- Home

- »

- Plastics, Polymers & Resins

- »

-

Transparent Plastics Market Size, Industry Report, 2033GVR Report cover

![Transparent Plastics Market Size, Share & Trends Report]()

Transparent Plastics Market (2025 - 2033) Size, Share & Trends Analysis Report By Polymer Type (PET, PVC, PP, PS, PC, PMMA), By Form (Rigid, Flexible), By Application (Medical & Healthcare, Automotive, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-691-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transparent Plastics Market Summary

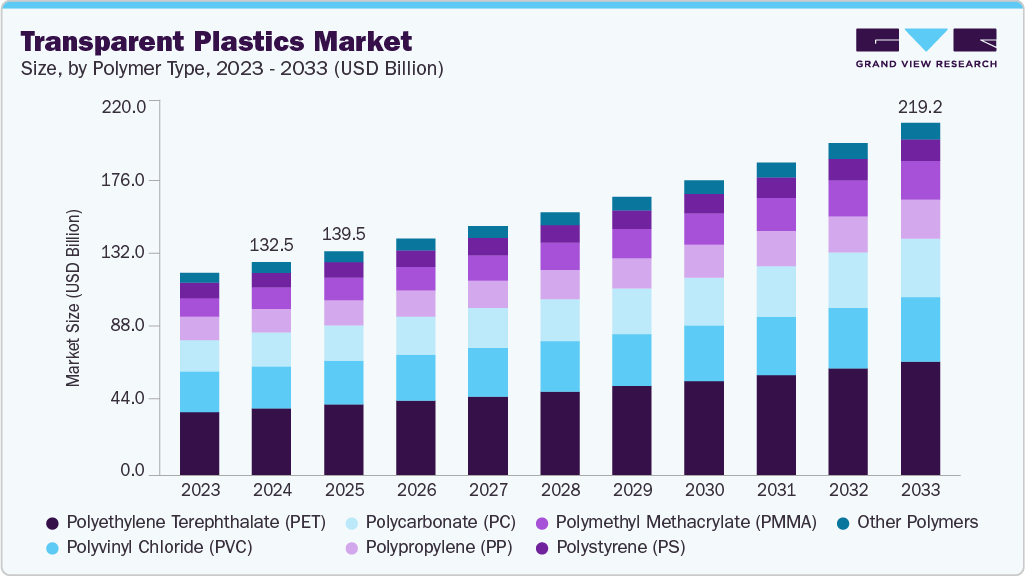

The global transparent plastics market size was estimated at USD 132.54 billion in 2024 and is projected to reach USD 219.17 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. A surge in e‑commerce and premium packaging demands is driving transparent plastics as brands seek clear, lightweight containers that showcase product quality and enhance shelf appeal.

Key Market Trends & Insights

- Asia Pacific dominated the transparent plastics market with the largest revenue share of 43.52% in 2024.

- The transparent plastics market in the U.S. is driven by the expansion of healthcare facilities and outpatient clinics.

- By polymer type, the polymethyl methacrylate (PMMA) segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By form, the rigid segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By applications, the medical & healthcare segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 132.54 Billion

- 2033 Projected Market Size: USD 219.17 Billion

- CAGR (2025-2033): 5.8%

- Asia Pacific: Largest market in 2024

Manufacturers benefit from streamlined production and reduced logistics costs when substituting glass with durable, shatter‑resistant polymer alternatives. The market is witnessing a pronounced shift towards bio‑based and recyclable resin formulations as sustainability becomes a central tenet of corporate strategy. Manufacturers are investing in advanced polymer chemistries that maintain optical clarity while enabling circularity through chemical recycling. Concurrently, there is growing adoption of additive manufacturing applications that leverage transparent thermoplastics for rapid prototyping and end‑use components. This convergence of environmental stewardship and manufacturing innovation is redefining market expectations and driving premiumization.

