- Home

- »

- Medical Devices

- »

-

UAE Cardiovascular Devices Market, Industry Report, 2033GVR Report cover

![UAE Cardiovascular Devices Market Size, Share & Trends Report]()

UAE Cardiovascular Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Diagnostic & Monitoring, Surgical Devices), By End Use (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers), And Segment Forecasts

- Report ID: GVR-4-68040-712-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Cardiovascular Devices Market Summary

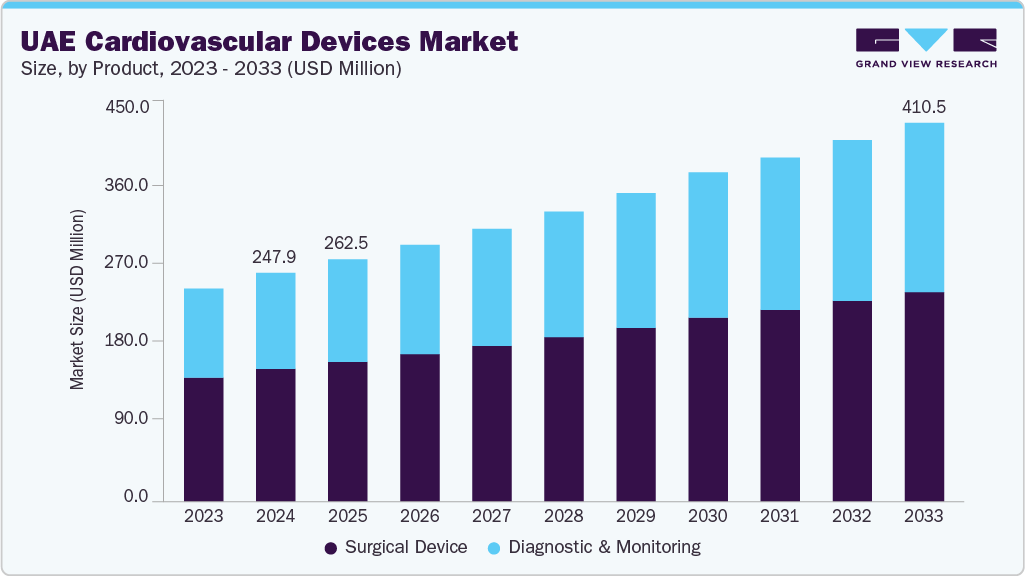

The UAE cardiovascular devices market size was estimated at USD 247.90 million in 2024 and is projected to reach USD 410.52 million by 2033, growing at a CAGR of 5.75% from 2025 to 2033. Increased incidence of cardiovascular disease is one of the key aspects driving the market's growth.

Key Market Trends & Insights

- The UAE cardiovascular devices industry is expected to grow significantly over the forecast period.

- By product, the surgical devices segment held the highest market share of 58.01% in 2024.

- Based on diagnostic and monitoring devices, the cardiovascular ultrasound sub segment held the highest market share in 2024.

- Based on surgical devices, the cardiac resynchronization therapy (CRT) segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 247.90 Million

- 2033 Projected Market Size: USD 410.52 Million

- CAGR (2025-2033): 5.75%

According to an article published by the American Heart Association, Inc. in November 2024, in the UAE, cardiovascular diseases (CVDs) represent the primary health challenge, being responsible for approximately 36.7% of all fatalities, nearly double the proportion of deaths linked to cancer. This high disease burden underscores the urgent need for advanced diagnostic, monitoring, and treatment solutions, thereby driving demand for cardiovascular devices in the country. The growing prevalence of risk factors such as obesity, diabetes, and sedentary lifestyles further amplifies the requirement for innovative medical technologies, positioning the UAE cardiovascular devices market for continued growth.

