- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoplastics In Construction Films Market, Industry Report, 2030GVR Report cover

![Thermoplastics In Construction Films Market Size, Share & Trends Report]()

Thermoplastics In Construction Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (LDPE, LLDPE, HDPE, PP), By Application (Moisture Barrier Films, Protective Films, Window & Door Films, Underslab Vapor Barriers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-566-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

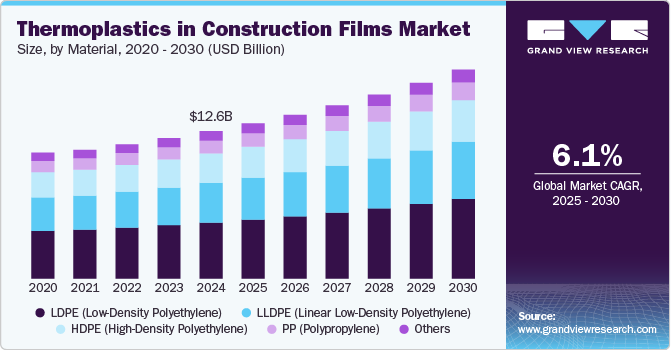

The global thermoplastics in construction films market size was estimated at USD 12.59 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. The anticipated growth of the thermoplastics in the construction films industry is likely to be fueled by a rise in construction activities, higher demand for moisture and weather protection solutions, innovations in recyclable thermoplastic films, and government policies encouraging the use of energy-efficient and sustainable building materials in both residential and commercial areas.

The market for thermoplastics used in construction films is anticipated to witness substantial growth due to various influences. An increase in global construction activities, especially in developing nations, is likely to drive the need for moisture barriers, protective films, and energy-efficient building materials. The growing focus on sustainability and eco-friendly building methods is predicted to promote the use of recyclable thermoplastics such as LDPE and LLDPE. Innovations in polymer technology are expected to enhance the functionality of thermoplastic films, improving their strength, UV resistance, and longevity.

The thermoplastics used in construction films industry is anticipated to experience considerable opportunities due to the increasing demand for sustainable and environmentally friendly materials. Biodegradable thermoplastic films are likely to become more popular in light of growing environmental concerns. The escalation of green building standards and energy-efficient construction initiatives is projected to boost the demand for thermoplastic films utilized in insulation, moisture barriers, and energy-efficient windows. The growth of construction activities in developing nations is expected to offer significant growth prospects. Furthermore, innovations in film technology, such as improved durability and recyclability, are predicted to further enhance market adoption.

However, the market is likely to encounter challenges due to the fluctuating prices of raw materials, mainly influenced by crude oil's unpredictability. This fluctuation directly affects the pricing structure of LDPE, LLDPE, and PP-based films. Furthermore, increasing environmental regulations and mounting pressure to decrease plastic usage are anticipated to hinder market growth, particularly in areas with stringent sustainability policies. The emergence of alternative eco-friendly materials is also projected to limit the growth prospects of traditional thermoplastic films throughout the forecast period.

Material Insights

The Low-Density Polyethylene segment recorded the largest revenue share of over 38.0%, in 2024. The demand for low-density polyethylene (LDPE) is projected to increase because of its versatility and extensive applications in construction films. LDPE is likely to remain the preferred option for moisture barrier films and protective sheeting due to its flexibility, affordability, and outstanding performance in challenging conditions. The rising need for sustainable, energy-efficient building materials, along with the expanding construction industry in developing countries, is anticipated to further boost the use of LDPE-based films in the market.

The Linear Low-Density Polyethylene segment is projected to grow at the fastest CAGR of 9.9% during the forecast period. The potential for growth of linear low-density polyethylene (LLDPE) in the construction films sector appears to be considerable. Due to its superior strength, puncture resistance, and flexibility, LLDPE is anticipated to perform well across various construction uses, such as moisture barrier films and protective coverings. With the rising demand for eco-friendly and affordable building materials, LLDPE’s recyclability and improved performance characteristics are likely to enhance its usage. Furthermore, the increasing construction activities in developing countries are expected to open up significant market opportunities for films made from LLDPE.

