- Home

- »

- Healthcare IT

- »

-

Global Track And Trace Solutions Market Report Report, 2030GVR Report cover

![Track And Trace Solutions Market Size, Share & Trends Report]()

Track And Trace Solutions Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Hardware Systems, Software Solutions), By Technology (Barcodes, RFID), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-229-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Track And Trace Solutions Market Summary

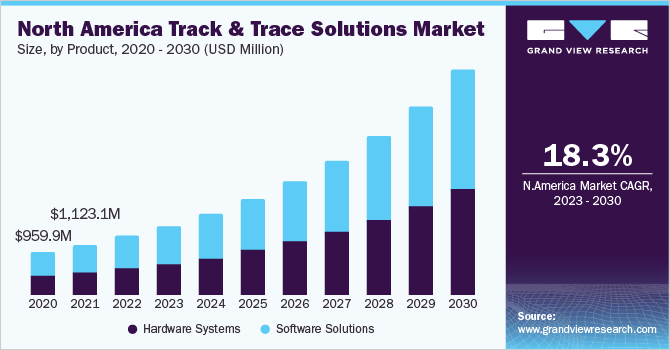

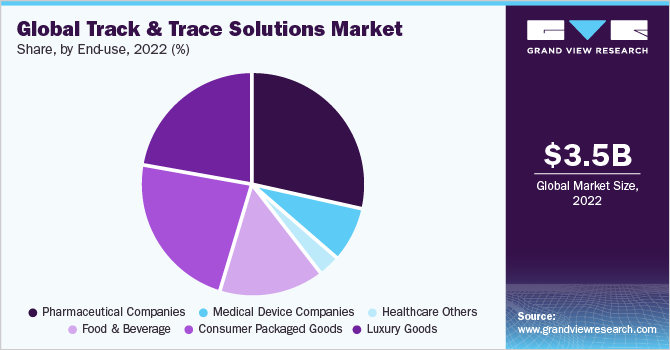

The global track and trace solutions market size was estimated at USD 3.5 billion in 2022 and is projected to reach USD 14.3 billion by 2030, growing at a CAGR of 19.3% from 2023 to 2030. The market growth is majorly accredited to the growing rate of counterfeiting and theft of healthcare products worldwide.

Key Market Trends & Insights

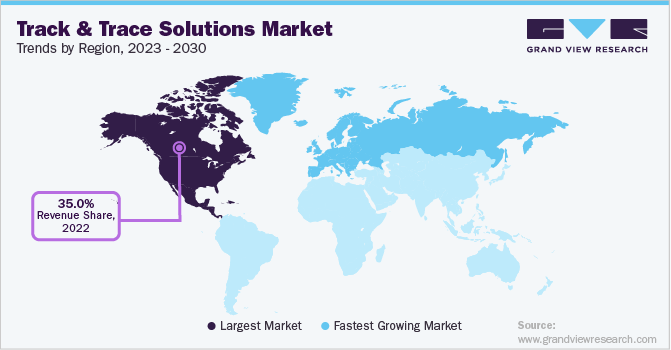

- North America accounted for the largest revenue share of over 35.0% in 2022.

- Europe emerged as the second-largest regional market for track and trace solutions in terms of revenue and is expected to remain unaltered till 2030.

- Based on application, serialization solutions held the largest revenue share in 2022.

- In terms of technology, barcode technology held the largest revenue share in 2022.

- Based on end-use, pharmaceutical companies dominated the market with a revenue share of over 25.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.5 Billion

- 2030 Projected Market Size: USD 14.3 Billion

- CAGR (2023-2030): 19.3%

- North America: Largest market in 2022

Biopharmaceutical, pharmaceutical, cosmetic products, and medical device manufacturers are adopting track and trace solutions and protecting their products and brand equity. Furthermore, favorable regulations for serialization implementation are anticipated to drive the application of track and trace solutions in the healthcare industry.

The market is anticipated to witness significant growth owing to the rising deployment of track and trace solutions by pharmaceutical and medical device companies. Drug counterfeiting is a major problem faced by pharmaceutical and biopharmaceutical companies. Thus, companies are adopting track and trace solutions for supply chain monitoring. It has been found that the influx of substandard/counterfeit medications is more prevalent in low to middle-income countries, such as India and Africa. According to the United States Trade Representative (USTR) report in 2019, around 20% of all sold drugs in India were counterfeit.

Product counterfeiting and theft are key problems faced by pharmaceutical, biopharmaceutical, and cosmetic companies. According to the WHO, it is estimated that around 10% of all medicines are counterfeit worldwide, and this percentage is much higher in some of the African, Asian, and Latin American countries (10% to 30%). Annually, thousands of people die due to the consumption of fake medicines. Thus, the governments of many countries have set standards and regulations for mandatory implementation of track and trace solutions in the healthcare industry to protect people from fake medicines and other products. In addition, the advancement in products and technology such as RFID drives the adoption of track and trace in the supply chain. It is estimated that over 40 countries and more than 75% of the worldwide medicine supply will be covered by track and trace regulations by 2018. However, the high cost associated with the implementation of track and trace in the supply chain could hinder the growth of this market.

