- Home

- »

- Drilling & Extraction Equipments

- »

-

Tunnel Boring Machine Market Size & Share Report, 2030GVR Report cover

![Tunnel Boring Machine Market Size, Share & Trends Report]()

Tunnel Boring Machine Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Hard Rock TBM, Soft Ground TBM), By End-use (Mining, Transport, Oil & Gas), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-144-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tunnel Boring Machine Market Summary

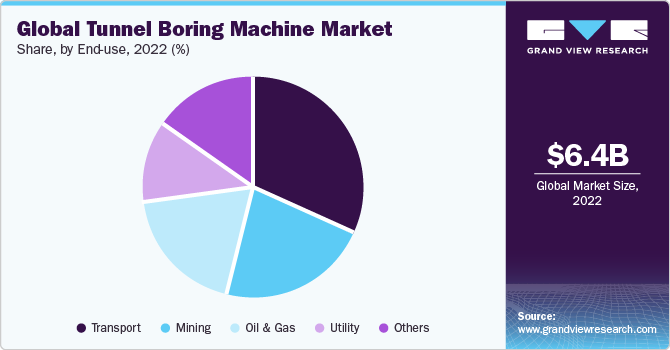

The global tunnel boring machine market size was estimated at USD 6,390.0 million in 2022 and is projected to reach USD 9,400.0 million by 2030, growing at a CAGR of 4.9% from 2023 to 2030. The rising demand for tunnel boring machines has primarily been propelled by the swift expansion of transportation infrastructure development.

Key Market Trends & Insights

- Asia Pacific is poised to expand at the fastest CAGR during the forecast period.

- Europe held the second-highest market revenue share in 2022.

- By end-use, the transport segment held the highest revenue share of 32.3% in 2022.

- By product type, the hard rock TBM segment held the highest market sharein 2022.

- By product type, the soft ground TBM segment is expected to witness the highest CAGR over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 6,390.0 Million

- 2030 Projected Market Size: USD 9,400.0 Million

- CAGR (2023-2030): 4.9%

- North America: Largest market in 2022

This infrastructure development has been fueled by vibrant economic growth, rapid urbanization, and smart city initiatives across the globe. To cater to the increasing connectivity needs, governments are making substantial investments in diverse construction projects, such as subways (metro), light rail transit, underground freight transport, and utility tunnels. Moreover, rising mining activities across the globe are expected to drive the Tunnel Boring Machine (TBM) market over the forecast period.

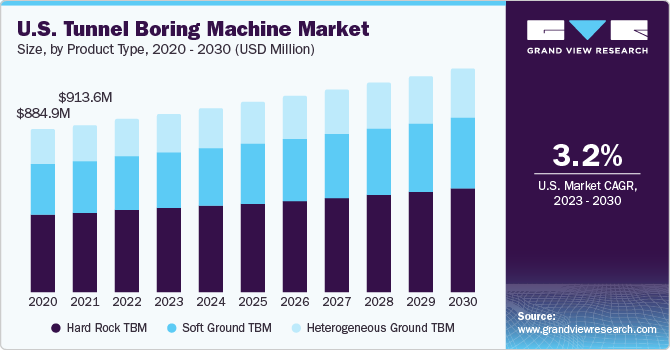

The growth of the transportation infrastructure in the U.S. is a key factor contributing to the market demand. Furthermore, rising investment in efficient transportation systems, high-speed rail networks, and smart city infrastructure in the U.S. has accelerated the construction of tunnels. For instance, The Northeast Maglev project announced in 2022 aimed to develop a high-speed Maglev train line connecting Washington, D.C. to Baltimore. In this project, it is planned that 70% of the high-speed rail track is to be made inside the tunnel. Such rising capital expenditure in the transportation sector has been fueling the market demand for TBMs.

International Tunneling and Underground Space Association (ITA-AITES) is the global organization that sets the standards for tunneling & underground construction across the world. Furthermore, the Ministry of Road Transport and Highways (MoRTH) in India has been regulating the market in India. The future of the global market is closely tied to the global infrastructure development landscape. As countries across the globe have been investing in public-private partnerships, renovation of existing infrastructure, and underground data centers, the market opportunity for tunnel boring machines is likely to remain positive. These machines are designed to handle challenging geologies like hard rock, soft soil, and heterogeneous ground conditions driving the demand for various construction projects across different terrains.

