- Home

- »

- Nutraceuticals & Functional Foods

- »

-

UAE Dietary Supplements Market, Industry Report, 2030GVR Report cover

![UAE Dietary Supplements Market Size, Share, & Trends Report]()

UAE Dietary Supplements Market (2025 - 2030) Size, Share, & Trends Analysis Report By Ingredients (Vitamin, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-674-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Dietary Supplements Market Summary

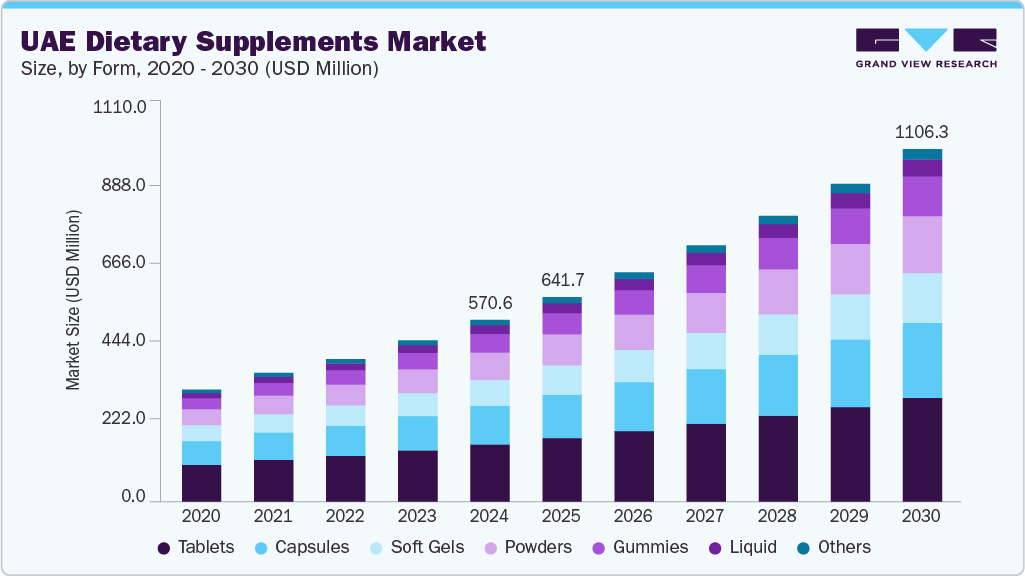

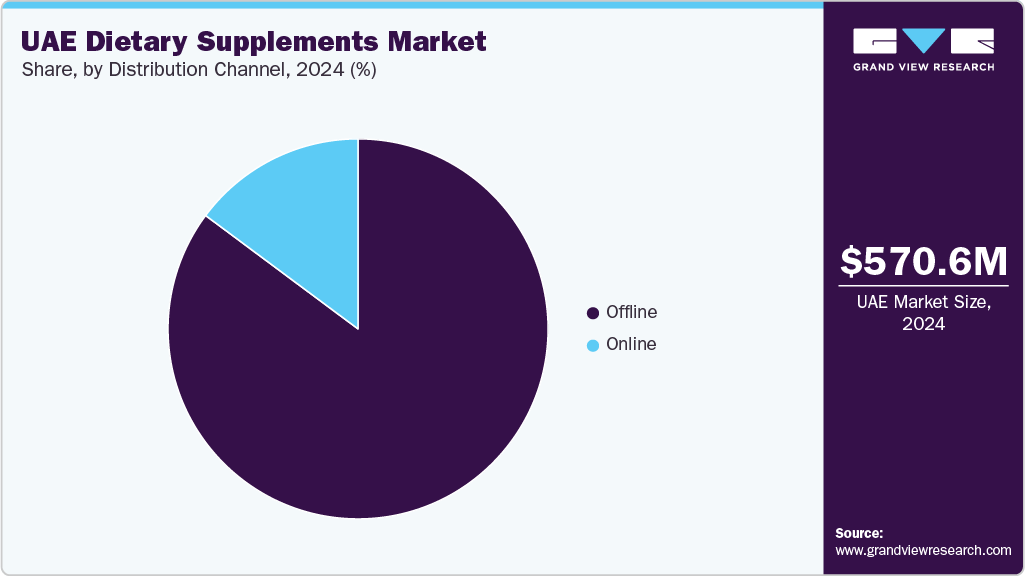

The UAE dietary supplements market size was valued at USD 570.6 million in 2024 and is expected to grow at a CAGR of 11.5% from 2025 to 2030. The market continues to grow due to increasing consumer focus on health and wellness. Higher disposable incomes and lifestyle shifts have led to greater use of supplements across various age groups. Consumers rely on vitamins, minerals, and herbal products to boost energy, support immunity, and maintain overall well-being, which drives the demand for the UAE dietary supplements industry.

