- Home

- »

- Homecare & Decor

- »

-

Treehouse Glamping Market Size, Industry Report, 2030GVR Report cover

![Treehouse Glamping Market Size, Share & Trends Report]()

Treehouse Glamping Market (2025 - 2030) Size, Share & Trends Analysis Report By Age Group (18-32 Years, 33-50 Years, 51-65 Years, above 65 Years), By Booking Mode (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-358-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Treehouse Glamping Market Summary

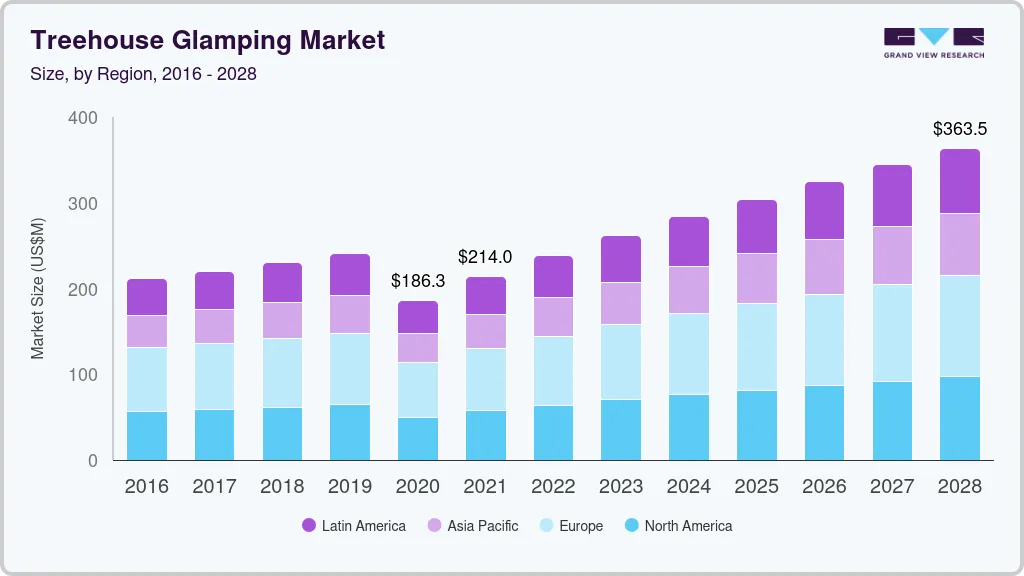

The global treehouse glamping market size was estimated at 332.4 million in 2024 and is projected to reach USD 473.2 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. Treehouse glamping is consistently gaining popularity among glamping enthusiasts.

Key Market Trends & Insights

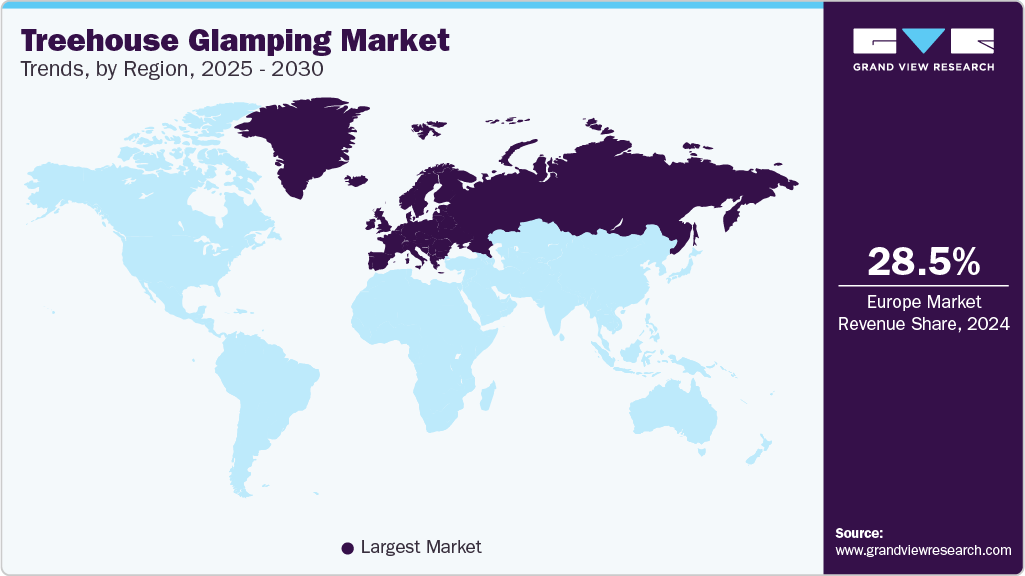

- The Europe Treehouse Glamping market held the largest share of 28.5% in 2024.

- The UK is expected to register the fastest CAGR during the forecast period.