Drivers, Opportunities & Restraints

Escalating demand from the consumer electronics sector is fueling transparent plastics growth as manufacturers seek lightweight and durable alternatives to glass for displays, touchscreens and optical lenses. The heightened focus on device portability and design aesthetics compels OEMs to integrate high‑performance polycarbonate and acrylic grades that offer superior impact resistance. Additionally, stringent requirements for material purity and surface finish in industries such as medical devices further amplify the reliance on transparent polymer solutions, solidifying their role in advanced applications.

Rapid urbanization and infrastructure development in emerging economies present significant growth prospects for transparent plastics in architectural and construction applications. Innovations in transparent polyether sulfone and polycarbonate glazing systems can deliver enhanced thermal insulation and UV protection, meeting evolving building codes and energy‑efficiency standards. Collaboration between resin producers and construction material suppliers to develop tailored extrusion and molding processes offers a pathway to capturing this burgeoning demand, especially in high‑rise and façade projects.

Volatility in raw material prices, driven by fluctuations in crude oil markets and feedstock availability, poses a considerable challenge to transparent plastics producers. This uncertainty can erode profit margins and hinder long‑term planning for capacity expansion.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies like Dow, Inc., SABIC, BASF SE, Covestro AG, PPG Industries, Inc., LyondellBasell Industries N.V., DuPont de Nemours, Inc., INEOS Group Limited, LANXESS AG, Berry Global, Cosmo Films, Amcor plc, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The transparent plastics sector is rapidly embracing advanced material sciences, with self‑healing polymers that autonomously repair surface scratches extending product lifespans and reducing maintenance costs. Concurrently, manufacturers are deploying blockchain‑enabled recycling platforms to trace feedstock provenance and certify recycled content, enhancing supply‑chain transparency and unlocking premium pricing for verifiable circular products. These convergent innovations are reshaping value propositions and driving investment into next‑generation resin technologies.

Stringent mandates under the EU Single‑Use Plastics Directive require 77% collection of plastic bottles by 2025 and a minimum of 25% recycled content in PET beverage containers from the same year. In July 2025, the European Commission’s consultation on chemically recycled content rules will standardize verification methodologies, fostering scale‑up of advanced recycling technologies and affording legal certainty to investors. Together, these regulatory drivers are compelling brand‑owners and converters to reconfigure formulations and adopt certified recycling streams to maintain market access.

Polymer Type Insights

Polyethylene terephthalate (PET) dominated the market, accounting for a share of 31.57% in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2033. Surging demand for sustainable beverage packaging underpins PET’s dominance, as brand owners shift toward lightweight, fully recyclable containers to meet circular economy targets.

Its proven barrier properties and compatibility with high‑speed filling lines deliver operational efficiencies and lower carbon footprints. Innovation in mono‑material PET trays and thermoforming solutions further cements its cost‑effective appeal for both food and non‑food applications.

The polymethyl methacrylate (PMMA) segment is anticipated to grow at the fastest CAGR of 7.3% through the forecast period. Rapid uptake of energy‑efficient LED lighting and architectural glazing drives PMMA’s exceptional growth, thanks to its superior light transmittance and weather resistance.

OEMs in the automotive and signage industries increasingly specify PMMA for headlamp covers and display panels to enhance design flexibility and durability. Ongoing material enhancements that improve scratch resistance and UV stability are accelerating adoption in specialty markets.

Form Insights

The rigid segment dominated the market, accounting for a share of 69.02% in 2024 and is anticipated to grow at a CAGR of 6.2% over the forecast period. Robust demand for clear, crash‑worthy automotive components and durable electronic housing propels the rigid segment to both the largest and fastest positions.

Manufacturers benefit from their structural integrity and dimensional stability, which reduces defects and rework in high‑precision molding processes. Furthermore, regulatory mandates for lightweight safety materials in transportation continue to prioritize rigid plastics over metal and glass alternatives.

The flexible segment is expected to grow at a significant CAGR of 5.0% through the forecast period. Growth in flexible films and sheets is being fueled by the rise of wearable technology and advanced packaging formats.

Companies are leveraging transparent, stretchable polymers in smart textiles and barrier laminates to balance user comfort with product protection. Enhanced formability and lower material consumption in roll‑to‑roll processing enable rapid scale‑up, bolstering cost efficiency for emerging applications.

