- Home

- »

- Medical Devices

- »

-

Topical Hemostat Market Size & Share, Industry Report, 2030GVR Report cover

![Topical Hemostat Market Size, Share & Trends Report]()

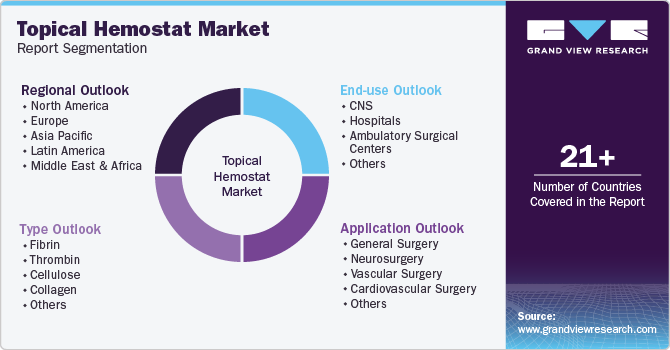

Topical Hemostat Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Thrombin, Collagen, Gelatin), By Application (General Surgery, Cardiovascular Surgery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-501-0

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Topical Hemostat Market Summary

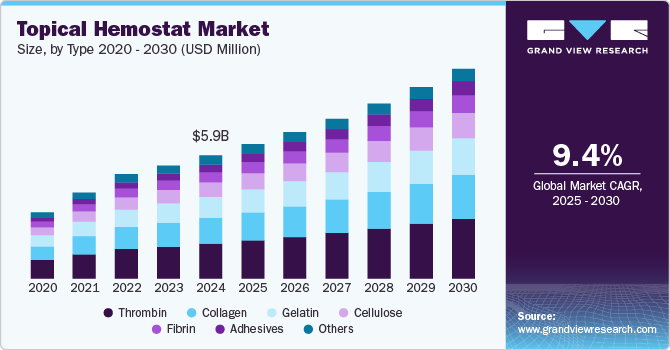

The global topical hemostat market size was valued at USD 5.9 billion in 2024 and is projected to reach USD 10.0 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The industry is growing due to rising surgical procedures, increasing trauma cases, and advancements in hemostatic technologies.

Key Market Trends & Insights

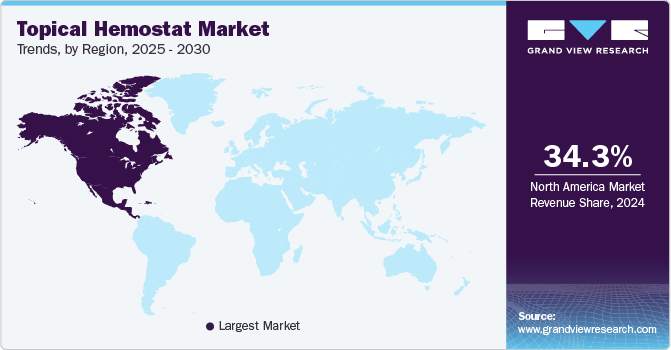

- North America topical hemostat market held a dominant position, capturing 34.29% of the global revenue share in 2024.

- The topical hemostat market in Asia Pacific is growing rapidly.

- Based on application, the general surgery segment dominated the market and accounted for a 34.5% share in 2024.

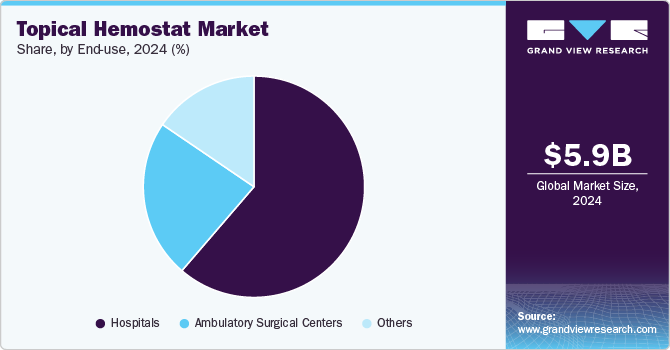

- In terms of end-use, the hospitals segment dominated the market with the largest revenue share of 61.3% in 2024.

- Based on type, the thrombin segment accounted for the largest revenue share of 28.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.9 Billion

- 2030 Projected Market Size: USD 10.0 Billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These products are widely used to control bleeding in surgeries, including cardiovascular, orthopedic, and neurosurgical procedures. The demand is fueled by the need for faster wound healing, reduced surgical complications, and improved patient outcomes. Growing healthcare infrastructure, particularly in emerging markets, and the rise in minimally invasive procedures further drive market growth.