- By age group, the 18-32 years age group accounted for the largest share of 47.0% in 2024

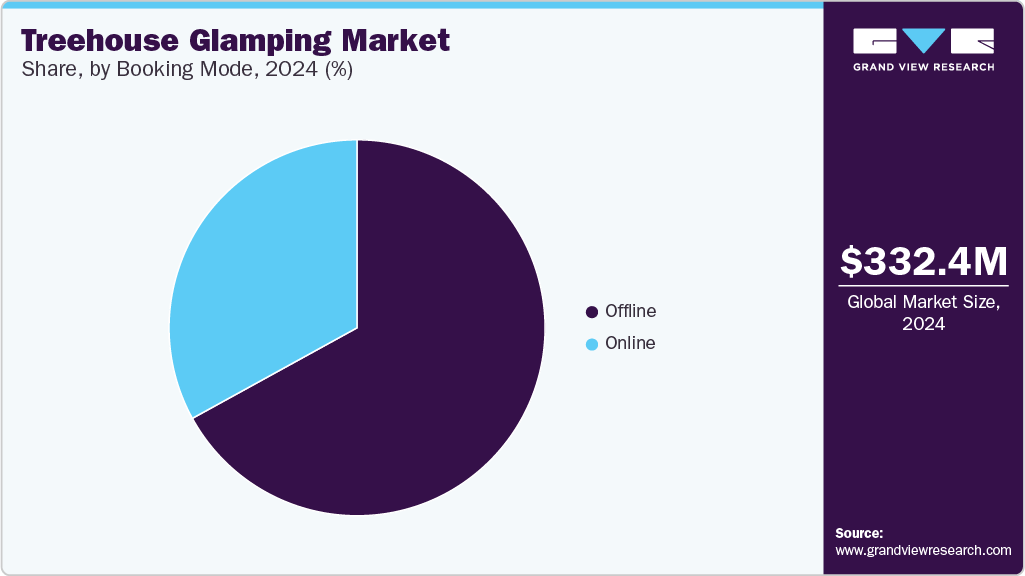

- By booking mode, offline mode held the largest revenue share in the overall treehouse glamping industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 332.4 Million

- 2030 Projected Market Size: USD 473.2 Million

- CAGR (2025 - 2030): 5.9%

- Europe: Largest market in 2024

Availability of safety hardware and efficient treehouse layouts helped the treehouses to be constructed in the most diverse places and intricate patterns across different tree types. Treehouses complement the definition of glamping as they offer uniqueness, comfort, and luxury. Besides overnight stays, treehouses are perceived as a unique venue for social activities such as corporate retreats and hosting intimate destination weddings. The demand for glamping spots was primarily driven by the high-income demographic, who are looking for vacation stays offering distinctive experiences and isolation from the crowd.Hectic lifestyles of consumers, long working hours, and less time for relaxation among the working-class population are expected to be the key factors fueling the market growth over the next few years. De-stressing and relaxation are the key factors encouraging people to engage in excursions to flourishing eco-tourism venues offering a healthy lifestyle. Younger generations’ demand for an active and outdoor regime is expected to have a positive impact on market growth over the forecast period. Furthermore, adventure vacations and corporate retreats are expected to create new opportunities for the treehouse glamping industry across the globe.

The increasing influence of social media on consumers, especially among millennials and GenZ, is expected to create a positive perception about treehouse glamping. In addition, holiday offers and appealing packages offered by various tourism websites are expected to have a positive impact on industry growth. Younger generations are more inclined towards gaining experience of new adventures compared to the traditional approach of trips and wellness retreats on their holidays. This has further boosted the demand for unconventional holidays, including treehouse glamping. These glamping sites provide the equivalent of comfort and luxury but at a competitive price compared to luxury hotels, which is another factor encouraging the treehouse glamping industry.

Age Group Insights

The 18-32 years age group accounted for the largest share of 47.0% in 2024 and is expected to witness the fastest growth over the forecast period. This is majorly attributed to the age group seeking unique & experiential holiday avenues and the growing trend of travel and tourism among millennials and Gen Zs. According to the article published by the mize.tech, millennials on average take a vacation of approximately 35 days each year, followed by Gen Z, Boomers, and Gen X. Simialry, as per the survey conducted by Glamping Hub, 83.0% of young respondents preferred glamping over regular hotels as it allows them to reconnect with nature. Besides, the growing solo young women traveler communities are preferring treehouse glamping, as these glamping stays are secure and offer an adventurous feel to their holiday experience. Young couples account for a major share of the travelers who are enthusiastic about glamping in the treehouses. Thus, the rising number of travelers from this age group with a high disposable income is another key driver of the market.