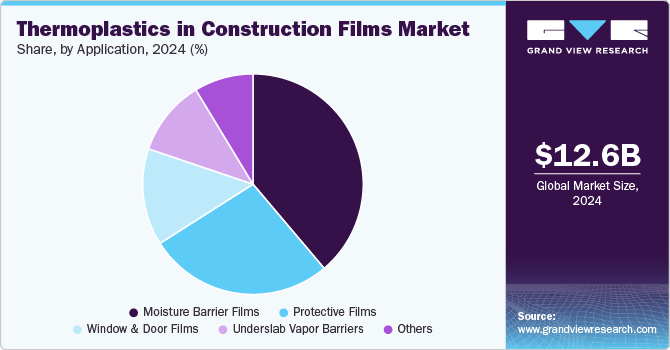

Application Insights

The moisture barrier films segment recorded the largest market share of 39.46% in 2024. The construction industry is anticipated to see a substantial increase in the demand for moisture barrier films, driven by a growing awareness of moisture management and building longevity. These films are projected to be essential in stopping water vapor penetration, preventing mold formation, and averting structural damage, particularly in areas with high humidity levels. As construction regulations shift towards creating more energy-efficient and durable buildings, the adoption of moisture barrier films is likely to increase. Furthermore, government initiatives aimed at improving insulation and indoor air quality are expected to enhance the growth of this market segment.

The protective films segment is projected to grow at a significant CAGR of 6.2% during the forecast period. The use of protective films in the construction sector is anticipated to experience significant growth due to the escalating demand for temporary surface protection during renovation and new building projects. These films are likely to see extensive application in safeguarding surfaces like glass, flooring, and metal panels from scratches, dust, and paint throughout the installation process. With the ongoing development of infrastructure and commercial real estate initiatives, the requirement for cost-effective and efficient protective solutions is projected to increase. Additionally, a rising focus on minimizing material damage and replacement expenses is expected to further bolster market expansion.

Regional Insights

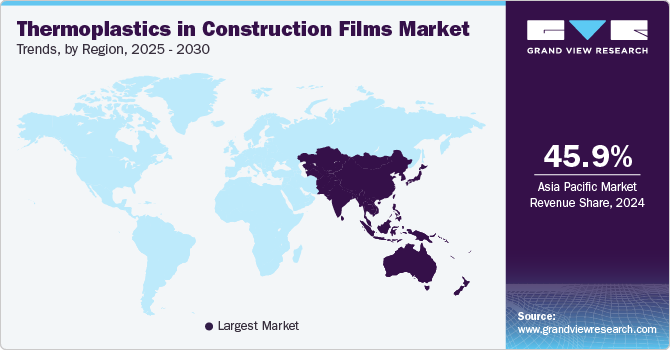

Asia Pacific dominated the thermoplastics construction films industry and accounted for the largest revenue share of 45.92% in 2024 and is anticipated to grow at a significant CAGR of 6.7% over the forecast period. The regional market is projected to experience significant growth due to rapid urban development, rising investments in infrastructure, and an increase in both residential and commercial construction activities in nations such as China, India, Indonesia, and Vietnam. The region will likely benefit from growing government initiatives that promote affordable housing and the development of smart cities. Furthermore, the heightened awareness regarding moisture protection, energy efficiency, and the utilization of long-lasting building materials is anticipated to drive the demand for thermoplastic films. The presence of a solid manufacturing base, access to inexpensive raw materials, and the rising need for sustainable construction solutions are also expected to contribute to the expansion of the regional market.

China's thermoplastics in construction films market growthis expected to be fueled by swift industrial growth, urban development, and continuous infrastructure projects. The Chinese government's emphasis on cost-effective housing, sustainable buildings, and urban revitalization efforts is likely to increase the demand for moisture barrier and protective films.

North America Thermoplastics in Construction Films Market Trends

The thermoplastic construction films sector in North America is anticipated to see consistent growth, supported by rising investments in residential, commercial, and infrastructure projects. Initiatives from the government promoting energy-efficient and sustainable construction methods are likely to boost the need for high-performance moisture barriers and protective films.

U.S. Thermoplastics in Construction Films Market Trends

The U.S. thermoplastics in construction films industry growth is expected to be spurred by the high demand in both residential and commercial building sectors, especially in the areas of new home construction and infrastructure improvements. Regulations from the government that advocate for energy efficiency, moisture management, and green building certifications such as LEED are anticipated to encourage the use of moisture barriers and protective films.