Tunnel boring machines (TBM) offer several environmental benefits as compared to conventional tunneling methods. Reduced surface disruption, less noise pollution, lower carbon emissions, improved groundwater management, and high alignment accuracy are some of the key benefits offered by these machines, which drive their demand. Key companies in the global market are actively focusing on investing in R&D activities, further penetrating the market, and thereby enabling them to retain their market share. The competition is driven by technological innovation, project-specific bidding, after-sales service, and the ability to meet the specific needs of tunneling projects. The integration of these machines with artificial intelligence (AI) has helped companies offer innovative products in the market.

End-use Insights

The transport segment held the highest revenue share of 32.3% in 2022. They are extensively used in the transportation sector for the construction of tunnels and underground passages, including road tunnels, rail tunnels, and subway systems. These machines excavate tunnels through densely populated areas and challenging geological conditions, minimizing surface disruptions, traffic congestion, and noise pollution. Tunnel boring machines are often equipped with systems for the installation of tunnel lining, which provides structural support to the tunnels and ensures long-term safety and reliability. Due to these characteristics & reduced environmental impact, they enable the construction of additional transportation infrastructure in densely populated regions, thereby increasing capacity and accommodating growing passenger and cargo volumes.

The oil & gas segment is expected to witness the highest CAGR over the forecast period. In the oil & gas exploration process, TBM produces cause less disruption to the surroundings by producing less distribution zone. Due to this attribute, it requires less rock support than the conventional drilling method. Furthermore, the use of backloading cutters makes TBM more productive, as they reduce the time required for oil & gas pipeline installation, thereby making the hydrocarbon transportation process safe and cost-efficient. In some cases, oil & gas reservoirs are located deep underground or in remote and challenging environments. TBMs can be used to create access tunnels to these reservoirs for exploration purposes. As TBMs can be easily deployed and work under such extreme conditions with increased workplace safety, the demand forTBMs in the oil & gas segment is expected to grow over the forecast period.

Product Type Insights

The hard rock TBM segment held the highest market sharein 2022. These machines are designed for excavating tunnels in geological conditions where the rock is exceptionally hard and abrasive. High torque and thrust, advanced cooling & lubrication systems, robust cutting heads with extreme hardness, and easy customization required depending on different geological conditions are some of the product attributes of the hard rock TBM. The use of hard rock TBMis extensive in a variety of construction and infrastructure projects that involve tunnel excavation in exceptionally hard and abrasive rock. Furthermore, hard rock TBMs are widely used in mining operations to create access tunnels and galleries for the extraction of valuable minerals, ores, and resources. As these tunnel boring machineshelp improve the safety and efficiency in underground mining, they are mostly used in the mining process.

The soft ground TBM segment is expected to witness the highest CAGR over the forecast period. Soft ground TBM is a specialized type of tunnel boring machine designed for excavating tunnels in geological conditions characterized by unconsolidated materials. These materials typically include soil, clay, silt, and sand. Due to the design requirement, mud pressure control and lining installation systems are present in these machines. Soft ground TBMs help create tunnels for housing utility infrastructure, such as electrical cables, water pipelines, and telecommunications networks. They can be employed to excavate tunnels for water supply systems, transporting fresh water from reservoirs. In coastal regions where soft soils are prevalent, soft-ground TBMs can be used to create tunnels that pass beneath bodies of water. These machines are deployed in the tunneling process through the soft, cohesive soils commonly found in cities.

Regional Insights

Asia Pacific is poised to expand at the fastest CAGR during the forecast period, due to factors such as significant investments in the regional transportation infrastructure, including underground metro systems, high-speed rail networks, and extensive road tunnels. Moreover, rapid population growth and urbanization in many regional countries have created a strong demand for infrastructural development. These factors are expected to increase the demand for TBMs in the region. Moreover, Asia Pacific is witnessing extensive mining exploration activities. Many countries, such as India and China, have rich mineral resources, resulting in robust mining activities. A TBM is used in mining operations to make these activities profitable and safe.