Moreover, the increasing prevalence of CVD drives the growth of the market. According to a BioMed Central Ltd article published in December 2024, in the UAE, the age-standardized cardiovascular disease (CVD) prevalence was estimated at around 11,066.8 cases per 100,000 population, marking the highest rate in North Africa and the Middle East. This significant disease burden underscores a substantial demand for advanced cardiovascular devices to support early diagnosis, effective treatment, and long-term management of heart-related conditions. The high prevalence rate reflects the growing need for innovative medical technologies, such as minimally invasive surgical tools, advanced monitoring systems, and next-generation implantable devices, to address the escalating cardiovascular health challenges within the country.

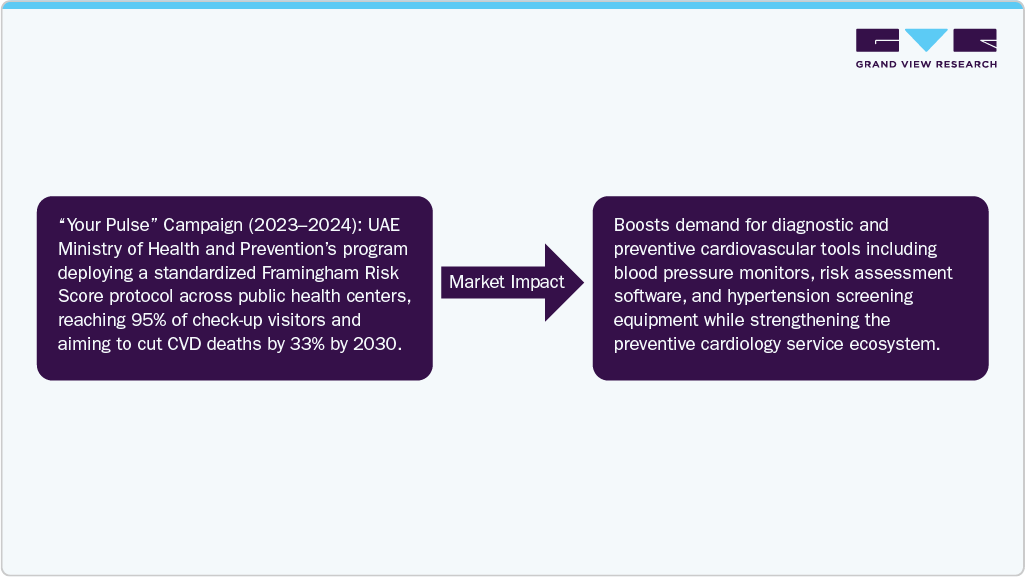

Increased government initiatives for cardiovascular diseases drive the growth of the market. According to a Gulf News article published in October 2024, the UAE Ministry of Health and Prevention launched the “Your Pulse” initiative, combined with the 2023-2024 National Campaign for Early Detection of Hypertension, targeting adults aged 40 and above. Implemented across government health facilities, it introduced a standardized Framingham Risk Score protocol to identify high-risk individuals early. The initiative reached 95% of visitors to government check-up centers and aims to reduce CVD mortality by 33% by 2030.

Furthermore, as per the Gulf News article published in November 2024, government-led awareness and screening programs are crucial in driving early diagnosis and preventive care. A notable example is the recent launch of the “Your Heart, Your Life” campaign by Emirates Health Services (EHS), aimed at screening 10,000 individuals for cardiovascular diseases. Introduced in the presence of Dr. Yousif Mohamed Al Serkal, Director General of EHS, the initiative underlines the importance of proactive heart health management. It aligns with the National Strategy for Wellbeing 2031. Encouraging early detection and timely intervention, such campaigns are enhancing public awareness and creating a stronger demand for diagnostic tools, treatment solutions, and long-term cardiovascular care in the UAE.

United Arab Emirates - Medical Instruments Trade (2023)

Category

Value (USD Million)

Global Rank

Total Countries Considered

Exports

246

41

217

Imports

802

33

226

Source: OEC & Grand View Research

The rising medical instrument trade is fueling the market's growth. The UAE’s substantial import value of medical instruments highlights the country’s reliance on advanced healthcare technologies, including cardiovascular devices, to meet growing treatment needs. High import levels suggest robust demand for state-of-the-art diagnostic, monitoring, and surgical tools to address the country’s significant cardiovascular disease burden. Moreover, its export capacity indicates the UAE’s emerging role as a regional hub for re-exporting and distributing medical devices.

