Report Overview

The global tissue engineered skin substitutes market size was valued at USD 660.1 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2020 to 2027. The demand for tissue engineered skin substitutes is increasing owing to the technological advancements in healthcare, increasing prevalence of acute and chronic wounds, high demand for skin grafts, and rising awareness regarding various treatment options.

Increasing incidence of accidents such as road accidents, burns, and trauma events across the globe is also anticipated to drive the market for tissue engineered skin substitutes. For instance, as per WHO (2018), burn is the second most common injury in rural Nepal and it accounts for 5.0% of disabilities in the country. According to The American Burn Association, in 2016, 486,000 patients received burn injury treatment in the U.S. Furthermore, as per the WHO, nearly 1.4 million people die from road traffic crashes every year. It also reported that a road accident is the leading cause of death in children and adults aged 5 to 29 years. The skin grafts are majorly done for the treatment of acute wounds. Biosynthetic and synthetic tissue engineered skin substitutes are used in the treatment of moderate and severe burns. Similarly, biological skin substitutes are used during the surgeries for healing large wounds. Thus, a rising number of accidents is expected to boost the demand for tissue engineered skin substitutes, which is expected to lead to considerable market growth over the forecast period.

Increasing awareness level among people regarding various treatment options is also a key factor driving the market for tissue engineered skin substitutes over the forecast period. The market is also gaining pace owing to the rising willingness among the people to spend more and opt for new and advanced burn care products. Biosynthetic and synthetic skin grafts are majorly used for the treatment of moderate and severe burns. Biological tissue engineered skin substitutes are used for the treatment of first degree burn cases.

Presence of government organizations such as non-profit organizations like the American Burn Association (ABA) and the World Health Organization (WHO) also contribute towards increasing awareness levels. The WHO has been collaboratively working with The International Society for Burn Injuries (ISBI) and other such organizations to develop strategies to prevent burn injuries and improve burn care treatment globally. The U.S. Food and Drug Administration (FDA) follows the pre-market approval process for scientific review of Class III devices to ensure the safety and effectiveness of any medical product. Tissue engineered skin substitutes are classified under Class III medical devices. Some of the FDA approved tissue engineered skin substitutes are Apligraf, Dermagraft, and Integra Omnigraft Dermal Regeneration Matrix.

Furthermore, presence of non-profit organizations such as British Burn Association (BBA), which aims towards providing and propagating the knowledge on best treatment and rehabilitation following a burn injury and Canadian Association of Burn Nurses (CABN), which aims towards providing nurses who are expert in treating patients with burns are also increasing the awareness levels regarding burn care and treatment among the people.

Product Insights

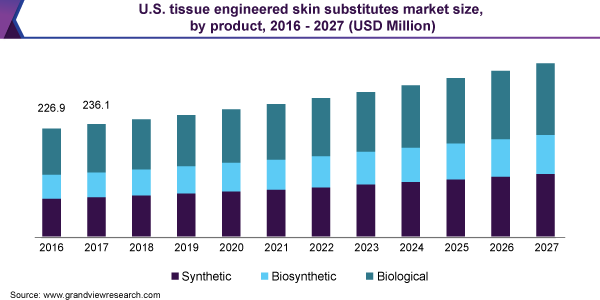

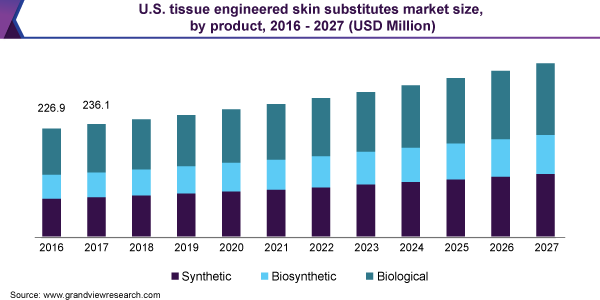

On the basis of product, the market for tissue engineered skin substitutes has been segmented into biological, synthetic, and biosynthetic. The biological tissue engineered skin substitutes segment held the largest market share in 2019 owing to the rising prevalence of acute wounds across the globe. The major advantage of biological tissue engineered skin substitutes is that skin is readily available from the patient itself. Biological tissue engineered skin substitutes have more extracellular matrix, which aids in excellent re-epithelialization and faster healing of the wound.

The synthetic tissue engineered skin substitute segment is anticipated to witness the fastest growth rate over the forecast period. The growth of the segment is attributed to the rising technological advancements in the healthcare sector. Synthetic tissue engineered skin substitutes demonstrate more control over scaffold composition. Advancements in technology for development of tissue engineered skin substitutes such as collagen-synthetic bilaminates and tissue culture-derived membranes are contributing towards market growth.

