- Home

- »

- Medical Devices

- »

-

Trocars Market Size & Share, Growth, Industry Report, 2030GVR Report cover

![Trocars Market Size, Share & Trends Report]()

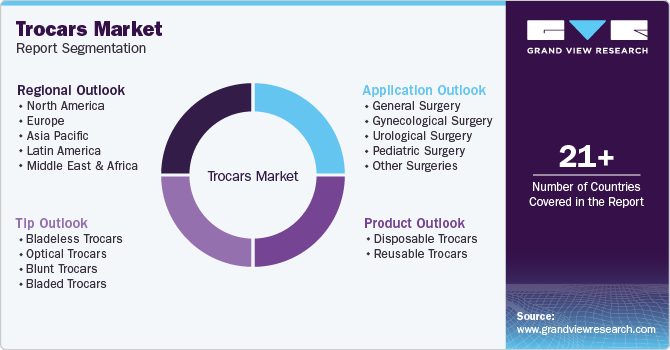

Trocars Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Reusable), By Tip (Bladeless Trocars, Optical Trocars), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Pediatric Surgery), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-570-0

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Trocars Market Summary

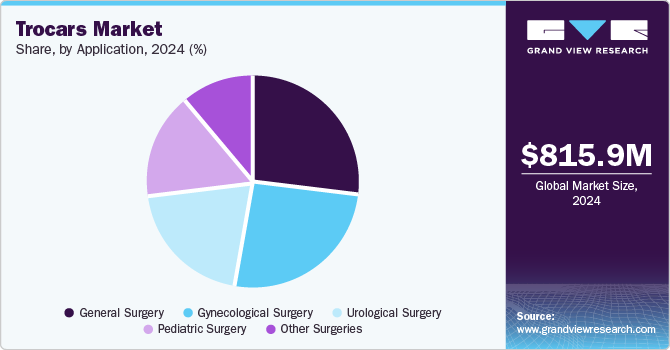

The global trocars market size was estimated at USD 815.9 million in 2024 and is projected to reach USD 1,120.2 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. Favorable reimbursement policies, growing reliance on laparoscopy, and an aging population drive up demand for trocars in the coming years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, disposable trocars accounted for a revenue of USD 547.3 million in 2024.

- Reusable Trocars is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 815.9 Million

- 2030 Projected Market Size: USD 1,120.2 Million

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

In addition, the growing prevalence of liver and gastrointestinal illnesses has raised interest in general medical procedures, which positively impacts market growth.

The growing prevalence of chronic diseases is significantly contributing to the growth of the trocars industry. Some of these diseases include irritable bowel syndrome/disorder (IBS/IBD), cancers, endometriosis, and liver diseases, among others. These conditions continue to affect a large portion of the global population, increasing the demand for surgical interventions and driving the demand for trocars. In the case of certain cancer types, like colorectal cancer, as the incidence increases, there is a growing demand for minimally invasive treatment options that offer better patient outcomes and reduced recovery time. According to the statistics released by the Colon Cancer Coalition, nearly 150,000 colorectal cancer cases were diagnosed in the U.S. in 2024.

Furthermore, most surgical procedures are performed on the geriatric population, which is more susceptible to chronic diseases like heart attack and cancer. According to the Asian Development Bank, the population of people aged 60 or more is likely to reach 1.3 billion by 2050. This population is expected to grow as the baby boomer generation ages. Therefore, it is anticipated that the trocars industry's demand for surgical procedures will be driven by the growing geriatric population. Therefore, it is anticipated that the global market is expected to expand firmly during the forecast period due to the factors above.

The growing preference for precise and less traumatic surgical options has led to an increase in the adoption of trocars, therefore driving market growth. Apart from cancer, the treatment or diagnosis of other conditions, such as IBS, gallstones, Crohn's disease, ulcerative colitis, and gastroesophageal reflux disease (GERD), is also carried out through laparoscopic surgeries, which eventually require the use of trocars. For instance, according to the Crohn's & Colitis Foundation of America (CCFA), approximately 70,000 cases of IBD are diagnosed every year in the U.S.

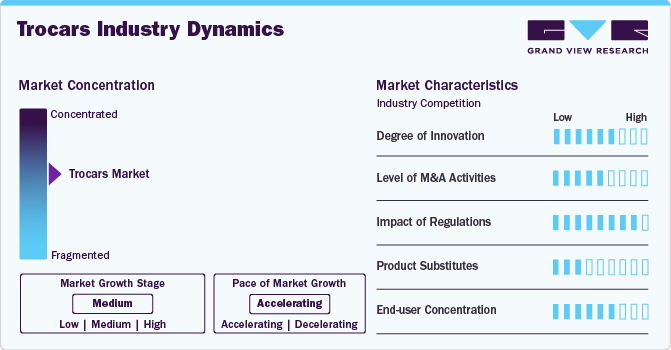

Market Concentration & Characteristics

There is a considerable degree of innovation in the global market; key players are constantly developing and releasing new techniques and technologies. It has grown in popularity as a disposable trocar that yields reliable and safe results. Because of this, industry participants spend more time developing cutting-edge techniques and technologies to meet the demand for products.