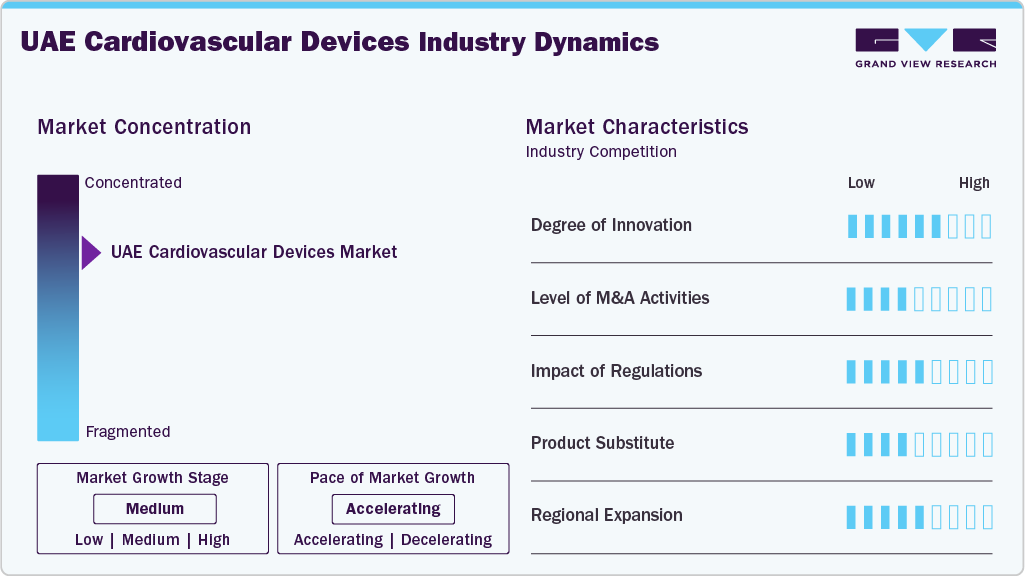

Market Concentration & Characteristics

The UAE cardiovascular devices industry is witnessing high innovation, supported by the rapid adoption of AI-powered diagnostic tools, advanced biomaterials, and minimally invasive techniques across leading Abu Dhabi and Dubai hospitals. Recent UAE milestones include the introduction of bioresorbable stents, AI-assisted cardiac MRI systems, and leadless pacemakers used in complex procedures. These advancements drive faster recovery times, enable precision treatment, and meet the UAE’s strategic healthcare goals for advanced cardiac care.

Several key players in the UAE cardiovascular devices industry, including Abbott, Medtronic, Boston Scientific Corporation, and Edwards Lifesciences Corporation, reinforce their market presence by launching physician training programs, setting up demonstration centers, and introducing product lines adapted to Gulf region patient demographics. Their strategies enhance adoption rates and strengthen the UAE’s role as a cardiovascular innovation hub for the Middle East.

Regulatory bodies such as the UAE Ministry of Health and Prevention (MOHAP), Dubai Health Authority (DHA), and Department of Health - Abu Dhabi (DoH) play a critical role in overseeing the cardiovascular devices market. They ensure products comply with rigorous safety, efficacy, and quality requirements. Recent regulatory initiatives include digital device registration platforms and faster review timelines for priority cardiovascular technologies, supporting quicker patient access to life-saving innovations.

There are no direct substitutes for cardiovascular devices in managing and treating critical heart conditions in the UAE. While medications and lifestyle changes can help manage symptoms, devices such as pacemakers, stents, and implantable defibrillators provide essential interventions. In the UAE’s high-acuity care settings, these devices are critical in preventing sudden cardiac death and managing advanced heart failure.

Key cardiovascular device manufacturers in the UAE are expanding their presence by targeting underserved emirates, partnering with public and private healthcare providers, and launching awareness programs to encourage early detection of cardiovascular disease. These initiatives improve access to advanced cardiac treatments nationwide and support the UAE’s commitment to delivering world-class cardiovascular care.

