- Home

- »

- Medical Devices

- »

-

Trichoscope Devices Market Size, Industry Report, 2030GVR Report cover

![Trichoscope Devices Market Size, Share & Trends Report]()

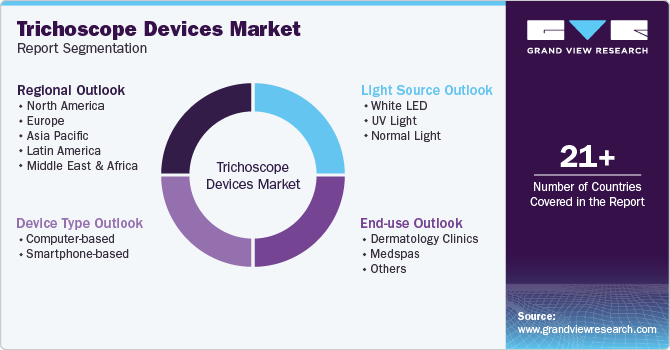

Trichoscope Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type (Computer-based, Smartphone-based), By Light Source (White LED, UV Light), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-566-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Trichoscope Devices Market Size & Trends

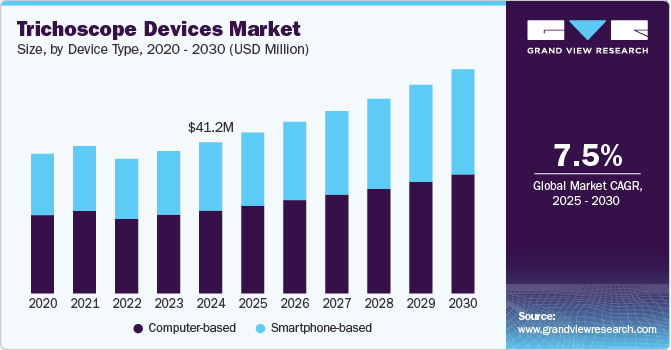

The global trichoscope devices market size was estimated at USD 41.18 million in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The increasing prevalence of hair and scalp disorders drives significant growth of the trichoscope devices industry. For instance, in May 2024, Harvard Health Publishing mentioned that it is normal to lose approximately 50 to 100 scalp hairs daily. If the amount exceeds this range, noticeable hair thinning and larger quantities of hair in brushes, clothing, or drains may be observed. The rising occurrence of conditions such as alopecia, dandruff, and scalp psoriasis is leading to higher demand for early diagnosis and continuous monitoring. The increasing use of trichoscope devices allows for detailed visualization of the scalp, hair shafts, and follicles, enabling tailored treatment strategies. The growing reliance on these devices is reinforcing their adoption across dermatology clinics and aesthetic treatment facilities.

The growing focus on aesthetics and personal grooming significantly influences the market landscape. Individuals across various age groups are seeking solutions for hair thinning and scalp health, contributing to the rising usage of trichoscopy in cosmetic procedures. Increased disposable incomes and a higher willingness to invest in long-term hair care are expanding the consumer base. In response, manufacturers are launching user-friendly, portable trichoscope models with digital integration to improve accessibility and ease of use. These advancements are enhancing customer satisfaction and encouraging repeat usage among dermatology professionals.

Technological innovations propel the trichoscope devices market by improving diagnostic accuracy and operational efficiency. Integrating artificial intelligence and digital imaging software enables real-time analysis and better patient record management. Cloud-based platforms facilitate seamless data storage, image sharing, and remote consultations, crucial for personalized care. Leading companies are investing in research to develop compact, multifunctional trichoscopes with improved resolution and ergonomic designs. This continuous product enhancement drives market expansion across hospitals, clinics, and home-use segments.

Operating trichoscope devices effectively requires a strong understanding of scalp imaging and dermatological diagnostics. However, there is a shortage of professionals trained in using these tools, especially in rural and underdeveloped areas. Inexperienced users may misinterpret images, leading to incorrect diagnoses or ineffective treatment plans. This limitation reduces the clinical reliability and perceived value of the device. The shortage of skilled personnel, therefore, hampers broader adoption and market expansion.