Application Insights

On the basis of application, the tissue engineered skin substitutes market has been segmented into acute and chronic wounds. The acute wound segment held the largest market share in 2019 owing to the rising number of surgeries and the increasing prevalence of burn injuries. As per the American Burn Association, in the U.S., burn injuries are one of the major causes of unintentional injury and death. The segment has been further categorized into surgery and trauma, and burn injuries.

The chronic wound segment is anticipated to witness the fastest growth rate over the forecast period. Tissue engineered skin substitutes are majorly used in the treatment of extreme cases of diabetic foot ulcers, pressure ulcers, and venous leg ulcers. In this procedure, biological tissue engineered skin substitutes are majorly used in the grafting process.

End-Use Insights

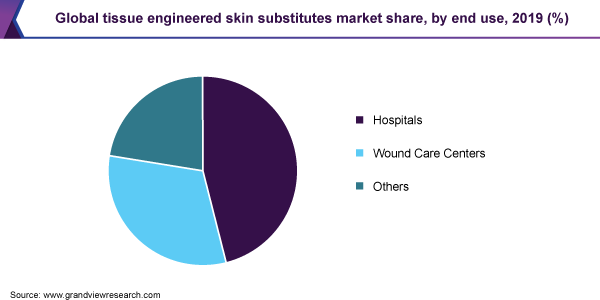

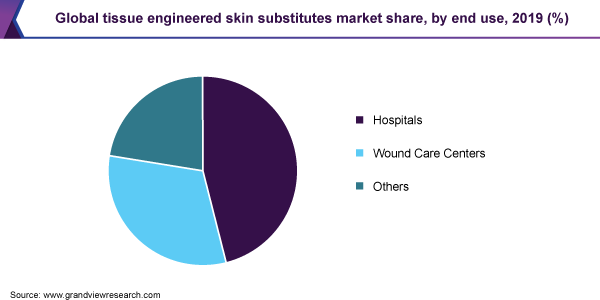

The hospital segment held the largest revenue share in 2019 in the market for tissue engineered skin substitutes owing to the rising number of surgeries across the globe. The increasing cases of diabetic foot ulcers and venous leg ulcers are the major driving factors for the segment. In addition, increasing cases of surgical wounds due to a rising number of surgeries is also driving the segment.

The wound care centers segment is anticipated to witness significant growth over the forecast period. Wound care centers are dedicated institutions for wound treatment. In many countries, wound care centers are still a new concept but are rapidly gaining popularity. Therefore, this segment is anticipated to witness significant growth over the forecast period.

Regional Insights

In North America, the market for tissue engineered skin substitutes held the largest revenue share in 2019 owing to the technological advancements in the healthcare sector, rising number of burn injuries, and the presence of key players in the region. Increasing sports injuries, road accidents, and the presence of several key players in the region are anticipated to drive the market in North America. In addition, the availability of skilled professionals and improvement in healthcare infrastructure is also expected to drive the market in the region over the forecast period.

In the Asia Pacific, the market is anticipated to witness the fastest growth rate over the forecast period. The presence of developing countries such as China, India, and Japan is anticipated to boost the market growth in the region. In addition, the rapidly growing medical tourism industry in these countries can also be attributed to the increase in demand for tissue engineered skin substitutes in the region.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers and acquisitions, partnerships, and launching new products to strengthen their foothold in the market. These players are investing heavily in research and development to manufacture technologically advanced products. Some of the prominent players in the tissue engineered skin substitutes market include:

Tissue Engineered Skin Substitutes Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2020

|

USD 688.7 million

|

|

Revenue forecast in 2027

|

USD 947.3 million

|

|

Growth Rate

|

CAGR of 4.7% from 2020 to 2027

|

|

Base year for estimation

|

2019

|

|

Historical data

|

2016 - 2018

|

|

Forecast period

|

2020 - 2027

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2020 to 2027

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, end-use, and region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, and MEA

|

|

Country scope

|

U.S., Canada, U.K., Germany, China, Japan, Brazil, Mexico, South Africa, Saudi Arabia

|

|

Key companies profiled

|

Amarantus BioScience Holdings; Organogenesis, Inc.; KCI Licensing, Inc.; Smith and Nephew; BSN medical; Mölnlycke Health Care AB; Integra LifeSciences Corporation; Medtronic; Tissue Regenix

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global tissue engineered skin substitutes market report on the basis of products, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Synthetic

-

Biosynthetic

-

Biological

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Acute Wounds

-

Surgery & Trauma

-

Burn Injuries

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

End-Use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Wound Care Centers

-

Others

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

MEA

-

South Africa

-

Saudi Arabia