- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastic Elastomers Market Size & Share Report, 2030GVR Report cover

![Thermoplastic Elastomers Market Size, Share & Trends Report]()

Thermoplastic Elastomers Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Industrial, Medical), By Material (Poly Styrenes, Poly Olefins), By Region, And Segment Forecasts

- Report ID: 978-1-68038-478-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoplastic Elastomers Market Summary

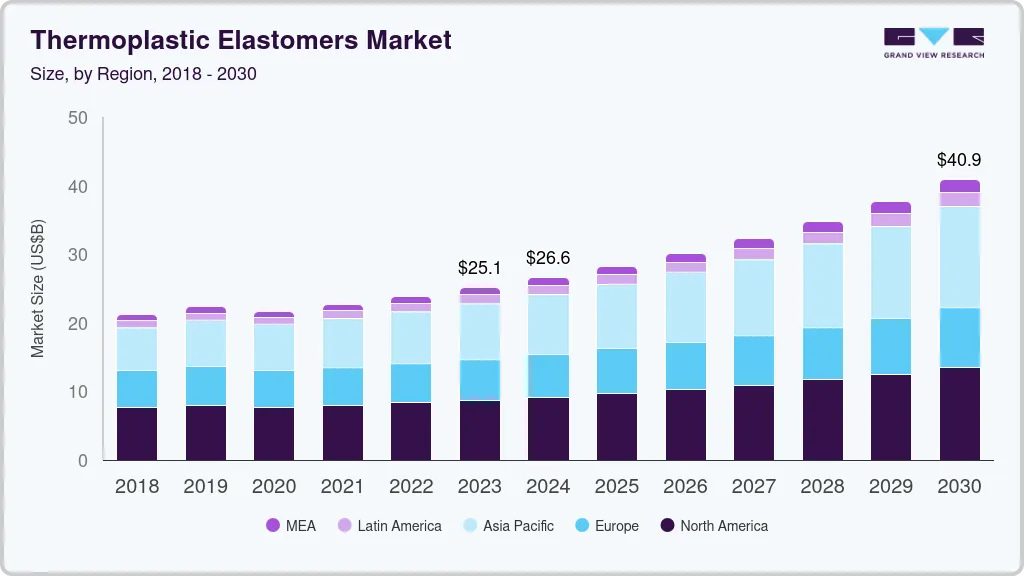

The global thermoplastic elastomers market size was estimated at USD 25.15 billion in 2023 and is projected to reach USD 40.9 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The rising demand for flexible and durable materials such as Thermoplastic Elastomer (TPEs) in various industries, such as automotive, construction, and consumer goods, drives the market's growth worldwide.

Key Market Trends & Insights

- North America thermoplastic elastomers market dominated the global market with a revenue share of 34.7% in 2023.

- The thermoplastic elastomers market in Asia Pacific is expected to register the fastest CAGR of 9.1% in the forecast period.

- The thermoplastic elastomers market in the U.S. dominated the North American market with a revenue share of 75.0% in 2023.

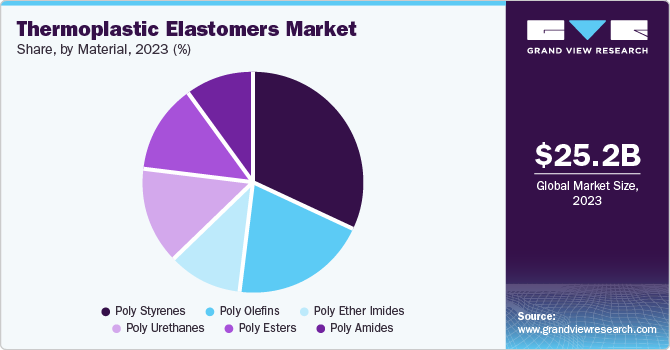

- Based on material, the poly styrenes segment led the market with a revenue share of 31.6% in 2023.

- In terms of application, the automotive segment dominated the market, with a revenue share of 40.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.15 Billion

- 2030 Projected Market Size: USD 40.9 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Due to their lightweight, flexibility, and durability, the increasing demand for lightweight and fuel-efficient vehicles has propelled the adoption of TPEs in automotive components, such as bumpers, seals, and interior components. Moreover, the surge in electric vehicles (EVs) has further amplified the demand for TPEs, which are essential for developing lightweight EV components with enhanced performance.