Several market players, such as CONMED Corporation, The Cooper Companies, Inc., Teleflex Incorporated, and Medtronic, are involved in strategic activities like partnership, M&A, and new product development to expand their geographic reach and enter new territories.

Medical devices are frequently categorized according to risk, and each class is subject to different regulations. Trocars are surgical instruments, so they need to undergo regulatory approval to guarantee their safety and efficacy. To guarantee the uniformity and caliber of their output, manufacturers are obliged to establish and maintain quality management systems (QMS). Regulatory bodies frequently mandate adherence to established standards like ISO 13485.

A trocar is a medical device that consists of a cannula, a seal, and an obturator with a metal or non-bladed tip. The trocar is an entry point for various tools, including staplers, scissors, and graspers. Trocars are highly useful devices that allow gas or liquid to escape from internal organs. Although trocars are frequently used in minimally invasive surgeries, some other techniques and tools can be used to accomplish the same objectives. The following are some substitutes for trocars: Hasson Technique, Veress Needle, and Visual Entry Systems.

Regional expansion in the trocars industry is moderate. Companies are actively targeting new geographic markets, driven by increasing demand for advanced treatments. Expansion efforts are particularly focused on regions with growing healthcare infrastructure and rising prevalence of cancer, such as Asia-Pacific and Latin America. This regional growth is crucial for market penetration and establishing a global presence. For instance, in October 2024, Purple Surgical officially launched its operations in Brazil, debuting at the 72nd Brazilian Congress of Coloproctology. The event marked a significant milestone for the company as it expanded its global presence.

Product Insights

Based on product, the disposable trocars segment led the market with the largest revenue share of 63.75% in 2024. This dominance can be attributed to its growing importance in laparoscopic surgery and diagnostic laparoscopy. During laparoscopic procedures, disposable trocars are frequently used as access ports to insert cameras into the abdominal cavity. Because they are disposable, each surgery can be set up quickly and easily while maintaining sterility, lowering the risk of infection, and requiring no reprocessing.

The reusable trocars are expected to register the fastest CAGR during the forecast period. The segment's growth is supported by factors like affordability and simplicity of access to the body's internal structure. It can result in significant cost savings over time for facilities with high procedure volumes. Using disposable trocars increases the amount of medical waste produced and raises environmental issues. Hence, healthcare facilities have preferred reusable trocars recently, driving segment growth.

Tip Insights

Based on tip, the bladeless trocars segment held the market with the largest revenue share of 35.4% in 2024. In the coming years, bladeless trocars are expected to be the most well-known market category. Factors such as the product's unique entry mode into the abdominal cavity during laparoscopic surgeries, its flexible usage, and its versatile applicability are driving its growth. Also, the ease of use and low risk of infection are expected to drive the segment in the coming years.

The optical trocars segment is expected to register the fastest CAGR during the forecast period. Worldwide adoption of optical trocars is supported by factors like the rising number of laparoscopic surgeries performed and the ability to view tissues in detail. The benefits of this product also include the safe and quick initial placement of trocars, which is anticipated to propel the segment's growth.

Application Insights

In terms of application, the general surgery segment led the market with the largest share of revenue in 2024. This dominance can be attributed to the increasing number of surgical procedures and demand for trocars. According to the National Center for Biotechnology Information (NCBI) report, around 330 million major surgeries are performed globally, of which Europe performs nearly 50 million, while the U.S. performs 40 million. Surgeons are expected to introduce surgical instruments via cannulas inserted through these incisions made by trocars.

The general surgery segment is also expected to grow at the fastest CAGR during the forecast period, owing to the increasing hospitalization of patients with cancer, heart attack, and others. Laparoscopic surgical trocars are highly functional and safe instruments precisely engineered for use during these surgeries.

Regional Insights

North America trocars industry dominated globally with a revenue share of 31.53% in 2024. Moreover, competition among key players in terms of product innovation is expected to impact market dynamics. The rising incidence of cardiovascular diseases also fuels demand for trocars. The CDC reports that heart disease accounted for 702,880 deaths in the U.S. in 2022.

U.S. Trocars Market Trends

The U.S. trocars industry is witnessing significant growth, driven by the increasing volume of minimally invasive surgical procedures across various medical specialties. According to The American Society of Plastic Surgeons' Procedural Statistics 2023, around 1,575,244 cosmetic surgeries were performed in 2023, recording a growth of 5% from 2022. The surge in such procedures boosts the need for advanced laparoscopic devices such as trocars.

Europe Trocars Market Trends

Europe trocars industry was identified as a lucrative market globally. Operative laparoscopy has become the most acceptable approach for most of the common surgeries like cholecystectomy, ovarian cystectomy, ligation, appendectomy, and others in European hospitals, driving the need for trocars.

The trocars industry in the UK is expected to grow at the fastest CAGR over the forecast period due to the rising volume of surgical procedures such as bariatric surgery. According to the UK National Bariatric Surgery Registry Report 2023, nearly 5,500 primary bariatric surgeries are performed in the country. In addition, the growing geriatric population has contributed to the market's expansion, as older individuals are more likely to require surgical treatments that involve trocars.