Urbanization and limited time for home-cooked meals have created nutrient gaps in daily diets, particularly in major cities. Rising health concerns and an increase in lifestyle-related diseases such as obesity, diabetes, and heart disease have led consumers to seek products that support weight control, heart health, and metabolic balance. The shift toward preventive care and the spread of fitness culture have boosted interest in convenient, high-quality supplement options. Various products are now sold through pharmacies, supermarkets, and online platforms. Consumers prefer trusted brands and clean-label formulas, especially in younger and middle-aged groups.

The country is experiencing a demographic shift, with the number of people aged 60 and above expected to grow from around 311,000 in 2020 (3.1% of the population) to 2 million by 2050 (19.7%). The growth in the elderly population is expected to increase the demand for supplements supporting joint, bone, and immune health. With growing nutrition awareness, more people are including supplements in their routines, which supports the expansion of the UAE dietary supplements industry.

Consumer Insights

Consumer behavior in the UAE is shaped by the rise in health awareness, urban living, and a growing interest in preventive care. Across major cities, limited time for home-cooked meals and sedentary routines contribute to nutrition gaps, which drives the demand for daily supplements. Fitness habits are becoming more common among all age groups. The UAE Ministry of Health and Prevention’s National Health Survey found that 29.2% of adults engage in enough physical activity to meet global recommendations, reflecting a population increasingly focused on maintaining physical well-being. This shift has led to greater use of supplements that support energy, strength, and recovery, particularly among those with active lifestyles.

Consumer Demographics

Digital access and retail expansion have further changed consumer engagement with health products. Consumers now prefer buying supplements online due to convenience, product variety, and the ability to compare reviews. Strong interest in personal well-being and fitness goals drives this shift. For example, as per the UAE & KSA Health & Fitness Report in January 2025, 92.0% of respondents in the UAE aim to improve their health, reinforcing the rising demand for vitamins, minerals, and plant-based supplements. Younger and middle-aged adults prefer clean-label and trusted brands, while physically active users often incorporate sports nutrition into their routines. These patterns continue to support steady growth across the UAE market.

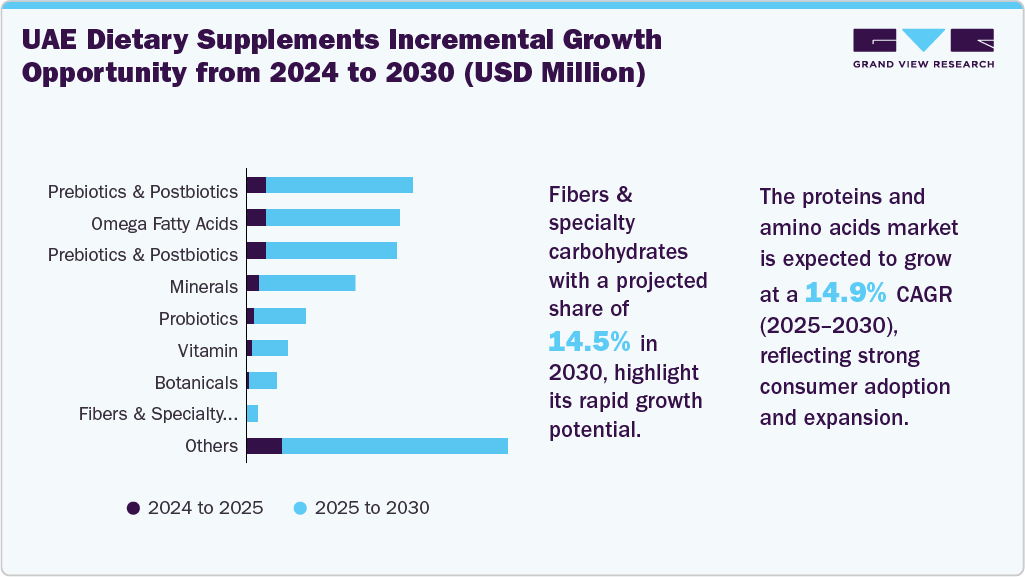

Ingredients Insights

The vitamins segment accounted for the largest revenue share, 31.3%, in 2024.This growth is driven by the rise in the demand for nutrients that help maintain immunity and overall wellness. Products such as multivitamins and individual vitamins, including A, B, C, D, E, and K, continue to be widely used. These supplements are widely available across pharmacies, supermarkets, and online channels, making them accessible to users. The rise in nutritional awareness consistently contributes to the UAE dietary supplements industry.

