- Home

- »

- Medical Devices

- »

-

UK Anesthesia Needles And Syringes Market, Report, 2030GVR Report cover

![UK Anesthesia Needles And Syringes Market Size, Share & Trends Report]()

UK Anesthesia Needles And Syringes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Anesthesia Syringes, Anesthesia Needles), By Safety Features, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-464-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

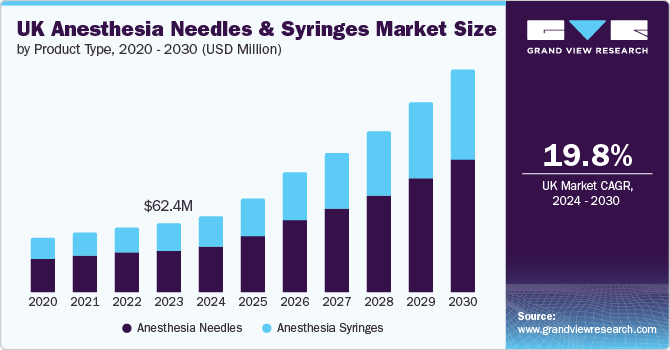

The UK anesthesia needles and syringes market size was estimated at USD 62.4 million in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030. Its growth can be attributed to factors such as increasing demand for regional anesthesia, need for syringes, and number of surgical procedures are the primary factors driving the demand for anesthesia syringes and needles. According to data released by the Royal College of Anaesthetists (RCoA) in March 2024, approximately 25% of anesthetic procedures incorporate either peripheral regional blocks or central neuraxial blocks in some capacity. Additionally, research published by John Wiley & Sons, Inc. in January 2021 indicates that more than 700,000 central neuraxial blocks, which are a common method of regional anesthesia, are conducted annually in the UK.

The increasing availability of needles and syringes for regional anesthesia provided by various industry players is anticipated to boost the demand for these products, particularly as the popularity of regional anesthesia continues to rise in the upcoming years. For example, B. Braun SE manufactures needles specifically designed for regional anesthesia applications, including spinal anesthesia.

Furthermore, a study published by Bone & Joint in March 2023 highlighted a notable increase in the frequency of lumbar spinal surgeries in Norway. Concurrently, various companies within the industry are providing needles designed for spinal anesthesia. For example, BD manufactures the NRFit spinal needles. Consequently, the growing incidence of spinal surgeries, along with the availability of specialized needles and syringes for spinal anesthesia, is expected to drive market expansion over the next decade.

The increasing prevalence of chronic diseases such as cancer is expected to lead to more surgical procedures, which will drive the demand for anesthetic needles and syringes in the coming years. Different types of anesthesia, including general and regional anesthesia, are utilized in cancer treatments.

Cancer incidence, prevalence, and number of deaths in UK

Country

Number of new cases, 2022

Number of deaths

5-year prevalence

UK

4,54,954

1,81, 807

1 4,35, 322

The rising number of surgical procedures is expected to increase the demand for anesthesia needles and syringes. These instruments are utilized in a variety of surgical operations, including those involving the lower abdomen, pelvis, rectum, or lower limbs. Additionally, spinal anesthesia is frequently employed in numerous spinal surgeries. For instance, according to NYSORA, spinal anesthesia is a prevalent method, with an estimated 324,950 spinal anesthetics administered annually in the UK.

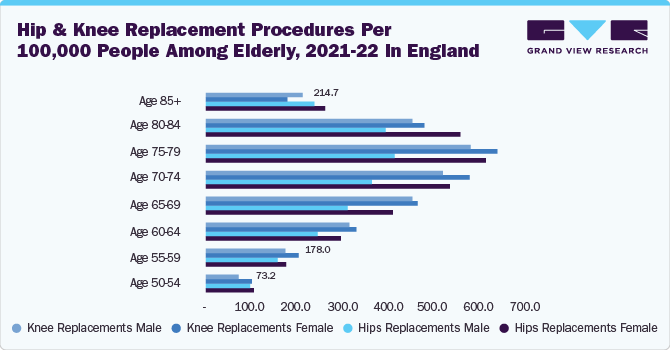

The increasing number of knee and hip replacement surgeries is anticipated to contribute significantly to market expansion. The regional anesthesia techniques most frequently utilized in joint replacement operations include epidural blocks, spinal blocks, and peripheral nerve blocks. According to information released by the National Institute for Health and Care Excellence, more than 100,000 knee replacement surgeries are conducted annually in the UK.

Moreover, older individuals undergo several surgeries, such as joint replacement surgeries, due to low immunity and weakened muscles. Hence, an increasing number of surgeries being performed among this patient population is anticipated to drive the demand for anesthesia needles and syringes.

Recent innovations in anesthesia delivery systems and needle designs are significantly improving the effectiveness and safety of anesthesia administration. Developments such as ultra-thin needles, safety-engineered syringes, and smart syringes equipped with integrated technology are propelling market growth. These advancements contribute to reduced patient discomfort, enhanced accuracy, and a decrease in complications, thereby encouraging the adoption of newer products. In February 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. introduced the TE9 ultrasound system to the UK market. This system features a large 21.5-inch high-definition touchscreen along with advanced imaging capabilities that allow clinicians to achieve detailed and precise visualization of patient anatomy.