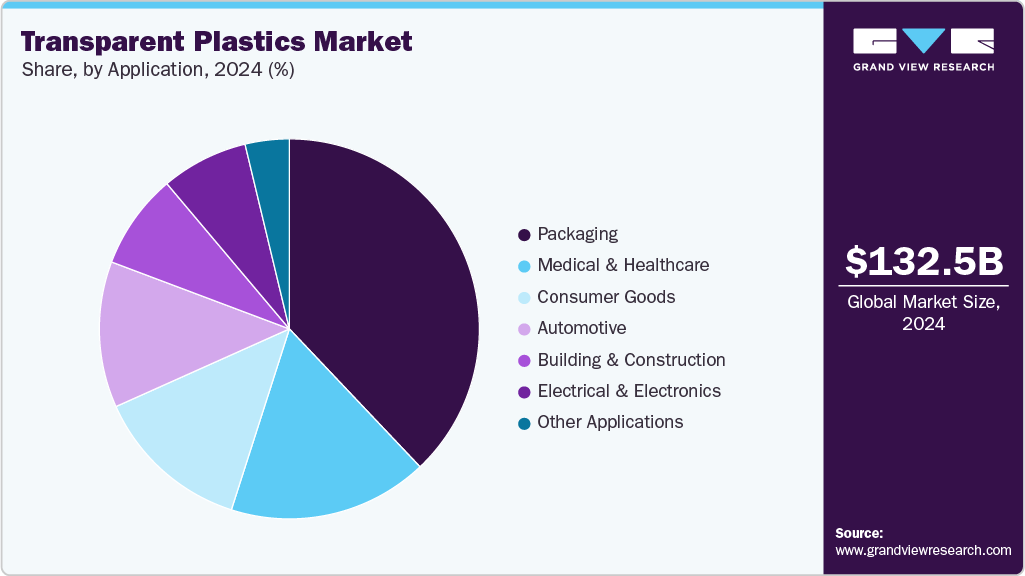

Application Insights

Packaging led the market, accounting for a share of 37.93% in 2024 and is expected to grow at a CAGR of 5.6% through the forecast period. The broader shift toward premium retail experiences and online grocery channels is driving packaging to remain the largest application.

Transparent plastics empower brands to showcase product integrity while offering tamper‑evident features that build consumer trust. Simultaneously, investments in lightweight, mono‑material solutions reduce freight expenses and simplify recycling streams, appealing to both retailers and sustainability‑focused regulators.

The medical & healthcare segment is expected to expand at a substantial CAGR of 7.4% over the forecast period. Expanding requirements for single‑use diagnostic devices and sterile packaging are accelerating transparent plastics in medical markets.

Clarity is critical for visual inspection in fluid management systems and sample collection kits, prompting healthcare OEMs to favor polymers with proven biocompatibility and gamma‑sterilization resistance. Ongoing collaborations between resin suppliers and medical device manufacturers are unlocking novel formulations that meet stringent regulatory standards while improving patient safety.

Regional Insights

Asia Pacific transparent plastics market held the largest share of 43.52% in 2024. Environmental regulations and financial incentives across China, Japan, South Korea, and India are accelerating the uptake of CO₂‑based and bio‑sourced transparent polymers. Public‑private partnerships and R&D consortia are scaling up carbon capture utilization (CCU) technologies to produce low‑carbon resins, while booming consumer electronics and packaging sectors drive volume growth. The region’s holistic policy frameworks and investment in sustainable feedstock position it as the fastest‑growing transparent plastics market.

China Transparent Plastics Market Trends

China transparent plastics market is underpinned by its vast electronics and electric vehicle industries. OEMs specify clear polycarbonate and PMMA for lightweight display covers, headlamps and interior trim to improve energy efficiency and design flexibility. Concurrent infrastructure expansion-ranging from smart glazing in high‑rise buildings to clear plastic barriers in public transit-further cements domestic demand for advanced transparent resin grades.