The proteins & amino acids segment is expected to grow at the fastest CAGR of 14.9% from 2025 to 2030. The rising focus on fitness, recovery, and general physical well-being drives growth. Products such as whey protein, collagen, and amino acid blends are frequently used to support muscle development, energy, and overall body composition. Various formats, from powders to ready-to-drink options, allow consumers to integrate these supplements into daily routines.

This segment continues to expand as more individuals pursue structured wellness and fitness goals. In November 2023, ProUp, an Italian protein brand, launched its high-protein egg-white drink in the UAE during the Dubai muscle show. The product delivers 20 grams of protein per 250 ml and is gluten-free, low in sugar, and suitable for individuals with milk or lactose intolerance. This launch highlights the rise in the demand for innovative, nutrient-rich formulations tailored to active lifestyles in the region.

Form Insights

The tablets segment held the largest share in 2024. This growth is driven by convenience, portability, and strong consumer acceptance. Users prefer tablets due to their ease of use, precise dosage, and extended shelf life compared to other forms, such as powders or liquids. It is considered traditional and clinically reliable, appealing to consumers who trust familiar, pharmacy-grade supplement forms. The widespread availability of tablets across pharmacies, supermarkets, and healthcare outlets further supports their dominance in the market.

The gummies segment is expected to grow at the fastest CAGR from 2025 to 2030 due to its easy-to-consume form, appealing taste, and suitability for various age groups. Gummies are preferred by children, teens, and adults who avoid tablets or capsules. These supplements simplify daily intake and promote regular usage. In May 2022, Power Gummies, a New Delhi-based nutraceutical brand specializing in vegan chewable supplements, announced its expansion into the UAE dietary supplements market. The company launched its product line, including hair & nail vitamins, weight management gummies, and collagen boost variants, through an official UAE website and targeted distribution in key regions such as Dubai. This form supports higher adherence and aligns with the region’s growing preference for wellness solutions.

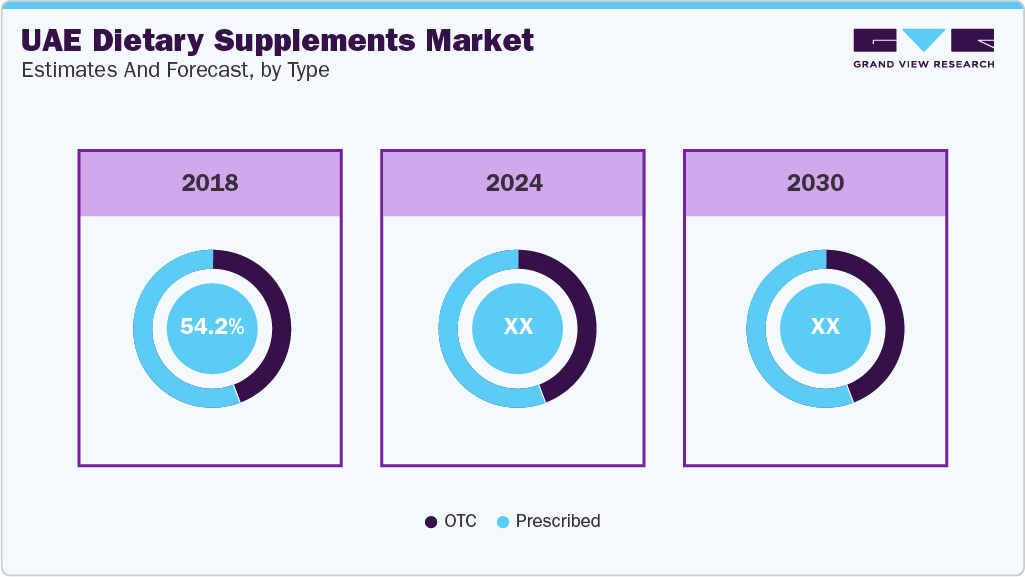

Type Insights

The prescribed segment held the largest share in 2024, supported by a strong reliance on medical advice and widespread use in managing specific health needs. Consumers turn to healthcare professionals for guidance, especially when dealing with nutrient deficiencies, chronic conditions, or pregnancy-related needs. Iron, folic acid, and vitamin D are often prescribed to support anemia, maternal health, and bone strength. With an aging population and rising awareness of targeted nutrition, prescribed supplements remain prominent in clinical care and pharmacy-based distribution across the country.

