- Home

- »

- Medical Devices

- »

-

Thyroid Ablation Devices Market Size & Share Report, 2030GVR Report cover

![Thyroid Ablation Devices Market Size, Share & Trends Report]()

Thyroid Ablation Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Radiofrequency, Microwave), By Product (Thermal, Non-thermal), By Application (Cancer, Nodules), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-030-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thyroid Ablation Devices Market Trends

The global thyroid ablation devices market size was valued at USD 168.4 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.58% from 2024 to 2030. There is an increasing demand for thyroid ablation procedures as well as devices owing to the rising prevalence of thyroid cancer and thyroid nodules. According to the American Cancer Society, there were around 43,720 new thyroid cancer cases across the U.S. in 2023 . Moreover, a growing preference for minimally invasive surgeries and availability of technologically sound ablation procedures are expected to drive the thyroid ablation devices market globally.

Thyroid ablation devices are most frequently used and efficient for the treatment of thyroid nodules and thyroid cancers. Thyroid ablation procedures are efficient since, it is less invasive, and thus has a potential of fewer complications also helps in preserving more of the thyroid and help patients maintain normal thyroid function. Thyroid cancer is known to be at increased risk due to radiation exposure. The International Agency for Research on Cancer (IARC) has found that people who are overweight or obese are more likely than those who are not to get thyroid cancer. In regions where iodine intake is low, follicular thyroid cancers are more prevalent. Iodine-rich diets, however, may increase the risk of papillary thyroid cancer. Because it is added to table salt and other meals in the U.S., the majority of people consume enough iodine.

The integration of robotics and Artificial Intelligence (AI) has revolutionized thyroid ablation procedures. Robotic-assisted thyroid ablation allows increased precision and control, reducing the risk of complications and improving patient safety. AI algorithms aid in preoperative planning and real-time monitoring during the procedure, enhancing the accuracy and efficiency of thyroid ablation.

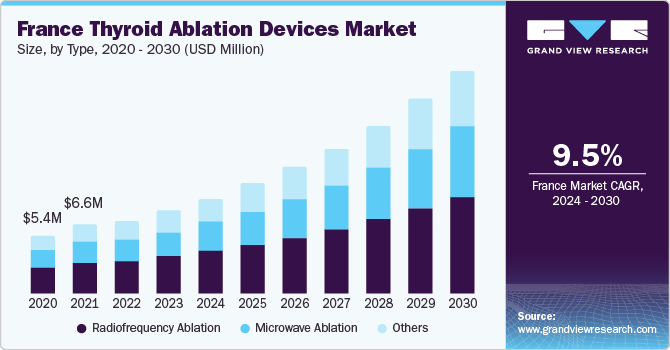

Type Insights

In 2023, radiofrequency ablation segment dominated the market and accounted for largest revenue share, since it significantly lessens the necessity for nodule surgery and application of radioactive iodine (RAI). The RFA process is less invasive, safe, and a rapid alternative to surgery, which leaves a visible scar. RFA also enables patients to get back to their daily activities with less time for recovery.

Microwave ablation segment is anticipated to witness lucrative growth with 9.71% CAGR during the forecast period owing to shorter treatment duration, a wider ablation zone, and less heat sink effect. A generator, a flexible cable, and an antenna make up the MWA system. It makes use of high-frequency electromagnetic waves with frequencies between 915 MHz and 2450 GHz.

Product Insights

Thermal based devices held over 70% of the market share in 2023. It is widely known that thermal ablation (TA) is an efficient and secure alternative for surgery of benign thyroid nodules (BTNs). However, several studies with longer follow-up times revealed a tendency for the treated thyroid nodules to enlarge after 2 to 3 years.

The non-thermal based devices are expected to grow at a fastest pace during the forecast period. Only cells can be destroyed by non-thermal based devices, keeping the extracellular structures’ functional qualities unaltered. It is thus possible to safely ablate tissues close to big blood arteries, the esophagus, or nerves using non-thermal based devices. This indicates that thyroid ablation next to the esophagus is effective.

Application Insights

In 2023, the thyroid cancers segment the application segment market with over 67% market share owing to increasing prevalence of thyroid cancer globally. For instance, according to the International Agency for Research on Cancer, the cases of thyroid cancer are estimated to reach 1,984,927 in 2025. The same source stated that thyroid cancer was the fifth most common cancer among females in 2020. The estimated global death toll for thyroid cancer in 2020 is 43,646. Thus, the aforementioned factors are expected to contribute to market growth over the forecast period.

The thyroid nodule segment is expected to exhibit the fastest growth rate during the forecast period, as reducing the size of thyroid nodules and regaining thyroid function are both possible outcomes of thyroid ablation, a non-surgical therapy approach. Increasing abnormal growth of thyroid nodules among individuals is anticipated to drive the product demand

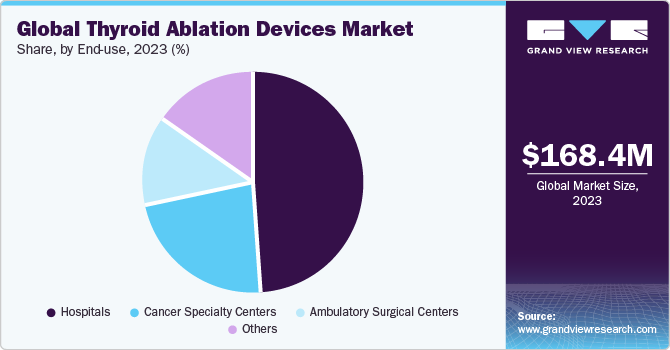

End-use Insights

Hospitals segment held the largest share of around 49% in 2023. Hospitals have technologically advanced medical devices and witness a significantly higher number of patients for treatments than other healthcare settings due to the simplicity of handling any issues that may arise after surgical procedures and the accessibility of a wide range of treatment alternatives in the setting.

