- Home

- »

- Healthcare IT

- »

-

UAE Digital Health Market Size, Share, Industry Report 2030GVR Report cover

![UAE Digital Health Market Size, Share & Trends Report]()

UAE Digital Health Market Size, Share & Trends Analysis Report By Technology (Healthcare Analytics, mHealth), By Component (Hardware, Software, Services), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-244-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

UAE Digital Health Market Size & Trends

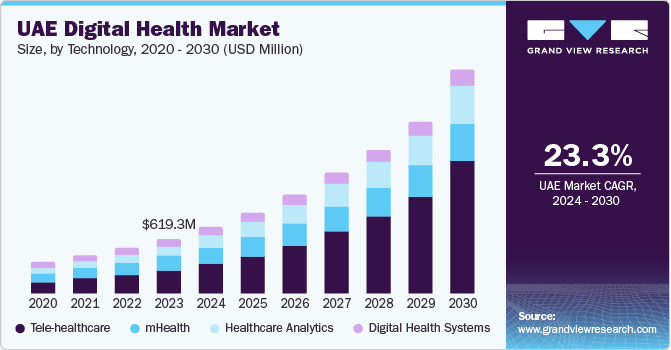

The UAE digital health market size was estimated at USD 619.3 million in 2023 and is expected to grow at a CAGR of 23.3% from 2024 to 2030. The market growth is driven by multiple influential factors, with the government's initiatives playing a key role in this development. The UAE's focus on technological advancements has further fueled the digital health landscape, encouraging innovation and development of infrastructure. Notably, a growing emphasis on preventive healthcare and patient-centric solutions is growing, indicating a fundamental shift towards holistic and proactive health management.

The increasing health expenditure in the region is a significant factor driving the market growth, as higher investments underscore the country's commitment to advanced healthcare solutions. This financial support enables the implementation of cutting-edge digital technologies, infrastructure development, and innovative healthcare services, fostering a dynamic and technologically driven healthcare ecosystem in the UAE.

Rising Health Expenditure Fuels UAE’s Digital Health Revolution

Cost pressures fuel efficiency: With healthcare spending at 3.5% of GDP, and 70% coming from public funds, the need for cost-effective solutions is necessary. Digital health offers significant promise including:

-

Telehealth: Remote consultations reduce in-person visits, hospital stays, and associated costs

-

Remote patient monitoring: Chronic disease management becomes more affordable and effective

-

AI-powered diagnostics: Early detection and prevention lead to lower treatment costs

-

Streamlined administration: Digital tools like EHRs and scheduling software improve efficiency

Improved access to care: Rising costs can create barriers to accessing care, especially for those with chronic conditions or limited mobility. Digital health solutions can bridge this gap by providing affordable, convenient access to services. Telehealth consultations allow patients to connect with specialists from anywhere, while online appointment booking and prescription refills reduce travel time and associated costs.

Enhanced chronic disease management: Chronic diseases like diabetes, heart disease, and cancer are major contributors to rising healthcare costs. Digital health solutions offer tools for patients to better manage their conditions at home, reducing the need for expensive hospitalizations and complications. Remote monitoring devices, medication adherence apps, and educational platforms can empower patients and improve outcomes.

Administrative efficiency: Streamlining administrative processes can significantly reduce healthcare costs. Digital health technologies like electronic health records (EHRs) and appointment scheduling software can automate tasks, improve data accuracy, and reduce administrative burden on healthcare providers. This frees up their time and resources for patient care.

Government initiatives: Recognizing the cost-saving potential of digital health, the UAE government has actively promoted its adoption. Initiatives like the "National Digital Health Strategy" and "Smart Health" strategy incentivize healthcare providers and patients to utilize digital solutions, further accelerating market growth.

Increased competition: Rising healthcare costs put pressure on healthcare providers to reduce expenses and improve efficiency. This creates a competitive landscape where digital health solutions offer a valuable edge. Providers are increasingly adopting these technologies to differentiate themselves and attract cost-conscious patients.

Moreover, the UAE's economic growth has been influenced by the increasing number of smartphone users in the country, leading to a rise in tech-savvy consumers and a boost in the availability of digital services. This trend has impacted various sectors, including commerce, communication, and digital health. The utilization of smartphones has also been on the rise; according to The Mobile Economy 2023, smartphone penetration was 76% in 2022, and it is expected to reach 92% by 2030 globally. The adoption of smartphones by consumers is driving the growth of mHealth applications in the market. In addition, continuous improvement in network infrastructure and expanding network coverage are fueling the demand for mHealth services. Mobile network operators see mHealth as an investment opportunity due to the increasing use of smartphones and growing awareness of fitness.