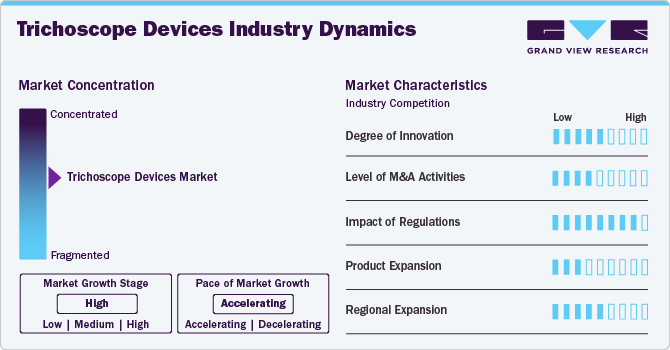

Market Concentration & Characteristics

The trichoscope devices market demonstrates a moderate to high degree of innovation, with companies investing in AI-based scalp analysis and high-resolution imaging. Advancements focus on improving diagnostic accuracy for conditions such as alopecia, psoriasis, and scalp infections. Portable and wireless models are gaining traction among dermatologists and cosmetic clinics. Integration with teledermatology platforms further enhances utility in remote consultations. Continuous R&D efforts support competitive differentiation and product enhancement.

Mergers and acquisitions in the trichoscope devices industry gradually increase, driven by the desire for technology integration and portfolio diversification. Larger diagnostic firms and aesthetic solution providers are showing interest in acquiring smaller, innovation-driven firms. Most deals aim to improve market access, expand distribution channels, and accelerate time-to-market for new solutions. Cross-border acquisitions are emerging to tap into the high-growth potential of Asia-Pacific and Europe. However, the overall M&A intensity is still lower compared to mainstream medical device segments.

Regulatory frameworks for trichoscope devices vary by region but generally fall under non-invasive Class I or II medical devices, resulting in moderate compliance burdens. The European MDR and FDA's 510(k) clearance impact product timelines and development costs. Companies must ensure adherence to data privacy standards when integrating digital or AI-powered functions. The regulatory landscape indirectly influences pricing and feature complexity. Despite these challenges, the market remains attractive due to relatively straightforward approval processes compared to therapeutic devices.

Product expansion in the market for trichoscope devices is steady, focusing on broader use cases and enhanced user interfaces. Companies are introducing devices tailored for both clinical and consumer use, expanding beyond traditional dermatology practices. Innovations include multi-spectrum lighting, mobile app integration, and real-time data capture. These improvements help address the growing demand for personalized scalp health assessments. Product lines are also diversifying based on portability, imaging clarity, and AI support, fueling user-specific adoption.

Company expansion in the market is gaining momentum as firms target untapped regions with rising dermatological awareness. Leading players are entering Asia-Pacific through strategic partnerships with local distributors in countries like India, China, and South Korea. European manufacturers are expanding into North America by leveraging FDA clearances and participating in dermatology-focused trade shows. Similarly, North American firms are establishing a presence in Europe and the Middle East through e-commerce platforms and clinical collaborations. These expansion efforts aim to boost brand visibility and meet growing demand for advanced scalp diagnostic tools in emerging and developed regions.

Device Type Insights

The computer-based segment dominated the market with the largest revenue share of over 54.3% in 2024. This growth is primarily attributed to the superior imaging capabilities and advanced data storage features, such as those found in systems like Trichoscan and Fotofinder, which enable clinicians to perform high-resolution scalp and hair analyses. By offering enhanced clinical accuracy, these systems support precise diagnostics and treatment planning, a key requirement in dermatology. The seamless integration with electronic medical records improves workflow efficiency and allows for better patient monitoring over time, as seen in platforms like DermEngine and VISIOMED. Dermatologists prefer these devices due to their exceptional performance, making them popular in professional settings.

The smartphone-based segment is expected to grow at the fastest CAGR during the forecast period, driven by portability, ease of use, and increasing consumer awareness. Compact devices like smartphones appeal to home users and mobile practitioners due to their affordability and convenience. Apps such as TrichoScreen and DermLite enable users to capture and share high-quality trichoscopic images with specialists for real-time consultations, while advancements in smartphone cameras, like those in the iPhone 13 and Samsung Galaxy S21, ensure clearer diagnostic images. The rise of tele-dermatology and remote consultations further boosts the demand for smartphone-compatible solutions, alongside the growing focus on personal wellness monitoring. Platforms like SkinVision and MoleScope empower users to track their skin health, aligning with the global adoption of digital health.

