- Home

- »

- Advanced Interior Materials

- »

-

Topological Insulators Market Size, Industry Report, 2033GVR Report cover

![Topological Insulators Market Size, Share & Trends Report]()

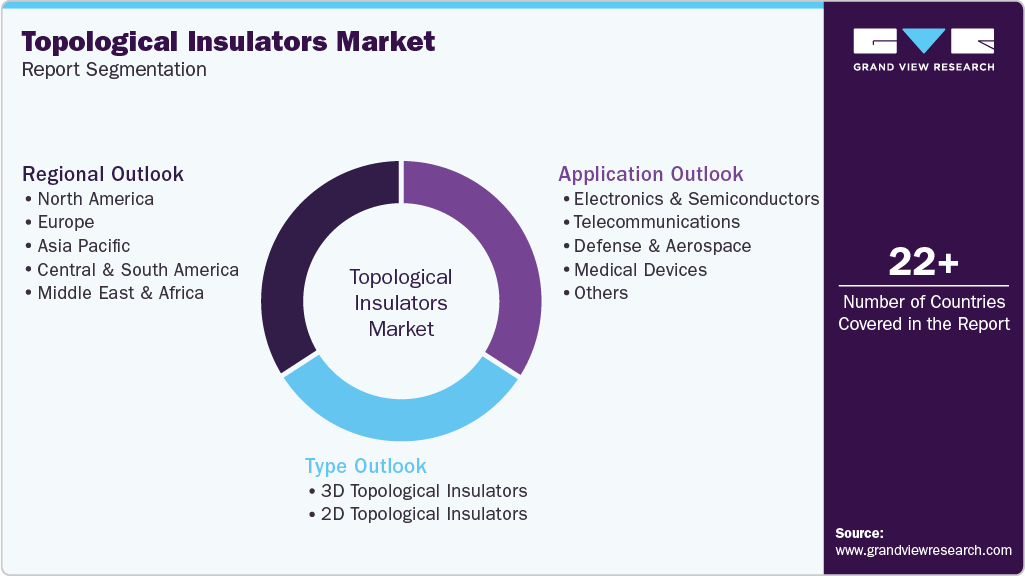

Topological Insulators Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (3D Topological Insulators, 2D Topological Insulators), By Application (Electronics & Semiconductors, Telecommunications, Defense & Aerospace, Medical Devices), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-763-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Topological Insulators Market Summary