To meet compliance requirements and protect against potential accidents, the product is expected to become irreplaceable in the near future. Europe held the second-highest market revenue share in 2022, aided by factors such as several cross-border infrastructure projects for improving the connectivity between neighboring nations. The use of TBM is necessary for the success of such projects, thus enhancing regional connectivity. For example, the Channel Tunnel (Eurotunnel) is a high-speed rail tunnel project between France and the UK. Many European countries are promoting sustainability and green initiatives to meet the objectives mentioned in the Paris Conference. One way to reduce traffic and emissions is to construct underground transportation systems to reduce surface congestion and emissions. TBMs are used to facilitate such environment-friendly transportation projects.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new Material developments, and geographical expansions to enhance market penetration and cater to the changing technological requirements of various end-use industries. In April 2023, TERRATEC officially introduced a reconditioned 6.61-meter diameter Earth Pressure Balance Tunnel Boring Machine (EPBM) for deployment in Phase I of the Surat Metro Rail Project in India. The specific geological conditions along the tunnel routes will primarily consist of sand, clay, gravel, and silt. Some of the major companies have undertaken measures, such as technological upgrades and material launches for manufacturing superior quality and gaining sustainability in the sector.

Key Tunnel Boring Machine Companies:

- Kawasaki Heavy Industries, Ltd.

- Herrenknecht AG

- The Robbins Company

- TERRATEC Ltd.

- Japan Tunnel Systems Corporation

- Mitsubishi Heavy Industries, Ltd.

- Komatsu Ltd.

- SN Mercantile India Pvt. Ltd.

- High Speed Two Ltd.

- Amberg Engineering

- Mammoet

- Hitachi Zosen Sakai Works

- China Railway Tunnel Group

- Sika AG

- Liaoning Censcience End-Use Co. Ltd.

Tunnel Boring Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6,705.8 million

Revenue forecast in 2030

USD 9,400.0 million

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; UAE; South Africa; Saudi Arabia

Key companies profiled

Kawasaki Heavy Industries, Ltd.; Herrenknecht AG; The Robbins Company; TERRATEC Ltd.; Japan Tunnel Systems Corp.; Mitsubishi Heavy Industries, Ltd.; Komatsu Ltd.; SN Mercantile India Pvt. Ltd.; High Speed Two Ltd.; Amberg Engineering; Mammoet; Hitachi Zosen Sakai Works; China Railway Tunnel Group; Sika AG; Liaoning Censcience End-Use Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tunnel Boring Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the tunnel boring machine market report on the basis of product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Rock TBM

-

Shielded TBM

-

Open Type TBM

-

-

Soft Ground TBM

-

Slurry Shield TBM

-

Earth Pressure TBM

-

Open Face Type TBM

-

Others

-

-

Heterogeneous Ground TBM

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining

-

Oil & Gas

-

Transport

-

Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global tunnel boring machine market size was estimated at USD 6,390.0 million in 2022 and is expected to reach USD 6,705.8 million in 2023.

b. The global tunnel boring machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 and reach USD 9,400.0 million by 2030.

b. Asia Pacific dominated the tunnel boring machine market in 2022 due to the factors such as heavy investment in transportation infrastructure, including high-speed rail networks, underground metro systems, and extensive road tunnels, and rising extensive mining exploration activities.

b. Some of the key players operating in the tunnel boring machine market include, Kawasaki Heavy Industries, Ltd., Herrenknecht AG, The Robbins Company, TERRATEC Ltd., Japan Tunnel Systems Corporation, Mitsubishi Heavy Industries, Ktd., Komatsu Ltd., SN Mercantile India Pvt. Ltd., High Speed Two Ltd, Amberg Engineering, Mammoet, Hitachi Zosen Sakai Works, China Railway Tunnel Group, Sika AG, Liaoning Censcience End-Use Co. Ltd.

b. The key factors that are driving the market are, rising capital expenditure to improve the transport infrastructure, increasing urbanization in developing countries, and growing importance of energy efficient transport systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.