- Home

- »

- Medical Devices

- »

-

Wound Care Centers Market Size And Share Report, 2030GVR Report cover

![Wound Care Centers Market Size, Share & Trends Report]()

Wound Care Centers Market (2023 - 2030) Size, Share & Trends Analysis By Type (Hospitals, Clinics), By Procedure (Specialized Dressings, Negative Pressure Wound Therapy, Compression Therapy), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-883-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

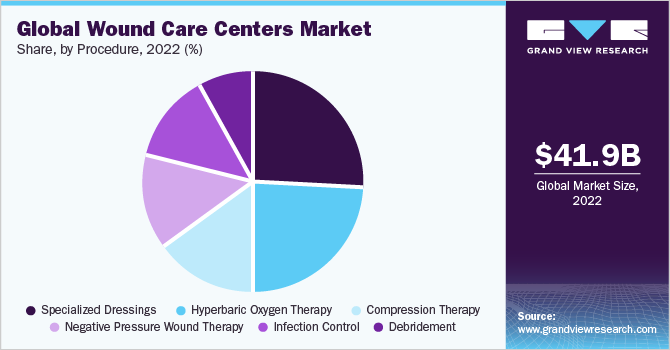

The global wound care centers market size was valued at USD 41.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030. The increasing number of surgical procedures worldwide and the growing geriatric population prone to various disorders are anticipated to drive the market. In addition, a growing number of conditions, such as sun radiation sores, pressure sores, foot ulcers caused by diabetes, and disorders caused by bad blood circulation, are expected to fuel the market in the future.

According to the American Hospital Association’s 2019 Hospital Statistics report, hospitals’ total outpatient revenue amounted to USD 472 billion in 2017, whereas total inpatient revenue was USD 498 billion. The ratio of hospitals’ inpatients grew from 83% in 2013 to 95% in 2017. Such growing admission of wound patients in care centers is expected to increase the service demand, driving the market over the forecast period.

The growing prevalence of diabetes is also expected to fuel the market over the next few years. According to the International Diabetes Federation, approximately 537 million adults in the age group 20-79 years suffered from diabetes in 2021, and this number is expected to cross 783 million by the end of 2045. Diabetic patients are expected to develop slow healing wounds, which can cause wounds to rot easily and cause complications ranging from an infection near the tissue or bone to life-threatening cases. For instance, foot ulcers due to diabetes are expected to affect 1 in 4 patients with diabetes, which, on progression, could lead to foot amputation. According to American Diabetes Association, approximately 154,000 amputations due to diabetes were reported in the U.S.

Chronic wounds such as pressure ulcers, diabetic foot ulcers, and leg ulcers are some of the highly prevalent disorders observed among the elderly. As per the Journal of the German Society of Dermatology, the number of people with venous leg ulcers was more than those with pressure ulcers. Venous leg ulcers caused by venous hypertension require long term stay in care centers. As per studies, one in 170 adults is affected by venous leg ulcers. Thus, the growing prevalence of leg ulcers is expected to drive the market for wound care centers in the future. According to a report published by the National Library of Medicine (NLM), the annual incidence of diabetic foot ulcers is between 9.1 to 26.1 million globally.

In addition, the rising number of long term care patients in the U.S. is anticipated to propel the market over the forecast period. Long term care is an insurance-based service sold in the U.S. due to significant growth in geriatric patients. According to the American Affairs Journal, approximately 11 million patients are currently utilizing long term care, which is anticipated to double by the end of 2050. The population of individuals over 85 is high in developed economies, increasing the incidence and prevalence of chronic conditions.

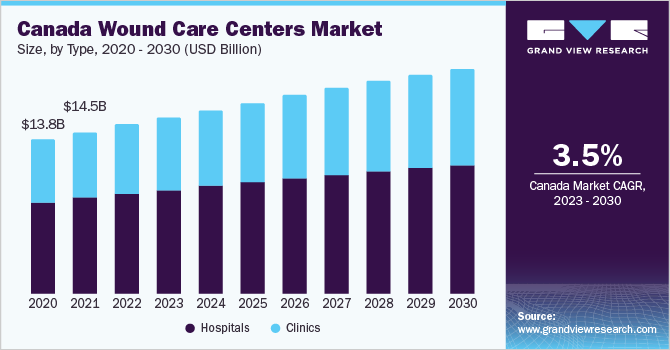

Type Insights

The hospitals segment accounted for the largest revenue share in 2022 owing to well-established healthcare facilities and a growing patient pool in developed economies. In addition, the growing number of professional caregivers and staff in hospitals is expected to fuel the market for wound care centers in the future. According to Makeshift, approximately 5.7 million people are employed in hospitals in the U.S.