Some Statistics on High Penetration of the Internet in UAE, 2020

Total Population

Mobile Phone Connections

Internet Users

Active Social Media Users

9.83 million

18.38 million

9.73 million

9.73 million

The United Arab Emirates has a population of 9.83 million people who are actively using electronic gadgets. Hootsuite reports that the country has a population penetration rate of 187% through 18.38 million cellular connections. Internet usage is high among 9.73 million individuals, while social networking is hugely popular, with 9.73 million active users, representing a 99% penetration rate in the country.

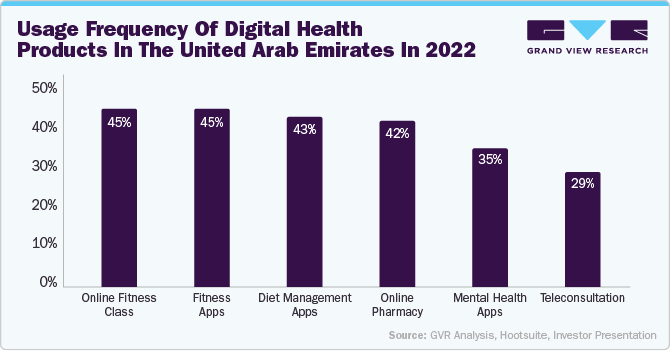

Furthermore, there has been a significant rise in the use of digital health apps in the UAE as people are recognizing the convenience of managing their healthcare needs through technology. The population is becoming more aware of the advantages of digital health, leading to a growing trend of using these apps for accessing medical information, remote consultations, and personalized health monitoring.

The healthcare system in the UAE is rapidly progressing towards digitization, which promises to improve patient care, streamline operations, and drive innovation. Numerous initiatives, such as the Clinical Genomic Medicine & Genetic Counselling Programme, are underway to train physicians in genomics for personalized treatments. The Al Hosn App has revolutionized healthcare in the UAE by digitizing health records, allowing real-time monitoring, and helping manage infectious diseases.

In addition, healthcare providers can now access patient records across the Northern Emirates by integrating Malaffi and Riayati platforms, improving coordination and care quality. The UAE’s digital health landscape includes advanced technologies like telemedicine, AI-powered diagnostics, and digital therapeutics catering to diverse healthcare needs. Government support, private sector investment, and public awareness are credited for the UAE’s success in this domain. By investing in a skilled workforce, utilizing data effectively, and adopting various technologies, the UAE is on track to shape the future of healthcare.

Case Study: Staying Fit and Fighting Diabetes with Digital Apps in the UAE

Introduction:

The United Arab Emirates faces a growing challenge with chronic diseases, particularly diabetes. With over 19% of the population affected, the country ranks second globally in diabetes prevalence. This necessitates innovative solutions to improve health outcomes and empower individuals to manage their conditions. Digital health apps are emerging as powerful tools in this fight, offering personalized support, convenient monitoring, and improved disease management for people with diabetes in the UAE.

Example: A 42-year-old resident of Dubai was diagnosed with type 2 diabetes two years ago. They discovered "Sehaty," a mobile app designed for diabetes management. The app offered:

-

Personalized meal plans: Based on their preferences and blood sugar levels, the app suggested healthy recipes and portion sizes

-

Real-time blood sugar tracking: They could easily log their blood sugar readings and visualize trends to understand their response to food and exercise

-

Educational content: The app provided educational articles and videos on diabetes management, empowering them to make informed decisions

-

Community support: They were connected with other users through the app's forum, sharing experiences and receiving encouragement

Impact of Digital Health Apps:

Digital health apps offer several benefits for people with diabetes:

-

Improved self-management: Apps empower individuals to actively participate in their health, leading to better disease control and reduced complications

-

Increased accessibility: Apps offer 24/7 access to information and support, overcoming geographical barriers and busy schedules

-

Cost-effectiveness: Apps can be a cost-effective way to manage diabetes compared to traditional methods like frequent clinic visits

-

Personalized care: Apps can tailor recommendations based on individual needs and preferences, promoting effective management

Market Concentration & Characteristics

The market is characterized by continuous innovation, with a strong focus on user-friendly telehealth technologies. These advancements aim to simplify the adoption process for both patients and healthcare providers. Furthermore, various prominent players are introducing innovative products, solutions, and services to sustain a competitive advantage. For instance, in October 2023, PureHealth, the leading healthcare platform in the Middle East, launched 'PureNet', a dedicated healthcare cloud offering a digital health-as-a-service platform. This platform aims to enhance operational efficiencies, empowering healthcare providers to deliver comprehensive and patient-centric care while concurrently minimizing operational costs. PureNet serves as a comprehensive solution for healthcare providers of all sizes, offering cost-effective and immediate access to manage their operational technology requirements.