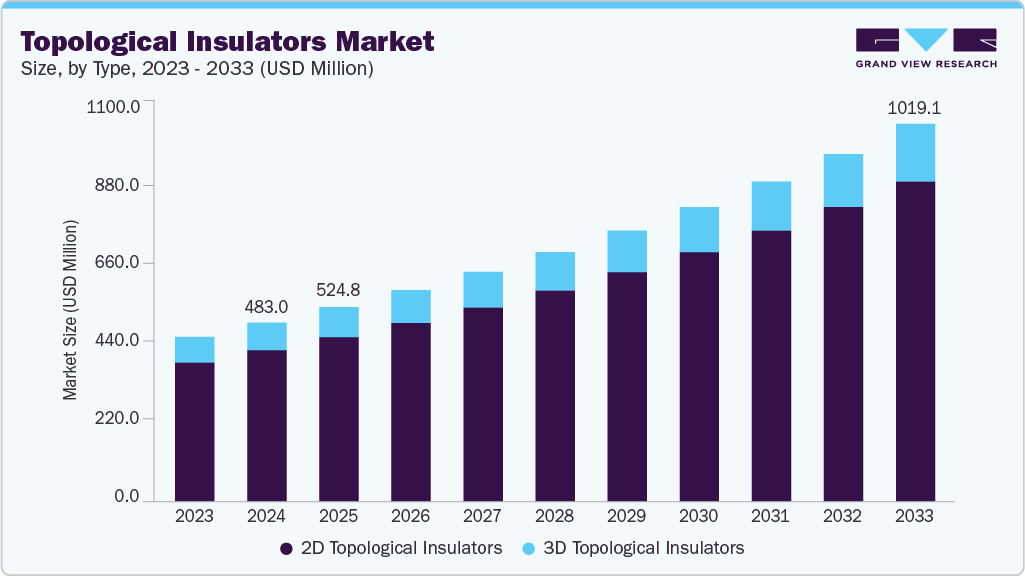

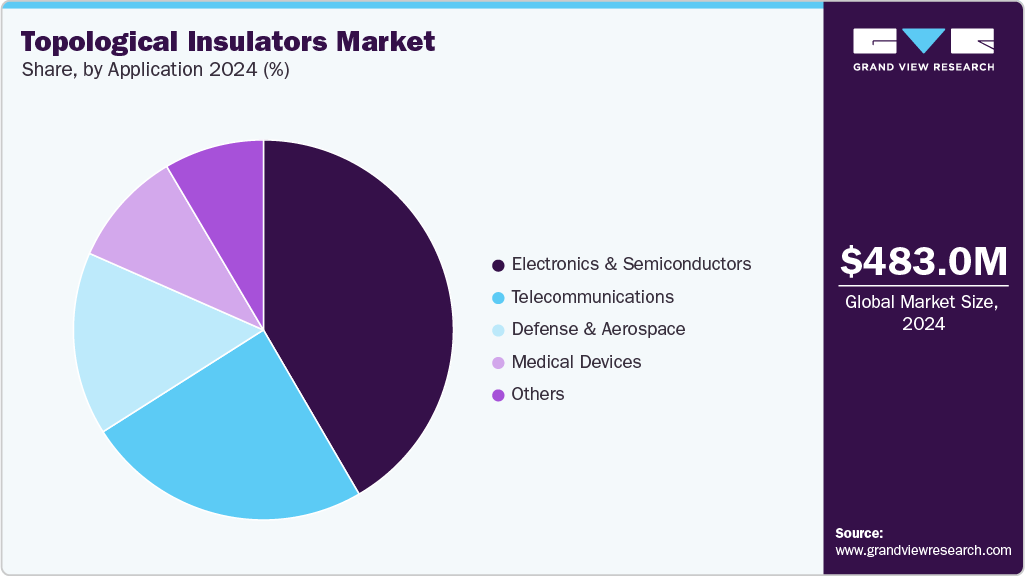

The topological insulators market size was estimated at USD 483.0 million in 2024 and is projected to reach USD 1,019.1 million by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The demand for topological insulators is rising due to their unique electronic properties, where surface states conduct electricity while the bulk remains insulating.

Key Market Trends & Insights

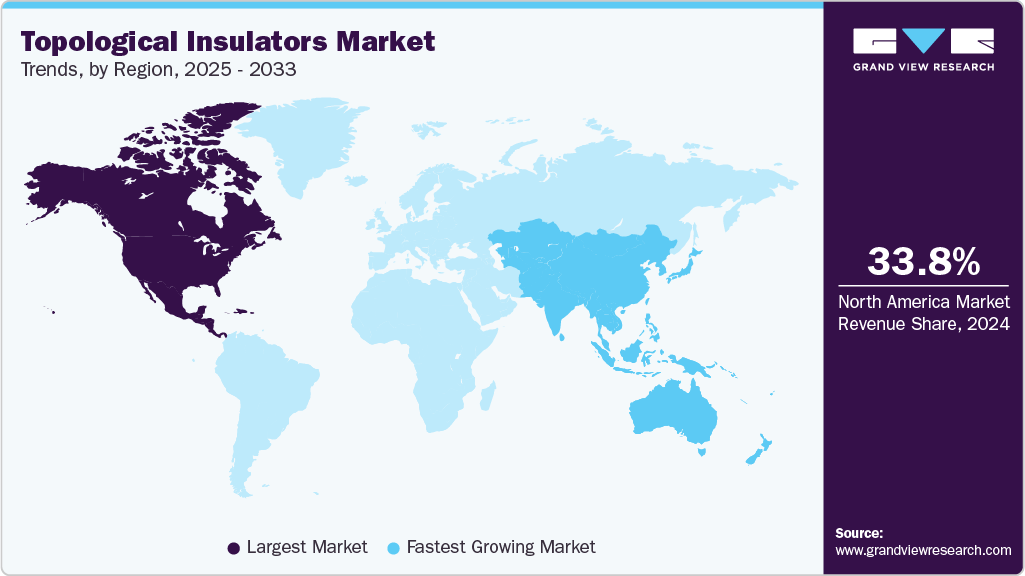

- North America dominated the global topological insulators industry with the largest revenue share of 33.8% in 2024.