Light Source Insights

The white LED segment dominated the trichoscope devices industry with the largest revenue share of 70.6% in 2024, attributed to superior brightness, energy efficiency, and reliable illumination. These light sources provide consistent lighting that supports detailed hair and scalp visualization. White LED enhances image clarity, crucial for identifying subtle trichoscopic features. Its long operational lifespan reduces replacement frequency, lowering maintenance costs for clinics. White LED devices are also safe for continuous use without heating the skin's surface. Maintaining uniform lighting across the field of view ensures high diagnostic accuracy. Broad adoption across professional settings further solidifies its market lead.

The UV light segment is projected to grow at a significant CAGR over the forecast period, due to the increasing demand for scalp disorder detection and fungal infection assessment. UV light reveals fluorescent patterns not visible under standard lighting, assisting in early and accurate diagnosis. This diagnostic advantage appeals to both dermatology clinics and research institutions. Expanding awareness of scalp health encourages the use of advanced diagnostic tools, including UV-based systems. Innovation in portable and hybrid devices incorporating UV functionality is supporting wider adoption. The focus on non-invasive diagnostic techniques is boosting interest in UV-enhanced trichoscopy. Integration into multi-light trichoscopes is expected to drive segment growth further.

End Use Insights

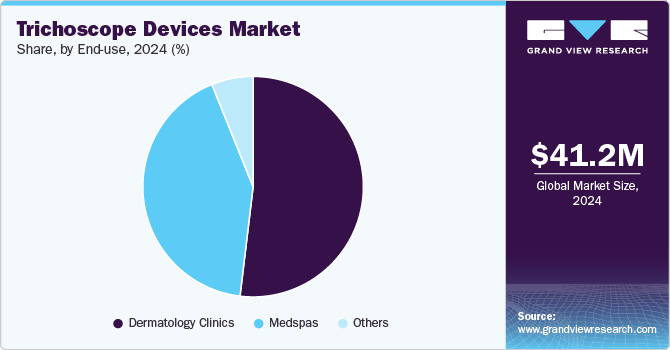

The dermatology clinics segment dominated the market with the largest revenue share of 51.9% in 2024, driven by high patient footfall and preference for specialist consultations. Dermatologists rely heavily on trichoscopy to precisely diagnose various scalp and hair conditions. Clinics invest in high-performance diagnostic tools to enhance service quality and treatment outcomes. The presence of trained professionals supports proper device handling and interpretation of findings. Increasing cases of alopecia and scalp infections are prompting higher demand for trichoscopic evaluations. Clinics also play a central role in clinical studies and product validation, sustaining device utilization. The availability of advanced infrastructure further reinforces the strong position of this segment.

The medspas segment is projected to grow at the fastest CAGR over the forecast period, fueled by the rising demand for aesthetic hair treatments and wellness services. Trichoscopy devices are increasingly used in medspas to assess hair health and customize treatment plans. Consumers are seeking non-invasive diagnostic options as part of their cosmetic procedures. The trend toward preventive hair care supports early scalp analysis in wellness centers. Medspas is expanding its service offerings by integrating diagnostic tools to differentiate itself from traditional salons. Growing consumer expenditure on personal appearance is encouraging investment in technologically equipped facilities. Promotional efforts by device manufacturers targeting Medspa operators are also driving adoption.

Regional Insights

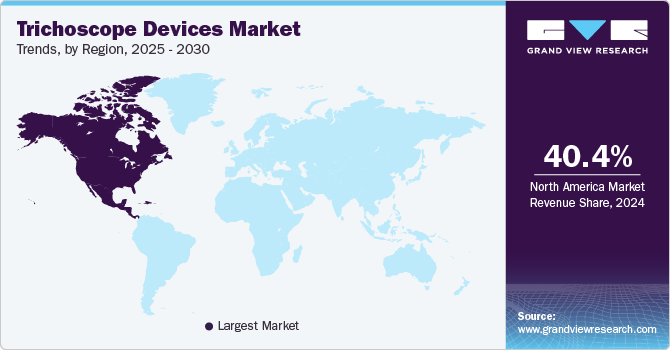

North America dominated the trichoscope devices industry with a revenue share of 40.4% in 2024, due to advanced dermatological infrastructure and high adoption of digital diagnostic tools. The presence of major market players enhances product availability and innovation across the region. Rising awareness of scalp and hair health contributes to early diagnosis and increased device usage. Cosmetic dermatology trends continue to push demand for precision imaging tools. The region also benefits from strong collaboration between clinics and research institutions for dermatological innovations. Growing demand for aesthetic treatments further strengthens North America’s dominant market position.