Europe Thermoplastics in Construction Films Market Trends

The Europe thermoplastic construction films industry is projected to grow consistently during the forecast period, propelled by strict regulations on building energy efficiency, a growing embrace of sustainable construction methods, and the refurbishment of outdated infrastructure. The demand for moisture barrier and protective films is anticipated to increase as countries focus on developing green buildings and thermal insulation options.

The thermoplastics in construction films market in Germany is driven by various important factors. The strong focus on energy-efficient and sustainable building methods in Germany is likely to increase the need for high-performance thermoplastic films, especially in uses such as moisture barriers and protective sheeting.

Key Thermoplastics In Construction Films Company Insights

Prominent players in the thermoplastics construction films sector include Berry Global Inc.; RKW Group; Saint-Gobain; Polifilm Group; and Inteplast Group. These firms command a substantial share of the market thanks to their robust production capabilities, varied product offerings, and well-established international presence. They supply an array of thermoplastic films utilized in different construction applications, such as moisture barriers, protective coverings, and vapor retarders. Leading companies are continuously innovating with sustainable and high-performance products, positioning themselves to take advantage of the increasing demand for energy-efficient and environmentally friendly construction materials.

-

In April 2024, RKW Group presented its wide array of customized masterbatches and compounds at the Elmia Polymer 2024 trade fair in Jönköping, Sweden. Taking place from May 14 to 17, the event showcased RKW's polyolefin-based compounds and masterbatches, highlighting their use across various industries, including construction. The company's involvement demonstrated its dedication to delivering sustainable and high-performance film solutions tailored to the changing demands of the construction industry.

-

In February 2024, Berry Global launched its Circular Innovation and Training Center in Tulsa, Oklahoma. This facility, spanning 12,000 square feet, focuses on promoting sustainable flexible packaging solutions and offering practical training. The center is designed to expedite the creation of innovative products through advanced materials science and engineering, creating a collaborative environment for testing and developing groundbreaking stretch film projects aimed at maintaining the use of materials while protecting the environment.

Key Thermoplastics In Construction Films Companies:

The following are the leading companies in the thermoplastics in construction films market. These companies collectively hold the largest market share and dictate industry trends.

- Berry Global Inc.

- RKW Group

- Saint-Gobain

- Polifilm Group

- Inteplast Group

- 3M Company

- Toray Industries, Inc.

- Ginegar Plastic Products Ltd.

- Qenos Pty Ltd.

- Cosmoplast

Thermoplastics In Construction Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.25 billion

Revenue forecast in 2030

USD 17.84 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Segments covered

Material, application, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Berry Global Inc.; RKW Group; Saint-Gobain; Polifilm Group; Inteplast Group; 3M Company; Toray Industries, Inc.; Ginegar Plastic Products Ltd.; Qenos Pty Ltd.; Cosmoplast

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermoplastics In Construction Films Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermoplastics in construction films market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

LDPE (Low-Density Polyethylene)

-

LLDPE (Linear Low-Density Polyethylene)

-

HDPE (High-Density Polyethylene)

-

PP (Polypropylene)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Moisture Barrier Films

-

Protective Films

-

Window & Door Films

-

Underslab Vapor Barriers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thermoplastics in construction films market size was estimated at USD 12.59 billion in 2024 and is expected to reach USD 13.25 billion in 2025.

b. The global thermoplastics in construction films market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030, reaching USD 17.84 billion by 2030.

b. LDPE (Low-Density Polyethylene) segment dominated the Thermoplastics in Construction Films market with a share of 38.00% in 2024. The demand for LDPE (Low-Density Polyethylene) is projected to increase because of its versatility and extensive applications in construction films. LDPE is likely to remain the preferred option for moisture barrier films and protective sheeting due to its flexibility, affordability, and outstanding performance in challenging conditions.

b. Some key players operating in the thermoplastics in construction films market include Berry Global Inc., RKW Group, Saint-Gobain, Polifilm Group, Inteplast Group, 3M Company, Toray Industries, Inc., Ginegar Plastic Products Ltd., Qenos Pty Ltd., and Cosmoplast, among others.

b. Key factors that are driving the thermoplastics in construction films market growth include rise in construction activities, higher demand for moisture and weather protection solutions, innovations in recyclable thermoplastic films, and government policies encouraging the use of energy-efficient and sustainable building materials in both residential and commercial areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.