- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastic Vulcanizates Market Size, Share Report, 2030GVR Report cover

![Thermoplastic Vulcanizates Market Size, Share & Trends Report]()

Thermoplastic Vulcanizates Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Fluid Handling), By Grade, By Processing Method, By Region, And Segment Forecasts

- Report ID: 978-1-68038-362-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoplastic Vulcanizates Market Summary

The global thermoplastic vulcanizates market size was estimated at USD 1,650.3 million in 2023 and is projected to reach USD 2,921.80 million by 2030, growing at a CAGR of 8.7% from 2024 to 2030. The market for thermoplastic vulcanizates (TPV) is expected to grow during the forecast period due to rising demand for lightweight, environmentally friendly solutions that offer exceptional durability as well as increased safety.

Key Market Trends & Insights

- North America dominated the global Thermoplastic Vulcanizates Market with a revenue share of 34.0% in 2023.

- The thermoplastic vulcanizates market in Asia Pacific is expected to be one of the fastest-growing markets over the forecast period.

- Based on grade, the natural segment held the largest share, 54.1%, in 2023.

- Based on processing method, the Injection molding segment held the largest share in 2023.

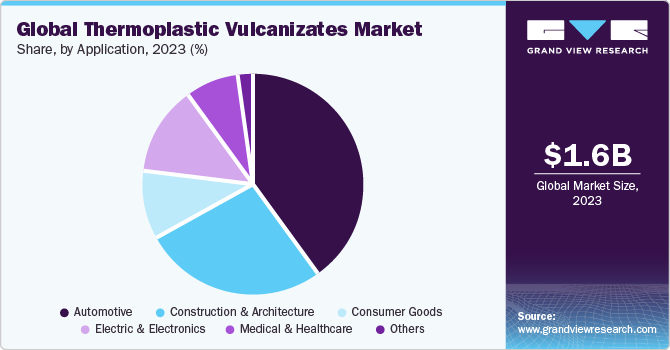

- Based on application, automotive segment emerged as the largest application segment in 2023 in terms of revenue.

Market Size & Forecast

- 2023 Market Size: USD 1,650.3 Million

- 2030 Projected Market Size: USD 2,921.80 Million

- CAGR (2024-2030): 8.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

High-performance elastomers known as thermoplastic vulcanizates (TPV) provide exceptional flexibility, processing ease, durability, and resistance to heat, fluids, and chemicals. Due to these qualities, they may be used to create lightweight automobile parts, including car doors, weather seals, and engine-related elements.Thermoplastic Vulcanizates (TPV) are now increasingly being used as an alternative to PVC plastic due to several stringent regulations regarding the use of polyvinyl chloride (PVC) in the automotive industry, which in turn is expected to increase market demand in the coming years. In addition, a strong shift towards replacing metals with lightweight materials such as thermoplastic vulcanizates (TPV) to improve fuel efficiency in automobiles is expected to increase demand for thermoplastic vulcanizates (TPV) during the forecast period.

TPVs are widely used for making automobiles' interior and exterior components, such as wiper systems, air guides and dams, spoilers and trims, and flappers. The inclination of consumers toward fuel-efficient vehicles across the globe is leading to rising demand for TPV in the automotive application and is expected to drive market growth over the forecast period.

Favorable federal regulations set by agencies such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) on carbon emissions, along with EU initiatives to develop a TPV app to build light and fuel-efficient vehicles, are likely to boost market growth. The high raw material costs associated with EPDM are expected to hinder profitability.

Favorable government policies for encouraging lightweight and recyclable material applications in various industries including automotive and construction are expected to support the demand for thermoplastic vulcanizates over the forecast period. The investment of USD 2 trillion by the U.S. government as a part of the coronavirus responsible for the development of infrastructure, including hospital building and construction, is expected to further propel the demand for thermoplastic vulcanizates (TPV) in medical and fluid handling applications in the coming years.

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include Dawn Polymer, Ravago Manufacturing, RTP Company, Mitsui Corporation Inc., Celanese Corp., Trinseo, among others. Several players are engaged in framework development to improve their market share.