A recent case underscored the limitations of conventional hemostatic materials like gauze, where its unintended presence in a patient post-surgery caused pain, inflammation, and infection. Traditional materials such as gauze and medical bands primarily control surface bleeding but lack adherence to bleeding sites and are prone to contamination. Alternatives like fibrin glue and collagen sponges, though biodegradable, are expensive due to reliance on human or animal-derived proteins.

Researchers have addressed these limitations and developed an innovative bilayer nanofiber membrane hemostat using natural proteins from mussels and silkworm cocoons. This novel hemostat offers strong tissue adhesion, effective bleeding control, and protection against infection. Led by Professor Hyung Joon Cha and a collaborative team from POSTECH, Ewha Womans University, and Seoul St. Mary’s Hospital, the research was published in the journal Small in February 2024. The hemostatic agent integrates mussel adhesive proteins, which activate platelets for rapid hemostasis, and silk fibroin from silkworms, modified with methanol vapor to create a hydrophobic nanofiber outer layer. This dual-layer design ensures biocompatibility, biodegradability, and robust infection prevention.

Animal experiments demonstrated the agent’s ability to accelerate tissue adhesion and hemostasis in bleeding wounds. Its inner layer enhances adhesion while the outer layer protects against waterborne contaminants and bacteria. These advancements address critical shortcomings in existing hemostatic materials, offering a safer, multifunctional solution for surgical applications. The research team emphasized the agent’s potential for real-world surgical settings and its transformative impact on patient care.

The industry benefits from growing awareness of such innovations, as well as funding and research support. This study, supported by Korea’s Marine Bio Materials Research Center Program and the National Research Foundation, highlights the importance of government initiatives in driving market growth. As demand for advanced, cost-effective, and biocompatible hemostatic agents rises, the market is poised for substantial expansion, propelled by technological breakthroughs and the continuous pursuit of safer surgical outcomes.

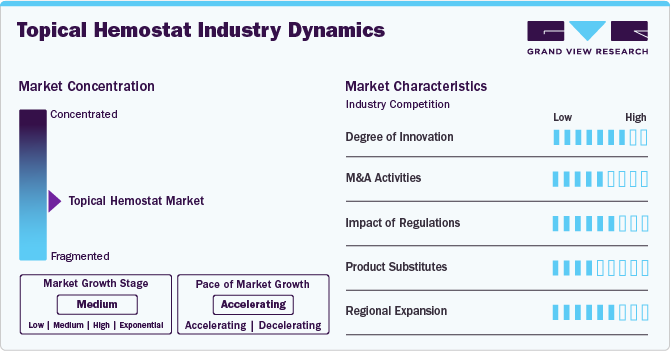

Market Concentration & Characteristics

The industry is characterized by moderate to high concentration, with a few key players dominating it. Companies focus on innovation, leveraging advanced biomaterials like fibrin, collagen, and gelatin to create biocompatible, effective, and cost-efficient products. Regulatory standards and clinical efficacy drive competition, pushing firms to invest in research and development. The industry also benefits from rising surgical procedures globally and increased awareness of advanced hemostatic solutions. However, challenges such as high production costs and strict regulatory approvals create barriers for new entrants, leading to a market dominated by established players with strong distribution networks.

The industry demonstrates a moderate degree of innovation, emphasizing advanced product development to improve surgical outcomes. A notable example is SURGICEL Snow, which surpasses SURGICEL Original by offering enhanced hemostasis, superior conformability, improved handling, and better tissue adherence. These innovations address critical surgical needs, such as effective bleeding control and reduced operative time. Manufacturers are integrating novel biomaterials and design features to enhance performance and biocompatibility, catering to diverse surgical applications.

Regulations significantly influence the industry by ensuring product safety, efficacy, and quality. Regulatory bodies like the FDA and EMA require rigorous pre-market evaluations, including clinical trials, to approve new hemostatic agents. Strict post-market surveillance further ensures safety and effectiveness. Regulatory oversight also encourages innovation by defining clear pathways for approvals of novel products like biomaterial-based hemostats. However, navigating complex regulatory landscapes can increase development costs and time-to-market, posing challenges for manufacturers. Overall, regulations are pivotal in shaping the industry's growth and fostering patient safety.