North America Transparent Plastics Market Trends

The transparent plastics market in North America is driven by robust investments in chemical recycling infrastructure and stringent corporate sustainability targets. Leading converters are adopting next‑generation depolymerization techniques to meet regional circular economy goals while satisfying growing demand from the medical device and pharmaceutical packaging sectors. The recent rebound in U.S. residential construction is also fueling the use of polycarbonate and acrylic glazing for energy‑efficient windows, and Canada’s cold‑weather automotive components increasingly rely on impact‑resistant clear polymers.

The transparent plastics market in the U.S. is driven by the expansion of healthcare facilities and outpatient clinics, which is creating a surge in demand for high‑clarity, biocompatible plastics in diagnostic kits and surgical trays. Meanwhile, accelerated residential and commercial building activity is driving transparent polymer use in lightweight window systems and interior partitions. As of 2025, the American Hospital Association reports over 6,100 hospitals and 919,000 active construction sites, underscoring the sector’s role as a key growth engine for transparent plastics.

Europe Transparent Plastics Market Trends

The transparent plastics market in Europe is shaped by aggressive circularity mandates, including the EU’s requirement for 25% recycled content in PET bottles by 2025. Governments are subsidizing AI‑driven sorting and advanced recycling facilities, enabling converters to supply certified recycled‑content grades for automotive headlamps and architectural façade systems. This policy‑backed momentum is complemented by rising demand for sustainable materials in high‑end packaging and electronics applications.

Key Transparent Plastics Company Insights

Key players operating in the transparent plastics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Transparent Plastics Companies:

The following are the leading companies in the transparent plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Dow, Inc.

- SABIC

- BASF SE

- Covestro AG

- PPG Industries, Inc.

- LyondellBasell Industries N.V.

- DuPont de Nemours, Inc.

- INEOS Group Limited

- LANXESS AG

- Berry Global

- Cosmo Films

- Amcor plc

Recent Developments

-

In May 2024, Dow and SCG Chemicals (SCGC) signed a memorandum of understanding (MOU) to create a circularity partnership in the Asia Pacific region aimed at transforming 200,000 tons per annum (KTA) of plastic waste into circular products by 2030. The agreement focused on advancing technologies for both mechanical and advanced recycling to convert a broader range of plastic waste into high-value applications.

-

In March 2025, the Philippines launched the National Plastic Action Partnership (NPAP), to tackle its growing plastic waste crisis and promote a circular economy. Led by the Department of Environment and Natural Resources (DENR), NPAP united the government, private sector, civil society, academia, and development partners to develop inclusive, collaborative solutions to reduce the country's annual 2.7 million metric tons of plastic waste, a significant portion of which pollutes oceans.

Transparent Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 139.45 billion

Revenue forecast in 2033

USD 219.17 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segmentation covered

Polymer type, form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Dow, Inc.; SABIC; BASF SE; Covestro AG; PPG Industries, Inc.; LyondellBasell Industries N.V.; DuPont de Nemours, Inc.; INEOS Group Limited; LANXESS AG; Berry Global; Cosmo Films; Amcor plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transparent Plastics Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global transparent plastics market report on the basis of polymer type, form, application, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Polycarbonate (PC)

-

Polymethyl Methacrylate (PMMA)

-

Other Polymers

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Rigid

-

Flexible

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical & Healthcare

-

Automotive

-

Consumer Goods

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global transparent plastics market size was estimated at USD 132.54 billion in 2024 and is expected to reach USD 139.45 billion in 2025.

b. The global transparent plastics market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2033, reaching USD 219.17 billion in 2033.

b. Polyethylene terephthalate (PET) dominated the global transparent plastics market with a revenue share of 31.57% in 2024, owing to surging demand for sustainable beverage packaging as brand owners shift toward lightweight, fully recyclable containers to meet circular economy targets.

b. Some of the key players in the global transparent plastics market include Dow, Inc., SABIC, BASF SE, Covestro AG, PPG Industries, Inc., LyondellBasell Industries N.V., DuPont de Nemours, Inc., INEOS Group Limited, LANXESS AG, Berry Global, Cosmo Films, and Amcor plc

b. Key factors driving the global transparent plastics market are brands seeking clear, lightweight containers that showcase product quality and enhance shelf appeal.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.