Another significant market driver is the rising demand for consumer electronics, where TPEs are used in mobile phone cases, cables, connectors, and various electronic components. The increasing adoption of advanced technologies in everyday devices has fueled the demand for TPEs, which offer unique properties such as flexibility, durability, and excellent aesthetic appeal. Moreover, the growing trend towards lightweight and portable electronic devices has led manufacturers to opt for TPEs, which provide a smooth finish, resistance to wear and tear, and ease of processing.

Furthermore, the growing emphasis on sustainability has driven the demand for bio-based thermoplastic elastomers and eco-friendly alternatives supporting environmental protection initiatives. The Asia-Pacific region is expected to dominate the market due to its strong manufacturing base and rapid growth in TPE consumption. Technological advancements in production processes and material formulations have also enhanced the performance characteristics of TPEs, making them more attractive for various applications.

Application Insights

The automotive segment dominated the market, with a revenue share of 40.7% in 2023. The automotive industry drives demand for TPEs due to their lightweight, durable, and flexible properties, which are utilized in manufacturing vehicle components such as seals, hoses, and interiors.

thermoplastic elastomers medical applications are expected to grow at the fastest CAGR of 9.0% over the forecast period.The growing geriatric population in countries such as Japan, Germany, and the U.S. drives demand for medical devices. TPEs are gaining popularity in the medical field due to their biocompatibility, flexibility, and softness, making them ideal for applications such as medical tubing, catheters, and syringe components.

Material Insights

The poly styrenes segment led the market with a revenue share of 31.6% in 2023, driven by its versatility in various industries, including packaging, consumer goods, and automotive. This material offers a unique balance of flexibility, durability, and cost efficiency, making it a popular choice for manufacturing lightweight, high-performance products.

Poly-amide TPEs are projected to grow at the fastest CAGR of 8.8% over the forecast period. Nylon TPEs, a type of polyamide-based thermoplastic Elastomers, are known for their combination of rigidity and flexibility, providing excellent thermal and mechanical performance. These TPEs are specifically engineered for demanding environments and are commonly utilized in automotive and industrial applications that require strength and heat resistance.

Regional Insights

North America thermoplastic elastomers market dominated the global market with a revenue share of 34.7% in 2023, driven by robust demand from key industries such as automotive, construction, and consumer goods for TPEs. The region’s advanced manufacturing capabilities and emphasis on sustainable materials contribute to its dominance in the global market. Investment in innovation and product development also fuels growth.

U.S. Thermoplastic Elastomers Market Trends

The thermoplastic elastomers market in the U.S. dominated the North American market with a revenue share of 75.0% in 2023. Known for its advanced technological innovations in the automotive, healthcare, and electronics industries, the country’s strong technological infrastructure supports extensive R&D activities and promotes TPE utilization in various innovations.

Europe Thermoplastic Elastomers Market Trends

The thermoplastic elastomers market in Europe held a substantial market share in 2023. The region is expected to maintain its dominance in the sector, driven by growing demand for lightweight electric and hybrid vehicles. For instance, according to the European Commission, in 2023, 448.8 million people in the EU were above the age of 65, which is 21.3% of the total population. This is likely to boost the automotive industry, increasing demand for TPE, while the aging population’s need for medical tubing further drives demand.

Germany thermoplastic elastomers market led Europe in 2023 and is expected to grow lucratively over the forecast period. The country produced more than 4.1 million vehicles in 2023 and holds a significant share of the EU’s passenger car production. Given its widespread applications and benefits in automotive components, this dominance is expected to fuel market expansion further.

Asia Pacific Thermoplastic Elastomers Market Trends

The thermoplastic elastomers market in Asia Pacific is expected to register the fastest CAGR of 9.1% in the forecast period. Market growth in the region is fueled by industrialization, urbanization, and demand for lightweight, durable, and recyclable materials in industries such as automotive, construction, and consumer goods. The shift to EVs and fuel-efficient vehicles further accelerates demand, particularly in automotive applications.

China thermoplastic elastomers market dominated the Asia Pacific in 2023, owing to its manufacturing dominance and strong demand from the automotive, construction, electronics, and consumer goods sectors. The country’s emission reduction efforts and focus on sustainable development boost TPE adoption.