Mergers and acquisitions (M&A) in the industry are reshaping the competitive landscape. In July 2021, Baxter International Inc., a global leader in medical products, acquired PerClot Polysaccharide Hemostatic System assets from CryoLife through its Baxter Healthcare Corporation subsidiary. This acquisition aligns with Baxter's strategy to enhance its hospital-focused portfolio, including operating room solutions. PerClot is commercially available in over 35 countries, although it has not yet received clearance for sale in the U.S. The move demonstrates Baxter's commitment to expanding its product offerings and strengthening its position in the global hemostatic products market.

Product substitutes pose a moderate challenge, primarily from advanced surgical techniques and alternative hemostatic materials. Technologies like electrocautery and ultrasonic devices offer effective bleeding control without the need for topical agents. Additionally, fibrin sealants and synthetic adhesives serve as substitutes, providing biocompatibility and controlled degradation. However, these alternatives often come with higher costs and specific application requirements, limiting their widespread adoption. Traditional options like sutures and staples remain prevalent but lack the immediate efficacy of topical hemostats. As innovation continues, the industry must address cost and application barriers to maintain its competitive edge against substitutes.

The industry is witnessing regional expansion driven by increasing surgical procedures, advancements in healthcare infrastructure, and growing awareness of effective hemostatic solutions. Emerging markets in Asia-Pacific and Latin America are experiencing significant growth due to rising investments in healthcare and higher prevalence of chronic diseases. North America and Europe remain dominant, supported by advanced medical technologies and established players.

Type Insights

The thrombin segment accounted for the largest revenue share of 28.3% in 2024, driven by its high efficacy in rapid blood clotting and widespread application in surgical procedures. Thrombin-based products are favored due to their ease of use, minimal adverse effects, and ability to enhance hemostasis when combined with other agents like fibrin. Increasing surgical volumes, especially in cardiovascular and orthopedic surgeries, further boost demand for thrombin-based hemostats. Additionally, ongoing innovations, improved availability, and favorable regulatory approvals contribute to its dominance.

The adhesives segment is expected to grow at the fastest CAGR over the forecast period due to their superior tissue bonding capabilities and versatility across various surgical procedures. These adhesives provide effective hemostasis, reduced surgical complications, and faster wound healing, making them highly preferred. Advancements in bio adhesive technologies, such as synthetic and natural adhesives, enhance their biocompatibility and safety profiles, driving adoption.

End-use Insights

The hospitals segment dominated the market with the largest revenue share of 61.3% in 2024. This growth is primarily driven by the high volume of surgeries performed in hospitals, including general, orthopedic, and neurosurgeries, which require effective hemostatic solutions for controlling bleeding. Hospitals are equipped with advanced healthcare infrastructure, ensuring the availability of a variety of hemostatic products. Additionally, the increasing number of surgical procedures, particularly in the aging population and patients with chronic conditions, further contributes to the high demand for topical hemostats. Hospitals also benefit from regulatory support and access to the latest medical technologies.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by the rising preference for outpatient procedures due to their cost-effectiveness, shorter recovery times, and reduced hospital stays. ASCs provide an efficient environment for minor surgeries, including those requiring hemostatic products to control bleeding. The growing adoption of minimally invasive surgical techniques, along with the increasing number of surgeries performed in outpatient settings, further supports the demand for topical hemostats in ASCs.

Application Insights

The general surgery segment dominated the market and accounted for a 34.5% share in 2024, driven by the high volume of procedures requiring effective bleeding control. These surgeries, including abdominal, thoracic, and soft tissue procedures, frequently necessitate advanced hemostatic products to minimize blood loss and enhance patient outcomes. The segment benefits from increasing surgical intervention rates due to rising chronic disease prevalence and aging populations worldwide.

The neurosurgery segment is anticipated to grow at the fastest CAGR from 2025 to 2030, in the topical hemostat market due to the critical need for precise bleeding control during delicate brain and spinal procedures. Rising neurological disorders, such as brain tumors and traumatic brain injuries, have increased surgical intervention rates, driving demand for effective hemostatic solutions. Advances in minimally invasive neurosurgical techniques and the adoption of biocompatible, fast-acting hemostatic agents further propel growth.

Regional Insights

North America topical hemostat market held a dominant position, capturing 34.29% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40-50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments.

U.S. Topical Hemostat Market Trends

The topical hemostat market in the U.S. is expected to expand due to the rising number of surgical procedures, increasing chronic conditions requiring surgical interventions, and healthcare infrastructure advancements. The population aged 50 and older in the U.S. will grow by 61.11%, from 137.25 million in 2020 to 221.13 million by 2050, with chronic disease cases in this group projected to rise 99.5%, from 71.522 million to 142.66 million. The presence of leading companies and research institutions fosters innovation in the topical hemostat sector. Furthermore, regulatory support and investments in healthcare technology drive market growth.