France trocars industry is expected to grow at the fastest CAGR over the forecast period due to the growing number of laparoscopic surgeries related to gynecology. According to the French Federation of Digestive and Visceral Surgery (FCVD), over 250,000 surgeries related to the digestive system are performed through laparoscopy annually in France. Thus, the increasing number of these surgeries is expected to boost demand for trocars in the forecast period.

Asia Pacific Trocars Market Trends

The Asia Pacific trocars industry is expected to grow at the fastest CAGR over the forecast period. This growth is due to the significantly increasing investments in trocar technologies across the region. Japan, China, South Korea, India, and Singapore are leading the way in promoting laparoscopic surgery adoption and fostering innovation through government-led initiatives.

The trocars industry in China is expected to grow at the fastest CAGR over the forecast period. Government initiatives aimed at modernizing healthcare infrastructure, such as the "Healthy China 2030" plan, have led to higher adoption of advanced surgical instruments, including trocars. The aging population and rising obesity rates have also led to a higher prevalence of conditions requiring laparoscopic interventions, such as gallbladder diseases and colorectal cancers.

The Japan trocars industry is expected to grow at the fastest CAGR over the forecast period. Japan has one of the highest rates of laparoscopic surgeries in the world, particularly in fields such as gastrointestinal, urological, and gynecological surgeries. The country's rapidly aging population is a key driver for trocar usage, as elderly patients often require surgical interventions for conditions such as colorectal cancer, gallbladder diseases, and hernias.

Latin America Trocars Market Trends

Latin America trocar industry is anticipated to grow at a healthy CAGR over the forecast period.

Brazil trocars industry is expected to grow at a lucrative CAGR over the forecast period. The increasing number of surgeries highlights the robustness of Brazil's healthcare system and the growing demand for laparoscopic devices, creating demand for trocar devices. For instance, according to the International Trade Administration (ITA), as of December 2023, Brazil spends 9.47% of its GDP on healthcare. As the allocation of more resources in being done in Brazil, the impact on the market for medical instruments like trocars increases.

Middle East and Africa Trocars Market Trends

The Middle East and Africa trocar industry is anticipated to grow at a healthy CAGR over the forecast period.

The Saudi Arabia trocar industry is expected to grow at the fastest CAGR over the forecast period. Robotic and laparoscopic surgeries represent a significant advancement in the field of medical science, providing patients with minimally invasive surgery options for a variety of procedures in Saudi Arabia.

Key Trocars Company Insights

Some of the key players operating in the market include Teleflex Incorporated, Medtronic, and Johnson & Johnson Service Inc. Different strategies are taken by the players to strengthen their market position globally. Companies are involved in expanding their market presence by signing agreements with other players in emerging markets. New product approval is another strategy adopted by these players.

Emerging players like Genicon, Inc., Espiner, and Dutch Ophthalmic Research Center (International) B.V. are undertaking various strategies such as new product development and their launch, partnership, and collaboration with key participants and other players in the trocars industry to expand their presence.

Key Trocars Companies:

The following are the leading companies in the trocars market. These companies collectively hold the largest market share and dictate industry trends.

- Cooper Companies Inc.

- Teleflex Incorporated

- Mölnlycke Health Care AB

- Medtronic plc

- B. Braun Medical Inc.

- Johnson & Johnson Service Inc.

- Purple Surgical

- Applied Medical Resources Corporation

- LaproSurge

Recent Developments

-

In February 2024, Johnson & Johnson MedTech launched direct operations in Saudi Arabia, aiming to enhance healthcare through advanced medical and surgical equipment, including laparoscopic devices

-

In December 2023, Xpan received FDA 510(k) clearance for its universal trocar system, a radially expandable device with the capability to expand to 5mm or 12mm.

-

In March 2023, Nexus CMF announced the launch of a new 1.9mm disposable trocar to enhance its product portfolio.

Trocars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 860.0 million

Revenue forecast in 2030

USD 1.12 billion

Growth rate

CAGR of 5.43% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, tip, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

The Cooper Companies Inc.; Teleflex Incorporated; GENICON, INC.; Medtronic; B. Braun Medical Inc.; Johnson & Johnson Service Inc., Purple Surgical: Applied Medical Resources Corporation; LaproSurge

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trocars Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global trocars market report based on product, tip, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Trocars

-

Reusable Trocars

-

-

Tip Outlook (Revenue, USD Million, 2018 - 2030)

-

Bladeless Trocars

-

Optical Trocars

-

Blunt Trocars

-

Bladed Trocars

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Pediatric Surgery

-

Other Surgeries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global trocars market size was estimated at USD 815.9 million in 2024 and is expected to reach USD 860 million in 2025.

b. The global trocars market is expected to witness a compound annual growth rate of 5.43% from 2025 to 2030 to reach USD 1.12 billion by 2030.

b. North America dominated the trocars market with a market share of 31.5% in 2024. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the trocars market include The Cooper Companies Inc., Teleflex Incorporated, GENICON, INC, Medtronic, B. Braun Medical Inc., and Johnson & Johnson.

b. Key factors that are driving the market growth include increasing reliance on laparoscopy, favorable reimbursement policies, and increasing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.