TPV market is characterized by a moderate level of product substitutes. TPV are high-performance elastomers that provide exceptional durability, flexibility, and resistance to heat, liquids, and chemicals. One of the potential substitutes for TPV is thermoplastic olefins (TPO). TPO is a type of thermoplastic elastomer (TPE) that can be used in the same applications as TPV, such as car interior components. The shift in regulatory scenario and government policies to support electric vehicles (EVs) are expected to fuel the demand for TPO, as these materials are used in EVs, due to their superior performance compared to traditional materials.

Furthermore, the TPV market is highly innovative. The key market players are increasingly developing innovative solutions to consolidate their position while being highly competitive. For instance, In October 2023, Celanese Corp. announced the launch of new products in the Fakuma 2023 trade fair. The products included Santoprene TPV Eco-R, Tecnoprene PP Eco-R, and Celanex PBT Eco-R. Celanese has further enhanced its Santoprene TPV's sustainability credentials by incorporating post-consumer recyclate into its formulations. The first two grades of the TPV contain a minimum of approximately 15% or 25% post-consumer recyclate (PCR). Celanese has estimated that utilizing these formulations can reduce carbon emissions by up to 59% compared to an EPDM rubber-based part with similar characteristics. The material can be employed in automotive weather seals, EV cooling lines, children's toys, garden hoses, and more.

Grade Insights

The natural segment held the largest share, 54.1%, in 2023 and is characterized by the material's inherent properties and easy customizability. Natural grade TPVs refer to uncolored or naturally colored versions of TPVs, valued for their versatility and ease of customization. These materials are extensively used across various industries due to their inherent properties, including flexibility, durability, and resistance to chemicals and extreme temperatures. Their neutral color allows easy coloring and customization to meet specific design requirements.

The standard black segment is anticipated to witness substantial growth, primarily due to its extensive application in various industries such as automotive and construction. It is distinguished by its inherent color, which offers exceptional ultraviolet (UV) resistance and durability. Consequently, this grade is a favored choice for applications demanding robust performance in challenging environments.

Processing Method Insights

Injection molding dominated the processing method segment in 2023; it is experiencing significant growth owing to the increasing demand for lightweight and high-performance materials from the automotive industry. Thermoplastics vulcanizates (TPVs) are widely used in the production of automotive components such as seals, gaskets, and interior trims. These materials help manufacturers reduce vehicle weight, improve fuel efficiency, and lower emissions, which are critical requirements as per the environmental regulations worldwide.

Companies are increasingly investing in research and development (R&D) to drive innovation and gain a competitive edge in the market. In August 2023, Teknor Apex Company, Inc. announced the launch of a new Sarlink RX 3100B Series of TPVs. They contain up to 40% recycled content and are suitable for injection molding. These multi-purpose TPVs are used in various automotive applications, such as extruded seals, and offer sustainability benefits by reducing dependency on virgin petroleum-based plastics.

The extrusion molding segment held a significant revenue share of the TPVs market in 2023 and is expected to witness substantial growth over the forecast period. Extrusion molding, a manufacturing process in which TPVs are melted and shaped into continuous forms such as tubes, profiles, and sheets, is widely used across industries due to its efficiency and consistent quality of its output.

Application Insights

In terms of revenue, automotive emerged as the largest application segment in 2023, and this trend is projected to continue over the forecast period. Over the forecast period, the growing demand for lightweight and high-performance materials in the automotive industry is projected to boost the demand for thermoplastic vulcanizates (TPV). Furthermore, favorable government regulations regarding the application of lightweight materials and better fuel efficiency are expected to drive the global market for TPVs in the automotive industry.

In the automotive sector, thermoplastic vulcanizates (TPVs) are increasingly used as an alternative for thermoset rubbers, such as chlorosulfonated polyethylene, styrene-butadiene rubber (SBR), and ethylene propylene diene monomer (EPDM), owing to their properties such as low maintenance, better reliability, low cost of manufacturing of parts, and safety. Some of the applications of TPVs in the automotive segment include weather seals for glass run channels, sunroofs, windshields, and roof lines. They are also used for manufacturing various lightweight interiors and exteriors such as flapper door seals, air guides and dams, spoilers and trims, wiper systems, handles and grips, and mats and cup holders.

The medical & healthcare segment is projected to witness the fastest CAGR through the forecast period. The high demand for advanced healthcare services owing to the availability of well-developed healthcare infrastructure, increasing incidences of cardiovascular diseases, and rising aging population globally is anticipated to drive the demand for medical devices, which, in turn, is expected to have a positive impact on the demand for TPVs in medical application.

