- Home

- »

- Consumer F&B

- »

-

UK Bottled Water Market Size & Share, Industry Report 2030GVR Report cover

![UK Bottled Water Market Size, Share & Trends Report]()

UK Bottled Water Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Spring Water, Mineral Water, Sparkling Water), By Packaging (PET, Cans), By Distribution Channel (On-trade, Off-trade), And Segment Forecasts

- Report ID: GVR-4-68040-216-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Bottled Water Market Size & Trends

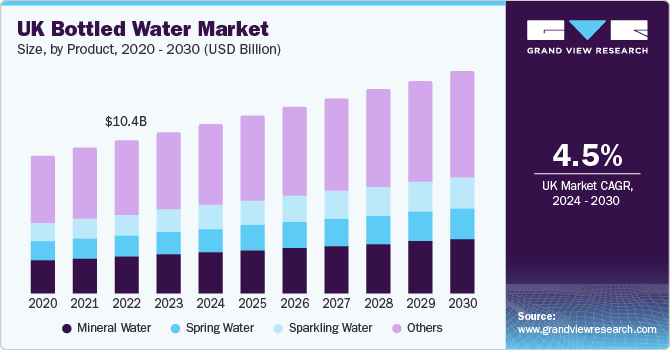

The UK bottled water market size was estimated at USD 10.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The ease of portability and convenience of bottled water, coupled with the potential for illness from drinking tainted tap water, are the main factors driving the demand for bottled water. The environmental contamination brought on by plastic waste presents a barrier to the market's expansion. There are health risks associated with drinking bottled water.

Growing knowledge of waterborne infections, increasing disposable income, growing urban population, and increased consumer health consciousness have all contributed to the growing demand for bottled water among health-conscious consumers. Additionally, growing concerns about the plastic wastes originating from the bottled water industry are pushing producers to employ more PET and plant-based water bottles in order to achieve sustainability. With the development of eco-friendly bottles, it is expected that the demand for bottled water would rise in developed economies like Europe and North America. It is expected that the market will grow considerably, largely because of the innovative packaging. The use of sustainable materials in bottle production improves brand perception among consumers.

Premiumization is another strategy companies employ to differentiate their bottled water offerings and appeal to affluent customers. The creators highlight the exceptional quality and rarity of the premium brands. Premiumization is therefore essential to the producers' capacity to turn a significant profit.

Market Concentration & Characteristics

The UK bottled water market is fragmented in nature, with the large number of regional and local players operating in the country. The market stage growth is medium, and pace of growth is accelerating.

The industry's major companies are focusing on new product launches, technology developments, and capacity expansions. The enterprises' market shares vary because there are several locally owned manufacturers spread out over different regions.

Companies in the sector provide services to clients either locally or worldwide. In order to allow customers to choose the flavor of the water they drink from reusable, personal bottles, they are focusing on launching new variations.Furthermore, because of the wider distribution networks and product availability that come with e-commerce, manufacturers are being urged to offer their products online, which in turn generates significant possibilities for market participants.

Impact of regulations is higher considering that the potable water industry has to follow strict guidelines set by the regulatory authorities. Such stringent protocols are set to ensure no harmful or toxicity is spread through drinking water.

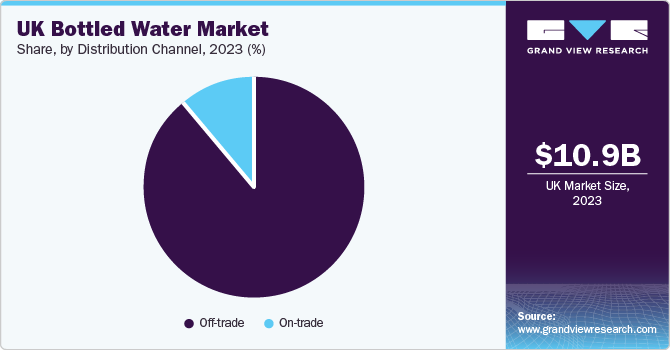

Distribution Channel Insights

The off-trade channel held the market share of 89% in 2023. The segment includes all retail outlets such as hypermarkets, supermarkets, convenience stores, mini markets, and traditional stores. The increasing convenience of quickly picking the required brand of bottled water with a particular set of minerals will boost the market in the forecast period. Some of the brands sold via the above-mentioned stores are Aquafina, Dasani, Nestlé, and Danone.

The on-trade channel is anticipated to grow at a CAGR of 4.6% from 2024 to 2030. The on-trade channel benefits from the social and recreational aspects associated with dining out or visiting entertainment venues. Consumers often choose to enjoy a meal or drink in a restaurant or bar setting, where bottled water is readily available. This creates a continuous market for bottled water within the on-trade distribution channel.