Moreover, stringent regulations and standards pertinent to serialization implementation and aggregation are expected to drive the market. In July 2019, Therapeutic Goods Administration (TGA) imparted new guidelines on product coding to reduce counterfeiting in Australia. However, the high cost connected with the track and trace implementation and the lack of unified global standard regulations for serialization and aggregation could hinder the market growth.

The COVID-19 impact revealed the importance of traceability and standardization to effectively monitor people, supply chain, and assets in the healthcare industry. The COVID-19 outbreak has heightened the risks posed by the global trade in counterfeit pharmaceutical products. According to the World Health Organization (WHO), a rising capacity of false medicines linked to COVID-19 are on sale in developing countries along with an upsurge in counterfeit medical products related to coronavirus.

Product Insights

Software solutions held the largest revenue share in 2022 due to the growing adoption in healthcare companies, including pharmaceuticals, biopharmaceuticals, and medical devices. These software solutions are used for continuous management of manufacturing facilities, product lines, case and bundle tracking, and warehousing and shipping. Companies developing such software are investing in R&D for better product development, which is expected to propel growth. The software solutions segment is expected to be the most lucrative segment of this market. Increasing investment in R&D and focus on customer service by software companies are contributing to the growth of this segment.

The hardware systems segment is expected to witness lucrative growth over the forecast period. In the hardware systems segment, the printing and marking solutions segment held the largest revenue share in 2021. This system plays an important role in the production and supply chain to ensure the quality and authenticity of the products. Rising demand for serialization and the need to achieve regulatory compliance are fueling market growth. Printing and marking equipment is expected to play a crucial role to meet the Drug Supply Chain Security Act (DSCSA) requirements by 2023. Moreover, advancement in coding technologies such as laser marking systems, large character marking (LCM), and thermal transfer overprinting (TTO) is expected to fuel market growth in the coming years.

Application Insights

Serialization solutions held the largest revenue share in 2022 due to the increasing focus of regulatory bodies on the implementation of the same. The federal agencies, country governments, and healthcare industry are taking measures to decrease product diversion and drug counterfeiting. Serialization is a major step to comply with new ePedigree regulations that are required for product traceability during the supply chain. In addition, the increased focus on patient safety and brand protection by manufacturers is expected to propel the segment growth during the forecast period.

Manufacturers are facing challenges due to the growing complexity and diversity in serialization requirements, primarily in the pharmaceutical industry. Variations in standards and regulations across the countries and the management of aggregated complex data make it difficult for manufacturers to implement serialization in track and trace. However, the increasing rate of counterfeiting of pharmaceuticals and other healthcare products drives the adoption of serialization in the supply chain. The aggregation solutions segment is expected to grow at a high rate during the forecast period because of the growing adoption of these solutions by healthcare companies.

Technology Insights

Barcode technology held the largest revenue share in 2022. The 2D barcode is the dominant segment of barcode technology and is expected to maintain its position throughout the forecast period. The increased application of 2D barcodes in pharmaceutical and biopharmaceutical product packaging is a major factor that contributed to the higher revenue share. In addition, ample data storage capacity of 2D barcodes than linear barcodes and its higher popularity in the industry boost the demand for 2D barcode-based solutions.

Government regulations and an increase in counterfeit drug sales led to the implementation of barcode technology in the healthcare industry. For instance, the Directorate General of Foreign Trade issued a notice announcing the execution of a track and trace system integrated barcode technology for pharmaceutical products exported from India since 2011. Thus, the demand for barcode technology in the market has increased and is expected to remain high during the forecast period. The RFID segment is expected to exhibit the fastest growth rate during the forecast period. Key factors that are contributing to the growth of the segment are technological advantages such as high durability and reusability, more data storage capacity, and no requirement of the line of sight.

End-use Insights

Pharmaceutical companies dominated the market with a revenue share of over 25.0% in 2022. Ensuring safe product track and trace abilities across various entities throughout the supply chain by implementing serialization is a crucial step to address the challenges faced by pharmaceutical companies. Currently, pharmaceutical manufacturers must comply with federal and state regulations for track and trace solutions, which is fueling the demand. In September 2013, the Drug Quality and Security Act H.R. 3204 was approved by the Senate as the U.S. federal law. According to this bill, manufacturers are required to incorporate a product identifier number on each package and case of prescription drugs. The demand for track and trace solutions for the pharmaceutical and biopharmaceutical supply chain was high in 2020 and is expected to increase further during the forecast period.