U.S. Trichoscope Devices Market Trends

The U.S. commands a substantial share within North America due to its highly developed healthcare system and emphasis on dermatological research. High patient awareness regarding scalp disorders promotes early visits to dermatologists. Access to advanced diagnostic equipment boosts clinical efficiency and supports market growth. Strong marketing and consumer interest in personal care drive consistent demand for trichoscope devices. Clinical focus on non-invasive imaging tools contributes to widespread product integration. Robust investments in teledermatology also play a role in expanding trichoscope usage across remote regions.

Europe Trichoscope Devices Market Trends

Europe holds a significant position in the global trichoscope devices industry due to its advanced healthcare systems and rising demand for scalp analysis. Dermatology clinics in major countries deploy digital dermatoscopes to ensure accurate hair disorder diagnosis. Growing emphasis on aesthetic treatments increases the adoption of hair imaging technology. Continuous product development by regional manufacturers enhances accessibility and clinical outcomes. Expanding medical tourism in countries such as Hungary and Poland promotes equipment upgrades. Educational initiatives from professional dermatology organizations also help reinforce technology use across Europe.

The trichoscope devices market in the UK demonstrates solid growth, due to its strong dermatology network and early adoption of advanced diagnostic tools. Rising cases of alopecia and other hair-related conditions drive demand for imaging-based evaluations. Dermatologists prefer trichoscopy to ensure precise treatment planning, which supports steady market expansion. Technological innovation in diagnostic tools offers clinics high-resolution imaging capabilities. Cosmetic clinics also use trichoscopes to improve customer consultation experiences. Increased public interest in scalp care further drives device penetration in private and public healthcare settings.

Germany trichoscope devices market remains a key contributor in Europe, due to its large base of dermatology specialists and well-equipped clinics. The high frequency of trichology-related consultations strengthens the demand for imaging tools. The country’s strong medical device industry supports continuous innovation in diagnostic imaging. Clinics often integrate trichoscopy systems to improve clinical accuracy and patient trust. The popularity of aesthetic dermatology treatments adds another layer of demand for scalp analysis tools. Germany’s focus on clinical efficiency encourages digital device adoption for faster.

Asia Pacific Trichoscope Devices Market Trends

Asia Pacific is expected to record the fastest CAGR in the trichoscope devices industry due to its rising demand for dermatology and improved healthcare access. Rapid urbanization and rising disposable income have increased the focus on aesthetic health. Scalp-related disorders are gaining clinical attention, driving dermatologists to adopt non-invasive diagnostic tools. Local manufacturers are introducing cost-effective solutions, improving device accessibility in smaller clinics. The growing popularity of hair restoration procedures also supports wider product usage. Telemedicine expansion in rural areas promotes digital dermatology tools, including trichoscopes.

China trichoscope devices market presents strong growth opportunities due to its large population base and rising focus on personal health. Urban centers have seen increasing adoption of advanced dermatology technologies. Aesthetic procedures involving hair restoration are gaining momentum, which boosts the use of scalp imaging tools. Rising consumer spending and awareness of hair health drive clinic visits and demand for digital diagnostics. Local companies are entering the market with competitively priced devices to meet growing demand. The expansion of private dermatology chains further increases the distribution of trichoscope systems.

The trichoscope devices market in Japan contributes to regional growth due to its high medical imaging and precision diagnostics standards. The aging population presents a growing need for scalp health evaluations, which drives trichoscope device adoption. Dermatology clinics focus on technological efficiency, encouraging the use of advanced imaging tools. Consumer interest in hair and scalp care continues to rise, pushing clinics to adopt specialized diagnostics. Local innovation in medical electronics supports new product launches tailored to the Japanese market. Integration of trichoscopy in both clinical and cosmetic applications helps maintain steady growth.

MEA Trichoscope Devices Market Trends

The MEA region shows emerging potential due to growing awareness of dermatological health and rising private healthcare investments. Countries in the Gulf Cooperation Council are expanding dermatology services, supporting the demand for advanced diagnostic tools. Clinics in urban areas increasingly use trichoscopy to enhance scalp disorder assessments. The rising popularity of aesthetic treatments also influences technology adoption. Educational campaigns focused on hair health contribute to increasing patient visits. Private clinics are investing in modern diagnostic infrastructure, creating new opportunities for market expansion.