Product Insights

In 2023, the mineral water held a market share of 24.3% in terms of revenue. Contaminated particles in flowing water are typically the cause of diseases including typhoid, diarrhea, and dysentery; as a result, businesses are tackling the same challenges and consumers are searching for safe water sources. For example, Aquafina provides filtered and sodium-free options for drinking that have been purified. Similarly, Dasani provides safe and clean drinking options that are cleaned and have additional minerals added.

However, the sparkling water segment is projected to register a CAGR of 5.2% from 2024 to 2030. One of the market's main drivers is the increasing focus on health and wellbeing. As consumers' awareness of their general health grows, they are actively looking for functional beverages that can help them achieve their particular health objectives. Bottled functional water offers consumers an easy-to-access and convenient way to add these extra advantages to their regular hydration regimen.

Packaging Insights

The PET water bottles market stands out in the bottled water market due to its cost-effectiveness when compared to alternative materials such as glass or aluminum. The production of PET bottles is relatively inexpensive, and their lightweight nature significantly reduces transportation costs. This cost advantage has established PET as the preferred packaging option for water, enabling manufacturers to provide affordable bottled water choices to a wide range of consumers.

A major factor in the product's increasing uptake has been its packaging. Bottles made entirely of recycled PET (rPET) were released by Coca-Cola Bangladesh in December 2022 for their Kinley water brand. With the introduction of 100% rPET bottles in two-liter packs, Coca-Cola Bangladesh becomes the pioneer firm in South-West Asia. The organization has endeavored to decrease its dependence on virgin plastic and augment its utilization of recycled plastic. The company is currently present in more than 40 global markets with 100% rPET bottles.

The cans segment is projected to register the fastest CAGR during the forecast period. Cans offer superior product protection by creating an airtight and light-resistant barrier, safeguarding the quality and taste of the water. This advantage is of utmost importance for bottled water, as it guarantees the retention of its freshness and purity throughout its entire shelf life.

Key UK Bottled Water Company Insights

The market comprises both worldwide and domestic players. Brand market share analysis signifies that prime players are emphasizing on tactics such as new product launches, collaborations, mergers & acquisitions, and global expansions.

Some of the key companies include, Nestlé, PepsiCo, and The Coca-Cola Company, and DANONE, among others.

- In March 2021, Nestlé Waters, via its mineral water brand S. Pellegrino, launched new flavors such as black raspberry, blood orange, coffee, and cocoa. The tactical unveiling was intended at assisting the brand boost its growth.

Some emerging players operating in the market include, Fiji Water Company LLC and Highland Spring

- In January 2020, FIJI Water Company LLC developed the Blue Nature Alliance, through better management of coastal ecosystems and coastal conservation areas, as an initiative and international cooperation that intends to stimulate the protection of 18 million square kilometers of ocean in five years. The organization seeks to reconcile community and individual well-being with environmental efforts. For successful long-term ocean conservation, the initiative entails the cooperation of scientists, governments, NGOs, and indigenous people.

Key UK Bottled Water Companies:

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Highland Spring

- VOSS WATER

- Buxton

- Crag Spring Water

- Hildon

Recent Developments

-

In March 2022, RHODIUS Mineralquellen has declared the manufacturing of PET bottles made from 75% recycled PET. The development was intended to launch a sustainable packaging solution for bottled water.

-

In February 2021, Coca Cola brand aha launched two new sparkling water, which are calorie, sodium and sweetener-free. The flavor comprises Mango + Black Tea and Raspberry+ Acai.

UK Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.53 billion

Revenue forecast in 2030

USD 15.04 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel

Country scope

UK

Key companies profiled

Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Highland Spring; VOSS WATER; Buxton; Crag Spring Water.; Hildon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Bottled Water Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the UK bottled water market report based on product, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spring Water

-

Mineral Water

-

Sparkling Water

-

Others

-

-

Packaging Outlook (Revenue, USD Billion, 2018 - 2030)

-

PET

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Off-trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

On-trade

-

Frequently Asked Questions About This Report

b. The UK bottled water market size was estimated at USD 10.97 billion in 2023 and is expected to reach USD 11.53 billion in 2024.

b. The UK bottled water market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 15.04 billion by 2030.

b. Mineral water dominated the UK bottled water market with a share of 24.35% in 2023. The increasing preference for nutrient-fortified water is trending due to the rising importance of health and wellness among consumers. The demand has increased among travelers, working professionals, and in-house consumers.

b. Some key players operating in the UK bottled water include Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Highland Spring; VOSS WATER; Buxton; Crag Spring Water.; Hildon

b. The ease of portability and convenience of bottled water, coupled with the potential for illness from drinking tainted tap water, are the main factors driving the demand for bottled water.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.