Furthermore, the well-established healthcare system in the UK, known for its advanced hospitals and clinics, drives a significant demand for anesthesia needles and syringes. Investments aimed at enhancing and expanding medical facilities contribute to an increased usage of these products. The funding allocated by the National Health Service (NHS) for healthcare services supports the procurement of modern medical equipment, which encompasses anesthesia needles and syringes. According to data from the UK Parliament, total health expenditure in the UK reached USD 273.84 billion for the financial year 2022/2023.

The National Patient Safety Team of NHS England, in collaboration with the Association of Anaesthetists, the Royal College of Anaesthetists, and the Safe Anaesthesia Liaison Group, has released a National Patient Safety Alert. These alert mandates that all NHS-funded providers must switch to NRFit Connectors for all intrathecal and epidural procedures, as well as for the administration of regional blocks. The deadline for completing this transition is set for January 31, 2025.

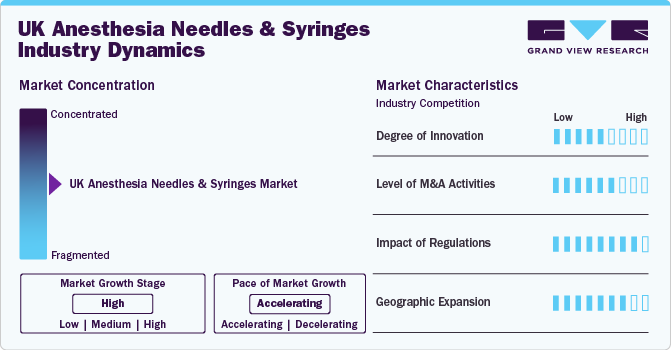

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration that is high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The industry is fragmented, with smaller and larger players offering a variety of specialized services and customized solutions. The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and geographic expansion of the industry is high.

The degree of innovation in the market is moderate. Advancements in the designs and features of anesthesia syringes & needles are anticipated to propel market growth. Advancements included the introduction of breech-loading syringes that could accommodate sealed cartridges containing anesthetic solutions, minimizing exposure to air and contamination. Safety syringes have been developed to prevent needlestick injuries, featuring retractable or shielded needles that automatically cover the sharp after use. Additionally, dose-sparing syringes have emerged, which minimize residual liquid left in the barrel after injection, thus maximizing the amount of medication delivered per dose.

The impact of regulations on the market is expected to remain high. The Medicines and Healthcare Products Regulatory Agency (MHRA) serves as the main regulatory body in the UK, tasked with ensuring that medical devices, such as anesthesia needles and syringes, adhere to essential safety and efficacy standards prior to their market release. Following Brexit, the UKCA mark has taken the place of the CE mark for medical devices sold in Great Britain, which includes England, Scotland, and Wales. This UKCA marking indicates that a product complies with applicable UK regulations. In contrast, the CE mark remains valid in Northern Ireland due to provisions established by the Northern Ireland Protocol. The principal legislation governing medical devices in the UK is encapsulated in the Medical Devices Regulations 2002.

The merger & acquisition activity in the market is moderate, driven by needs for improved patient outcomes, cost efficiency, and enhanced service delivery. Hospitals are forming strategic alliances with various stakeholders, including other healthcare providers, technology companies, and community organizations. For instance, in July 2024, GBUK Group Ltd., a portfolio company of A&M Capital Europe, acquired Care & Independence (“C&I”), a rapidly expanding UK provider of patient handling and mobility devices.

Geographic expansion in the market is high due to factors including increasing healthcare needs, advancements in medical technology, and a growing emphasis on safety and hygiene. The market encompasses a wide range of products, including disposable syringes, safety-engineered devices, and specialized needles for different medical applications. The expansion is particularly evident in urban areas where healthcare facilities are more concentrated, leading to higher demand for these essential medical supplies. Additionally, the rise of chronic diseases such as diabetes and the need for vaccinations have further propelled the market growth across different regions.

Product Type Insights

The anesthesia needles segment dominated the market with a revenue share of 60.6% in 2023. The growth is attributed to the growing innovations such as improved needle designs that provide enhanced accuracy, minimized discomfort, and greater safety. For instance, innovations in the bevel design of needles and the emergence of safety-engineered needles can reduce complications and enhance patient outcomes. Moreover, the increasing incidence of chronic pain conditions is leading to a higher demand for peripheral nerve blocks and various anesthesia techniques, which in turn raises the need for specialized needles. A report from The British Pain Society in 2024 indicates that approximately 8 million adults suffer from moderate to severely disabling chronic pain.

The anesthesia syringes segment is expected to grow at the fastest CAGR over the forecast period. The rising developments in drug delivery systems and syringe technologies are expected to increase the demand for specialized anesthesia syringes. Features such as accurate dosage control, reduced dead space, and compatibility with a range of anesthesia medications enhance their effectiveness in clinical settings. Furthermore, the progression of anesthesia administration methods, including target-controlled infusion and computer-assisted drug delivery, is shaping the need for advanced anesthesia syringes. Syringes designed for precise drug titration and controlled delivery are well-aligned with current trends in anesthesia management. For instance, in August 2023, Mindray introduced innovative enhancements to its A Series Anesthesia Systems, which aim to improve patient safety and operational efficiency.