Key Thermoplastic Elastomers Company Insights

Some key companies operating in the market include BASF SE, Arkema, DuPont, Covestro AG, China Petrochemical Corporation, Dynasol Elastomerss, and EMS-CHEMIE HOLDING AG, among others. Organizations employ new product launches, partnerships, capacity expansions, and collaborations to increase their market presence and competitiveness.

-

Arkema manufactures commodity and specialty chemicals, specializing in industrial products such as fluorochemicals, thiochemicals, acrylics, and hydrogen peroxide, as well as performance chemicals and vinyl products.

-

Lubrizol Corporation is a specialty chemicals provider serving transportation, consumer, and industrial markets as a subsidiary of Berkshire Hathaway Inc. It operates through three business segments: Lubrizol Additives, Lubrizol Advanced Materials, and Lubrizol Advanced Solutions.

Key Thermoplastic Elastomers Companies:

The following are the leading companies in the thermoplastic elastomers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Arkema

- DuPont

- Covestro AG

- China Petrochemical Corporation

- Dynasol Elastomerss

- EMS-CHEMIE HOLDING AG

- Evonik Industries

- LG Chem

- LCY Chemical Corporation

- Lubrizol Corporation

- LyondellBasell Industries

- Tosoh Corporation

- Avient Corporation

- Teknor APEX Company

- The Dow Chemical Company

- TSRC Corporation

Recent Developments

-

In April 2024, Lubrizol Corporation and Eastman collaborated to enhance the adhesion strength of TPEs over-molded onto Eastman’s Tritan copolyester, demonstrating sustainable product improvements.

-

In March 2024, KRAIBURG TPE Americas collaborated with APTA Resinas to expand the distribution of TPE in Brazil and South America, successfully increasing market presence and availability in the region.

Thermoplastic Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.6 billion

Revenue forecast in 2030

USD 40.9 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

BASF SE; Arkema; DuPont; Covestro AG; China Petrochemical Corporation; Dynasol Elastomerss; EMS-CHEMIE HOLDING AG; Evonik Industries; Kraton Polymers LLC; LG Chem; LCY Chemical Corporation; Lubrizol Corporation; LyondellBasell Industries; Tosoh Corporation; Avient Corporation; Teknor APEX Company; The Dow Chemical Company; TSRC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

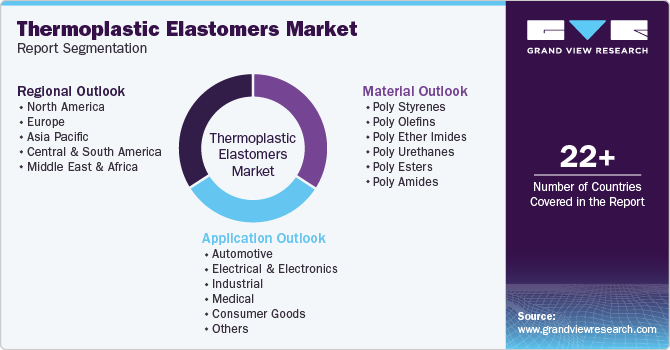

Global Thermoplastic Elastomers Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermoplastic elastomers market report based on application, material, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Medical

-

Consumer Goods

-

Others

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poly Styrenes

-

Poly Olefins

-

Poly Ether Imides

-

Poly Urethanes

-

Poly Esters

-

Poly Amides

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global thermoplastic elastomer market size was estimated at USD 25.15 billion in 2023 and is expected to reach USD 26.61 billion in 2024.

b. The global thermoplastic elastomer market is expected to grow at a compound annual growth rate of 7.4% from 2022 to 2030 to reach USD 40.90 billion by 2030.

b. The automotive segment dominated the thermoplastic elastomer market with a share of over 40.7% in 2023.The growing per capita income in developing and developed countries is spurring the demand for automotives for personal as well as commercial needs.

b. Some key players operating in the thermoplastic elastomer market include Advanced Elastomer Systems L.P., Arkema S.A., BASF SE, Bayer MaterialScience LLC, China Petroleum & Chemical Corporation, Dynasol Elastomers LLC, EMS group, Evonik Industries

b. Key factors that are driving the thermoplastic elastomer market growth include increasing demand in automotive component manufacturing and increasing consumer preference for high-performance and lightweight passenger cars.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.