Europe Topical Hemostat Market Trends

The topical hemostat market in Europe is expected to grow during the forecast period, largely driven by the high prevalence of chronic diseases, which contribute to 80% of the EU's overall disease burden. This significant healthcare challenge poses a threat to the sustainability of healthcare systems, increasing the demand for innovative solutions like topical hemostats.

The UK topical hemostat market is experiencing notable growth due to the increasing prevalence of chronic diseases such as diabetes and the growing elderly population. According to the UK Department of Health & Social Care, the number of individuals aged 85 and older is projected to rise by one million between 2021 and 2036.

The topical hemostat market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

Germany topical hemostat market is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools.

Asia Pacific Topical Hemostat Market Trends

The topical hemostat market in Asia Pacific is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as topical hemostats, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

Japan topical hemostat market is expanding as the aging population contributes to a higher prevalence of chronic diseases. Research indicates that over 90% of adults aged 75 and older in Japan are affected by at least one chronic condition, driving demand for advanced medical solutions like topical hemostats.

The topical hemostat market in China is expected to grow as the country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

India topical hemostat market is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand.

Latin America Topical Hemostat Market Trends

The topical hemostat market in Latin America is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Topical Hemostat Market Trends

The topical hemostat market in the Middle East and Africa is growing due to increasing surgical procedures, a rising prevalence of chronic conditions, and improving healthcare infrastructure. Enhanced access to medical facilities and the adoption of advanced technologies are fueling demand for effective hemostatic solutions.

Saudi Arabia topical hemostat market is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Topical Hemostat Company Insights

The topical hemostat market is highly competitive, with key players such as Baxter, BD., and Pfizer Inc. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Topical Hemostat Companies:

The following are the leading companies in the topical hemostat market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Medicom

- Baxter

- HemoSonics

- Hemostasis, LLC

- Medline Industries

- Pfizer Inc.

- Johnson & Johnson

- HemCon Medical Technologies Inc.

- Integra LifeSciences

- Teleflex Incorporated

Recent Developments

-

In July 2024, Teleflex Incorporated secured two group purchasing agreements with Premier, Inc., allowing Premier members to access special pricing on Teleflex's hemostatic products, including QuikClot Hemostatic Dressings and Devices, which control bleeding faster than standard gauze or laparotomy pads.

-

In April 2024, LifeScience PLUS introduced DonorSeal, a 100% natural, plant-based cellulose matrix designed to enhance hemostasis and promote wound healing at donor sites. Upon contact with blood, it forms a gel that creates a moist environment conducive to tissue regeneration. DonorSeal is absorbable, biodegradable, and safe for all age groups.

Topical Hemostat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.4 billion

Revenue forecast in 2030

USD 10.0 billion

Growth Rate

CAGR of 9.4% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

BD, Medicom, Baxter, HemoSonics, Hemostasis, LLC, Medline Industries, Pfizer Inc., Johnson & Johnson, HemCon Medical Technologies Inc., Integra LifeSciences, Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Topical Hemostat Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global topical hemostat market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fibrin

-

Thrombin

-

Cellulose

-

Collagen

-

Gelatin

-

Adhesives

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Neurosurgery

-

Vascular Surgery

-

Cardiovascular Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global market for topical hemostat was estimated at USD 5.9 billion in 2024 and is expected to reach USD 6.4 billion in 2025.

b. The global topical hemostats market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 10.0 billion by 2030.

b. The thrombin segment dominated the market in terms of revenue of 28.3% in 2024 and adhesives segment is anticipated to grow at the fastest CAGR of 10.8%, driven by advancements in minimally invasive surgeries and enhanced wound healing solutions.

b. Major market players included in the topical hemostats market are BD, Medicom, Baxter, HemoSonics, Hemostasis, LLC, Medline Industries, Pfizer Inc., Johnson & Johnson, HemCon Medical Technologies Inc., Integra LifeSciences, Teleflex Incorporated.

b. Key factors driving topical hemostat market growth include the rising number of surgical procedures globally, increasing prevalence of chronic diseases requiring surgeries, advancements in hemostatic product technology, and growing awareness of effective blood loss management. Additionally, expanding healthcare infrastructure and regulatory approvals further support market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.