Product Insights

The surgical devices segment held the largest share, 58.01%, in 2024. This segment includes various products to diagnose, treat, and manage cardiovascular conditions. These devices comprise surgical instruments for procedures such as Coronary Artery Bypass Grafting (CABG), valve repair or replacement surgeries, and minimally invasive techniques such as catheter-based interventions. Rapid technological advancements and a stronger emphasis on patient-centric care solutions drive the market’s growth.

The diagnostic and monitoring segment is growing fastest during the forecast period, driven by rising demand for proactive cardiovascular care. These devices are essential for timely detection, continuous tracking, and effective management of heart-related conditions. Advancements in sensor technology, AI-enabled analytics, and connectivity have significantly improved their precision and usability, making them indispensable for clinical settings and home-based monitoring programs.

Distribution Channel Insights

The offline segment held the largest share of 76.40% in 2024, supported by the strong presence of brick-and-mortar healthcare equipment distributors, hospital procurement channels, and direct sales networks across the region. Many healthcare providers prefer offline purchasing for cardiovascular devices due to the ability to inspect products, negotiate contracts face-to-face, and access immediate after-sales support, ensuring reliability and trust in critical medical applications.

Online shopping is growing fastest during the forecast period, driven by the increasing adoption of digital procurement platforms, expanding e-commerce infrastructure, and the convenience of remote ordering. Enhanced product visibility, competitive pricing, and faster delivery timelines encourage healthcare institutions and individual practitioners to shift towards online purchasing, further accelerated by integrating secure payment systems and virtual product demonstrations.

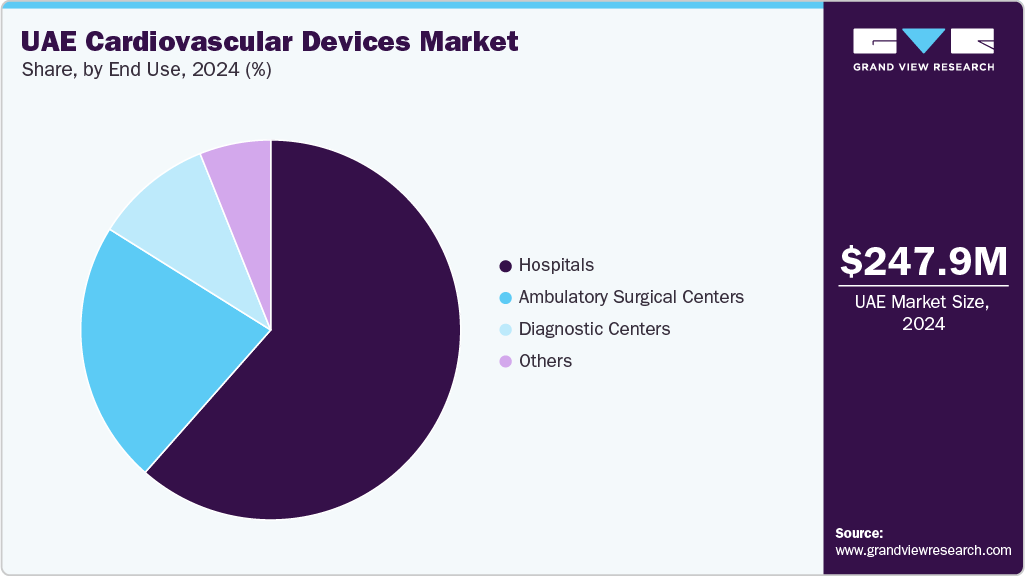

End Use Insights

The hospitals segment held the largest share of 61.50% in 2024, driven by their role as primary centers for delivering comprehensive cardiovascular care. Equipped with advanced surgical infrastructure, specialized cardiac units, and experienced medical teams, hospitals are well-suited to manage complex procedures and adopt the latest technologies, making them a key end user in the market.

