- Home

- »

- Conventional Energy

- »

-

Tight Gas Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Tight Gas Market Size, Share & Trends Report]()

Tight Gas Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Industrial, Power Generation, Residential, Commercial, Transportation), By Region, And Segment Forecasts

- Report ID: 978-1-68038-024-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tight Gas Market Size & Trends

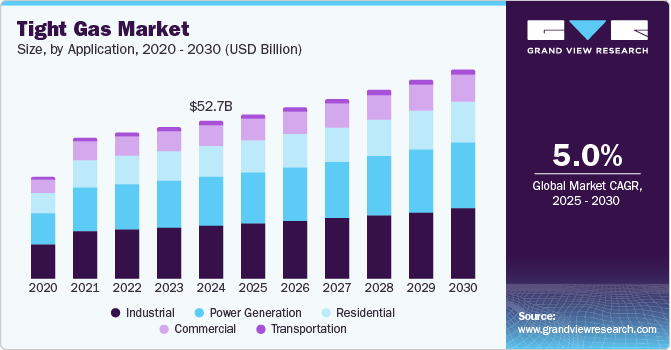

The global tight gas market size was valued at USD 52.71 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. This growth is attributed to the rising global energy demand, particularly in developing economies, which necessitates exploring unconventional gas sources like tight gas. In addition, advancements in extraction technologies, such as hydraulic fracturing and horizontal drilling, have made it more economically viable to tap into these resources. Furthermore, the environmental benefits of natural gas, including lower carbon emissions compared to coal and oil, further enhance its appeal as a cleaner energy source, supporting the market's expansion.

Tight gas refers to natural gas trapped in rock formations with extremely low permeability, typically found in sandstone or limestone, requiring significant hydraulic fracturing for extraction. The increasing global energy demand has spurred exploration and production of unconventional gas resources like tight gas. This demand and advancements in drilling technologies have fostered a conducive environment for the tight gas market's growth. As economies expand and urbanize, the preference for natural gas rises due to its lower environmental impact than coal and oil.

In addition, infrastructure development to facilitate natural gas distribution, including new pipelines and LNG export terminals, reflects this rising demand. For instance, expanding the Sabine Pass LNG terminal in the U.S. has enhanced export capabilities to meet global needs. These developments highlight how the growing appetite for cleaner energy sources propels the tight gas market forward.

Furthermore, natural gas's environmental advantages contribute to its increased demand. With governments and organizations striving to minimize carbon emissions, cleaner energy options like natural gas are becoming more attractive. Consequently, the combination of rising energy needs and a shift toward environmentally friendly fuel sources drives significant growth in the global tight gas market.

Application Insights

The industrial application segment led the market and accounted for the largest revenue share of 33.5% in 2024. This growth is attributed to its extensive use as a feedstock in various manufacturing processes. Tight gas is a crucial raw material for producing fertilizers, chemicals, and other commodities essential for numerous industries. In addition, as industrial activities expand globally, the demand for tight gas will increase significantly. Furthermore, government initiatives promoting clean energy and the economic advantages of utilizing domestically sourced tight gas will likely enhance production capabilities and boost industrial output in gas-rich regions.

The power generation segment is expected to grow at a CAGR of 5.4% over the forecast period, owing to the transition from coal to natural gas. Tight gas combustion results in lower carbon emissions than coal and other fossil fuels, making it an attractive option for power plants aiming to reduce their environmental impact. In addition, this shift aligns with global efforts to decarbonize energy systems, leading to increased investments in natural gas infrastructure. Furthermore, as countries seek cleaner energy alternatives, the share of tight gas in their energy mix is anticipated to rise rapidly, positioning it as a key player in future power generation strategies.

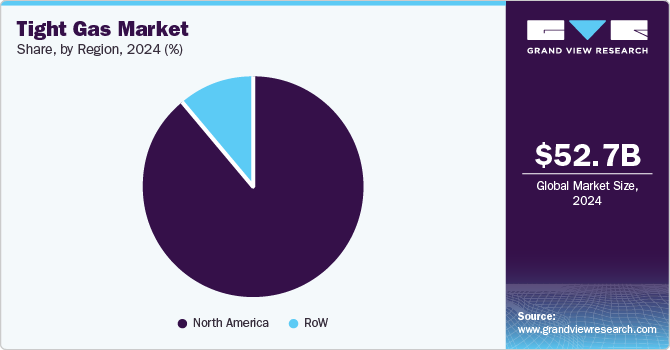

Regional Insights

North America tight gas market dominated the global market and accounted for the largest revenue share of 89.0% in 2024. This growth is attributed to the vast reserves and advanced extraction technologies. In addition, the region accounts for a significant portion of global tight gas production, particularly in the Permian Basin, Anadarko, and Niobrara formations. Furthermore, adopting hydraulic fracturing and horizontal drilling has enhanced recovery rates and reduced costs, making tight gas more economically viable. Moreover, strong demand for cleaner energy sources amid environmental concerns supports the growth of this market, positioning North America as a leader in tight gas production.