Advancements in wound care centers are also driving the market. The U.S. Wound & Podiatry Registry (USWR) has developed various risk-stratified wound healing quality techniques for venous leg ulcers (VLUs) and diabetic foot ulcers (DFUs) on account of its Qualified Clinical Data Registry (QCDR). The intervention approaches in care centers include compression bandaging, advanced dressings, cellular and/or tissue-based therapies, off-loading, negative pressure wound therapy, hyperbaric oxygen therapy, antibiotics, and debridement. This helps practitioners report the progress in healing rates compared to earlier statistics.

The clinics segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to high preference by patients due to the growing number of hospital-acquired infections (HAI). According to the Centers for Disease Control (CDC), approximately 1.7 million people are infected by HAIs annually. Approximately more than 99,000 patients die from HAIs annually in the U.S. compared to patients with wounds resulting from radiation, car accidents, and more. In addition, the growing number of wound care clinics and specialists is expected to drive segment growth. Wound care clinics are better-equipped healthcare and easily accessible for ulcerative wounds and related long term wound treatment, according to patients.

Procedure Insights

The specialized dressings segment accounted for the largest revenue share of 25.7% in 2022 and is estimated to register the fastest CAGR of 4.1% over the forecast period due to the growing introduction of new and effective products, such as biological skin products, skin substitutes, and other complex dressing products. The growing number of skin substitute procedures due to burn cases and the increasing number of burn victims is expected to boost segment growth. Skin substitutes offer speedy wound healing, require a less vascularized wound bed, improve the dermal component of the healed wound, reduce inhibitory factors of the wound healing process, and minimize subsequent scarring. These factors are anticipated to increase the demand for skin substitutes in care centers.

Negative pressure wound therapy is expected to grow lucratively over the forecast period owing to its increasing use in the management of various chronic and acute wounds in care centers. Negative pressure wound therapy, also known as vacuum-assisted wound closure, constantly or periodically applies sub-atmospheric pressure to the wound surface. This pressure has various benefits for animals too. However, it is only used for some types of wounds since its clinical evidence has yet to be proven.

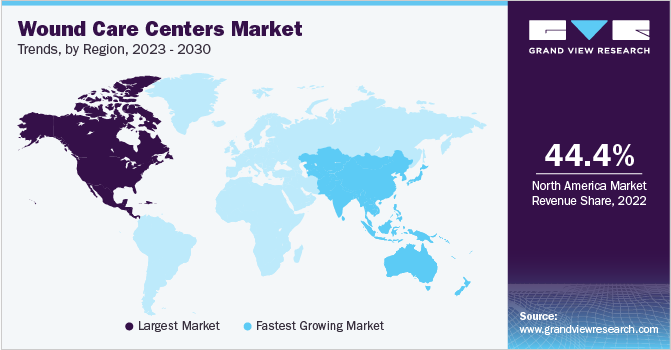

Regional Insights

North America dominated the wound care centers market and accounted for the largest revenue share of 44.4% in 2022. The dominance of the region is due to the greater affordability of patients in treating pressure ulcers in healthcare centers. In addition, a growing number of research and development activities associated with the quick healing of wounds are expected to drive the market in the region.

Increased spending on pressure ulcers is also expected to drive the market in the region. In the U.S., approximately USD 11.0 billion is spent annually on treating pressure ulcers in healthcare centers, with approximately USD 500-70,000 spent on a single wound. In addition, the growing prevalence of obesity and cardiovascular disorders is predicted to fuel the market over the forecast period.