The ambulatory surgical centers segment is expected to grow at a significant growth rate during the forecast period. Ambulatory surgical centers are medical units that operate in outpatient settings and do not require longer hospital stays. These centers provide emergency and urgent medical care in cases of trauma and accidental cases. Technological advancements and usage of minimally invasive techniques are major factors that can be attributed to the growth of ambulatory services. Ambulatory surgical centers provide cost-effective and high-quality alternative to inpatient hospital care for surgical interventions.

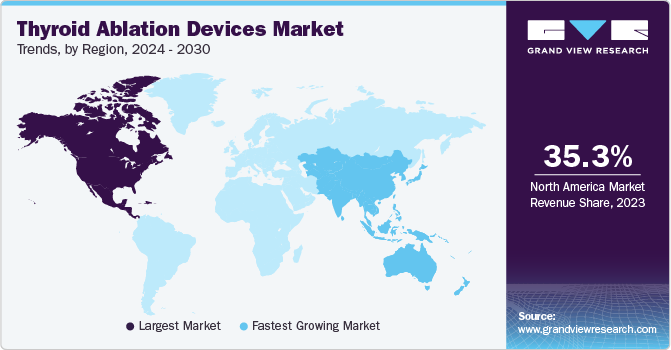

Regional Insights

North America dominated the market and accounted for the largest revenue share of 35.3% in 2023. Major factors that contribute to the growth of regional market include, increasing prevalence of thyroid cancer, presence of key players, and high purchasing power. For instance, according to the International Agency for Research on Cancer, in 2020 around 52,912 thyroid cancer cases were reported in the U.S., and the cases are expected to reach to 206,812 by 2025. The same source stated that in 2020 thyroid cancer accounted for 2,161 deaths in the U.S. Thus the growing prevalence of thyroid cancer is expected to boost market growth during the forecast period.

In Asia Pacific, the market for thyroid ablation devices is estimated to witness the fastest CAGR of 10.51% during the forecast period owing to the rising patient population and growing needs for better treatment in the region. Additionally, with government support, healthcare utilization throughout Asia Pacific is rising. For instance, in India, Ayushman Bharat a health insurance scheme offers financial support to underprivileged patients. An annual health insurance benefit of 5 lakh rupees per family is offered under this program for secondary or tertiary care hospitalization.

Key Companies & Market Share Insights

The market players are adopting competitive strategies, such as mergers & acquisitions, strategic alliances, collaborative agreements, partnerships, product development and government approvals to sustain the competition. For instance, in December 2022, Boston Scientific Corporation acquired a majority stake in Acotec Scientific Holdings Limited. The portfolio of Acotec Scientific Holdings Limited encompasses a wide range of medical products, including RFA technologies, thrombus aspiration catheters.

In July 2023, Baird Medical received approval from China’s NMPA for its Class III microwave ablation disposable needle for the treatment of thyroid nodules.

In August 2023, STARmed Co., Ltd announced the launch of its subsidiary named STARmed America across the U.S.

Key Thyroid Ablation Devices Companies:

- Boston Scientific Corporation

- BVM Medical System

- Integra Life Sciences

- Johnson & Johnson

- Medtronic Plc.

- MedWaves Inc.

- Olympus Corporation

- StarMed Co.Ltd.

- Terumo Europe

- Theraclion

Thyroid Ablation Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 183.9 million

Revenue forecast in 2030

USD 318.4 million

Growth rate

CAGR of 9.58% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; BVM Medical System; Integra Life Sciences; Johnson & Johnson; Medtronic Plc.; MedWaves Inc.; Olympus Corporation; StarMed Co.Ltd.; Terumo Europe; Theraclion

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thyroid Ablation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thyroid ablation devices market based on type, product, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiofrequency Ablation

-

Microwave AblationOthers

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal Based Devices

-

Non-Thermal Based Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Thyroid Cancer

-

Thyroid Nodules

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Cancer Specialty Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global thyroid ablation devices market size was estimated at USD 168.4 million in 2023 and is expected to reach USD 183.9 million in 2024.

b. The global thyroid ablation devices market is expected to grow at a compound annual growth rate of 9.58% from 2024 to 2030 to reach USD 318.4 million by 2030.

b. North America dominated the thyroid ablation devices market with a share of 35.3% in 2022. This is attributable to the increasing prevalence of thyroid, increasing adoption of minimally invasive procedures and the presence of efficient healthcare coverage policies.

b. Some key players operating in the global thyroid ablation devices market are Boston Scientific Corporation, BVM Medical System, Integra Life Sciences, Johnson & Johnson, Medtronic Plc., MedWaves Inc., Olympus Corporation, StarMed Co.Ltd., Terumo Europe, and Theraclion.

b. key factors driving the demand for thyroid ablation devices market ising prevalence of thyroid cancer & thyroid nodules, growing preference of minimally invasive surgeries, and availability of technologically sound ablation procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.