The ambulatory surgical centers segment is growing fastest during the forecast period, supported by the rising demand for cost-effective, same-day cardiovascular procedures. These centers offer specialized services with shorter waiting times, lower operational costs, and greater convenience for patients, while advancements in minimally invasive techniques enable a wider range of cardiac interventions to be performed outside traditional hospital settings.

Key UAE Cardiovascular Devices Company Insights

Some of the key players operating in the industry include Abbott, Medtronic, and Boston Scientific Corporation. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, LivaNova, Inc. and Canon Medical Systems are emerging players in the UAE cardiovascular devices market.

Key UAE Cardiovascular Devices Companies:

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- Siemens Healthineers AG

- Canon Medical Systems

- B. Braun SE

- LivaNova, Inc.

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

- W. L. Gore & Associates, Inc.

- BIOTRONIK SE & Co. KG

Recent Developments

-

In January 2025, during Arab Health 2025, Philips unveiled cutting-edge imaging technologies, including AI-enabled spectral CT, ultrasound systems, and other advanced diagnostics that help enhance cardiac imaging and streamline workflows in UAE hospitals.

-

In January 2025, Emirates Health Services (EHS) showcased the Total Artificial Heart, a titanium-based, magnetically levitated pump developed with the Texas Heart Institute at Arab Health 2025. This groundbreaking device is poised to become the UAE’s first-of-its-kind option for advanced heart failure patients, pending FDA approvals and local clinical trials at Al Qassimi Hospital.

-

In January 2024, at Arab Health 2024 in Dubai, GE Healthcare introduced 19 AI-powered innovations, including advanced imaging and diagnostic tools intended to revolutionize cardiac care and accelerate early detection in the UAE and the wider Middle East, Northeast Africa, and Turkey (MENEAT) region.

UAE Cardiovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 262.51 million

Revenue forecast in 2033

USD 410.52 million

Growth rate

CAGR of 5.75% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use

Country scope

UAE

Key companies profiled

Abbott; GE HealthCare; Edwards Lifesciences Corporation; Siemens Healthineers AG; Canon Medical Systems; B. Braun SE; LivaNova, Inc.; Cardinal Health; Medtronic; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; BIOTRONIK SE & Co. KG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Cardiovascular Devices Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the industry trends in each sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UAE cardiovascular devices market report based on product, distribution channel, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic & Monitoring

-

ECG

-

Implantable Cardiac Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

MRI

-

Cardiovascular Ultrasound

-

2D

-

3D/4D

-

Doppler

-

-

Cardiac Diagnostic Catheters

-

PET Scanner

-

-

Surgical Devices

-

Cardiac Resynchronization Therapy (CRT)

-

Implantable Cardioverter Defibrillators (ICDs)

-

Pacemakers

-

Coronary Stents

-

Catheters

-

Guidewires

-

Cannula

-

Valves

-

Occlusion Devices

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Others

-

Frequently Asked Questions About This Report

b. The global UAE cardiovascular devices market size was estimated at USD 247.90 million in 2024 and is expected to reach USD 262.51 million in 2025.

b. The global UAE cardiovascular devices market is expected to grow at a compound annual growth rate of 5.75% from 2025 to 2033 to reach USD 410.52 million by 2033.

b. The surgical devices segment held the largest share, 58.01%, in 2024. This segment includes various products to diagnose, treat, and manage cardiovascular conditions. These devices comprise surgical instruments for procedures such as Coronary Artery Bypass Grafting (CABG), valve repair or replacement surgeries, and minimally invasive techniques like catheter-based interventions.

b. Some key players operating in the UAE cardiovascular devices market include Abbott, GE HealthCare, Edwards Lifesciences Corporation, Siemens Healthineers AG, Canon Medical Systems, B. Braun SE, LivaNova, Inc., Cardinal Health, Medtronic, Boston Scientific Corporation, W. L. Gore & Associates, Inc.,BIOTRONIK SE & Co. KG.

b. The growing prevalence of risk factors such as obesity, diabetes, and sedentary lifestyles further amplifies the requirement for innovative medical technologies, positioning the UAE cardiovascular devices market for continued growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.