Regional Insights

North America thermoplastic vulcanizates market dominated the global TPV industry in 2023. The large market share is attributed to strong demand from the automobile industry as well as from other end-use industries such as healthcare and consumer goods. Favorable government regulations pertaining to thermoplastic vulcanizates (TPV) consumption in automotive applications as an alternative for alloys and metals along with growing passenger car production in the U.S. and Mexico are expected to further propel the regional demand for TPV over the forecast period.

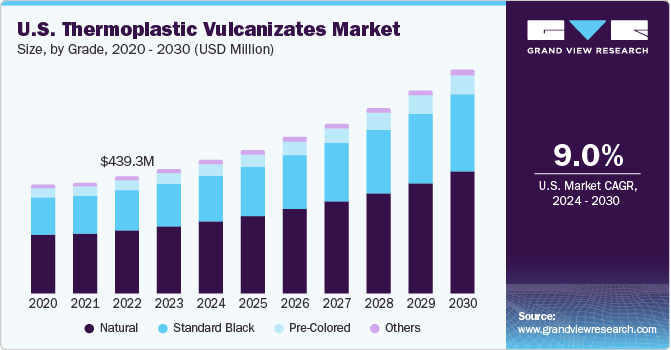

U.S. Thermoplastic Vulcanizates Market Trends

The U.S. TPV Market held the largest share in the North American region in 2023. The rising demand for TPV from the automotive and construction industries in the U.S. is expected to drive market growth over the forecast period. The shifting focus of the U.S. automotive industry toward fuel-efficient and electricity-powered cars has resulted in the extensive use of high-performance materials for manufacturing auto components, which, in turn, has promoted the use of TPV as an alternative to heavy-weight metals and alloys.

Asia Pacific Thermoplastic Vulcanizates Market Trends

The thermoplastic vulcanizates market in Asia Pacific is expected to be one of the fastest-growing markets over the forecast period, primarily driven by the ascending demand for the product from key industries, including automotive, electrical & electronics, and building and construction, in emerging economies, such as China and India.

The China thermoplastic vulcanizates market led the Asia Pacific region in 2023. China is the largest producer of automobiles and a prominent player in the electrical & electronic components market, owing to the presence of leading manufacturers, such as Dongfeng Motor Company, Great Wall Motors, Xiaomi Corporation, Hisense Co., Ltd., and Sumitomo Electric Industries, Ltd. Increasing investments by major automotive manufacturers in the country led to the growing production of all types of vehicles, including LCVs, HCVs, and passenger cars. In addition, the demand for lightweight and electric vehicles (EVs) is increasing in the country, which is expected to have a positive impact on the demand for TPV in the coming years.

The thermoplastic vulcanizates market in India is projected to witness substantial growth over the forecast period, owing to the rising demand for TPV for various applications in end-use industries, such as automotive, consumer goods, medical, and construction.

Europe Thermoplastic Vulcanizates Market Trends

The thermoplastic vulcanizates market in Europe is among the leading manufacturers of automobiles and is expected to continue its dominance in the sector over the forecast period. The rising demand for lightweight electric and hybrid vehicles, along with the presence of major automotive manufacturers including AUDI AG, BMW AG, Mercedes-Benz AG, JAGUAR LAND ROVER LIMITED, ASTON MARTIN, Volkswagen, Volvo Car Corporation, FCA Italy S.p.A., Ferrari S.p.A., Automobili Lamborghini S.p.A., and Porsche Austria GmbH & Co. in the region, is projected to result in the expansion of the automotive industry, which, in turn, is expected to drive the demand for TPV in the automotive industry over the forecast period.

The Germany thermoplastic vulcanizates market dominated the region in 2023. Germany is one of the most prominent automotive markets in Europe. According to the International Organization of Motor Vehicle Manufacturers, the country produced over 4.1 million units of total vehicles in 2023. The country is a prominent producer of passenger cars among all the member countries of the European Union (EU) and accounts for more than 29% share of the European automotive market. These factors are expected to contribute to the growth of the TPV market over the forecast period.