- By type, the 2D topological insulators segment is expected to grow at the fastest CAGR of 8.7% over the forecast period.

- By application, the electronics & semiconductors segment is expected to grow at the fastest CAGR of 9.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 483.0 Million

- 2033 Projected Market Size: USD 1,019.1 Million

- CAGR (2025-2033): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

This dual behavior is driving interest in next-generation electronics and quantum devices. With the growing need for miniaturized, faster, and energy-efficient systems, industries are turning towards materials that can support advanced applications. Increasing integration in spintronics, optoelectronics, and quantum computing is further boosting demand. Research institutions and semiconductor companies are actively exploring these materials to unlock their potential.

Key demand drivers include the rising global focus on quantum computing, where topological insulators provide robust states for qubits with reduced error rates. In addition, their spin-polarized edge states are critical for spintronics, which is set to transform data storage and transfer technologies. Another major driver is their ability to improve thermoelectric efficiency, making them vital for sustainable energy technologies. Semiconductor miniaturization challenges are pushing manufacturers toward new materials like topological insulators for efficient transistor scaling. Investments in nanotechnology and advanced materials research are creating opportunities for commercialization.

Recent innovations in the field include advances in molecular beam epitaxy (MBE) for fabricating high-quality thin films of topological insulators. Researchers are exploring hybrid systems that combine superconductors and topological insulators for quantum computing applications. There is also a trend toward integrating these materials into spintronic memory devices and photodetectors. Companies are focusing on scalable production methods to move from lab-scale to industrial adoption. Trends also include enhanced computational modeling to design new topological phases for practical use.

Market Concentration & Characteristics

The market for topological insulators is currently in its early commercialization phase, with a highly fragmented structure dominated by research institutions, universities, and specialized material startups. Large semiconductor and electronics companies are beginning to enter the space through strategic collaborations. The competitive landscape is shaped more by patents and research output than by established product lines. Since industrial adoption is still emerging, there is no strong concentration of market share yet. Over the next decade, consolidation is expected as commercialization progresses. Strategic partnerships and acquisitions will likely drive market maturity. For now, the ecosystem remains innovation-driven rather than production-driven.

The threat of substitutes remains moderate as other advanced materials like graphene, transition metal dichalcogenides (TMDs), and superconductors can serve similar purposes in some applications. For instance, graphene and TMDs are also explored for spintronics and energy-efficient electronics. However, topological insulators offer unique surface conduction properties and quantum protection that cannot be fully replicated by substitutes. In thermoelectric applications, competing materials such as skutterudites and half-Heusler alloys are also in use. While substitutes exist, the specialized role of topological insulators in quantum devices and spintronics reduces direct threats. Their unique advantage lies in robustness against scattering, which substitutes often lack.

Type Insights

The 2D topological insulators segment held the largest revenue market share of 84.5% in 2024, as their quantum spin Hall effect and thin-film form factor make them highly suitable for miniaturized electronics and semiconductor integration. Their edge-conducting channels enable dissipation-free transport, positioning them as a disruptive alternative to conventional semiconductor materials. Research on 2D TI materials such as bismuthene and stanene has expanded rapidly, with breakthroughs in atomic-level fabrication enabling stable and scalable structures. This dominance is reinforced by their compatibility with existing semiconductor manufacturing technologies, driving adoption in experimental device prototypes.

The 3D topological insulators segment is expected to grow at the fastest CAGR of 8.4% over the forecast period, due to their robust surface states that can conduct electricity even in the presence of impurities, making them highly attractive for quantum computing, spintronics, and advanced sensors. Their ability to support Majorana fermions in hybrid superconductor systems has sparked interest from global research labs working on scalable quantum devices. Moreover, their role in thermoelectric energy harvesting is gaining momentum as industries move toward sustainable power solutions. Increased funding in material synthesis techniques for bulk 3D TIs is expanding their use in both research and potential industrial applications.

Application Insights

The electronics and semiconductor segment held the largest revenue market share of 41.6% in 2024, due to the urgent need for energy-efficient and high-performance computing devices. Topological insulators are being explored as key enablers of next-gen transistors, spintronic devices, and neuromorphic computing elements, all of which aim to overcome the limitations of traditional CMOS scaling. The compatibility of TIs with semiconductor platforms has fueled collaborative research between academic labs and major electronics companies. Moreover, as Moore’s Law approaches its physical limits, the industry is seeking new materials to sustain performance improvements, and TIs offer unique opportunities.