The OTC segment is expected to grow at a significant CAGR over the forecast period. These supplements are readily available through pharmacies, supermarkets, and digital platforms, enabling consumers to make independent and informed choices. Demand for clean-label ingredients, plant-based formulas, and functional benefits such as immunity support and digestive balance is rising. Improved labeling, easier access to health information, and a growing wellness culture, especially among younger and middle-income groups, further strengthen this segment.

Application Insights

The immunity segment held the largest revenue share in 2024. Consumers across the country prioritize immune health due to greater awareness of illness prevention and the benefits of proactive wellness habits. Products that contain vitamin C, vitamin D, zinc, Echinacea, and elderberry remain in high demand, reflecting their key role in a routine that supports immune function. With deeper health consciousness and regular supplement use, the immunity segment is expected to maintain a strong position in the market.

The prenatal health segment is expected to grow at the fastest CAGR from 2025 to 2030. Demand for supplements such as folic acid, iron, calcium, and Docosahexaenoic Acid (DHA) is rising as more women prioritize maternal and fetal well-being during all stages of pregnancy. Increased health awareness, greater access to information, and consistent medical guidance have supported the early adoption of these products.

End Use Insights

The adult segment held the largest share in 2024. This growth is driven by the rise in the demand for supplements to manage immunity, maintain energy levels, address nutrient gaps, and support mental focus and fitness goals. The fast-paced urban lifestyle, long working hours, and dietary inconsistencies contribute to high dietary supplement usage. Adults seeking wellness solutions choose multivitamins, omega-3s, and botanical blends. Millennials and Gen X consumes show increased interest in clean-label, plant-based, and functional supplements aligned with their lifestyle preferences. With more adults taking proactive control of their health, this segment continues to account for the largest share of the UAE dietary supplements industry.

The infant segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increased parental attention toward early-stage nutrition and pediatric care. Supplements and formulas that help improve digestion, strengthen immune response, and support developmental milestones are becoming more common in households with young children.

Distribution Channel Insights

The offline distribution segment held the largest share in 2024, supported by the strong presence of pharmacies, supermarkets, and specialty retail outlets across the UAE. Pharmacies remain a trusted source for supplement purchases, particularly among older consumers and those seeking expert advice. In-store displays, promotional activities, and pharmacist recommendations influence brand visibility and purchasing decisions. Supplement brands often partner with well-known pharmacy chains and retail stores to secure shelf space and reach a wider audience, especially in urban centers such as Dubai and Abu Dhabi.

The online distribution segment is expected to grow at the fastest CAGR from 2025 to 2030. Growing digital literacy, widespread smartphone use, and a preference for convenience drive more consumers to purchase supplements through e-commerce platforms and health-focused delivery services. Younger users, particularly from Gen Z and millennial demographics, increasingly explore online channels for product variety, quick delivery, and access to customer reviews. Supplement companies are expanding their digital presence through dedicated websites and partnerships with regional delivery platforms to engage directly with consumers and adapt to evolving purchase behaviors.

Key UAE Dietary Supplements Company Insights

Some key players in the UAE dietary supplements industry include Abbott, Amway Corp., GSK plc, and GNC Holdings LLC.

-

Abbott operates in the UAE through its nutrition division, offering science-based products across life stages, including adult wellness, maternal nutrition, and pediatric formulas such as Similac. The company collaborates with healthcare providers to support clinical nutrition and public health goals.

-

Amway Corp. offers a wide range of wellness products under its Nutrilite brand, which covers immunity, energy, and digestive health. The company uses a direct-selling and digital model tailored to UAE regulations and consumer needs, providing localized access to its global nutrition portfolio.

Key UAE Dietary Supplements Companies:

- Abbott

- Amway Corp.

- GSK plc

- GNC Holdings, LLC

- Nu Skin Enterprises, Inc

- Bayer AG

- Pfizer Gulf FZ LLC.

- NOW Foods

Recent Developments

-

In June 15, 2023, the UAE National Nutrition Strategy 2030 was updated, outlining a federal roadmap to promote sustainable diets, expand nutrition coverage, and foster healthy eating environments across all age groups.

UAE Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 641.7 million

Revenue forecast in 2030

USD 1,106.3 million

Growth rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, and distribution channel

Key companies profiled

Abbott; Amway Corp.; GSK plc ; GNC Holdings, LLC; Nu Skin Enterprises, Inc.; Bayer AG; Pfizer Gulf FZ LLC.; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.