The 33-50 age group segment is projected to expand at a CAGR of 5.7% from 2025 to 2030. The combination of Gen Xers and millennials drives the market in this age group. In the years to come, this market is anticipated to be driven by the increasing popularity of family vacations to encourage kids' learning in a natural environment. Customers seeking luxury camping have more options owing to treehouse glamping features including Wi-Fi, kitchen, private toilets, linen service, and pools. Besides, additional recreational opportunities such as yoga, spa treatments, and adventure sports are also expected to attract consumers in this age group. Therefore, the treehouse glamping is expected to experience significant acceptance among this age group over the coming years.

Booking Mode Insights

Offline mode held the largest revenue share in the overall treehouse glamping industry in 2024. Hoteliers' preference towards offline bookings & travel agents/agencies, travelers' demand for personalized services, and convenience contribute to the segment's largest share. According to the report published by SiteMinder Limited in December 2024, 38% of millennials prefer traditional travel agents due to convenience and cost-effectiveness. Similarly, as per data published by EnsembleIQ in November 2023, 38% of Gen Z & millennials opt for travel agents over online booking options. These factors are expected to influence the segment's growth.

Online mode is expected to register the fastest CAGR during the forecast period. The travel and tourism industry has been moving toward online booking due to service providers switching to online booking systems. Online booking offers various features including listing of information related to hotel amenities, access to a wide range of hotels and prices, and flexibility in the procedure. According to Northstar Travel Media LLC, 2023 online direct bookings increased by 50% compared to the previous year. Mobile phones have become the most dominant medium for customers to book holidays. With the increasing penetration of the internet and smartphone devices across countries, treehouse glamping service providers are also looking to augment their online bookings and increase the number of monthly visitors to their websites.

Regional Insights

The North American Treehouse Glamping market held a significant share in 2024. This is attributable to changing traveler preferences for unique and experiential travel standouts. Additionally, growing consciousness towards eco-tourism and sustainable travel options, and willingness to invest in distinctive travel experiences are also promoting treehouse glamping industry in the region. According to the survey conducted in June 2023 by TIME USA, LLC, 56% of the total respondents marked environmental as an important factor to them while selecting their next vacation venue. These factors are expected to drive the growth of the market.

U.S. Treehouse Glamping Market Trends

The U.S. dominated the North American Treehouse Glamping market in 2024. High spending on travel tourism across the country is one major reason attributed to the market's growth. As per the September 2024 research by the World Travel & Tourism Council, the U.S. is the most influential travel and tourism market globally, with USD 2.36 trillion contributing to the country's GDP in 2023. With travelers wanting to experience a unique holiday, treehouse glamping is gaining momentum in the country.

Europe Treehouse Glamping Market Trends

The Europe Treehouse Glamping market held the largest share of 28.5% in 2024. The rapid penetration of high-speed internet and rising travel connectivity have made remote European places more accessible to travelers. This encourages the need to explore exotic, new, and exciting locations across the region among youngsters and individuals seeking adventure, fueling market growth over the forecast period. Countries including France, Italy, and Spain are some of the region’s largest markets for treehouse glamping. Additionally, the presence of large forest lands and traveler’s preferences towards European countries drive the region’s growth. For instance, in 2023, a travel and tourism platform Pitchup.com handled around 850,000 bookings for treehouse glamping across 69 European countries.

The UK is expected to register the fastest CAGR during the forecast period. Treehouses are rapidly rising to the top of the UK vacation destination list as tourists seek out unique ways to disconnect with routine life and connect with nature. Additionally, an increase in treehouse hotels in the country contributes to the fastest growth. For instance, In July 2024, TreeDwellers, Britain’s first treehouse hotel, opened in the Cotswolds, and in August, West Sussex saw the opening of the country’s first tree tent camping.

Asia Pacific Treehouse Glamping Market Trends

The Asia Pacific Treehouse Glamping market is anticipated to grow at the fastest CAGR of 6.7% during the forecast period. The growth is mainly attributed to the rising expenditure of consumers on travel and accommodation. The increasing spending of travelers from other developing countries, such as India, the Philippines, Vietnam, and Australia, is further estimated to support the market growth in the region. According to a report published by SPH Media Limited, in 2024, Asia Pacific contributed 51.2% to global passenger growth. The industry's key trends are higher cleanliness and hygiene standards, a self-check-in system, and less dependency on international travelers. Additionally, the presence of key market players such as Treehouse-Villas Thailand, Bangkok Tree House, and Rabeang Pasak Treehouse Resort is fueling the growth of the market in the region.

The Thailand Treehouse Glamping market held the largest market share in 2024 due to rising demand for experiential travel options, government support initiatives for the glamping industry, increasing social media influence, and emphasis on eco-tourism. For instance, the Thai government through the Board of Investment (BOI) consistently incentivizes the hotel sector through its various programs to stimulate foreign investment. Additionally, it encourages investment and promotes sustainable tourism in the country. Moreover, social media influence among youngsters due to aesthetic sharing, hashtags, and trends is also fueling the growth of the market.