The defense and aerospace segment is expected to grow at a CAGR of 8.9% over the forecast period, as these materials provide high sensitivity for advanced sensors, stealth technologies, and secure communication systems. TIs are being considered for use in quantum radar, navigation systems, and resilient communication networks, which are critical for modern defense strategies. Their robustness against external perturbations and dissipation-free edge states enhances the reliability of military electronics operating in extreme environments. In aerospace, TIs could play a role in lightweight energy-harvesting systems and next-generation avionics.

Regional Insights

North America topological insulators industry dominated the global market with the largest revenue share of 33.8% in 2024, fueled by pioneering research and innovation in topological materials. The U.S. leads global publications and patents related to TIs, with strong academic centers like MIT, Stanford, and Princeton driving advancements. Major funding comes from government bodies under the National Quantum Initiative and DARPA programs. Tech giants and semiconductor firms are investing in partnerships with universities to commercialize these materials for quantum computing and advanced electronics. Canada also supports research through collaborative programs and academic institutions. The presence of a strong venture capital ecosystem accelerates innovation.

U.S. Topological Insulators Market Trends

The U.S. topological insulators industry is at the core of topological insulator research and commercialization, supported by its advanced semiconductor industry and robust federal funding. National labs and universities are conducting groundbreaking work on superconductivity and quantum applications of TIs. DARPA and NSF provide large-scale funding to strengthen innovation pipelines. The U.S. tech industry, including startups, is exploring scalable production methods to move beyond lab-scale experiments. Defense and aerospace companies are also eyeing TI applications for secure communication and high-performance devices. Collaborative networks between academia, industry, and government are strong, ensuring knowledge transfer. These initiatives position the U.S. as a global leader in quantum-ready material development.

Asia Pacific Topological Insulators Market Trends

Asia Pacific topological insulators industry is driven by strong government and private investments in semiconductor R&D, nanotechnology, and quantum computing. China, Japan, and South Korea are at the forefront of developing scalable manufacturing techniques for these materials. Universities and national research institutes in the region are actively publishing breakthrough studies on topological phases and spintronics applications. Additionally, the presence of leading electronics and semiconductor industries creates strong commercialization prospects. Favorable government policies to boost advanced computing and material sciences are further accelerating adoption. Collaborative projects between academia and high-tech industries enhance progress.

China topological insulators market is rapidly emerging as a dominant player in the Asia Pacific market, thanks to aggressive funding in quantum technology and semiconductor innovation. National initiatives prioritize the development of advanced materials, including TIs, to achieve technological independence. Universities like Tsinghua and Peking are leading in condensed matter research and nanotechnology breakthroughs. Local startups and research centers are increasingly focusing on commercialization pathways. The government is also fostering collaborations between academia and semiconductor manufacturers. Integration of TIs into optoelectronics and spintronics is gaining traction.

Europe Topological Insulators Market Trends

Europe topological insulators industry is another important hub for topological insulator development, with heavy emphasis on collaborative research through Horizon Europe and EU-funded projects. The UK, Germany, and France lead in condensed matter physics and nanotechnology research. Several universities and national research centers are making advances in spintronics and TI-based thermoelectric systems. European industries are also exploring the integration of TIs into sustainable energy devices and quantum computing hardware. The presence of well-structured public-private partnerships enhances commercialization potential. Europe’s semiconductor ecosystem is less extensive than Asia or the U.S., but its research-driven environment ensures consistent progress.

Germany topological insulators market has a strong presence in the European market, backed by its excellence in materials science and engineering research. German universities and institutes are leading studies on quantum materials and their spintronic applications. Government funding programs support innovation in advanced materials, including TIs, under its national high-tech strategies. German industries are showing interest in thermoelectric applications to support energy efficiency goals. Collaborative frameworks between academia, research labs, and industrial players are helping translate lab discoveries into potential applications. With its advanced semiconductor and automotive industries, Germany has the infrastructure to scale TI adoption.