The thermoplastic vulcanizates market in the UK is poised to grow at a significant CAGR over the forecast period. The automotive industry in the country is expected to witness a period of intense technological innovations, which is expected to shape the growth of the industry over the foreseeable future. Initiatives toward new product developments, including driverless cars, EVs, and hybrid cars, are expected to increase investments in the industry. In addition, emerging trends to cut down vehicle emissions and develop cleaner cars are leading to the development of electric cars. All these factors are expected to have a positive impact on the growth of the automotive industry in the country, which, in turn, is anticipated to propel the demand for TPV over the forecast period.

Central & South America Thermoplastic Vulcanizates Market Trends

The market in Central & South America (CSA) is expected to witness significant growth, owing to the increasing investments in the automotive sector. The increasing trend of lightweight vehicles in Argentina, Brazil, and Columbia is expected to boost the demand for TPV over the forecast period.

Middle East & Africa Thermoplastic Vulcanizates Market Trends

Rapid industrialization, coupled with improving infrastructure in the Middle East, is expected to positively impact product demand. The growth of the construction sector, mainly in the UAE and Qatar, owing to the economic recovery, advanced real estate regulatory framework, and increasing number of infrastructure projects, is expected to drive the demand for TPV in various fluid handling systems used in the construction sector.

Key Thermoplastic Vulcanizates Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In August 2023, Teknor Apex Company, Inc. announced the launch of its new Sarlink RX 3100B Series of TPVs containing up to 40% recycled content. These multi-purpose TPVs are suitable for various automotive applications, such as extruded seals, and offer sustainability benefits by reducing dependency on virgin petroleum-based plastics. The two new grades, with 84 Shore A and 94 Shore A hardness, are based on the existing Sarlink 3100 Series technology but incorporate post-industrial recycled (PIR) content, which provides a more controlled and consistent raw material stream compared to post-consumer recycled (PCR) content.

Key Thermoplastic Vulcanizates Companies:

The following are the leading companies in the thermoplastic vulcanizates market. These companies collectively hold the largest market share and dictate industry trends.

- Dawn Polymer

- Ravago Manufacturing.

- RTP Company

- DuPont de Nemours, Inc.

- Mitsui Chemicals Inc.

- Celanese Corp.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corp.

- KRAIBURG TPE GmbH & Co. KG

- Teknor Apex Company, Inc.

- Trinseo

- Hexpol AB

- JSR Corporation

- Zeon Corporation

Thermoplastic Vulcanizates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,767.89 million

Revenue forecast in 2030

USD 2,921.80 million

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Tons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, processing method, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Eastern Europe; Japan; China; India; Australia; South Korea

Key companies profiled

Dawn Polymer; Ravago Manufacturing; RTP Company; DuPont de Nemours, Inc.; Mitsui Chemicals Inc.; Celanese Corp.; LyondellBasell Industries Holdings B.V.; Mitsubishi Chemical Corp.; KRAIBURG TPE GmbH & Co. KG; Teknor Apex Company, Inc.; Trinseo; Hexpol AB; JSR Corporation; Zeon Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermoplastic Vulcanizates Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermoplastic vulcanizates market report based on grade, processing method, application, and region:

-

Grade Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Standard Black

-

Pre-Colored

-

Others

-

-

Processing Method Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Extrusion Molding

-

Blow Molding

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Exteriors

-

Interiors

-

-

Construction & Architecture

-

Consumer goods

-

Electric & Electronics

-

Medical & Healthcare

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Eastern Europe

-

Russia

-

Poland

-

Hungary

-

Czech Republic

-

Belarus

-

Bulgaria

-

Romania

-

Slovakia

-

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global thermoplastic vulcanizates market size was estimated at USD 1.65 billion in 2023 and is expected to reach USD 1,767.89 million in 2024.

b. The global thermoplastic vulcanizates market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 2,921.80 million by 2030.

b. North America dominated the TPV market with a share of more than 34% in 2022. This is attributable to strong demand from the automobile industry as well as from other end-use industries such as medical and consumer goods.

b. Some of the key players operating in the global TPV market include Exxon Mobil Corporation; JSR Corporation; RAVAGO Manufacturing; Mitsui Chemicals; Kumho Polychem Co., Ltd.; Lyondellbasell Industries N.V.; Celanese Corporation; and Mitsubishi Chemical.

b. Key factors driving the TPV market growth include increasing consumption of lightweight materials in vehicles and rising demand for biobased thermoplastic vulcanizates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.