The consumer packaged goods segment is expected to witness significant growth over the forecast period. Common counterfeit goods include clothing, footwear, handbags, watches, OTC products, household products, books, batteries, cigarettes, and video games among others. According to Office for National Statistics, counterfeit trade in the U.K. was worth 9.3 billion in the year 2017. Consumer safety, brand retention, and product recalls are some of the major concerns owing to disorganized supply chain logistics. The growth of e-commerce globally has led to a rise in counterfeit production as consumer demand for these goods increases. Therefore, a rising number of manufacturers are adopting the use of track and trace solutions to provide consumers with authentic products.

Regional Insights

North America accounted for the largest revenue share of over 35.0% in 2022, primarily due to the presence of highly regulated serialization and aggregation standards and advanced healthcare infrastructure. Automatic identification technologies including barcoding and RFID are recommended to pharmaceuticals and other healthcare companies by the FDA. Furthermore, the presence of highly developed healthcare infrastructure and the adoption of this technology in the U.S. is expected to drive the market.

Europe emerged as the second-largest regional market for track and trace solutions in terms of revenue and is expected to remain unaltered till 2030. This can be attributed to the presence of developed economies, such as Germany, Turkey, the U.K., France, and Italy, in the region. The European Union aims to progressively implement track and trace solutions in the healthcare supply chain to deal with drug counterfeiting and theft. According to the Falsified Medicines Directive, manufacturers failing to comply with drug serialization regulations would not be allowed to market their products in Europe.

Key Companies & Market Share Insights

There are multiple small and large manufacturers offering products for tracking and tracing applications, resulting in intense competition among vendors. The vendors are increasing their focus on strategic partnerships with their consumers and are collaborating with other players in the sector. For instance, in January 2022, Optel Group acquired the track and trace unit of Korber Business Area Pharma, also known as Taxeed. The company is based in Germany and has helped Optel to leverage Taxeed’s expertise in agrochemical and pharmaceutical track and trace technologies. Furthermore, in September 2021, Rfxcel, a subsidiary of Antares Vision Group, signed a five-year cooperative agreement with the Lebanese Republic’s Ministry of Public Health for providing a GS1-compliant traceability hub for securing Lebanon’s entire pharmaceutical supply chain. Some prominent players in the global track and trace solutions market include:

-

Axway

-

Mettler-Toledo International, Inc.

-

Optel Vision

-

TraceLink, Inc.

-

Adents

-

Antares Vision S.r.l

-

Siemens AG

-

Korber AG

-

ACG Worldwide

-

Markem Imaje, a Dover Company

Track And Trace Solutions Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.1 billion

Revenue forecast in 2030

USD 14.3 billion

Growth rate

CAGR of 19.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Switzerland; Belgium; Russia; China; Japan; India; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Egypt

Key companies profiled

Axway; Mettler-Toledo International, Inc.; Optel Vision; Adents; Antares Vision SRL; TraceLink, Inc.; Siemens AG; ACG Worldwide; Korber AG; Markem Imaje

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. Grand View Research has segmented the global track and trace solutions market report by product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware Systems

-

Printing & Marking Solutions

-

Monitoring & Verification Solutions

-

Labeling Solutions

-

Others

-

-

Software Solutions

-

Plant Manager Software

-

Line Controller Software

-

Bundle Tracking Software

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Barcode

-

RFID

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Serialization Solutions

-

Bottle Serialization

-

Label Serialization

-

Carton Serialization

-

Data Matrix Serialization

-

-

Aggregation Solutions

-

Bundle Aggregation

-

Case Aggregation

-

Pallet Aggregation

-

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Pharmaceutical Companies

-

Medical Device Companies

-

Healthcare Others

-

Food and Beverage

-

Consumer Packaged Goods

-

Luxury Goods

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Belgium

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

- Egypt

-

-

Frequently Asked Questions About This Report

b. The global track and trace solutions market size was estimated at USD 3.5 billion in 2022 and is expected to reach USD 4.1 billion in 2023.

b. The global track and trace solutions market is expected to grow at a compound annual growth rate of 19.3% from 2023 to 2030 to reach USD 14.3 billion by 2030.

b. North America dominated the track and trace solutions market with a share of over 35% in 2022. This is attributable to the presence of highly regulated serialization and aggregation standards, as well as advanced healthcare infrastructure.

b. Some key players operating in the track and trace solutions market include Axway; Mettler-Toledo International, Inc.; Optel Vision; TraceLink, Inc.; Adents International; Antares Vision srl; Siemens AG; Seidenader Maschinenbau GmbH; ACG Worldwide; and Systech, Inc.

b. Key factors that are driving the track and trace solutions market growth include the associated advantages of track and trace solutions, such as continuous transparency, packaging, and logistics management, and product ID verification services facilitating hassle-free product movement within the distribution channel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.