Central & South America Topological Insulators Market Trends

Central & South America topological insulators industry remains in the early stages of adopting topological insulators, with limited industrial activity but growing academic research. Brazil and Mexico are leading the region in condensed matter physics and nanotechnology studies. Universities are collaborating with North American and European institutions to explore TI applications. Government funding remains modest, but international partnerships are filling gaps in resources. The market here is still largely research-driven, with no significant commercialization yet. However, as demand for advanced semiconductors and sustainable energy solutions grows, the region could gradually adopt TI-based technologies.

Middle East & Africa Topological Insulators Market Trends

The Middle East & Africa topological insulators industry is still nascent but shows potential due to rising investments in advanced materials research. Countries like Israel and the UAE are developing strong research hubs in nanotechnology and condensed matter physics. Israel’s advanced tech sector is particularly active in exploring quantum technologies, where TIs could play a critical role. The UAE is investing in academic partnerships with global universities to strengthen materials research capabilities. Africa remains underdeveloped in this field, though South Africa has some research activities in physics and materials science.

Key Topological Insulators Company Insights

Some of the key players operating in the market include HQ Graphene and American Elements.

-

HQ Graphene is a Netherlands-based company specializing in the growth and supply of high-quality 2D single crystals and layered materials, including key topological insulators such as Bi₂Se₃ and Bi₂Te₃. The company has built a strong reputation among global research institutions and universities for delivering defect-free crystals with superior purity, which are critical for experiments in spintronics, quantum materials, and condensed matter physics.

-

American Elements is a U.S.-based advanced materials manufacturer and supplier, known for its extensive catalog of more than 30,000 products spanning metals, alloys, nanomaterials, and ceramics. With strong global distribution capabilities, the company serves industries ranging from semiconductors to aerospace and energy. In the context of topological insulators, American Elements provides essential raw materials such as high-purity bismuth, antimony, and selenium compounds that are widely used in TI research and device development.

Ossila and Stanford Advanced Materials are some of the emerging market participants in the topological insulators industry.

-

Ossila, headquartered in the UK, has carved a niche in supplying affordable and accessible research materials and equipment to laboratories worldwide. Founded by scientists, the company is focused on supporting R&D in thin-film electronics, organic semiconductors, and 2D materials. Ossila’s catalog includes substrates, measurement equipment, and electronic materials that overlap with the requirements for topological insulator research and device fabrication.

-

Stanford Advanced Materials (SAM), based in California, is a long-established supplier of specialty materials, including rare earth elements, ceramics, optical crystals, and advanced composites. While not exclusively focused on topological insulators, SAM plays an important role in the broader advanced materials supply chain that supports semiconductor, optics, and energy research. Their portfolio includes substrates, purified metals, and compounds that can be applied in TI research and related fields.

Key Topological Insulators Companies:

The following are the leading companies in the topological insulators market. These companies collectively hold the largest market share and dictate industry trends.

- HQ Graphene

- MKNano

- Ossila

- American Elements

- 2D Semiconductors

- SixCarbon Technology

- Stanford Advanced Materials

- Nano Research Elements

- Heeger Materials Inc.

- Otto Chemie Pvt. Ltd.

Topological Insulators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 524.8 million

Revenue forecast in 2033

USD 1019.1 million

Growth rate

CAGR of 8.7% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America , Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

HQ Graphene; MKNano; Ossila; American Elements; 2D Semiconductors; SixCarbon Technology; Stanford Advanced Materials; Nano Research Elements; Heeger Materials Inc.; Otto Chemie Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Topological Insulators Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the topological insulators market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

3D Topological Insulators

-

2D Topological Insulators

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronics & Semiconductors

-

Telecommunications

-

Defense & Aerospace

-

Medical Devices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global topological insulators market size was estimated at USD 483.0 million in 2024 and is expected to reach USD 524.8 million in 2025.

b. The global topological insulators market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 1,019.1 million by 2033.

b. The gases & sprays segment held the highest revenue market share of 33.1% in 2024, due to their cost-effectiveness, ease of deployment, and wide acceptance among law enforcement and civilian users.

b. Some of the key players operating in the topological insulators market include HQ Graphene, MKNano, Ossila, American Elements, 2D Semiconductors, SixCarbon Technology, Stanford Advanced Materials, Nano Research Elements, Heeger Materials Inc., and Otto Chemie Pvt. Ltd.

b. Rising demand for advanced quantum materials, increasing applications in spintronics, energy-efficient electronics, and growing R&D in quantum computing are key factors driving the topological insulators market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.