEE compounds in the automotive, industrial machinery, packaging, and electrical and electronics industries. TPEEs are widely employed in automotive applications such as seals, gaskets, and interior components, contributing to the overall growth of the TPEE market in the region.

The continuously growing automotive manufacturing companies serve to fill the product gaps in the local market. China, Indonesia, India, and Bangladesh are expected to be the main factors driving the rise of the regional market. In addition, a robust electrical and electronics manufacturing base in China and South Korea is likely to influence the demand for thermoplastic polyester elastomer, thus driving market growth.

Europe is expected to grow at a significant CAGR in the coming years. The rise in the industrial sector in the region owing to the widening of the scope of machine parts and accessories is likely to boost TPEE consumption in the region.TPEEs possess superior strength, durability, and resistance to wear and tear, making them suitable for a wide range of industrial components and parts. The expansion of numerous industrial sectors, such as manufacturing, construction, and energy, has raised demand for materials such as TPEEs, particularly in emerging economies.

Key Companies & Market Share Insights

The market is highly competitive due to the presence of major industries across the region as these companies are comparatively concentrated and fiercely competitive along with acquisitions, mergers, and collaborations. For Instance, in June 2023, MM Polytrade Ltd announced the acquisition of acquisition of Celanese's business in thermoplastic copolyesters (TPC) and hotmelt polyesters manufactured in the Ferrara Donegani plant, as well as some assets present in the Forl compounding plant, through its existing subsidiary Taro Plast.

Key Thermoplastic Polyester Elastomer Companies:

- SABIC

- DuPont

- A. Schulman

- Teijin Plastics

- BASF SE

- Entec Polymers

- Covestro

- Celanese Corporation

- LG Chemicals

- Mitsubishi Engineering Plastics Corp.

- Arkema

- Chang Chun Group

- TOYOBO CO., LTD

- RadiciGroup

- Sunshine Plastics

Thermoplastic Polyester Elastomer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.59 billion

Revenue forecast in 2030

USD 2.28 billion

Growth rate

CAGR of 5.34% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

SABIC; DuPont; A. Schulman; Teijin Plastics; BASF SE; Entec Polymers; Covestro; Celanese Corporation; LG Chemicals; Mitsubishi Engineering Plastics Corp.; Arkema; Chang Chun Group; TOYOBO CO., LTD.; RadiciGroup; Sunshine Plastics.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

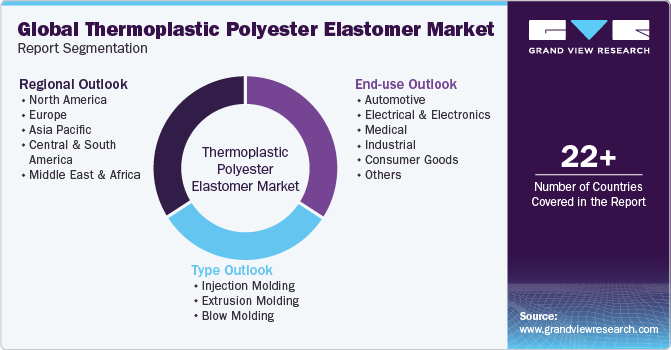

Global Thermoplastic Polyester Elastomer Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermoplastic polyester elastomer market report based on type, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding Grade

-

Extrusion Molding Grade

-

Blow Molding Grade

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Medical

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermoplastic polyester elastomer market size was estimated at USD 1.52 billion in 2022 and is expected to reach USD 1.59 billion in 2023.

b. The global thermoplastic polyester elastomer market is expected to grow at a compound annual growth rate of 5.34% from 2023 to 2030 to reach USD 2.28 billion by 2030.

b. The automotive segment dominated the thermoplastic polyester elastomer market with a share of 40.88% in 2022. This is attributable to the high usage of TPEE in seating & windows, passenger airbags, safety belt tensioners, and more.

b. Some of the key players operating in the thermoplastic polyester elastomer market include SABIC; DuPont; A. Schulman; Teijin Plastics; BASF SE; Entec Polymers; Covestro; Celanese Corporation; LG Chemicals; Mitsubishi Engineering Plastics Corp.; Arkema; Chang Chun Group; TOYOBO CO., LTD.; RadiciGroup; and Sunshine Plastics.

b. Key factors driving the thermoplastic polyester elastomer market growth include increasing adoption of TPEE for lightweight automobiles, wearable electronics, and expanding medical & healthcare facilities.

b. The Asia Pacific dominated the thermoplastic polyester elastomer market with a share of 32.35% in 2022. China and India are expected to have a significant market share in the region. The growing manufacturing sector in the region is expected to drive TPEE compound demand in industrial machinery, automotive, packaging, and electrical & electronics industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.