Asia Pacific is expected to grow at the fastest CAGR of 4.6% during the forecast period. The growth of the region is attributed to a large geriatric population prone to various disorders. Moreover, the rising number of surgeries in care centers, increasing healthcare expenditure, and growing awareness of wound care management among patients drive the market. A large patient pool suffering from diabetes, cancer, and other conditions is another factor likely to propel the market. According to a survey, in 2022, China houses the largest population of 141 million people living with diabetes globally, and is predicted to rise to 174 million by 2045.

Key Companies & Market Share Insights

The market of wound care centers comprises various competitors globally. These players are focusing on growth strategies such as new product development and mergers and acquisitions. For instance, in January 2022, Healogics announced the launch of the “Healing Can’t Wait” program. The program aims to impart knowledge regarding underserved chronic wound populations and the urgency and importance of treatment through Healogics wound care centers. Furthermore, in September 2021, Wound Care Advantage partnered with Swift Medical to integrate Swift Medical’s advanced wound imaging platform into Wound Care Advantage’s network hospital. The partnership is aimed at enhancing their collective impact care industry. Additionally, in March 2021, American Medical Technologies announced its merger with RestorixHealth,

ARANZ Medical, a medical equipment supplier based in New Zealand, has developed a wide range of smartphone-based wound imaging products. In early 2018, the company launched two modernized smartphone-based imaging products: SilhouetteLite and SilhouetteLite+. These applications are easy to use, portable, and offer high image consistency and precision. Silhouette helps professionals in quantitative wound assessment at a faster speed. The SilhouetteLite+ application is easy to use for multiple locations, which also helps in further analysis and reporting, besides consistency and security. Some of the prominent players in the global wound care centers market include:

-

Hologic, Inc.

-

Woundtech

-

OXYHEAL

-

Wound Care Advantage, LLC

-

Wound Care Specialists, LLC

-

RestorixHealth

-

Systagenix Wound Management

-

Mölnlycke Health Care AB

Wound Care Centers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 43.8 billion

Revenue forecast in 2030

USD 56.1 billion

Growth Rate

CAGR of 3.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, procedure, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Hologic, Inc.; Woundtech; OXYHEAL; Wound Care Advantage, LLC.; Wound Care Specialists, LLC; RestorixHealth; Systagenix Wound Management; Mölnlycke Health Care AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Care Centers Market Report Segmentation

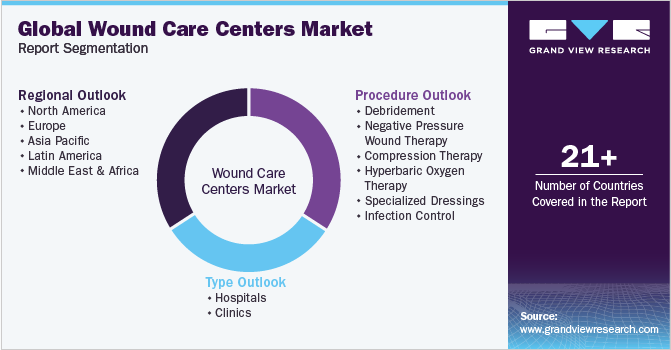

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wound care centers market report on the basis of type, procedure, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

-

Procedure Outlook (Revenue in USD Million, 2018 - 2030)

-

Debridement

-

Negative Pressure Wound Therapy

-

Compression Therapy

-

Hyperbaric Oxygen Therapy

-

Specialized Dressings

-

Infection Control

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound care centers market was estimated at USD 41.9 billion in 2022 and is expected to reach USD 43.8 billion in 2023.

b. The global wound care centers market is expected to grow at a compound annual growth rate of 3.6% from 2023 to 2030 to reach USD 56.1 billion by 2030.

b. the North American region accounted for 44.4% share in 2022 owing to greater affordability of patients in treating pressure ulcers in healthcare centers.

b. Key players in the market include Hologic, Woundtech, Oxyheal, Wound Care Advantage, Wound Care Specialists, RestorixHealth, Systagenix Wound Management Limited, and Mölnlycke Health Care AB.

b. The growing number of conditions such as sun radiation sores, pressure sores, foot ulcers caused by diabetes, and disorders caused by bad blood circulation are expected to fuel the market in the future.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.