Safety Features Insights

The traditional segment dominated the market with a revenue share of 94.2% in 2023. There is an increasing recognition of the complications that arise from needlestick injuries. By implementing safety mechanisms, healthcare settings can significantly decrease the risk of these injuries, thereby enhancing overall safety for both staff and patients. Additionally, healthcare facilities can establish policies that mandate the use of devices equipped with safety features to further protect their personnel and patients. These measures contribute to a heightened demand for traditional safety features in medical products.

The NRFit segment is expected to grow at the fastest CAGR over the forecast period. In order to avoid potentially dangerous mistakes and guarantee precise anesthetic delivery, NRFit connectors are specifically made to prevent misconnections between neuraxial and non-neuraxial systems. Their application in medical contexts is encouraged by this safety feature. Furthermore, NRFit connectors enhance patient safety during procedures by removing improper connections and reducing the possibility of cross-contamination. It is anticipated that this focus on lowering risks will increase demand for NRFit-compatible products.

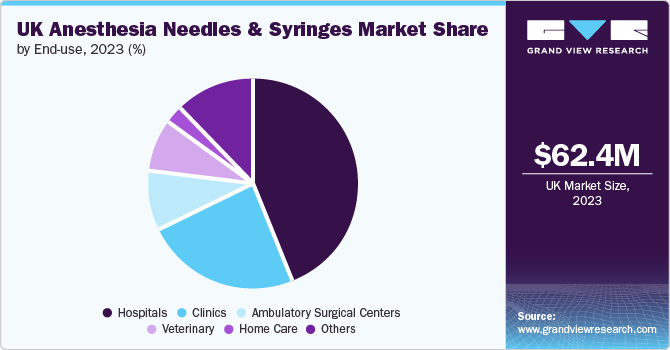

End-use Insights

The hospitals segment dominated market with the largest revenue share in 2023. This growth is owed to performing a high volume of surgical procedures that necessitate the use of anesthesia, which in turn boosts the demand for anesthesia needles and syringes. For example, according to a report from gov.uk, during the fiscal year ending in 2023, there were over 516,073 hospital admissions for cataract surgeries in the UK. This translates to an admission rate of 4,679 per 100,000 population, with a confidence interval ranging from 4,663 to 4,694.

The others segment is anticipated to grow at the fastest CAGR over the forecast period. The segment encompasses rehabilitation centers, long-term care facilities, and diagnostic laboratories. Each of these environments necessitates the use of anesthesia needles and syringes for various procedures, including pain management, diagnostic assessments, or ongoing treatments. The growth of this segment can be attributed to an increasing demand for specialized and precise anesthesia solutions. As these facilities broaden their service offerings and prioritize improved patient care, there is an escalating requirement for advanced anesthesia products that guarantee both safety and effectiveness.

Key UK Anesthesia Needles And Syringes Company Insights

The market is fragmented due to diverse product offerings and regulations. Companies such as BD; Cardinal Health; B. Braun SE. Europe dominate the market due to their extensive networks of facilities and comprehensive service offerings. The company has a significant share of the market due to its focus on quality products and operational efficiency. As companies continue to adapt to evolving healthcare needs and consumer preferences, their market shares may fluctuate based on strategic mergers and acquisitions or expansions into new regions of the country.

Key UK Anesthesia Needles And Syringes Companies:

- BD (Becton, Dickinson & Corporation)

- B. Braun SE

- SolM

- GBUK Group Ltd.

- Vygon (UK) Ltd.

UK Anesthesia Needles And Syringes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.2 million

Revenue forecast in 2030

USD 201.1 million

Growth rate

CAGR of 19.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, safety features, end-use

Country scope

UK

Key companies profiled

BD (Becton, Dickinson & Corporation); B. Braun SE; SolM; GBUK Group Ltd.; Vygon (UK) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Anesthesia Needles And Syringes Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK anesthesia needles and syringes market report based on product type, safety feature, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Syringes

-

Anesthesia Needles

-

-

Safety Features Outlook (Revenue, USD Million, 2018 - 2030)

-

NRFit

-

Traditional

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Veterinary

-

Home Care

-

Others

-

Frequently Asked Questions About This Report

b. The UK anesthesia needles and syringes market size was estimated at USD 62.4 million in 2023 and is expected to reach USD 68.2 million in 2024.

b. The UK anesthesia needles and syringes market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 201.1 million by 2030.

b. Anesthesia needles dominated the UK anesthesia needles and syringes market with a share of 60.6% in 2023. This is attributable to the growing innovations such as improved needle designs that provide enhanced accuracy, minimized discomfort, and greater safety.

b. Some key players operating in the UK anesthesia needles and syringes market include BD; B. Braun SE; Vygon (UK) Ltd; SolM; GBUK Group Ltd.

b. Key factors that are driving the market growth include an increasing number of surgical procedures and the rising geriatric population, which often requires anesthesia for various medical interventions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.