M&A activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth. Notable strategies include new product launches, expansions, and M&As. The market observes a moderate level of M&A activities among leading players. For instance, between 2016 and 2021, acquisitions or mergers dominated the healthcare sector, accounting for 81% of agreements

The Department of Health (DOH) serves as the regulatory authority overseeing the healthcare system in the Emirate of Abu Dhabi. Committed to achieving excellence in community health, DOH plays a crucial role in formulating the health system's strategy, diligently monitoring and analyzing the overall health status of the population, and assessing the performance of the healthcare system. Through these responsibilities, DOH aims to ensure the highest standards of health and well-being for the community it serves

This applies to a diverse range of stakeholders, including patients, individuals, consumers, and end-users who are seeking healthcare services in Abu Dhabi, whether through physical visits or virtual consultations. It also encompasses DOH-licensed healthcare providers and professionals delivering services to individuals in Abu Dhabi, either physically or through virtual means. In addition, the scope extends to DOH-licensed healthcare insurers, pharmaceutical manufacturers, and providers based in Abu Dhabi, as well as health and healthcare-related researchers. The application of these guidelines thus spans the entire healthcare ecosystem within the region

An alternative to digital health involves opting for non-digital alternatives in healthcare, relying on traditional services and interventions. This includes face-to-face consultations, traditional medical treatments, and paper-based health records rather than incorporating digital technologies into healthcare processes. In this approach, patients have physical visits to clinics or hospitals to consult with healthcare professionals. They exchange information through paper-based medical records and face-to-face interactions rather than digital documentation. In addition, traditional diagnostic and treatment methods may involve non-digital tools and procedures, indicating a dependence on established, analog healthcare approaches.

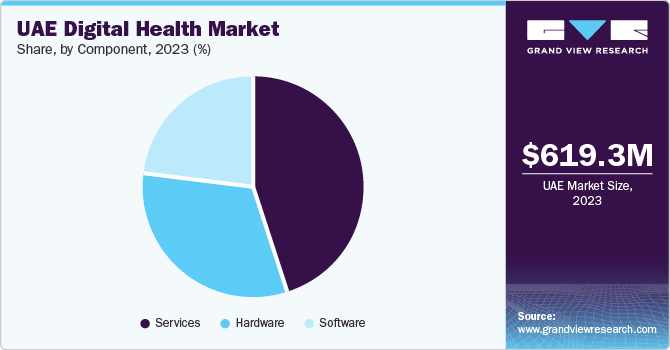

Component Insights

The services segment accounted for the largest revenue share in 2023 owing to the growing demand for remote healthcare services, strong government support, technological advancements, a focus on patient-centric solutions, and collaborations that enhance the capabilities of digital health platforms. These factors, coupled with changing healthcare dynamics and increased consumer awareness, contribute to a significant growth of digital health services in the UAE. The software segment is anticipated to register the fastest growth rate of 24.7% from 2024 to 2030.

This is due to rapid adoption of software systems by patients, healthcare facilities, providers, and insurance payers. This is mainly due to the increasing healthcare expenses and the trend of healthcare digitalization. The growing consumer demand for personalized medicine and shift towards value-based care are also driving segment growth. Healthcare facilities in emerging economies are also quickly adopting these advanced software system solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

Technology Insights

The tele healthcare segment dominated the market in 2023 and is also expected to register the fastest CAGR from 2024 to 2030. The growth of telehealth services is influenced by various factors, such as increasing accessibility of the internet & smartphones, readiness for advanced technology, shortage of healthcare providers, rising medical expenses, and widespread availability of telehealth applications. The constant development of telehealth technology and rapid innovation in this field are also contributing to market growth. In addition, government support, policies to digitalize healthcare, and increasing investment in healthcare IT are playing a significant role in driving the growth of the telehealth industry.

The mHealth segment held the second-largest revenue share of 26.0% in 2023. Mobile health technologies, including health apps, wearables, and remote monitoring solutions, are gaining traction among individuals seeking convenient and accessible healthcare options. The widespread use of smartphones in the UAE, with a high penetration rate, facilitates the adoption of mHealth solutions, allowing users to access health information, engage in telemedicine consultations, monitor their well-being through wearable devices, and manage health-related tasks on the go. The mHealth segment plays a crucial role in advancing patient-centric care, promoting preventive healthcare measures, and contributing to the overall digital transformation of the healthcare landscape in the UAE.

Application Insights

Based on applications, the diabetes segment dominated the market with the largest share of in 2023 and is expected to register the fastest CAGR of 25.2% from 2024 to 2030. The diabetes segment is witnessing significant advancements and the adoption of technology-driven solutions to address the rising prevalence of diabetes in the region. Digital health tools and platforms cater specifically to diabetes management, offering features, such as glucose monitoring apps, insulin dose calculators, and virtual consultations with healthcare professionals. These technologies empower individuals with diabetes to monitor and manage their condition more effectively, providing real-time insights and personalized care. Integrating digital solutions in the diabetes segment enhances patient engagement. It contributes to more proactive and preventive approaches to managing diabetes, aligning with the broader trends in the UAE's digital health landscape.