Saudi Arabia's trichoscope devices market is expanding due to its growing dermatology sector and focus on modern healthcare solutions. Urban clinics are upgrading their diagnostic capabilities to meet the rising demand for aesthetic procedures. Increasing consumer awareness of hair health has driven demand for non-invasive diagnostic tools. The private healthcare sector plays a strong role in introducing advanced trichoscopy systems. Dermatology conferences and training initiatives support awareness and clinical adoption. Growing preference for personalized scalp treatments reinforces trichoscope use in clinical workflows.

The trichoscope devices market in Kuwait demonstrates moderate growth driven by increasing demand for advanced dermatological services and aesthetic care. Rising hair-related concerns among younger populations encourage visits to dermatologists and trichologists. Private clinics invest in high-quality diagnostic tools to enhance service offerings. Awareness of scalp health and cosmetic treatments fuels market interest in precision imaging devices. Clinical professionals are adopting trichoscopes to ensure accurate and non-invasive diagnosis. The expansion of dermatology services in urban centers strengthens the presence of diagnostic technologies.

Key Trichoscope Devices Company Insights

Key players adopted the most strategies, including partnerships, collaborations, and product launches. Companies such as FotoFinder Systems launched Skeen, the first AI-driven wireless digital dermatoscopy with cloud storage for skin and hair imaging, to expand their market reach globally.

Key Trichoscope Devices Companies:

The following are the leading companies in the trichoscope devices market. These companies collectively hold the largest market share and dictate industry trends.

- FotoFinder Systems GmbH

- AnMo Electronics Corporation

- BOMTECH ELECTRONICS CO., Ltd

- Canfield Scientific, Inc.

- Firefly Global

- Cosderma

- Aakaar Medical

- MetaOptima Technology Inc.

- TrichoLAB

- Capillus.

Recent Developments

-

In March 2024, FotoFinder Systems launched skeen, the first AI-driven wireless digital dermatoscopy with cloud storage for skin and hair imaging. It featured a high-resolution camera with 20x or 40x magnification and AIMEE, an AI assistant for skin lesion evaluation. The device enabled polarized and non-polarized imaging for detailed skin and hair analysis.

-

In August 2023, Capillus, LLC announced FDA clearance for Capillus202, a laser therapy cap for treating androgenetic alopecia. The device featured 202 low-level laser diodes to promote hair regrowth by boosting scalp blood flow. It was portable, battery-operated, and designed for 30-minute sessions every other day. Priced at USD 1,999, it offered broader scalp coverage compared to similar products.

-

In December 2021, Canfield Scientific acquired Medici Medical S.r.l. to form Canfield Scientific S.r.l. and opened a new facility in Spilamberto, Modena. The company launched the Dreamoscopy educational program, featuring top dermatology experts. Over 70 dermatologists attended in person, and hundreds joined online.

Trichoscope Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.82 million

Revenue forecast in 2030

USD 62.84 million

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, light source, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

FotoFinder Systems GmbH; AnMo Electronics Corporation; BOMTECH ELECTRONICS CO., Ltd; Canfield Scientific, Inc.; Firefly Global; Cosderma; Aakaar Medical; MetaOptima Technology Inc.; TrichoLAB; Capillus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trichoscope Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global trichoscope devices market report based on device type, light source, end use, and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Computer-based

-

Smartphone-based

-

-

Light Source Outlook (Revenue, USD Million, 2018 - 2030)

-

White LED

-

UV Light

-

Normal Light

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology Clinics

-

Medspas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global trichoscope devices market size was estimated at USD 41.2 million in 2024 and is expected to reach USD 43.82 million in 2025

b. The global trichoscope devices market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 62.84 million by 2030

b. North America dominates the trichoscope devices market with a share of 40.4% due to advanced dermatological infrastructure and high adoption of digital diagnostic tools. The presence of major market players enhances product availability and innovation across the region.

b. Some key players operating in the trichoscope devices market include: FotoFinder Systems GmbH; AnMo Electronics Corporation; BOMTECH ELECTRONICS CO., Ltd; Canfield Scientific, Inc.; Firefly Global; Cosderma; Aakaar Medical; MetaOptima Technology Inc.; TrichoLAB; Capillus.

b. The increasing use of trichoscope devices allows for detailed visualization of the scalp, hair shafts, and follicles, enabling tailored treatment strategies. The growing reliance on these devices is reinforcing their adoption across dermatology clinics and aesthetic treatment facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.