U.S. Tight Gas Market Trends

The tight gas market in the U.S. led the North American market and accounted for the largest revenue share in 2024, driven by government policies and investments that are crucial in driving the tight gas market. In addition, supportive legislation and subsidies for extraction technologies have spurred production growth, particularly in prolific regions like Texas and North Dakota. Furthermore, the U.S. benefits from a highly skilled workforce and innovative drilling techniques that enhance efficiency. Moreover, as natural gas continues to replace coal in power generation, the demand for tight gas is expected to rise significantly, further solidifying the country’s position in the global market.

China Tight Gas Market Trends

China tight gas market is expected to grow at a CAGR of 8.5% over the forecast period owing to increasing energy demands and government initiatives aimed at promoting cleaner energy sources. In addition, the country has significant untapped tight gas reserves, particularly in the Ordos Basin and Sichuan Basin. Furthermore, the government's commitment to environmental sustainability drives a shift towards natural gas as a preferred fuel source for power generation and industrial applications.

Argentina Tight Gas Market Trends

The tight gas market in Argentina is expected to grow significantly over the forecast period. This growth is attributed to the development of the Vaca Muerta formation, which holds substantial technically recoverable reserves. The government's focus on attracting foreign investment and technology transfer has accelerated exploration activities in this region. As production from older fields’ declines, Vaca Muerta's continued development is crucial for maintaining Argentina's natural gas output. This strategic focus on tight gas resources is expected to enhance energy security and support economic growth in the country.

Key Tight Gas Company Insights

Some of the key companies in the market include Chevron Corporation, ConocoPhillips, Royal Dutch Shell Plc, and others. These companies adopt various strategies, including investing in advanced extraction technologies to improve operational efficiency and reduce costs. In addition, companies also focus on sustainable practices to minimize environmental impacts while maximizing production. Furthermore, strategic partnerships and joint ventures are being formed to share resources and expertise, facilitating access to new markets and enhancing overall supply chain capabilities. Furthermore, companies prioritize research and development to innovate new methods for tight gas extraction and processing.

-

ConocoPhillips operates across various segments, including upstream oil and gas, where it explores and produces crude oil, natural gas, natural gas liquids, and liquefied natural gas. ConocoPhillips has significant operations in regions such as the San Juan Basin, where it extracts tight gas from multiple formations, contributing to its overall production capabilities and positioning in the global energy market.

-

Royal Dutch Shell Plc focuses on developing unconventional resources through advanced extraction techniques. The company operates in several segments, including upstream exploration and production, where it engages in tight gas extraction from various basins worldwide. Shell's commitment to integrating sustainable practices into its operations further enhances its role in the tight gas market as it seeks to meet growing energy demands while minimizing environmental impacts.

Key Tight Gas Companies:

The following are the leading companies in the tight gas market. These companies collectively hold the largest market share and dictate industry trends.

- Chevron Corporation

- ConocoPhillips

- Royal Dutch Shell Plc

- Sinopec

- Marathon Oil

- Pioneer Natural Resources

- EOG Resources

- British Petroleum

- Exxon Mobil Corporation

- PetroChina

- Anadarko Petroleum Co.

- Devon Energy

Recent Developments

-

In October 2023, ExxonMobil announced a significant merger with Pioneer Natural Resources in an all-stock transaction that will more than double its footprint in the Permian Basin, enhancing its position in tight gas resources. This merger combines Pioneer’s extensive Midland Basin acreage with ExxonMobil’s holdings, creating an estimated 16 billion barrels of oil equivalent. The collaboration aims to improve production efficiency and accelerate net-zero emissions goals, ultimately strengthening U.S. energy security and economic stability.

-

In August 2023, Sinopec announced a major advancement in its Project Deep Earth, revealing 30.55 billion cubic meters of proven geological reserves at the Bazhong gas field in Sichuan, China. This field is notable for its tight sandstone gas, discovered at depths between 4,550 and 5,225 meters, posing significant exploration challenges. As part of its efforts, Sinopec has developed innovative models to enhance gas production and will continue to evaluate and expand tight gas reserves in the region.

Tight Gas Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.94 billion

Revenue forecast in 2030

USD 70.04 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in billion cubic feet, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region.

Regional scope

North America, Rest of the World (RoW).

Country scope

U.S., Canada, Mexico, China, Argentina, Australia.

Key companies profiled

Chevron Corporation; ConocoPhillips; Royal Dutch Shell Plc; Sinopec; Marathon Oil; Pioneer Natural Resources; EOG Resources; British Petroleum; Exxon Mobil Corporation; PetroChina; Anadarko Petroleum Co.; Devon Energy.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tight Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the tight gas market report based on application, and region:

-

Application Outlook (Volume, Billion cubic feet; Revenue, USD Billion, 2018 - 2030)

-

Industrial

-

Power Generation

-

Residential

-

Commercial

-

Transportation

-

-

Regional Outlook (Volume, Billion cubic feet; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

RoW

-

China

-

Argentina

-

Australia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.