Obesity is the second-largest application segment due to the use of technology to tackle obesity and encourage healthier lifestyles. To manage obesity, digital health platforms are equipped with mobile applications, wearables, and online resources that monitor dietary habits, promote physical activity, and offer personalized weight management plans. By incorporating these technological tools, these platforms aim to engage users, provide remote coaching and assistance, and encourage a proactive approach to obesity management. The use of digital solutions in the obesity segment of the UAE digital health industry is in line with the growing trend towards preventive healthcare and highlights the significance of technology in promoting wellness and healthy living in the UAE.

End-use Insights

The patient end-use segment held the largest share in 2023 and is expected to witness the fastest CAGR of 24.5% from 2024 to 2030. This is owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment is expected to witness significant growth over the forecast period. The adoption of advanced technologies like telemedicine and digital therapeutics largely drives the growth of this segment. Healthcare providers increasingly use digital solutions to provide remote consultations, customized treatment plans, and evidence-based therapies outside conventional care settings. By incorporating digital tools in their services, providers can offer more personalized and accessible care, ultimately leading to better patient outcomes.

Key UAE Digital Health Company Insights

Key players are adopting new product development, partnership, collaboration, product launches, and merger & acquisition strategies to increase their market share. Apple, Inc., Google, Inc., and Qualcomm Technologies, Inc. are market leaders with a presence in more than 30 countries, including headquarters, manufacturing sites, distribution centers, and office locations. Furthermore, Samsung Electronics Co. Ltd., Qualcomm Technologies, Inc., and Vodafone Group Plc. are the emerging market players.

Key UAE Digital Health Companies:

- Epic Systems Corporation

- AT&T

- Google, Inc.

- Softserve

- IBM Corporation

- CISCO Systems, Inc.

- Apple Inc.

- Oracle (Cerner)

- Vodafone Group

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

Recent Developments

-

In October 2023, the Abu Dhabi Department of Health (DoH) launched an innovative Health App with advanced features. The application is designed to empower residents with a convenient, highly personalized, and efficient healthcare experience. It will also provide seamless and secure access to integrated medical records in Malaffi, the Abu Dhabi Health Information Exchange, enable searching for a doctor and effortlessly booking appointments, and offer real-time health data tracking & insights. This user-centric approach to healthcare aligns with the DoH’s vision of putting patients at the center of a streamlined, connected, and holistic healthcare solution

-

In September 2023, the UAE’s health authorities introduced an upgraded version of the Al Hosn app, the country’s digital health platform, to strengthen childhood immunization initiatives. In addition, leveraging the latest advancements in digital technology, this upgrade is set to boost the effectiveness of measures against infectious diseases, supporting proactive healthcare initiatives and safeguarding the well-being of younger generations

-

In February 2023, Emirates Health Services (EHS) launched its IT Innovation Strategy for 2023-2026 in response to the evolving healthcare landscape, aiming to revolutionize healthcare delivery through a culture of innovation, enhanced sustainability, and strengthened internal capabilities

UAE Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 754.5 million

Revenue forecast in 2030

USD 2.65 billion

Growth rate

CAGR of 23.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, and end-use

Country scope

U.A.E.

Key companies profiled

Oracle Cerner; Apple Inc.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Google, Inc.; Samsung Electronics Co. Ltd.; Softserve; Computer Programs and Systems, Inc.; IBM Corp.; CISCO Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Digital Health Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the UAE digital health market report on the basis of technology, component, application, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers.

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal and Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet & Nutrition

-

Lifestyle & Stress

-

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

Frequently Asked Questions About This Report

b. The UAE digital health market size was estimated at USD 619.3 million in 2023 and is expected to reach USD 754.5 million in 2024.

b. The UAE digital health market is expected to grow at a compound annual growth rate of 23.3% from 2024 to 2030 to reach USD 2.65 billion by 2030.

b. The tele healthcare segment dominated the market with a revenue share in 2023 and is also expected to register the fastest CAGR over the forecast period. The growth of telehealth services is influenced by various factors such as the increasing accessibility of the internet and smartphones.

b. Some key players operating in the UAE digital health market include Oracle Cerner; Apple Inc.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Google, Inc; Samsung Electronics Co. Ltd.; Softserve; Computer Programs and Systems, Inc.; IBM Corp.; ISCO Systems. Inc.

b. The growth of digital health in the UAE is driven by multiple influential factors, with the government's initiatives playing a key role in this development. The UAE's focus on technological advancements has further fueled the digital health landscape.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."