Key Treehouse Glamping Company Insights

Some of the key companies in the Treehouse Glamping market include TreeHouse Villas Koh Yao, Bangkok Tree House, Rabeang Pasak Treehouse Resort, and others. Companies are concentrating on growing their clientele to obtain a competitive advantage in the market. Thus, significant participants are taking a number of strategic actions, including alliances with other large corporations and mergers and acquisitions.

-

TreeHouse Villas Koh Yao is a luxury resort chain designed for customers seeking environmentally friendly resorts. TreeHouse has around 31 villas with different options, such as treehouse, beachfront, and hilltop pools in the tropical jungle, Jurassic massifs, and private beaches near Phang Nga Bay.

-

Rabeang Pasak Treehouse Resort is a family-owned treehouse resort surrounded by teakwood forest. It opened in 2010 and became open to the public in 2012. Currently, the resort has a chain of 8 cottages and 3-family treehouses.

Key Treehouse Glamping Companies:

The following are the leading companies in the treehouse glamping market. These companies collectively hold the largest market share and dictate industry trends.

- TreeHouse Villas Koh Yao

- Bangkok Tree House

- Rabeang Pasak Treehouse Resort

- Keemala

- Orion Tree Houses B&B

- Nelson Tree House & Supply

Recent Developments

-

In October 2024, Treehouses.com LLC announced the 2024 World Treehouse Conference on 4,5, & 6th October 2024. This conference was done with an objective to promote different commercial treehouse design and building of insightful and friendly structures aloft.

-

In March 2023, Summit Hotel Properties acquired the first luxury treehouse resort in late 2022. The company is expanding its first glamping resort and developing another one. Additionally, the company expects to go through strategic partnerships with the glamping resort brand Onera.

Treehouse Glamping Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 356.3 million

Revenue forecast in 2030

USD 473.2 million

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

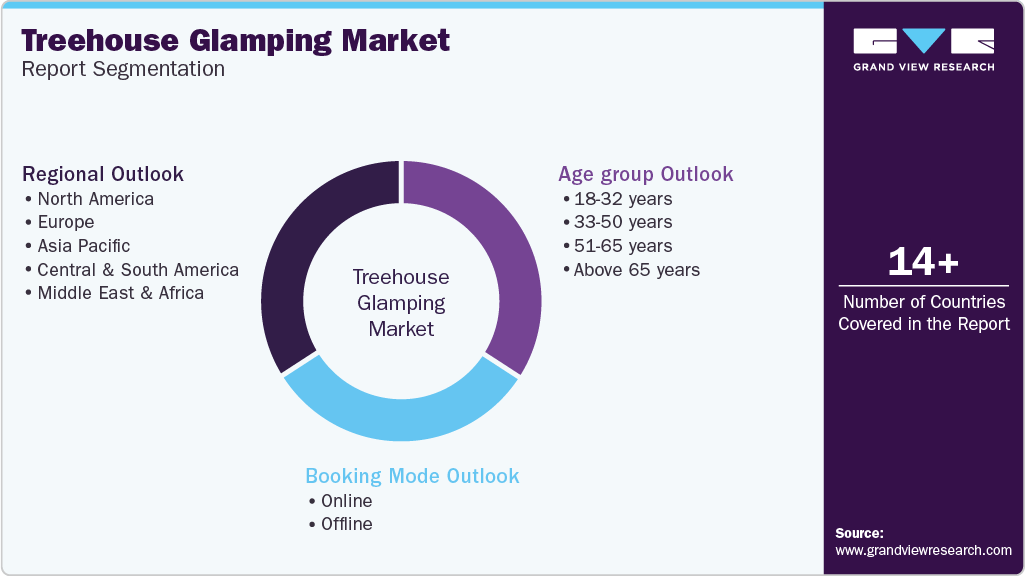

Segments covered

Age group, booking mode, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, France, Spain, Italy, Ireland, U.K., Thailand, China, Japan, India, Australia, Costa Rica, and South Africa.

Key companies profiled

TreeHouse Villas Koh Yao; Bangkok Tree House; Rabeang Pasak Treehouse Resort; Keemala; Orion Tree Houses B&B; Nelson Tree House & Supply

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Treehouse Glamping Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global treehouse glamping market report based on age group, booking mode, and region.

-

Age group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-32 years

-

33-50 years

-

51-65 years

-

Above 65 years

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Spain

-

Italy

-

Ireland

-

U.K.

-

-

Asia Pacific

-

Thailand

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Costa Rica

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.